Howdy!

The Kansas City Chiefs are extremely fortunate at the conclusion of games. When will this end?

Day two of NFL is here and my Buffalo Bills are already down to their last chance to beat Patrick Mahomes. The newsletter subscribers will keep me entertained:

Solana has chosen Kamino as the home of his liquidity incentive program

PayPal’s stablecoin PYUSD has seen rapid growth recently on Solana. Kamino, the newer DeFi-based platform which is the main driver of growth in this area, has been a major factor.

Kamino is a borrow/lend protocol based on Solana, which began to gain real traction at the end of 2023. In early July, generous liquidity incentives were offered for PYUSD. Onchain data shows that today, around $344,000,000 PYUSD are held in Kamino. On Solana, this is equivalent to 62%.

It’s easy to see why PYUSD grew so quickly on Kamino — it was offering 18% APY on the stablecoin for a time. The increased yield was not cheap. The PYUSD is spending $500,000 per week on incentives.

Sources with insider knowledge told me these incentives were given out by Trident Digital. This is a small, unknown firm which Paxos uses to boost its liquidity. It was not clear to me whether funds used for the incentive of PYUSD adoption are paid by PayPal or the Solana Foundation.

PYUSD’s adoption spending is not the only thing on Kamino. Actually, 8 of Kamino’s top 10 most-used liquidity vaults also have “incentives farms,” Kamino appears to be letting projects pay for their tokens upfront and then disbursing them to the depositors. Many Solana-funded projects appear to be doing this. Jito Marinade Blaze and Sanctum, for example, all have active liquidity farms. Ethena and Wormhole also seem to have spent money on liquidity incentives.

Kamino grew significantly during this time. DeFiLlama reported that, on December 6, 2023 Kamino’s total value (TVL) was $42 million. In nine months, the number was $1.4billion. Kamino could be a real contender to Jito as Solana’s biggest protocol by TVL.

Kamino has been compared to the Ethereum borrow/lend protocol, Aave. This blue-chip DeFi protocol is ranked 3rd in TVL of all protocols and currently holds over $11 Billion. Kamino isn’t the only borrow-lend protocol on Solana — MarginFi and Save (formerly Solend) also come to mind — but its liquidity management vaults tab appears to be setting it apart. It’s worth noting that the other two incumbents aren’t without their flaws.

Kamino TVL is still a question mark. The weekly yield increase appears to be gradually decreasing. Kamino also has $148 in cash vaults. Many of these are rewarded.

“Kamino lenders are happy lenders,” The co-founder of Kamino wrote a piece on X in this past week. It will be interesting to see whether liquidity incentives can keep them satisfied.

— Jack Kubinec

Zero In

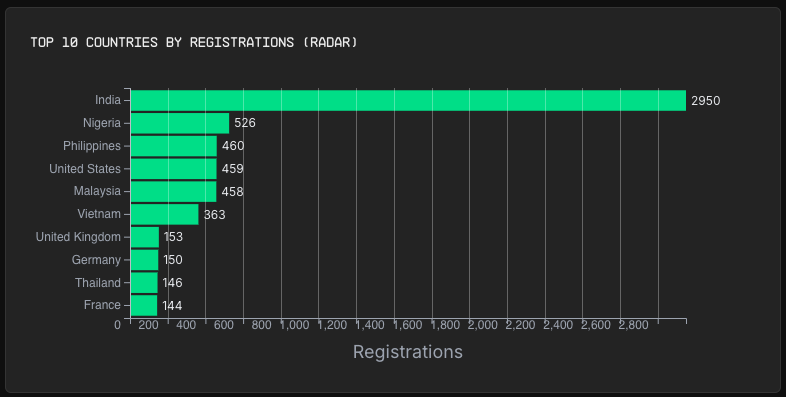

India showed up for Colosseum Radar’s hackathon.

More than one third of registrants are Indian. The hackathon is taking place from now through Oct. 8. Hackathon participants can join Colosseum’s Startup Accelerator, and receive a check for a small seed investment.

Colosseum’s first hackathon in the spring produced the viral Solana experiment Ore, which we’ve written a fair bit about, so I’ll be rooting for some similarly-interesting new projects to emerge from this hackathon.

— Jack Kubinec

The Pulse

ICYMI — Stories you may have missed this week:

- 0xDeep Solana Programs Verified Directory was created as a public dashboard of trusted and verified Solana Programs. This is to assist users in ensuring the integrity of interactions.

- PRISM Explorer The first AI-driven platform of data intelligence for Solana was launched. Users can now query the Solana ledger all the way back to Epoch 0 using SQL agents and AI.

- Volmex Finance Introduced the SVIV Index – Solana’s first implied Volatility Index, which tracks 14-day anticipated volatility, with updates for derivatives trading planned.

- Jupiter Exchange announced its new ‘Protect your swaps’ feature, intended to safeguard transactions from sandwich attacks by routing swaps directly to Jito Labs validators.

- GRASS is an airdrop caused disappointment among some users due to smaller-than-expected token allocations, despite its minimal participation requirements.

- Mercuryo The Spend card will allow users to spend crypto in over 90M Mastercard stores.

- Scammers The Token 2022 Standard has been used to create a method of burning tokens from Solana wallets, adding an additional layer of danger for unwary users.

- AggLayerThe CEO of Polygon Labs introduced a new layer that connects Solana to Ethereum and other blockchains. “infinite scalability” Web3.

- Byte The company has started to offer bbSOL – a liquid stake token for Solana. This allows the user to maximize their returns while maximizing liquidity.

— Jeffrey Albus

One Good DM

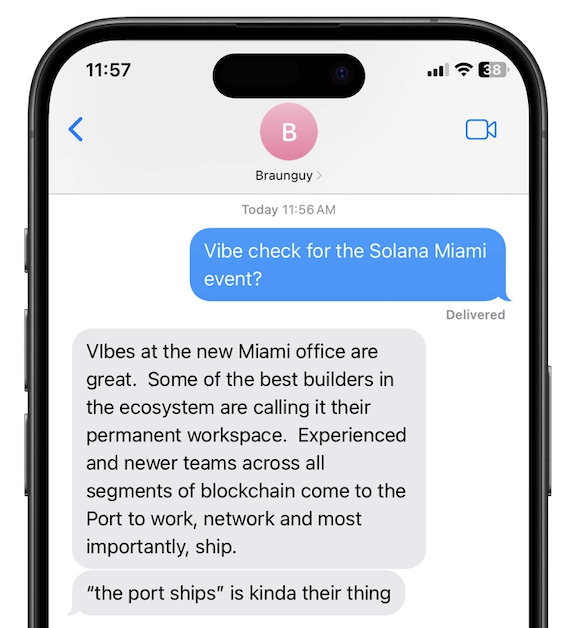

“Message from braunguyCo-founder and co-founder Lulo

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.