It is a good time to be in the economy

We received data today that confirms that the US economy is doing well, or much better than one would think following the Fed’s 50-basis point rate cut last month.

Retail sales were 0.4% higher than expected, compared to the 0.3% that was anticipated. This is a significant increase from the 0.1% of the previous month.

The Atlanta FED has revised their GDPNow third-quarter forecast upwards to 3.4%, from 3.2%.

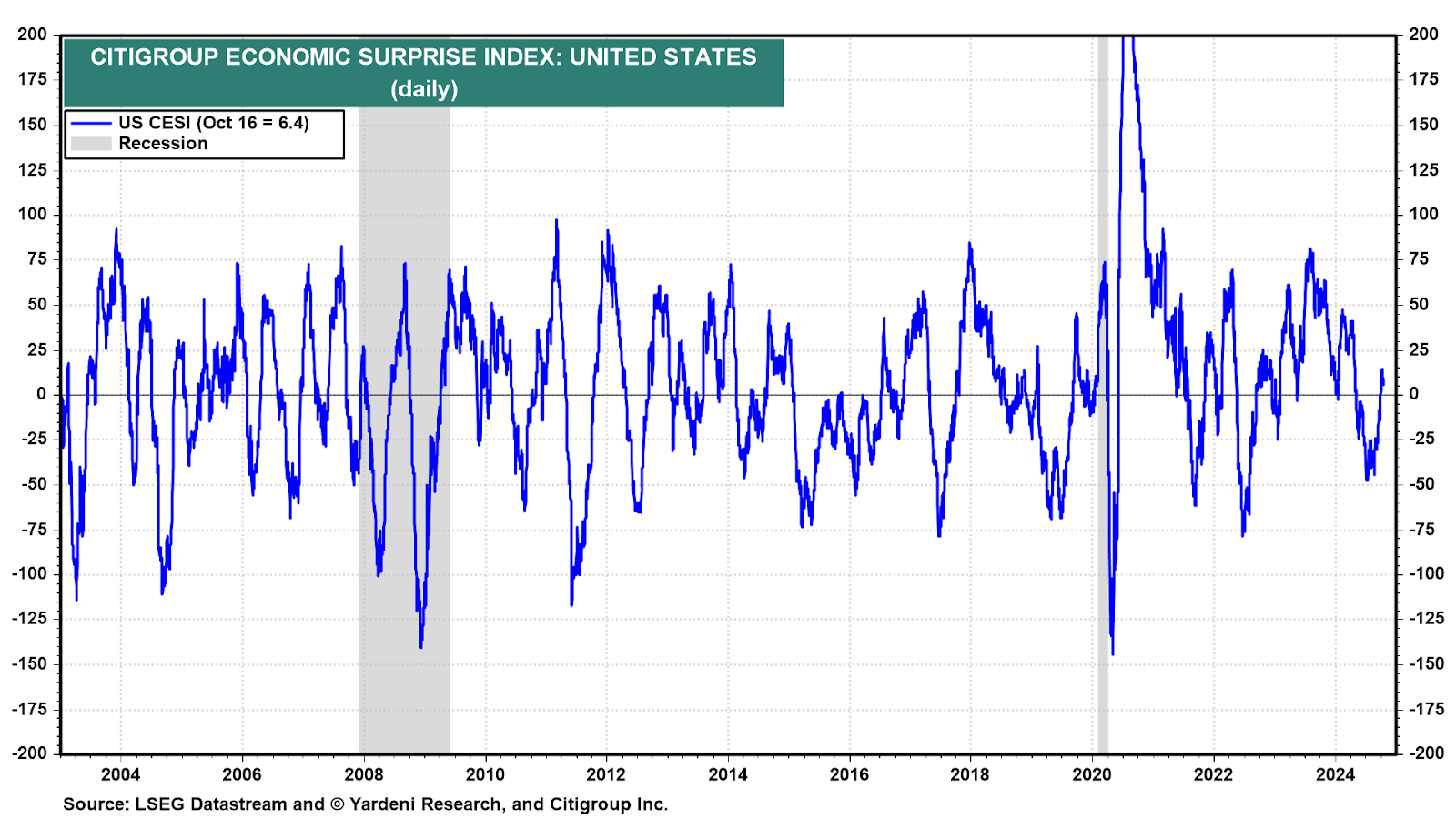

After a Summer Growth Scare, we see that nearly every single economic indicator is surprising on the positive side.

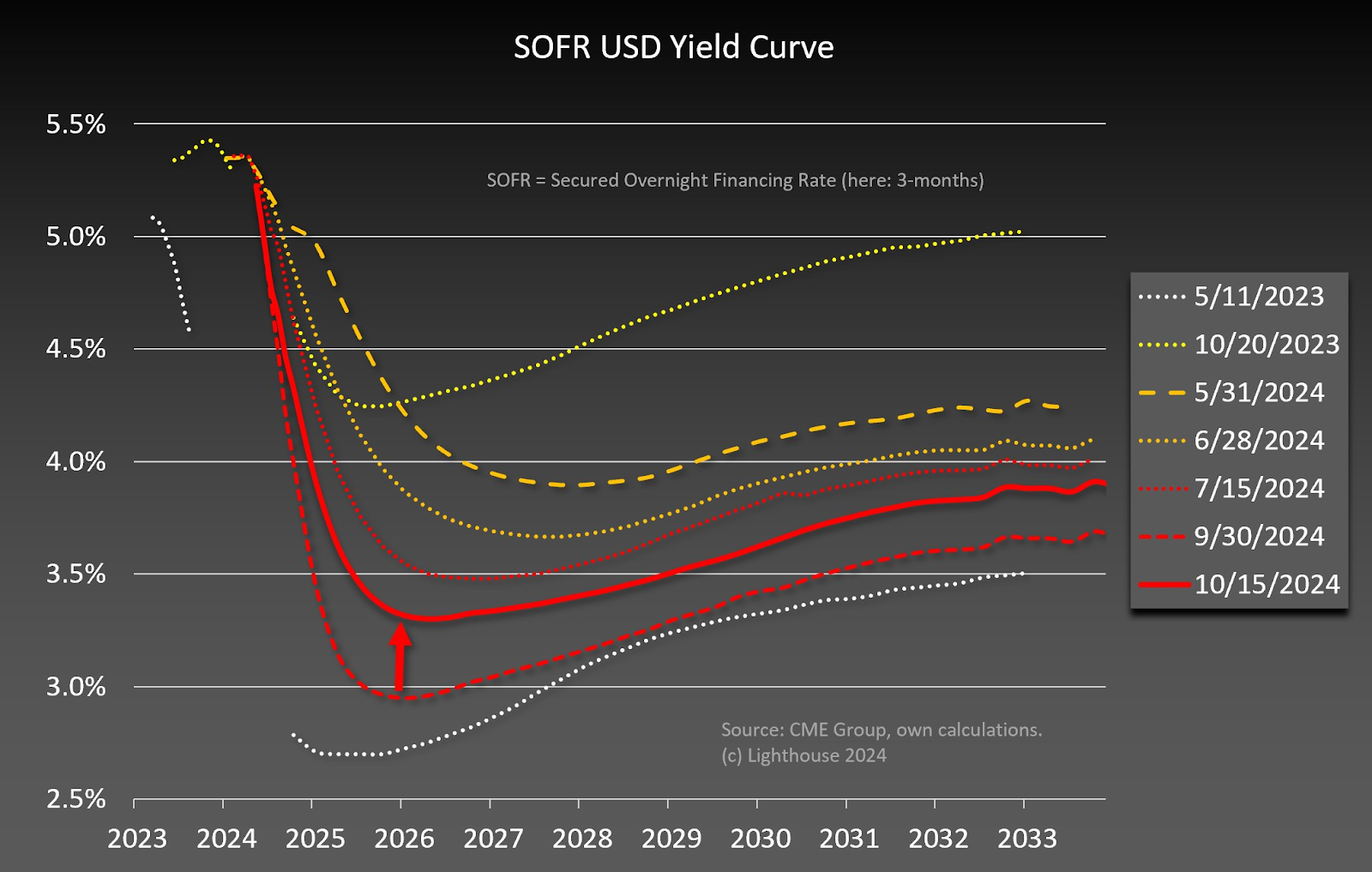

This has created a major whipsaw in terms of how the cycle of rate cuts began. We can gain some insights from the SOFR curve, which shows the path of rate cuts over the coming years:

- We saw that a large number of rate reductions were aggressively priced into the market during the recent growth scare.

- Around the time of the Fed’s first rate cut, the climax was reached.

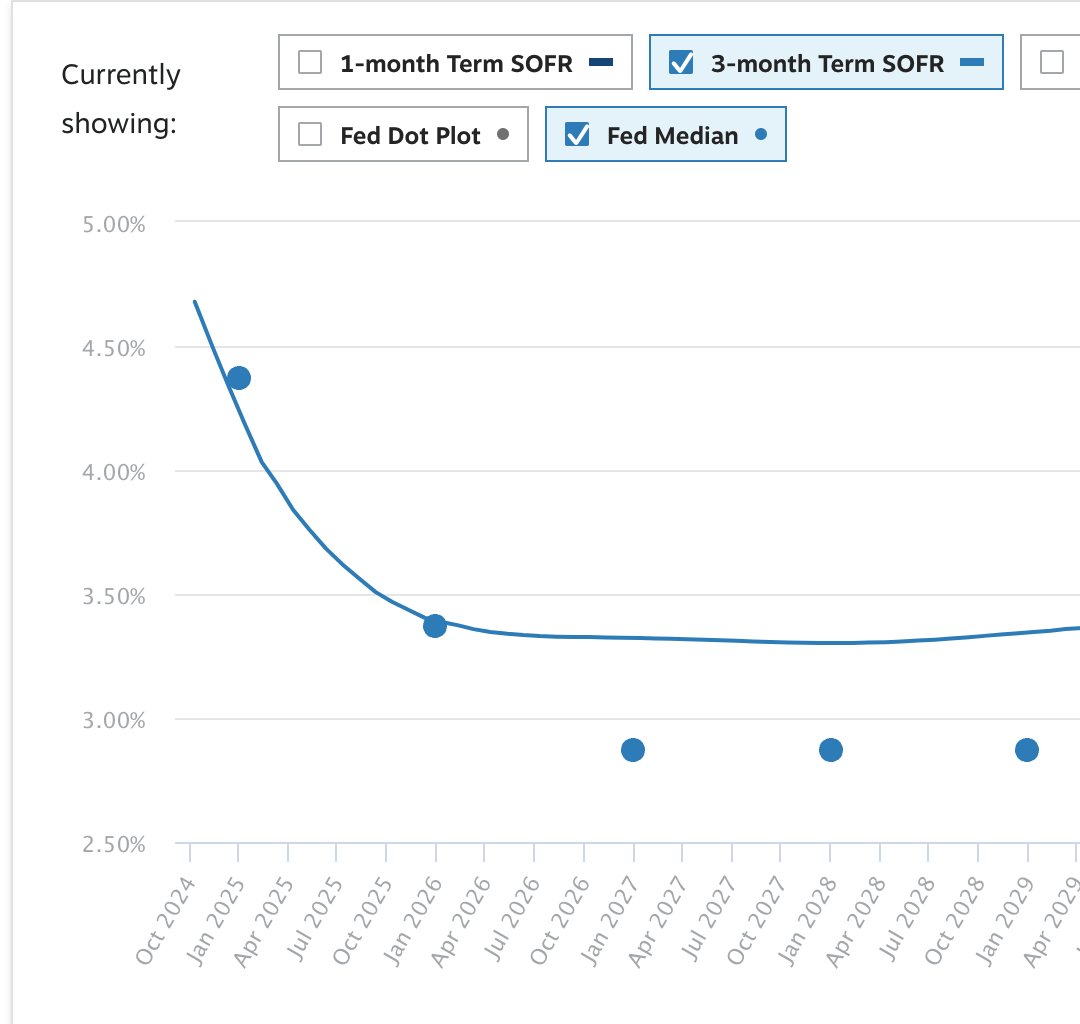

From there on, the Fed’s median dot plot forecast has become shallower than what the market prices in. The Fed’s median forecast for the dot plot is shown below.

The Fed had a final rate of approximately 2,9%. Now, market participants expect committee members will finish their cutting path around 3,3%. Two explanations are possible:

- Dot plots are stale in comparison to recent economic reports.

- Market participants don’t think the Fed will actually be as dovish in their forecast as they claim.

It’s possible that I believe in both. Recent economic data, which continues to surprise me on the positive side, confirms my conviction that the economy does not appear to be in recession.

But I do think the markets underestimate how determined the Fed is in achieving its goal of a soft landing. In order to do this, the Fed must proactively reduce rates in order to protect labor markets despite the fact that growth is looking good.

What are the results? We’re in goldilocks land. The Fed will continue to reduce rates as long inflation does not significantly increase.

— Felix Jauvin

2.55%

Gains made by the Philadelphia Semiconductor Index on Thursday afternoon. After a loss of up to 5.28% on Tuesday, the index has recovered and is now in green.

Tom Essaye says that semiconductor stocks are, “the most important of all the stocks.” “the canary in the stock market coal mine.” According to Sevens Report Research founder, where SOX moves, stocks will also follow.

Why? “Their risky balance sheets and high-beta stock price action tend to see them begin to rollover before most of the rest of the market as traders rotate away to lower-beta, more value-oriented names during times of uncertainty, including economic downturns,” Essaye said.

Essaye’s key SOX level of resistance is 4,521. We are currently at 5,288 as of today’s mid-session.

Hurricane hardships?

Data released on Thursday showed that initial jobless claims in the week ending Oct. 12 were unexpectedly lower than expected at 241,000. This is a drop of 19,000 compared to the previous week.

The Department of Labor also revised upwards the claims for the week ending Oct. 5, by 2,000, to 258,000. First-time claim numbers were up for two consecutive weeks, a trend that was largely due to hurricanes Helene and Milton. In addition, it’s estimated that the damage caused by the hurricanes has left many people unable file claims. This may mean data fluctuations in the near future.

Florida (-3 428) and North Carolina – 2,404 – saw the most significant declines of initial claims during the week ended October 12. In the week that ended October 5, each state had some of its highest number of new claims. This suggests storm impacts may be driving the figures.

Michigan was another large anomaly for the week that ended October 5. 16169 claims were filed in the state, which is likely related to ongoing effects of auto industry cutbacks. The number of claims in Michigan dropped from 8,357 to 8,357 for the week ending Oct. 12.

The number of continuing claims rose slightly in the week ending Oct. 5 to 1,867,000, an increase of 9,000 from the previous week.

After the report was released, the markets initially declined but recovered their losses in the second half of the session. The S&P 500 was trading 0.24% higher on the day at 2 pm ET while the Nasdaq Composite had gained 0.46% at that time.

Stifel’s chief economist Lindsey Piegza stated that jobless claim data showed the Fed had taken a step back. “too big of a step out of the gate” When they chose a reduction of 50bps last month. She thinks that central bankers may opt for a 50bps decrease. “dial back” Next month, you could decide to forgo the rate reduction altogether.

Fed Funds Futures as of Thursday disagree. CME Group data shows that there is a 90 percent chance of a rate reduction next month by 25 basis points, up just a little from the day before.

Hacker in SEC Data Breach Arrested

Indictment filed by the FBI against Eric Council Jr. You may recall that the hack was a fake announcement from SEC’s Twitter account that ETFs for spot bitcoin had been approved. A fraudulent bitcoin post caused the price to spike temporarily before SEC revealed that it had compromised its account and had not approved such an approval.

Council Jr. gained access to his account through a SIM switch, which allowed an unnamed person to use it. “co-conspirators” Make the “unauthorized post.”

He was able to access the account after creating a fake identity of the owner and obtaining a SIM from a mobile phone company in Alabama that had been linked to their phone number. According to the FBI, he received BTC as payment for his part in the breach.

According to the FBI’s report, Council Jr. later conducted some Internet searches. Among the searches he had made were: “How can I know for sure if I am being investigated by the FBI,” The following are some examples of how to get started: “What are the signs that you are under investigation by law enforcement or the FBI even if you have not been contacted by them.” This is not a joke.

Council Jr. has not been charged with any insider trading. According to the indictment it seems that he did not even deal with fake news. In connection with his involvement in the scheme, he has been charged under one count for conspiracy to commit fraud and identity theft.

Whether or not these co-conspirators emerge or face legal consequences — which I’d guess would be related to trades made on the fake news — remains to be seen. The CFTC, and DOJ, would have authority if we assume that BTC is a product (which it is, as per the SEC).

Bulletin Board

- Tomorrow, the SEC must submit its Form C to appeal the Ripple case. This filing, which will be released shortly after the SEC’s announcement that it intends to appeal Ripple, will give us more information about its position.

- The Deputy Minister of Finance in Italy announced this week the intention to raise capital gains taxes on cryptocurrency profits by up to 40%.

- Tony Greer from TG Macro joined Felix Jauvin on the Forward Guidance latest podcast. You can catch up on the latest episodes.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.