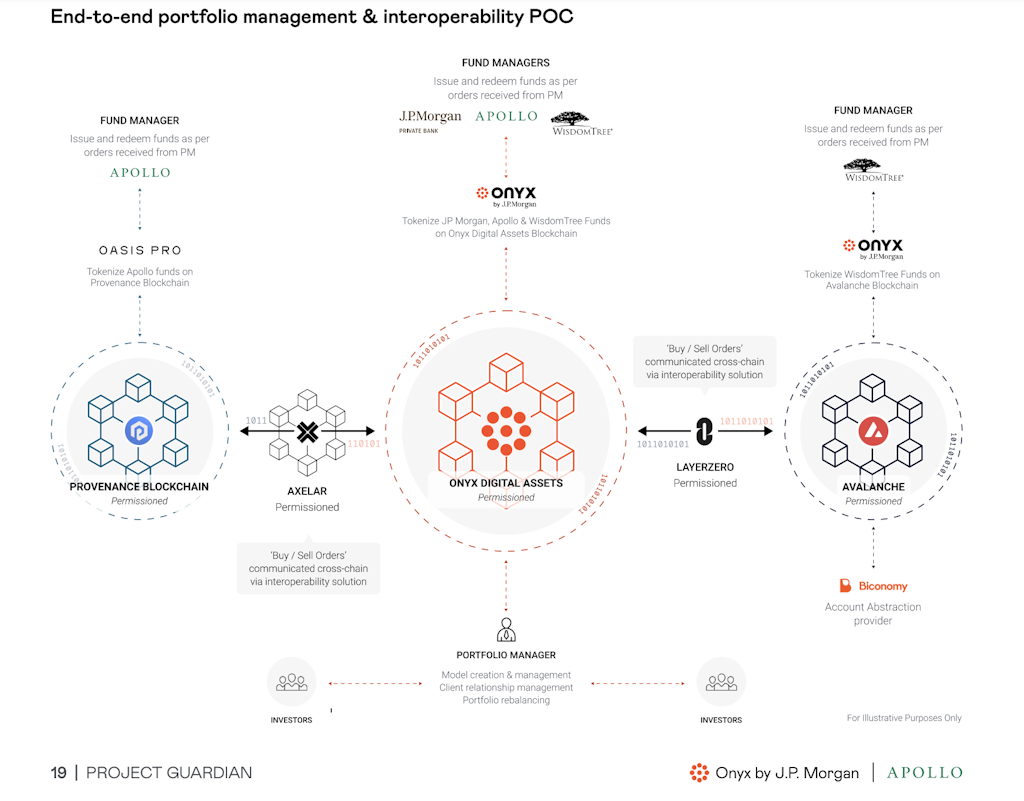

JPMorgan’s blockchain division, Onyx, has collaborated on a proof-of-concept with several industry startups that shows how tokenization could help manage financial assets better.

Project Guardian of the Monetary Authority of Singapore was responsible for testing. Its purpose is to allow fund managers tokenize their assets on blockchains of choice.

Wealth managers are able to purchase positions and then rebalance them across the different blockchain networks.

Provenance Blockchain and JPMorgan’s Onyx Digital Assets were chosen to be the three blockchain stacks used for this concept proof. Cross-chain communication protocol Axelar and issuance-slash-trading platform Oasis Pro also contributed to the initiative.

These transactions are important because they were permissioned, which means that only a few people had access to them on the private blockchain network. The transactions will not appear on chain explorers like Axelarscan and Mintscan. However, a JPMorgan and Apollo study provides examples of transactions.

Galen Moore (global communications lead, Axelar) told Blockworks Axelar had created an instance with permissions for linking different chains. It did this by altering its current cross-chain setup to be in line with the privacy management and access control requirements of the proof-of concept.

“The purpose of this Project Guardian was to demonstrate a system that would allow a portfolio manager to manage a large number of discretionary portfolios comprising tokenized assets across multiple blockchains,” Moore says “In that, it was successful.”

Future deployments are not certain whether mainnets and public chains will be included. JPMorgan, however, has actively explored possibilities within the space of blockchain technology. JPMorgan has also been processing tokenized foreign currency trades in Polygon’s mainnet via modified versions of Aave Arc, a permissioned DeFi-based platform.

JPM Coin, the system that is based on blockchain, has given its institutional clients more flexibility in terms of payment. Users can set different parameters around their payments.

On-chain digital wallets are also being explored by the bank, which allows users to manage and store digital identity through its platform.

“Consistent with the goals of Project Guardian, we believe our POC is a critical moment at the intersection between traditional finance and blockchain technology,” JPMorgan wrote a detailed report.

“We view our contribution to Project Guardian as the first step of a journey into the complex business of delivering higher quality discretionary investment portfolios in a thoughtful and efficient manner to improve the end investor’s experience and results.”

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.