The market had priced multiple cuts of 50 basis points in the September price, which could quickly bring us to the 3% fed funds rate for 2025. Now, fast forward to the present, where one to two rate cuts are best priced in 2025.

Find out what’s driving the change, and how to prepare.

Here is a graph that compares two-year Treasury notes with the Federal Funds Rate (EFFR).

We can learn a lot from the comparison of these two yields.

- We’ve witnessed many times in the past two decades where the 2-year priced an impending and aggressive cut cycle (e.g. when it heads below the EFFR).

- These two yields have been equal since the middle of 2022. It is clear that the market believes a cycle of rate cuts is over and does not expect any future increases.

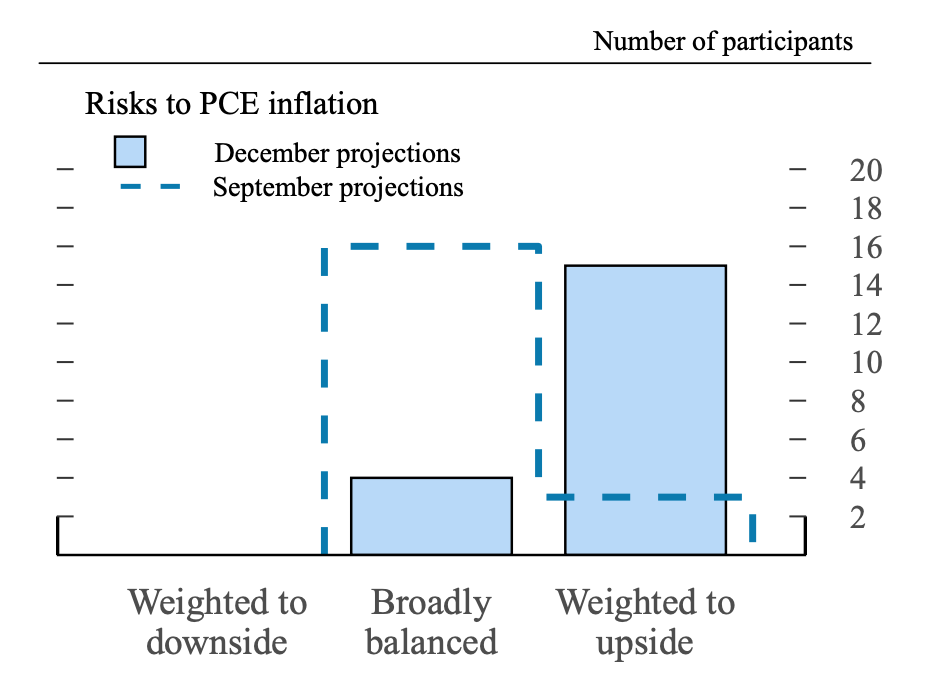

The surprising stubbornness of inflation is one factor that has fueled the talk of a quick end to this cycle. In the summary of December’s economic projections we see that FOMC members are no longer seeing inflation as broadly balanced, but rather as a risk to the upside.

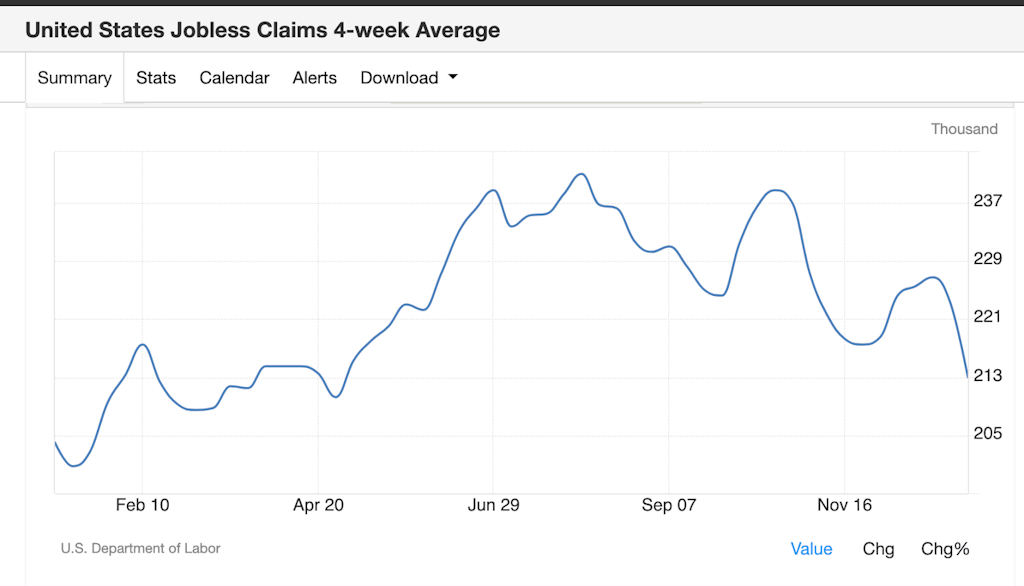

In combination with a labor market that is much stronger and more stable than it was in September, when the FOMC began to reduce rates, this is shifting the distribution towards a more hawkish response function.

Now that we have all the pieces, it’s easier to understand why the belief in the end of the rate cutting cycle has grown.

There are some dovish voices in the FOMC.

Waller said in his address this week that he believed he could still cut this year. “So what is my view? If the outlook evolves as I have described here, I will support continuing to cut our policy rate in 2025. The pace of those cuts will depend on how much progress we make on inflation, while keeping the labor market from weakening.”

Like the past two years, the year 2025 will be a year where markets go from aggressively hawkish to aggressively dovish.

Investors must decide quickly whether they want to ride the changes in sentiment, or just ignore them.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.