Six-figure commonplace

Mass adoption is a hen and egg downside.

By uncooked numbers alone, we’re possible properly on monitor to construct sufficient infrastructure to assist the following wave of customers.

There at the moment are dozens of layer-1 and layer-2 networks, interoperability protocols and different varieties of monetary plumbing able to pipe onchain exercise throughout our multichain future.

However whether or not it’s really sufficient is determined by how huge a wave we’re speaking about.

One other one or two million customers — particularly actually lively ones — may most likely match, so long as they unfold themselves out throughout all of the totally different blockchain networks out there.

That’s slightly than, say, all clamoring onto Ethereum mainnet. Doing so would inevitably make the chain far too costly to make use of.

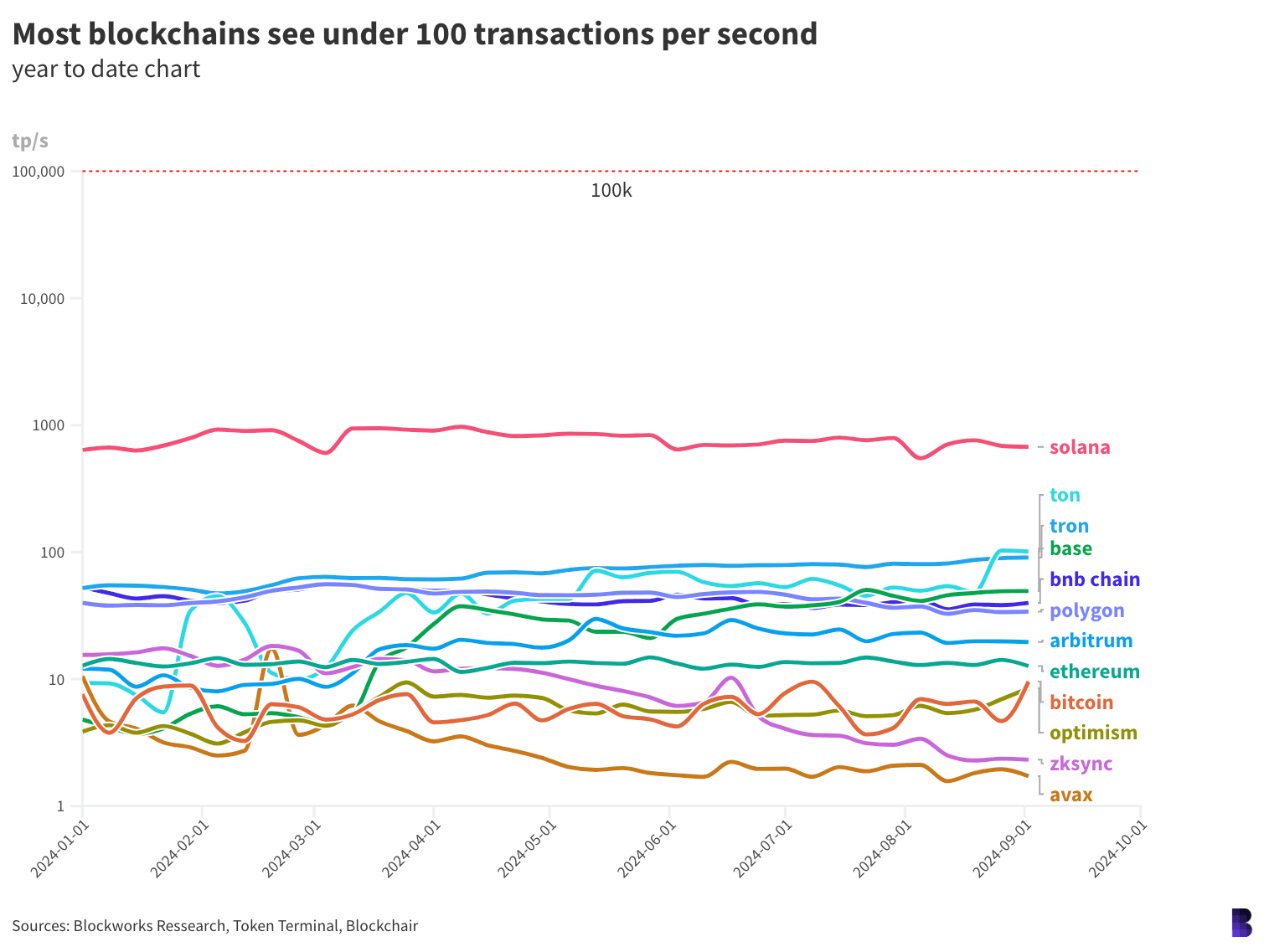

However whereas blockspace is changing into cheaper as a result of its rising abundance (in comparison with person demand), app builders are nonetheless restricted by what number of transactions will be processed at anyone time. Transactions per second, or throughput.

Crypto itself is a permissionless sandbox. After all, some use-cases shortly appeal to boogeymen just like the SEC, CFTC and DOJ. However builders and entrepreneurs can principally construct no matter they need — so long as it doesn’t want to make use of the chain too regularly.

That presents the riddle: Would crypto have extra customers if it had extra fully onchain client apps?

Would crypto have extra client apps if the underlying networks may deal with extra site visitors with out going offline?

MegaETH is weaving a lot of its future worth proposition on the reply to each questions being a convincing “yes.”

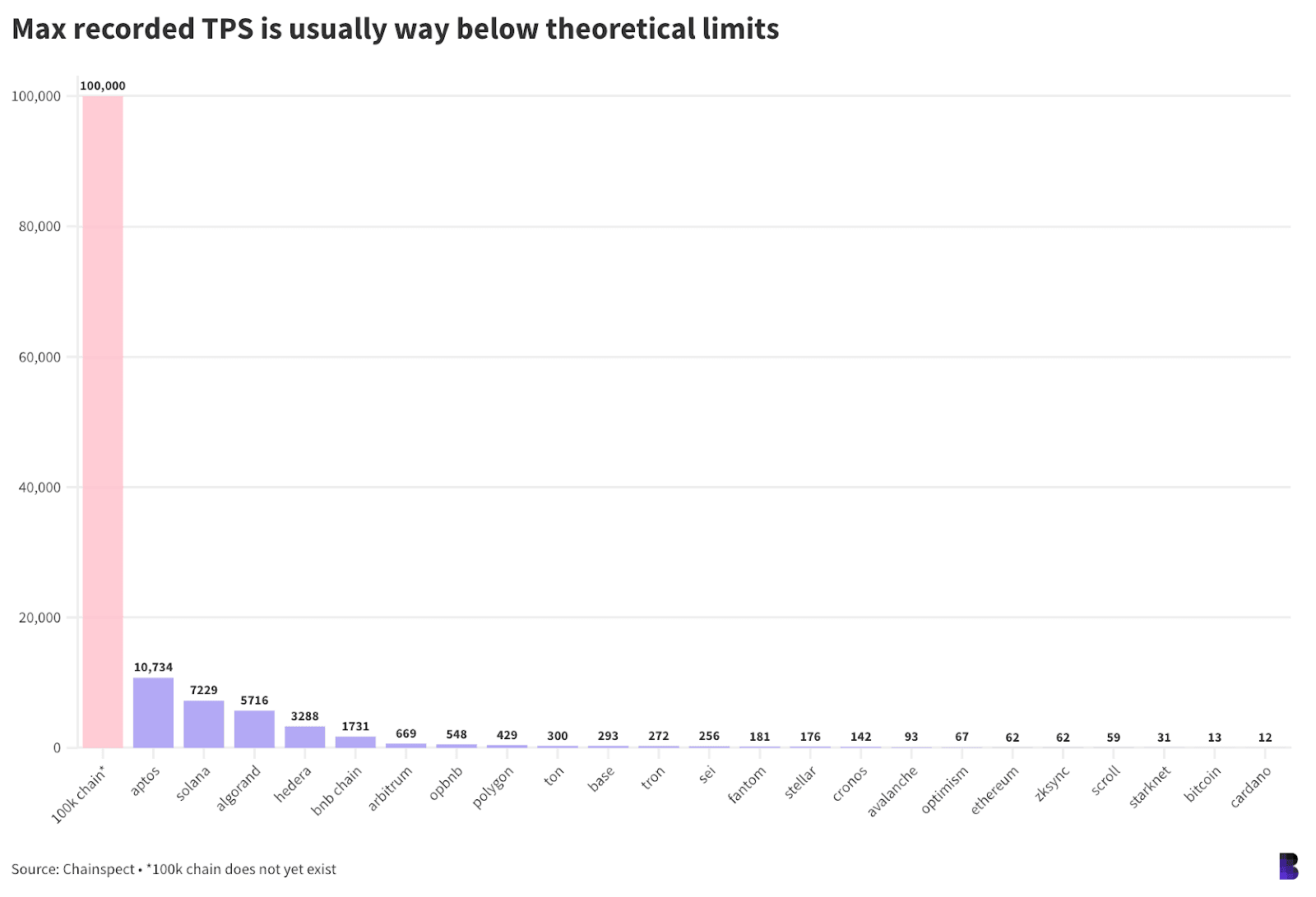

The undertaking is to be an Ethereum layer-2 community hinged on a souped-up centralized sequencer that goals to course of transactions onchain in real-time, or not less than, at 100,000 transactions per second.

That manner, builders may construct the high-performance apps of their goals and onboard all of the beginner customers hungry for onchain velocity. For scale, Visa touts that it may deal with 65,000 transactions per second.

It’s early days for MegaETH. However in any case, that 100,000 quantity is popping out to be an more and more widespread benchmark.

TON bragged final October that it had surpassed that quantity on a testnet implementation, however in actuality, it retains breaking at round 300 transactions per second. Aptos has beforehand claimed it may theoretically attain 160,000 per second however to date solely reached 10,734, per Chainspect.

Extra not too long ago, Ava Labs expressed hope in pushing Avalanche to ultimately hit six figures with a brand new scaling answer.

It might be that a few of these networks attain their theoretical limits, a few of that are near 100,000. And their odds would definitely be higher if there have been extra customers to get them there, as blockchain networks right this moment are not often really at capability, and if they’re, it’s normally non permanent.

Whether or not that may out of the blue make crypto’s subsequent killer app seem is anybody’s guess. Higher to maintain constructing, simply in case.

Knowledge Middle

- BTC is up 1.5% on the day and ETH is flat as markets pattern sideways. (BTC: $59,200; ETH: $2,510).

- KLAY, FLOKI and MATIC are the worst hit over the previous week, dropping between 19% and 18%.

- Every day Base stablecoin switch quantity is at one other all-time excessive past $5.44 billion, in keeping with Blockworks Analysis information.

- Over $550 million has flowed out of Arbitrum bridges up to now week, per DeFiLlama. $457 million has in any other case flowed into Ethereum bridges.

- Native ETH staking yield is at a file low of three%, down from 3.55% at first of the 12 months.

No enchancment

Binance exec Tigran Gambaryan’s trial restarted yesterday, and the scenario continues to look bleak for the American, who simply handed the six-month mark in Nigeria.

Gambaryan was initially detained in February and has been held within the nation since. His well being has deteriorated whereas in jail, together with bouts of pneumonia, and Gambaryan now suffers from a herniated disk. In keeping with a household spokesperson, he’s additionally suffered from malaria and tonsillitis.

A video shared on X depicts a distressed Gambaryan trying to stroll into the courtroom. He was, per a spokesperson, unable to make use of his wheelchair. In keeping with Gambaryan within the video, officers had been informed to not supply support.

“This is f*cked up,” Gambaryan says. He then factors to the guard strolling subsequent to him and exclaims, “He was told not to help me.”

“Why can’t I use a goddamn wheelchair? This is a show!” Gambaryan provides. “I’m f*cking innocent.”

Binance CEO Richard Teng shared the video, calling for the “inhumane treatment” to finish.

“He must be allowed to go home for medical treatment and to be with his family,” Teng added.

Gambaryan later informed the decide that he’s not receiving satisfactory medical care and hasn’t been in a position to talk along with his authorized workforce or embassy representatives. That’s not the primary time we’ve heard this from of us representing his household, both.

The prosecutor for Nigeria’s Financial and Monetary Crimes Fee (EFCC) pushed again on a brand new bail utility filed by Gambaryan’s legal professionals on medical grounds, arguing that the US govt isn’t affected by in poor health well being. However then, in keeping with a household spokesperson, the prosecutor additionally claimed that Gambaryan is refusing therapy, which doesn’t appear so as to add up.

We’ve coated Gambaryan’s detention earlier than, however ICYMI: The US citizen was held in Nigeria after flying there to fulfill with authorities officers when Nigeria accused Binance of cash laundering. Nigeria then charged Binance and Gambaryan with mentioned violations, which is what retains Gambaryan in a jail cell.

Nigerian officers additionally sought tax evasion fees towards each Binance and Gambaryan however dropped the fees towards Gambaryan himself over the summer season.

Earlier than both of those trials commenced, Binance ended assist in Nigeria — shortly after Gambaryan was detained.

“It is useful to point out that Nigeria has never been a big market for Binance. The Government has said that we made $26B in revenue from Nigeria in 2023. That is not the case. The $21.6B figure is the total transaction volume from 2023. To provide an understanding of transaction volume: if a person were to take $1000 and trade it 1000 times, that would represent $1m in transaction volume,” Teng wrote in a weblog submit final week.

US officers Rep. Chrissy Houlahan and Rep. French Hill visited Gambaryan again in June, calling for a “humanitarian release” on the time.

“The US Government must do more to help Tigran. I urge them to use every available tool to free an innocent American who is at risk of permanent damage,” Yuki Gambaryan, Tigran’s spouse, mentioned in a press release. I’ve reached out to of us at Houlahan’s and Hill’s workplaces.

Gambaryan is due again in court docket tomorrow, so we’ll proceed to watch how this performs out.

The Works

- SEC Commissioner Mark Uyeda thinks that the regulatory company ought to create a registration assertion that’s custom-made for crypto securities.

- The WazirX hacker has begun to maneuver funds over to Twister Money to scrub them, per Arkham Intelligence information.

- Metaplanet, the Japanese firm that adopted bitcoin as a reserve asset earlier this 12 months, introduced that it teamed up with SBI VC Commerce for custody, transactions and administration of its bitcoin.

- The SEC isn’t completely happy concerning the FTX property paying out some collectors in stablecoins and different crypto, including that it “reserves its rights to challenge transactions involving crypto assets.”

- Libre is including a couple of new digitized funds to the NEAR blockchain, opening the door for real-world belongings to be transferred throughout a number of blockchains, CoinDesk reported.

The Riff

I really suspect that MegaETH and all the opposite 100k hopefuls is perhaps proper.

Video games are the obvious instance. We’d like video games which can be fully onchain. In any other case, Web3 gaming is a poor and clunky imitation of video games that exist already. But it surely’s tough to do with the present throughput challenges, particularly at scale.

Crypto might be hitting its limits by way of the funds narratives. Chain abstraction — tucking away the blockchain beneath slick UX — will possible get us additional.

However the true closing type seemingly entails a sense of boundlessness with regards to crypto app growth.

So, mass adoption may matter, however there’s extra vital issues to attain earlier than that.

Sure.

That’s nonetheless the sunshine on the finish of the crypto tunnel, and the aim could also be lofty — however it’s reachable.

Many of the conversations I’ve with of us find yourself segwaying into mass adoption and both the initiatives they’re eyeing which have potential, or what they suppose mass adoption means for crypto.

Like I mentioned: it’s a lofty aim. But it surely’s an achievable one. Maybe the parameters simply have to be narrowed in order that it feels prefer it’s achievable or that we are able to deal with it as slightly runway for the bigger endgame.

But it surely’s attainable — and it nonetheless issues. Dream huge, proper?

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.