Howdy!

In the South, there have been a lot of Tesla Cybertrucks. Although I feel a bit ashamed to say this, I like the look of their trucks.

The car industry is experiencing a period of soul-crushing monotony. It’s refreshing, therefore, to see something unique. Why do more car companies not produce cars that are a bit wonky looking? Anyways:

SOL may back Ethena’s high-yield ‘internet bond’

Ethena is a stablecoin with a yield. “bond” The project has now announced the integration of Solana.

Ethena, the buzziest Ethereum project to date, is the next one to be launched on Solana. When it was launched in February, the project generated a lot of interest because its returns were over 20%. This raised concerns about sustainability.

Ethena releases the USDe “synthetic dollar” It is a sUSDe “internet bond,” This can be compared to a dollar or US Treasury that doesn’t require the use of traditional banks. They will all be available through Solana. If the Governance vote passes, SOL would become an asset backing these products.

USDe’s exposure is neutral because it has ether as its backer, along with bitcoin and solana. It also holds short perpetual futures trades. This protocol earns a yield on staked Ether, but also receives funding rates. Funding rates are basically market-driven payments for long or short positions. Ethena is paid to hold short crypto positions, since historically crypto traders have preferred going long. USDe may be staked against sUSDe to pass on the yield.

CoinGecko reports that USDe has a market cap of $3.1billion, making it the 4th largest stablecoin behind USDT USDC DAI.

Ethena could run into trouble if it scales up and increases the demand for shorters. Ethena, then, added Bitcoin and the $25 billion in open interest to its backing assets. It announced today that Solana may also be added.

“We aren’t opinionated on base layers and are just product and user focused — we will go where there is demand,” Guy Young, founder of Ethena told me that Solana’s open interest in the amount $2-3 millions would help. “comfortably” Add more than $500 Million in SOL Support to USDe.

Ethena plans to use USDe for Jito’s new restaking software, alongside a couple of Solana DeFi-integrations.

SUSDe yield has been declining in recent months. It’s currently at 12.3% according to Ethena website. Young told me he couldn’t forecast future crypto rates. However, he did note that funding rates have been at their lowest level in over a year. CoinGlass estimates that ether, bitcoin and solana have all had negative funding rates in the last year. All three currencies have also experienced positive rates over nearly all months.

USDe has seen its market cap shrink from $3.6 billion in late June to $3.1 billion today. It makes sense, given the yield crunch that Ethena would want to begin putting its SOL at risk to generate an extra source of income.

Young said “staking rates on Solana are clearly more interesting than ETH to dollarize into our product,” He did notice that such a move would have to be approved by Ethena.

Ethena’s launch on Solana is a bit reminiscent of PayPal’s similar recent move — as both are stablecoins that, after launching on Ethereum, made deployments on Solana to try capturing some of the excitement surrounding the ecosystem. Solana supporters may be hoping that this trend will continue, and that notable Ethereum projects start to consider launching on Solana as a standard.

“[I think] it’s an absolute no-brainer for a project to launch on Solana given the amazing user base and great builders,” Ethena’s director of growth Seraphim gave his opinion in an open message. “DeFi projects should be less dogmatic and look beyond just Ethereum for growth.”

Zero In

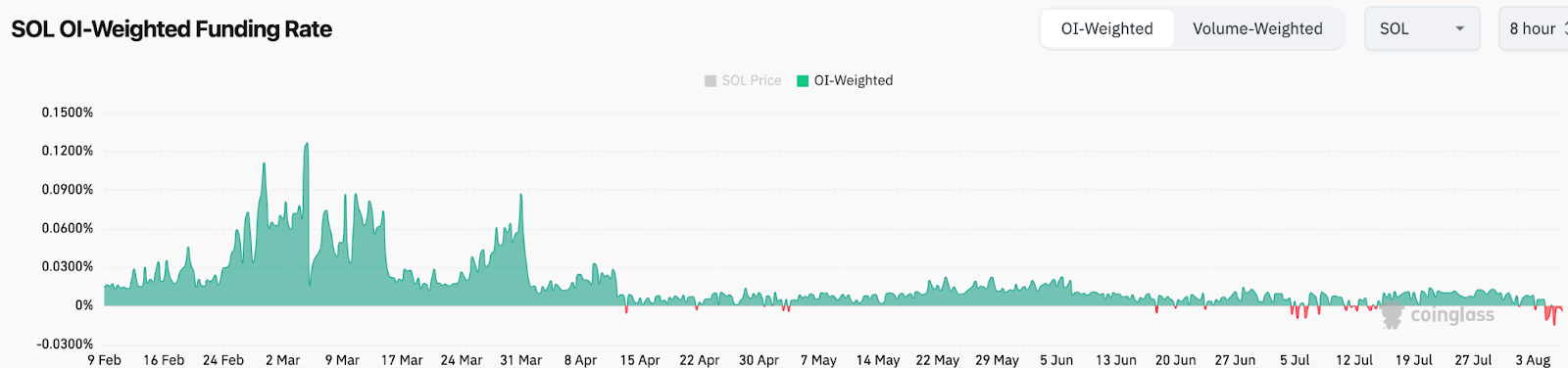

The funding rate is something we mention a lot on Lightspeed. But it’s important to bring up today.

CoinGlass measures the funding rate. This can be viewed as an indicator of demand for both long and short positions on an asset. When demand to go long on Solana is high, as it was in February and March, funding rates will be positive — and a more positive rate means greater demand.

The demand for these products has fallen in recent months. It even turned negative following this week’s turmoil on the stock market. Ethena likely would have been happy to witness a change in that number at some stage.

The Pulse

A degen has a tough life. Spending minutes each day to find the best memes is a daily ritual. Ten different podcasts about market fundamentals are on your iPod, all hosted by the favorite broligarchs who would be frat boys. Pump.Fun’s animations will never be turned off.

Everything you do is right. Here we are. Maximum pain. This is just not logical.

Who among us ever doubted that the renowned cryptocurrency asset Skibidi Toilet, currently down by 75% in just seven days? Peanie is a memecoin that has a theme of penguins (and nothing more). It can’t yet have reached its peak. Undoubtedly, an 800%+ recover is required. And that’s to say nothing of tier 1 memescience wünderkind, TrumpCoin (DJT). It’s true that it is down almost 98% since ATH but you have diamond hands. We’re going to be back in business with just one tweet. Please, Donald. Ser. Just a single tweet. (wait, what’s this? (It’s Eric Trump in a chair made of steel!)

Many people are playing on X. @CrashiusClay69 points out that “Despite the bloodbath, $brett remains the 67th largest coin in the world.” Very much true. It’s a lot like 67th. The drop is only 33%. Ponke is down by 54% in three weeks according to @LFGNOW1. “clearly the most undervalued memecoin.” Or JOHN only 82% down since May. @cryptofearsol informs us it is currently. “the most undervalued memecoin.” Harambe is also worth a shout out. Despite taking shots in July, to the tune 70% of its players were reportedly wiped off the field, it remains the “most undervalued memecoin.” Or Mini, Gracie, Nub, and Rogen, which, I don’t know if you’ve heard, but… pause for dramatic effect… they are all the “most undervalued memecoin” This is the right meow.

But we are back. I think this memecoin is a good idea. You gigachads keep going.

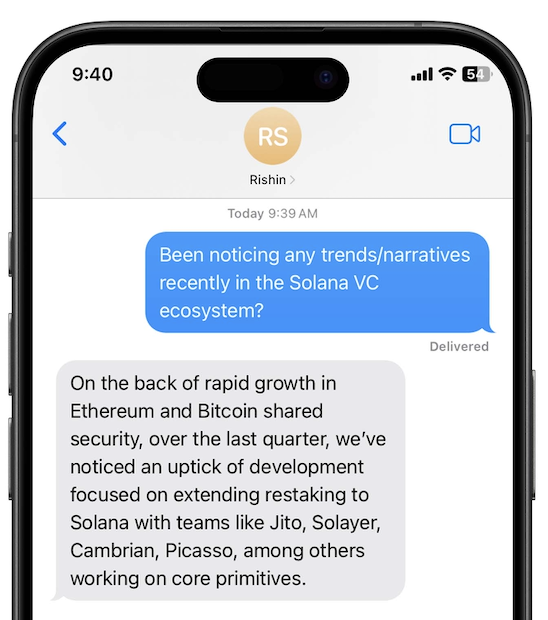

The One Good DM

An Message from Rishin sharma, investor at CoinFund:

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.