The Fed is still cutting interest rates despite an economy which appears to be doing well.

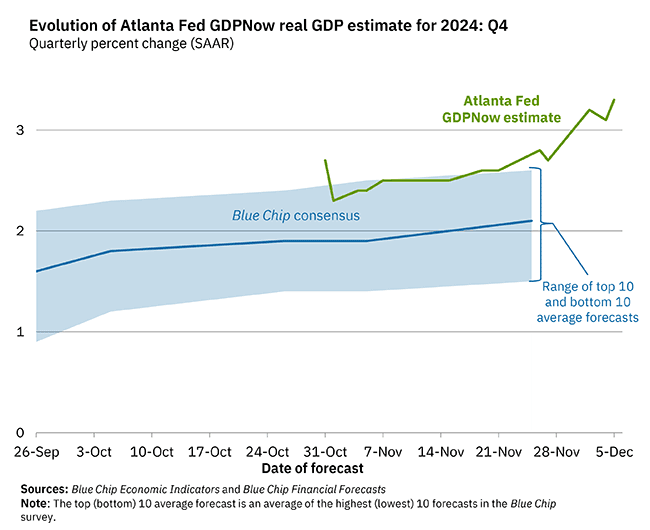

Atlanta Fed GDPNow forecasts 3.3% growth in real GDP for the fourth quarter, and this rate appears to be rising:

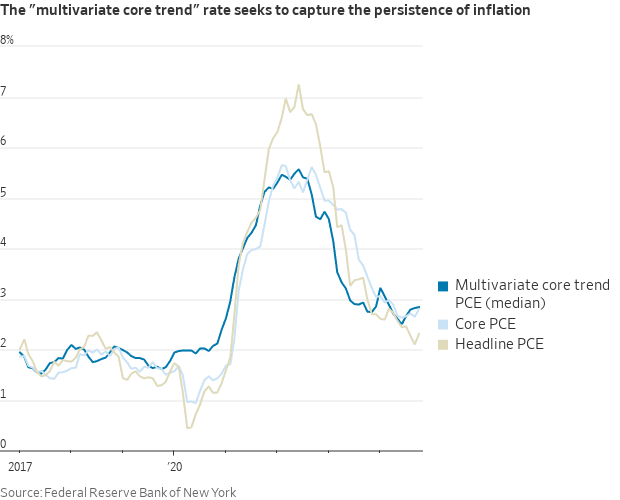

It appears that inflation has reached its bottom and is on the rise.

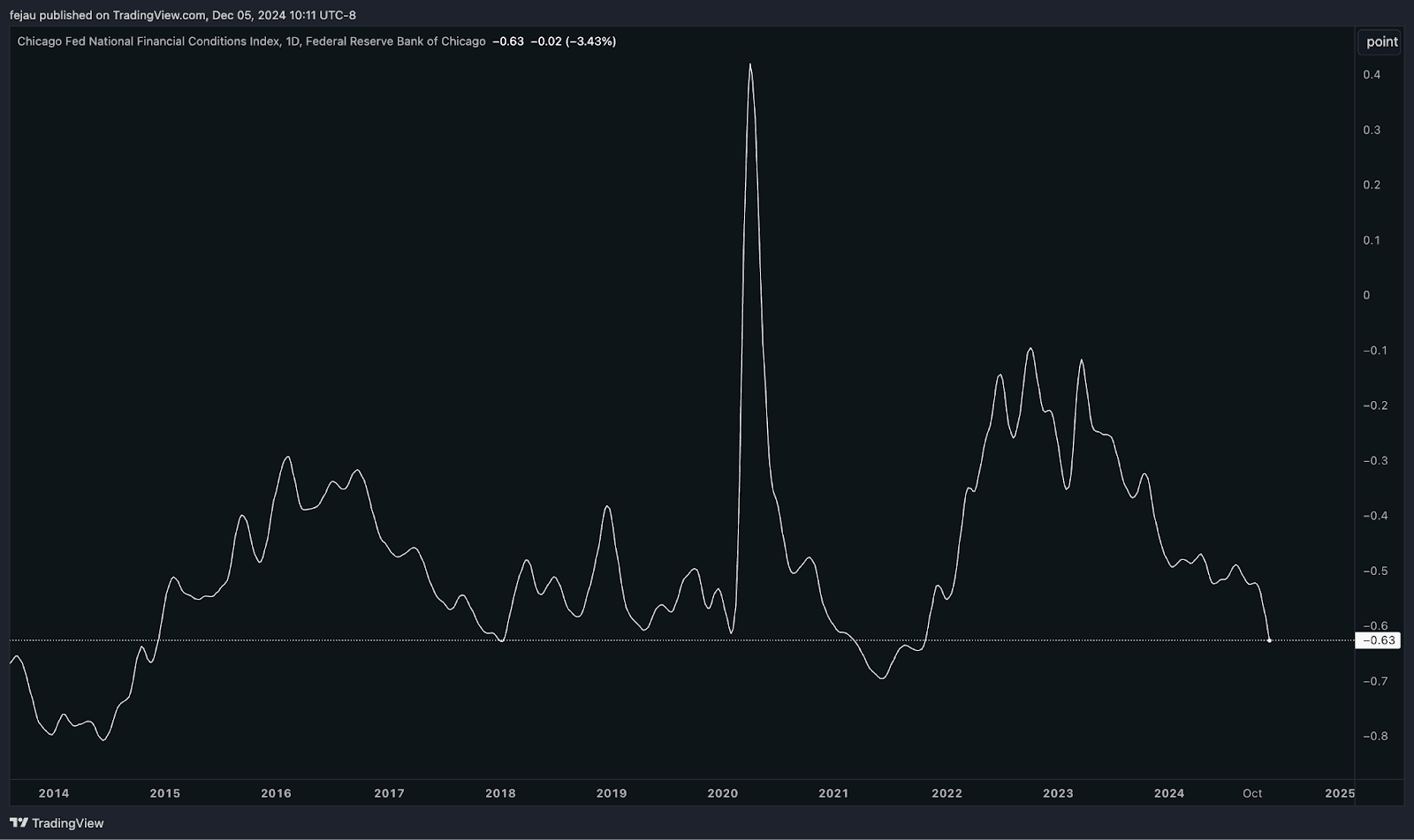

Financial conditions today are almost the same as in 2021, when things were a bit looser.

The FOMC still has a 70% chance of cutting interest rates in December, despite all the metrics that show an economy doing well. Many people are confused as to why the FOMC would cut rates.

Simple reason: the committee already steered the market in the direction of them cutting December. The committee would not want to upset the market, reverse the guidance or skip the cut when it was already expected.

It is more intriguing to know why the Fed made this decision. It has to do with r* — the neutral interest rate — and how the Fed measures it.

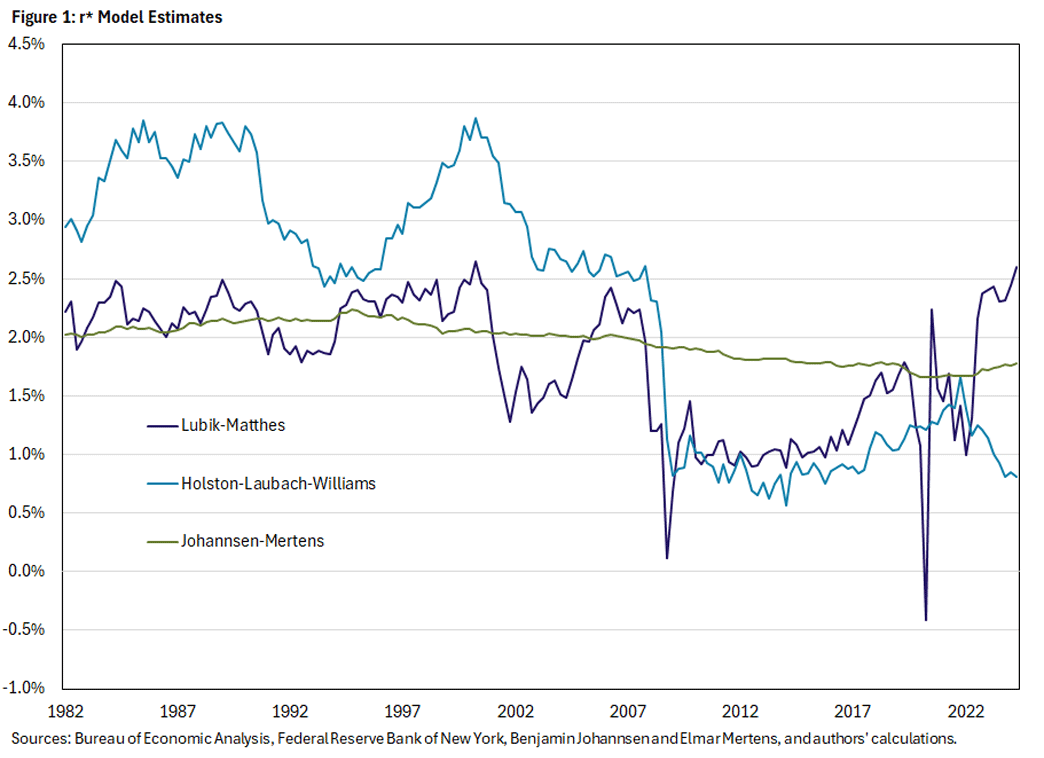

Because r* cannot be directly measured within the economy, policymakers instead rely on models that do their best attempt at estimating it. There are two models which do a good job of this: the Williams model and the Lubik Model.

The Lubik model is more dynamic and based on a statistical model approach, whereas the Williams model is based on more traditional macroeconomic models that are less sensitive to major shifts in the drivers of r*.

Considering that the creator of the Williams model — John Williams — is the current NY Fed president, this model is weighted more heavily within the confines of the Fed compared to the Lubik model.

As we can see in the chart below, the Lubik model has picked up a significant uptick in r*, whereas the Wiliams model remains at a secular low.

Due to this continued adherence to Williams’ model, FOMC still believes strongly that the monetary policies are very restrictive and they could easily reduce to 4% without compromising on their restrictiveness.

If we instead use the Lubik Model, it’s possible to argue that monetary policies are already neutral.

Market signals (as seen from the charts in this article) are all over the map that indicate we’re in an accommodative policy environment. The Williams model can be assumed to be incorrect, given the current state of the market and economy.

FOMC members have been talking a lot about where neutral could be. It’s possible that members are re-evaluating their commitment to the Williams Model. Austan Gholsbee is one FOMC member who prefers to “feel their way” Neutral. Take a look at the reaction of the economy and proceed from there.

In light of the fact that markets are hitting all-time records on a regular basis, it is hard to say we have a restrictive stance. A cut is still expected in December as long as the FOMC sticks to its bureaucratic inertia in relation to the Williams Model.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.