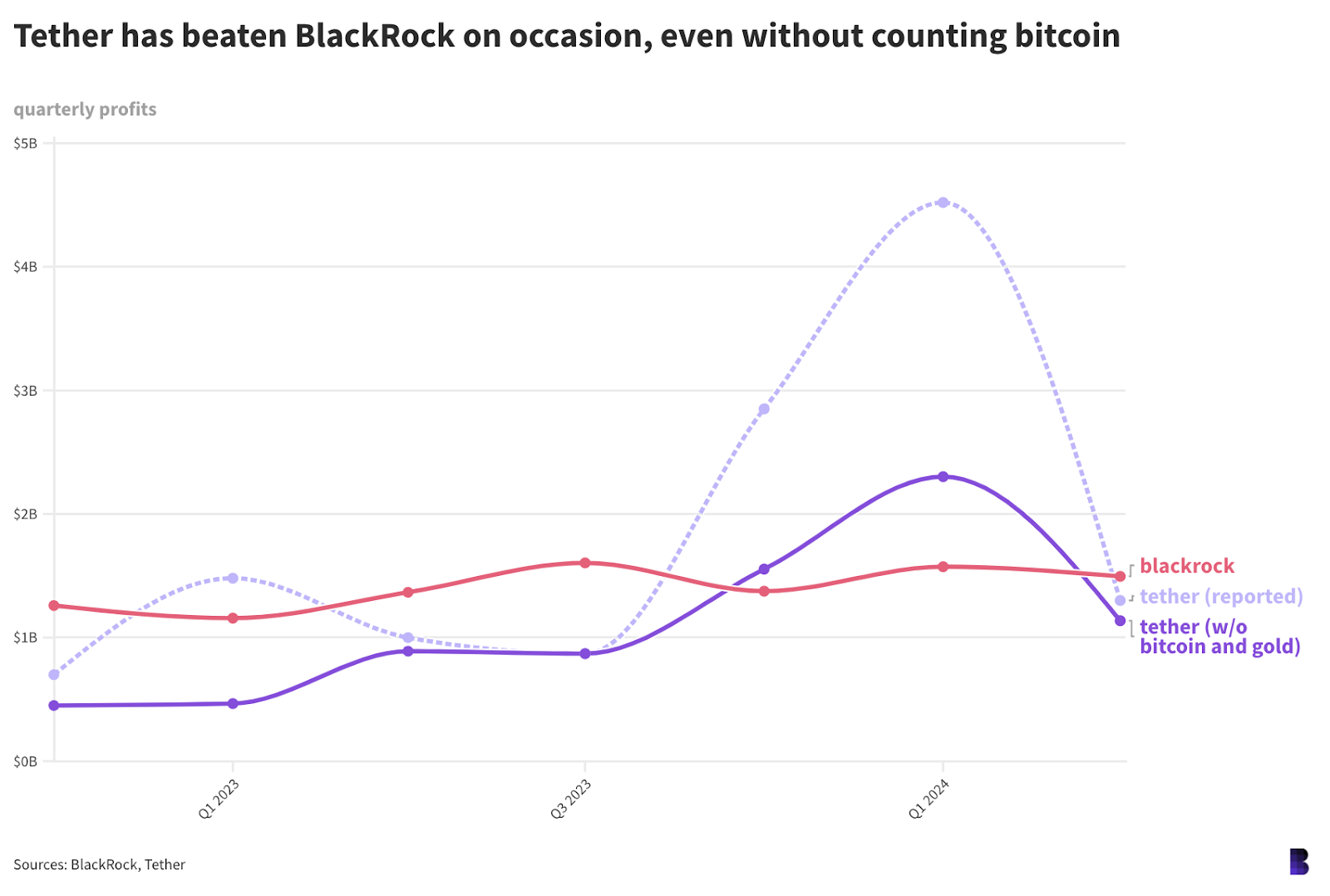

Tether has made a habit of sharing truly massive quarterly profit numbers alongside its attestations reports — and they’re bigger than BlackRock’s.

BlackRock has reported $9.83 billion of net profits since the fourth quarter 2022.

What isn’t usually discussed is that Tether is lumping in the profit from US Treasurys with the mark-to-market gains of its bitcoin and gold holdings — potential profit or unrealized gains — as outlined in one of its blog posts. Tether’s figures are inflated by this.

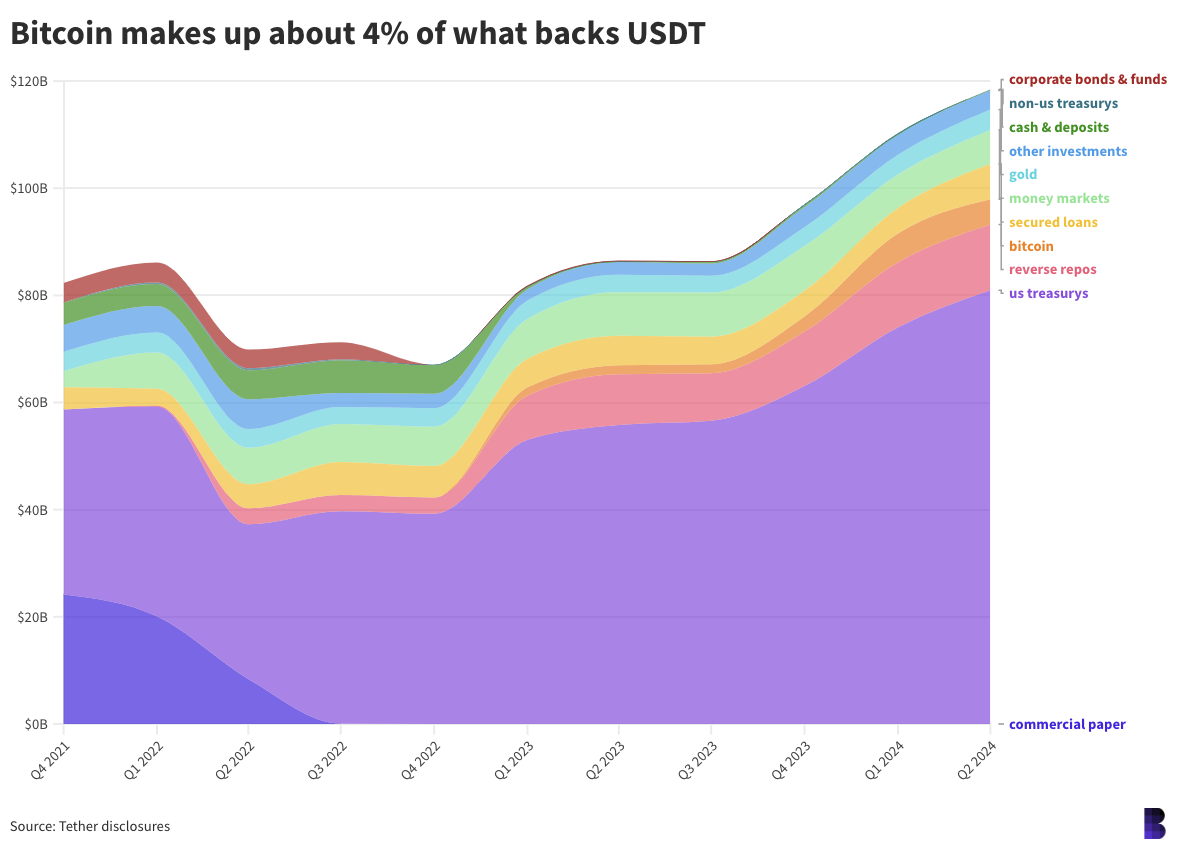

Tether’s quarterly reports describe the assets that make up the reserve pool, which gives tethers value. As of its most recent report, for the end of Q2, there was almost $118.44 billion backing the tethers in circulation — conveniently over $5 billion more.

All tether, then, is properly backed with an equivalent amount of reserves. Attestations, however, are not audits. Tether was never audited. “audited,” For reasons.

Short-dated US Treasurys accounted for around 68% Tether’s reserves. Reverse repurchase arrangements, money markets funds, secured loan and bitcoin were the second largest categories.

Bitcoin is cash — no need to sell it

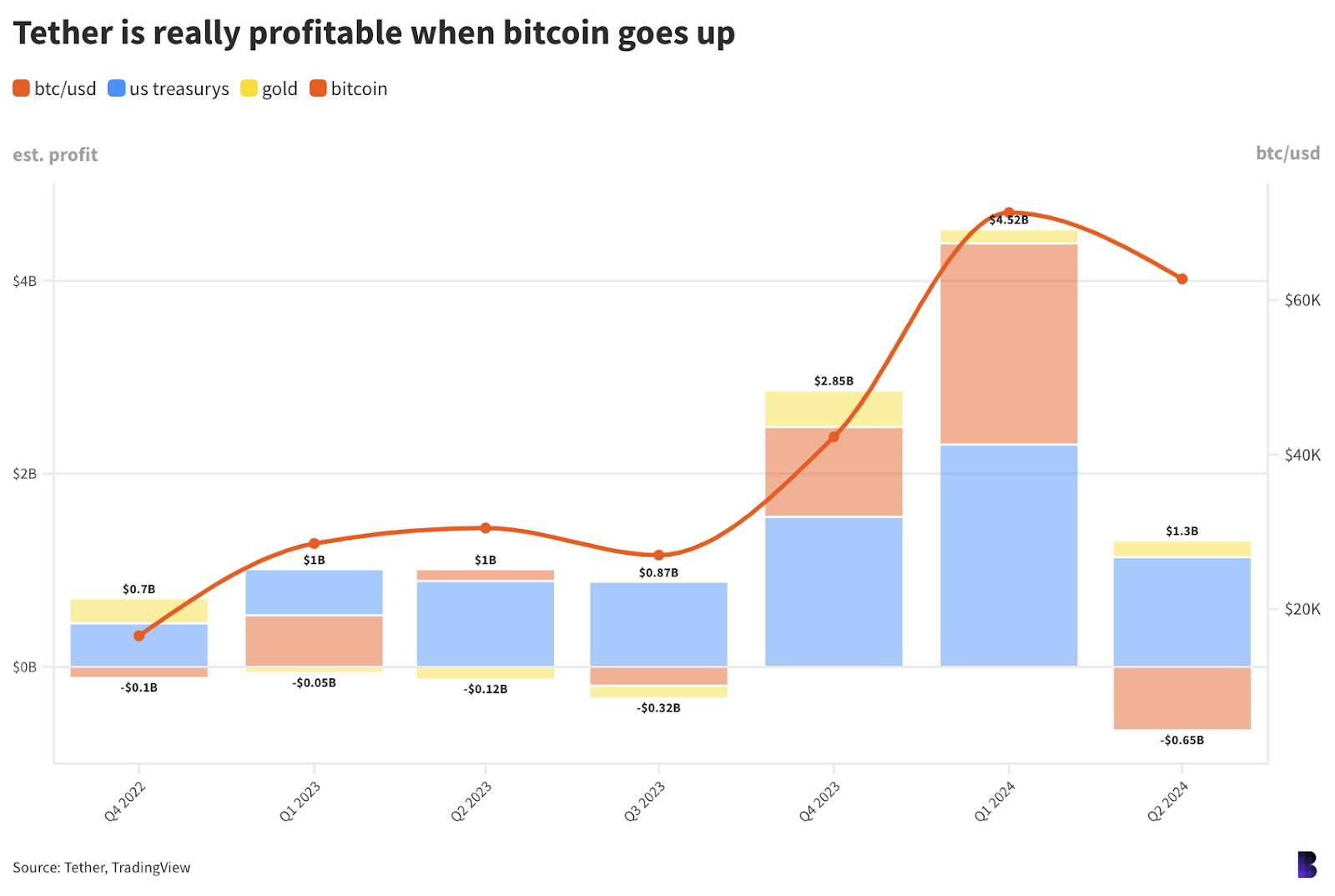

Tether announced a $1.3 Billion quarterly profit along with the Q2 announcement. This is a staggering sum considering the small number of employees, estimated to be less than 100.

The US Treasurys that it purchases are responsible for a large part of the profit. The rate on three-month Treasury Bills is currently 4.85%. Tether held almost $81 billion in Treasury bills, so the profit of 10 figures sounds right.

Take the first quarter of this year. Tether announced $4.52 Billion in profits. Tether is apparently considering the bitcoin price increase of almost 70% as free profits.

Tether’s profits have typically ranged between 1.01% to 1.81% when bitcoin isn’t so volatile. When bitcoin was at its highest point in 2024’s Q1, this figure was 4.1%.

The firm also reported that its bitcoin holdings increased in value by $2.56 billion throughout that period — from $2.82 billion to $5.37 billion. According to its history and attestations, Tether bought 8,888.88 BTC (currently worth $513.6 million) in the last quarter. However, it is not known at what price the firm bought the coins.

Tether has spent about $481.5 Million on bitcoin if you take the average quarterly price.

Tether’s quarterly earnings can be calculated by dividing its estimate of spending by the value of all its bitcoins. “bitcoin profit” Tether’s total reported was $2.08 Billion, which is 46%. US Treasurys contributed another 51% while the gold price’s appreciation may have offered around 3%.

These are estimates, based on the average price during an unstable period for the bitcoin’s value. It is not known how Tether acquires bitcoins that are deposited into the treasury.

Estimates suggest, however, that bitcoin contributed to nearly half of Tether’s reported quarterly profit, despite making up less than 5 percent of Tether’s portfolio.

Tether reports that the US Treasurys contributed $4.52 billion in Q1 to Tether’s profits, and the remaining $1 billion came from bitcoin gains, as well as gold. This would indicate that BTC is responsible for a much larger portion of Tether’s reported total profits. It could even be as high as 75%.

Tether wrote: “The main contributing [Tether Holdings Limited] entities are those in charge of issuing stablecoins [Tether] and managing the respective reserves where approximately $1 billion of this profit stemmed from net operating profits, primarily derived from US Treasury holdings. The remainder of reported profits were comprised of mark-to-market gains in bitcoin and gold positions.”

Tether could technically turn ‘unprofitable’ if BTC dives

Tether profits will be reduced when bitcoin prices and gold are lower.

Tether only reported $1.3 billion of profit last quarter – nearly 70% lower than the Q1 figures – despite having almost $6 billion additional in US Treasurys.

Tether’s value in bitcoin dropped by $648 million because bitcoin prices fell 12 percent between periods. Tether didn’t acquire any BTC in between quarters, which meant that there was no opportunity to gain a large amount of profit unrealized from newly acquired coins.

Tether’s quarterly profits would have been almost $2 billion if bitcoin had retained its value. Tether only disclosed its Q1 2024 financials in which it separated bitcoin, gold and US Treasury profits.

Does Tether make more money than BlackRock?

If you combine the gains from US Treasurys and bitcoin/gold appreciation, then Tether will be more lucrative than BlackRock. Tether has to actively buy US Treasurys in order to make money, but does not have to report the bitcoin or gold gains, just hold.

Tether’s profits are higher than BlackRock’s using this system.

On the basis of these ballpark figures, Tether could have made as little as $7.7 billion if it only included its US Treasurys in Tether’s reported profits.

This is a difference in the order of $5 billion. It’s still a monstrous amount of profit but would be just short of the largest asset manager in the world.

Tether has to be the most lucrative company outside crypto and within it.

Depending on your definitions of profit, it might still need a few more years to eclipse BlackRock — but it seems inevitable.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.