Vibe examine

The vibes are…bizarre.

Each bitcoin and ETH are down over 4% this morning in line with Coinbase. Bitcoin’s clinging to $56,000 whereas ETH holds on to $2,300.

In the event you requested Ikigai’s Travis Kling, he’d say that there’s a brand new perspective taking on in crypto: “Pervasive quiet quitting.”

Sure, the quiet quitting idea that went viral a number of years in the past, the place people simply cease doing greater than what was anticipated of them. It was labeled as giving up — although I feel we are able to agree that maybe it’s a situational factor, and also you don’t at all times must go above and past with out correct compensation… however I’ll hop off my soapbox now.

Kling, nonetheless, is rather more centered on the engagement a part of the quiet quitting pattern.

“Crypto enthusiasts cannot see what is going to drive the next big leg up. No DeFi summer. No NFT summer. Gaming is currently DOA. Metaverse turned out to be a complete joke. Decentralized social media has flatlined. People are trying to get excited about crypto x AI, but I (along with many others) think that excitement is likely misplaced (at least thus far),” he wrote.

Sound acquainted? Threads of this have actually made their manner into our reporting right here on Empire this summer season. David, for instance, has been attempting to make use of knowledge to see when or if we may see the altcoin market decide up.

“Things continue to be really range bound and relatively quiet, which is interesting to me, as we come out of summer, that we’re still experiencing these kinds of quiet markets. I guess maybe people are waiting for elections,” Ledn’s John Glover instructed me.

To place it fairly frankly, people are struggling to see a catalyst on the horizon. Pair that with the seasonality issue that September tends to not be bitcoin’s month (although Glover would inform you that he’s not so bought on that kind of historic learn, given all the adjustments bitcoin’s gone by way of).

However Glover does assume that bitcoin breaking out of its funk may act as a rising tide for all of our crypto boats.

“Once we start to see some upward momentum in bitcoin. I think everything’s going to come higher with that. I don’t think it’s just going to be bitcoin. I think you could be pulled alongside that as well. I think it’s what’s going to spur on that appreciation in bitcoin prices. I’m still not certain what’s going to cause that, because we have seen a bunch [of] hodler wallet addresses…adding,” however that transfer in all probability gained’t come till bitcoin tops $73,000.

As for when it may occur, that’s nonetheless anybody’s sport. Nevertheless it won’t be lifeless forward on the horizon, provided that open curiosity on CME declined final week, which factors to a discount in lengthy publicity, per K33.

“BTC futures premiums declined to 6.5%, its lowest reading since January 15, 2024,” the analysts added.

“So far this cycle, we haven’t even come close to bringing in the number of new people we have in prior cycles (new ETF investors excluded),” Kling identified, including that this could possibly be a backside sign.

Regardless of the murkiness, there are nonetheless ranges to observe, Glover stated, the underside ranges for bitcoin and ETH sit at $49,000 and $2,100 respectively. If a rising tide floats all boats….nicely, you get the image.

Whereas this might not be my most optimistic learn to date, the silver lining right here continues to be stablecoins, which sit at a complete market cap of $169 billion per DefiLlama knowledge.

Wake me up when September ends.

Knowledge Heart

- The whole crypto market has shed 5% over the previous day, now at $2.07 trillion capitalization, per CoinGecko.

- RUNE and TON are worst-off after slipping by 11% and 12% apiece.

- HNT and XMR are bucking the pattern, gaining over 10% prior to now week.

- 399 pairs have been created by way of the brand new Ethereum memecoin launchpad Ethervista since its launch on August 31. Whole influx quantity: $91.4 million.

- DAO treasuries are at the moment valued at below $20 billion, down from $42.5 billion on the March prime.

God forbid crypto has hobbies

Crypto has a number of traditions going for it.

Corporations and startups usually wage struggle with the SEC. The degens pump obscure digital novelties to sky-high valuations. And, after virtually each all-time excessive, token costs collapse by 80% or extra.

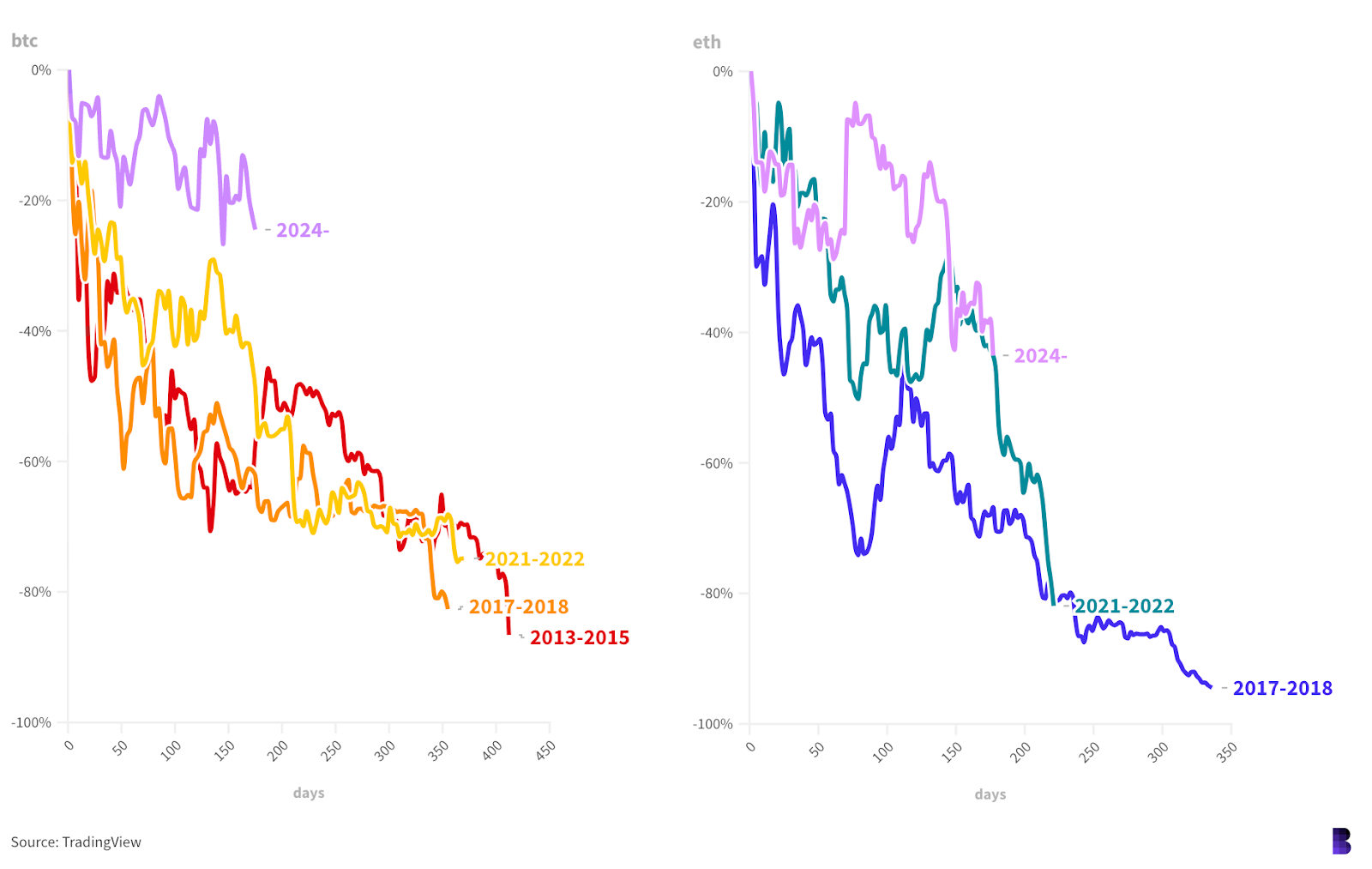

It isn’t simply the shitcoins carrying that exact torch. Bitcoin has retraced by that quantity (or extra) thrice since 2017 and ether has achieved it twice, though the latter has been a lot faster about it.

Bitcoin often bottoms out between 350 and 400 days after peaking, whereas ether has achieved it in simply over 200 on the shortest and below 350 days on the longest.

The chart under exhibits bitcoin and ether corrections after native peaks throughout the previous few cycles. We’re at the moment at round 200 days for the reason that pico prime.

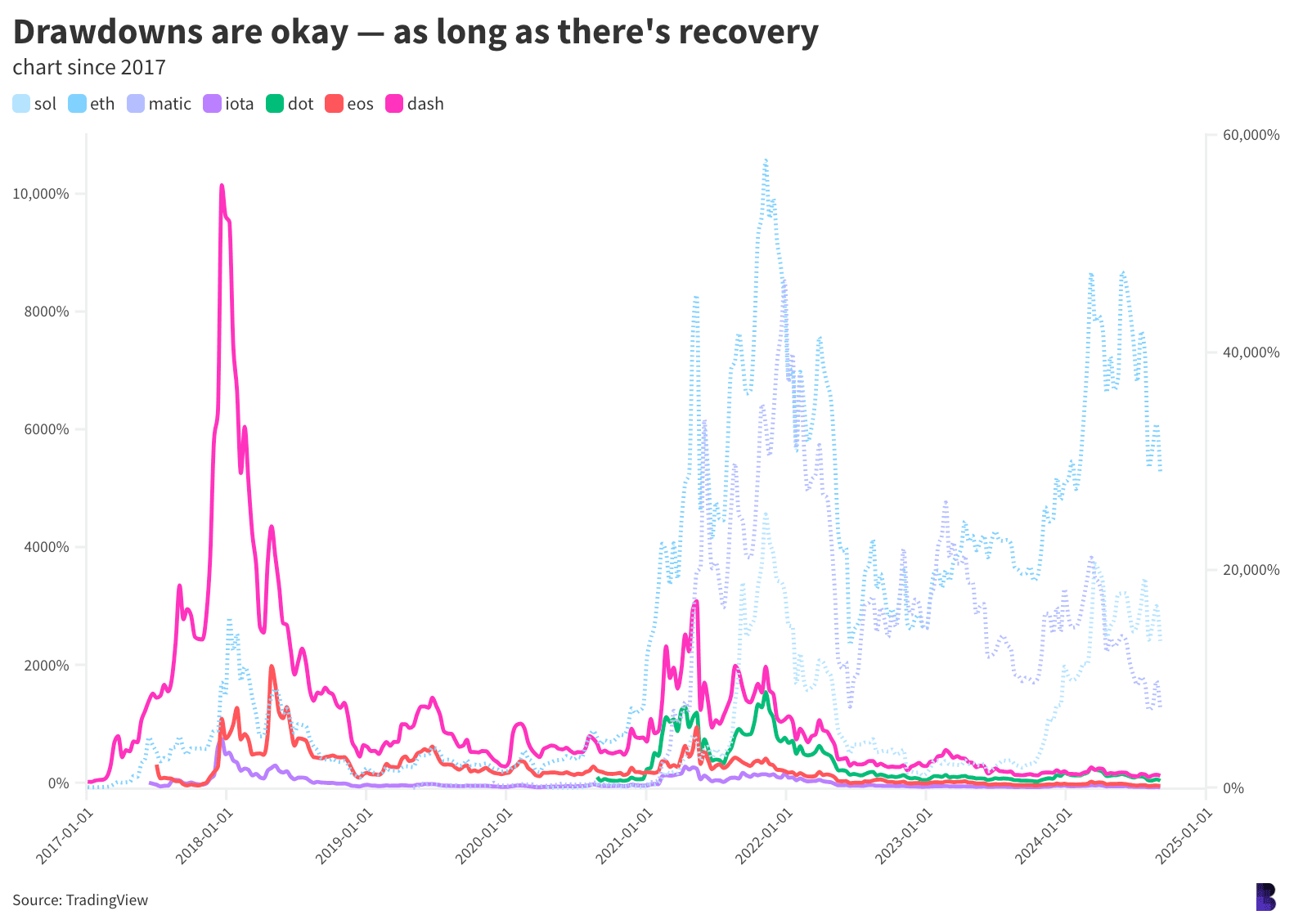

The actual trick is bouncing again even stronger from these sustained corrections. The checklist of prime 200 or so cryptocurrencies is plagued by tokens that by no means returned to report highs — together with even ether and sol.

This subsequent chart plots tokens that made it to at least one’s which can be nonetheless combating over the previous seven years. SOL, ETH and MATIC are the light strains within the again. These made it between cycles, regardless that MATIC is now struggling by comparability.

Within the entrance are former prime 10 cryptocurrencies which have largely missed out: IOTA, DOT, EOS and DASH.

All it is a reflection of crypto’s volatility. Cryptocurrencies could or could not run again their 80% corrections, however both manner, they’re — apparently — just about inevitable.

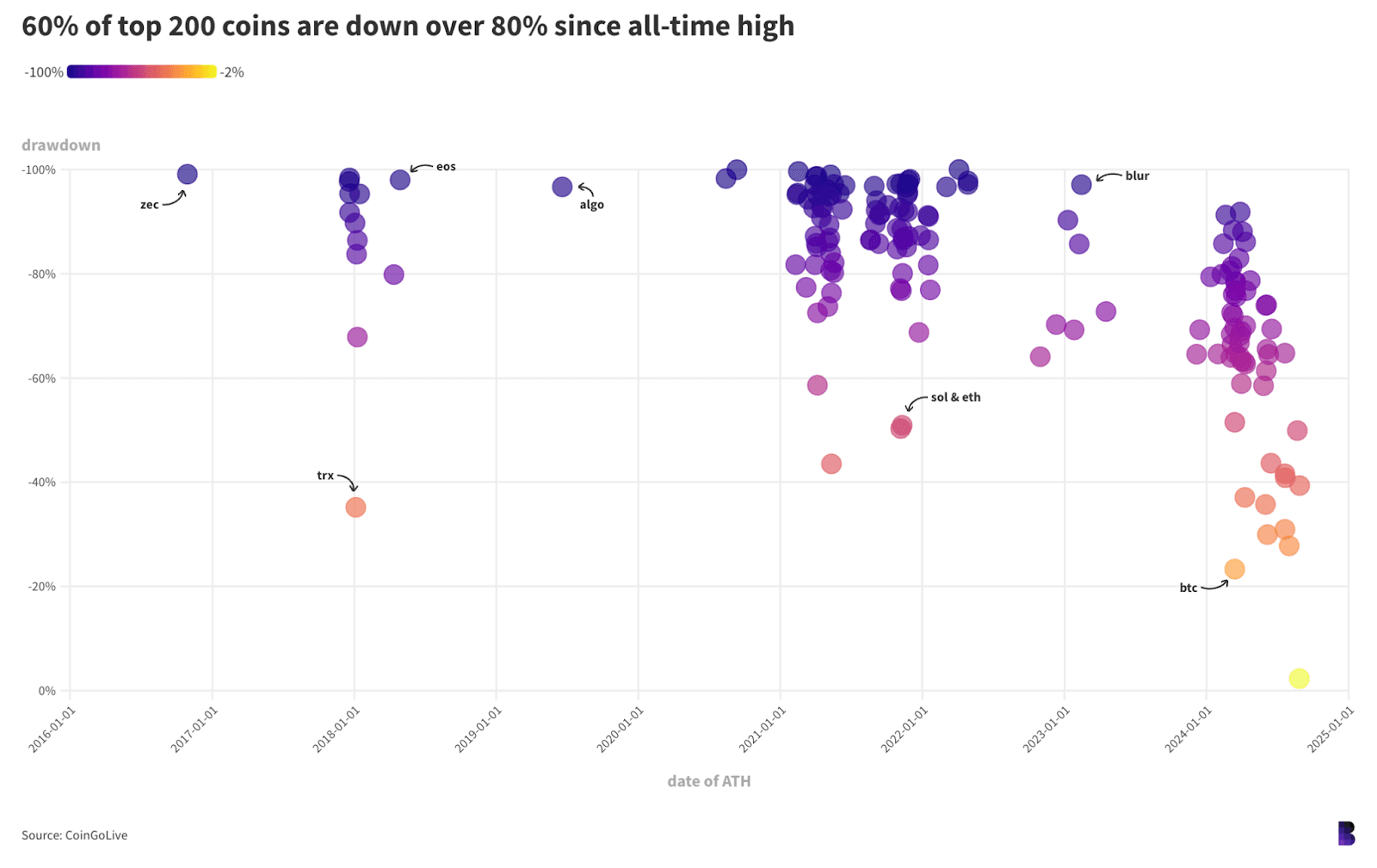

This subsequent chart kinds prime cryptocurrencies by the date they final reached all-time excessive. Every dot is a distinct token, they usually clearly focus across the tops of the previous three cycles, in 2018, 2021 and 2024.

Dots to the proper of the chart hit report highs most just lately, whereas those on the left had been for much longer in the past.

And cash gathered on the prime have corrected essentially the most — these on the very edge have misplaced virtually all of their worth in comparison with their all-time highs.

Greater than a dozen of the analyzed cryptocurrencies that set worth data this cycle have already had their 80% drawdowns, together with AEVO, STRK, WLD, W, ENA, DYM and DYDX.

Much more have misplaced over 60%.

As is custom.

The Works

- The Trump-backed World Liberty Monetary venture will likely be constructed on Aave and the Ethereum blockchain and can embrace decentralized borrowing and lending, CoinDesk reported.

- Tiffany and Lara Trump had their X accounts locked down after each had been hacked and falsely promoted the World Liberty Monetary venture.

- Ripple’s Brad Garlinghouse stated his firm just isn’t taken with going public within the US.

- Matter Labs reduce 16% of its workforce Tuesday, Blockworks reported.

- TradFi corporations are taken with transacting in bitcoin, Cantor Fitzgerald CEO Howard Lutnick stated.

The Riff

The one one which issues: the frequency of “gm” tweets from former Binance CEO Changpeng Zhao.

Zhao, who remains to be in custody till the top of this month, hasn’t tweeted “gm” since December 4, 2023 (and in no way since a number of weeks earlier than he checked into jail in June).

Bitcoin traded for $42,000 earlier than Zhao’s final “gm” and would go on to rally as much as 80% over the subsequent few months.

We already know the way bullish a Zhao gm might be — bitcoin has gone up nearly each time after these posts.

Calling it now: No god candle till Zhao shares his subsequent “gm.”

If we’re answering severely, then I’m maintaining a tally of the potential lows for bitcoin and ETH (particularly as ETH hangs round $2,300).

If I had been to have a bit of enjoyable with it, then I’d say I’m educating myself all about astrology due to Lexi Wangler of Mysten Labs.

Is crypto in retrograde? Do we have to control what moon we’re in? These are all essential inquiries to ask.

I, like Glover, take the historic knowledge with a grain of salt at this level, however the smaller indicators like CME open curiosity make me assume that maybe some merchants are studying into one thing (or perhaps they’re farther alongside of their astrology research and might higher predict what’s about to occur).

— Katherine Ross

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.