This week, the FOMC meeting minutes of November did not mention any rate reduction expectations.

This excerpt was hidden deep inside the minutes.

The Fed has essentially decided to lower the rate of award on assets of Reverse Repo Facility by 5 basis points. This would reduce the range for the Federal Funds Rate Band’s bottom target.

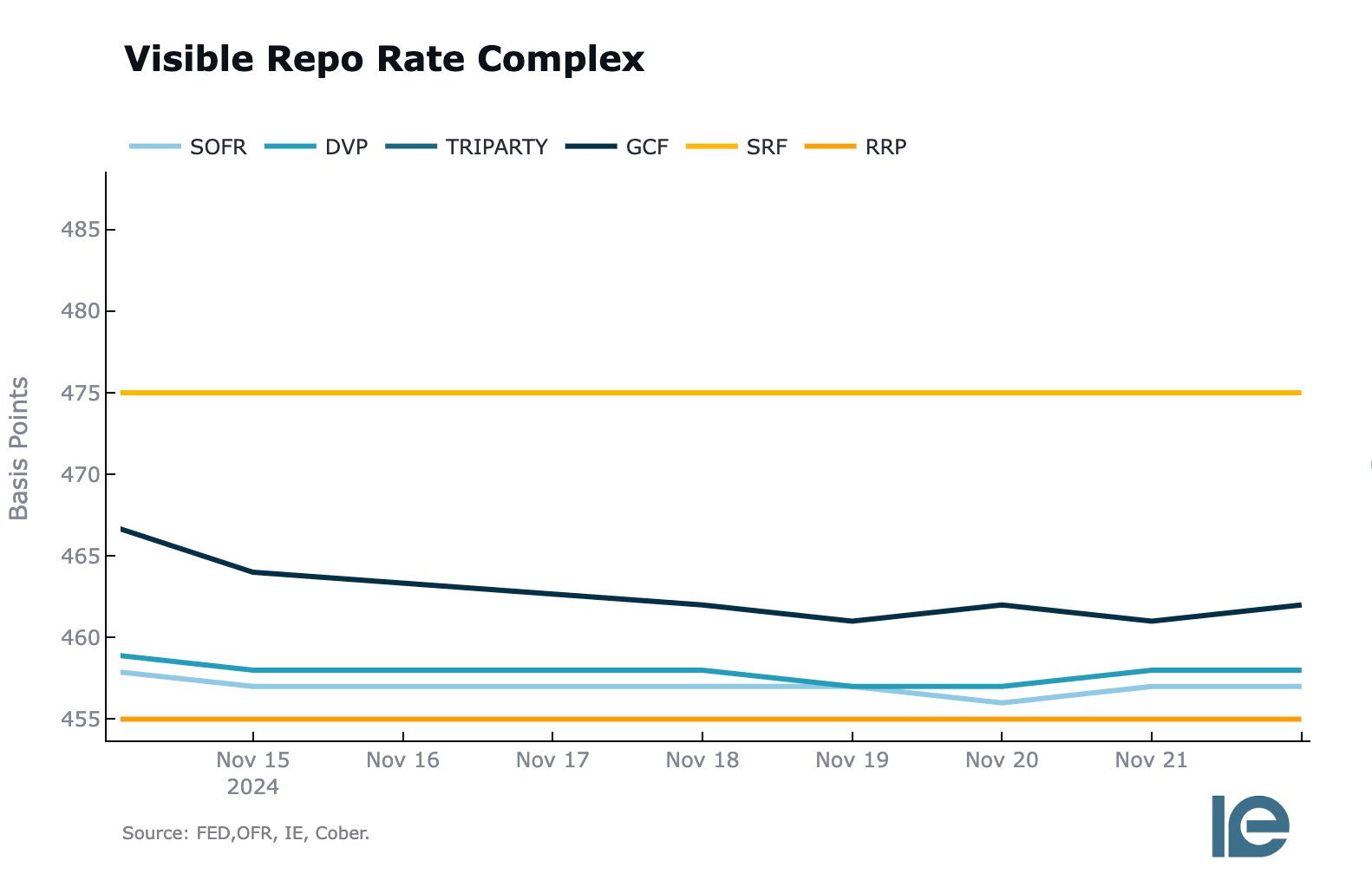

This is how the complex appears visually

There’s only one plausible theory as to why FOMC would want to reduce this rate:

The FOMC may be attempting to stay ahead of things by increasing the bank reserve and encouraging the outflow of funds from the Standing Repo Facility.

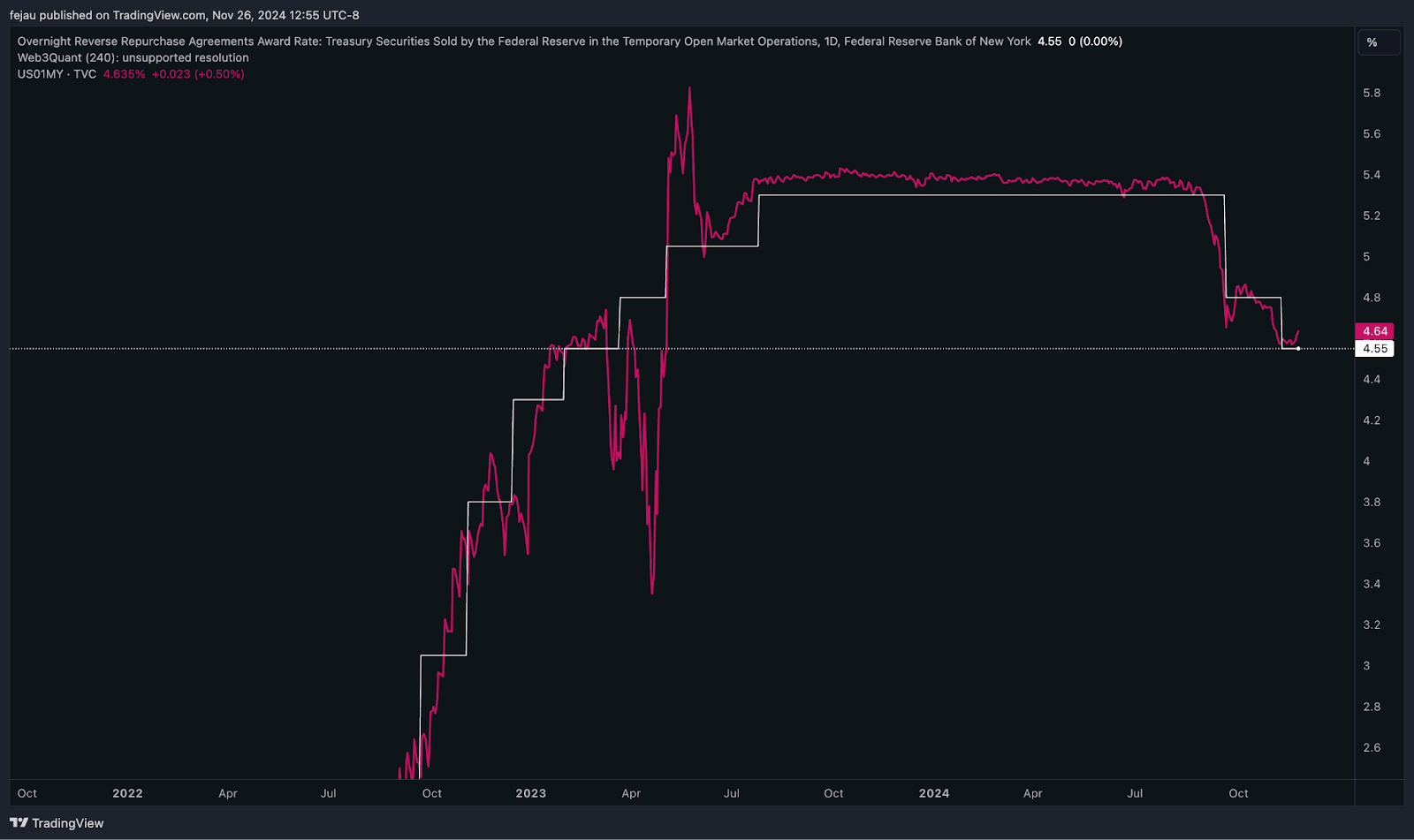

This chart compares the T-bill award rate and the RRP for a $1,000,000 bill. Money Market funds will generally own both, depending upon which one has the highest yield. The T-bills become more appealing by reducing the award rate:

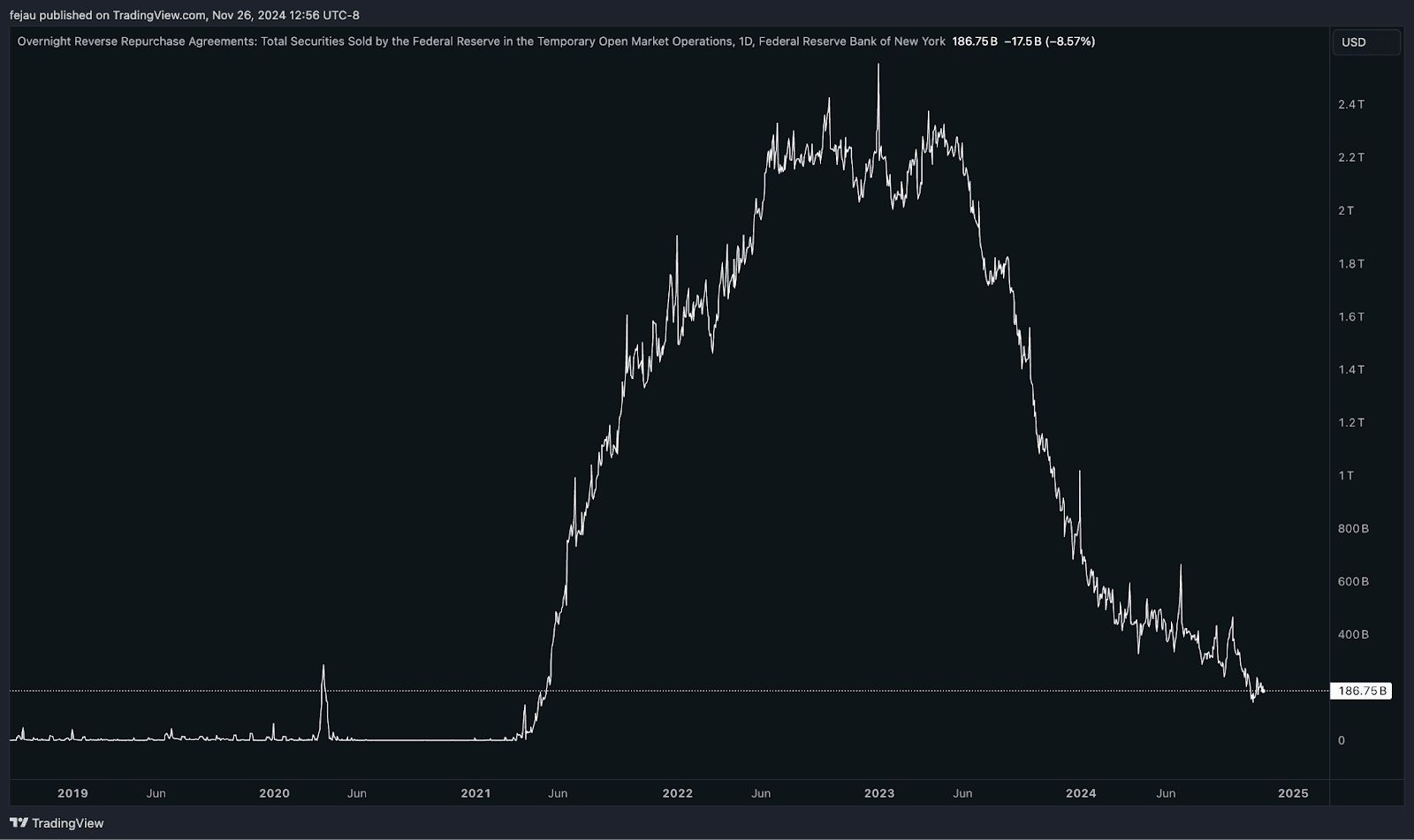

The RRP balance currently stands at $186 billion. “stuck” In the RRP. It appears that the FOMC wants to inject this money in the financial system, to maintain liquidity. It is important to note that the FOMC’s actions are in response to ongoing QT, which could put pressure on bank reserves.

It will be necessary to wait for the FOMC’s next meeting, in December, to determine if that is indeed the case. By acknowledging the potential for this dynamic, FOMC signals that it is becoming more concerned with bank reserves liquidity levels.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.