Howdy!

We’re currently in the worst sports month of the year — especially with the USA knocked out of Copa America — and the situation got so dire that I started watching the Tour de France. Mark Cavendish has broken a record. It’s time to go and touch the grass.

The story of the person who bought Solana for $0.04 per token.

Q&A: The true confessions of Solana’s first VC

Edith Yeung met Anatoly Yakovenko while investing in 500 Startups. He pitched the idea of Solana, which was a blockchain with a low cost and a quick speed. She saw Solana’s early days unfold — and made an incredibly lucrative venture investment in the process. Continue reading to read an excerpt of my interview with Edith.

Jack: What was your first encounter with Anatoly like?

Edith: Anatoly met me through a mutual friend. David is his name. I can’t even make this shit up — David played water polo with Anatoly. The fact that anyone can play underwater polo is beyond me. David was aware that I am a crypto enthusiast, and so said. “hey, you should meet this guy Anatoly.”

It wasn’t called Solana when he first told me. Loom was the name. He basically stated that the proof of work does not really work. The speed will never be high. It is impossible to make a horse as fast as an automobile. It’s easy to do, you just have to start from the beginning. I thought his ideas and thoughts were refreshing. He had absolutely nothing – not even a single whitepaper. We invested based on founder’s trust and faith.

[After launching, the Solana team] The number of staff members grew to an unprecedented level, from a single person up to four people and beyond. Our office manager was so shocked that she said: “You guys have way too many people. We need to kick you out now.”

[Solana co-founder Raj Gokal] We basically told them we needed a space. One Hawthorne Lane was the perfect space for them. This is walking distance. This is next door to the Gold Club which is an adjacent stripclub. It’s a good street. They were there up until Covid.

Jack: In the beginning, what did San Francisco people think of Solana?

Edith: Many investors dismissed the Solana, but if my memory serves me correctly, its valuation was between $15 and $20 million. That’s it. Most people did not want to invest.

People have pulled people out. [of the first round] because it was such a bad market and they didn’t want to get involved — and that’s a lot of the people who even are active in the crypto space. The people who are active in the crypto space just did not see it. “there’s going to be another Ethereum.”

Jack: How much did you invest in Solana initially?

Edith: The amount was $250,00 at $0.04 [per SOL token]This was the first round. The fund I had was very modest, only $10 million, and when $0.04 became $14.25 my fund already increased by 7 times.

We waited for about two years until the token launched. This is normal, and it’s the same as with equity IPOs. It started to trade, so the LPs that supported me asked, “What is this?” Most of the people who supported my career had never heard of crypto.

Early 2021 I handed out tokens to my licensees and basically said, “look, you may not understand what it is, but please trust me and keep it as long as you can and please don’t sell.”

Solana then went to a price of, I believe, $260. Some of the LPs looked like. “what the hell?” It was like I just sort of liked it. “you’re welcome.” Then there was nothing.

Jack: People often point out that FTX launched Serum, a decentralized exchange in the early Solana years. Was FTX involved in Solana before the collapse?

Edith: Sam [Bankman-Fried] Serum was built on Solana. They were searching for something. “can we find an alternative to Ethereum [for traders]?”

Serum became a hit because FTX promoted the product, but it also allowed Solana to demonstrate his knowledge of the subject. [it is] Fast enough for DEXes […] This was a very early support of Solana by the FTX team, which really made them stand out in the DeFi eco-system. However, this didn’t actually last.

Jack: Do you still have your original tokens in the wallet?

Edith: It’s a yes, I am very grateful.

It is my passion to invest in others. They are the best investment I can make.

— Jack Kubinec

Zero In

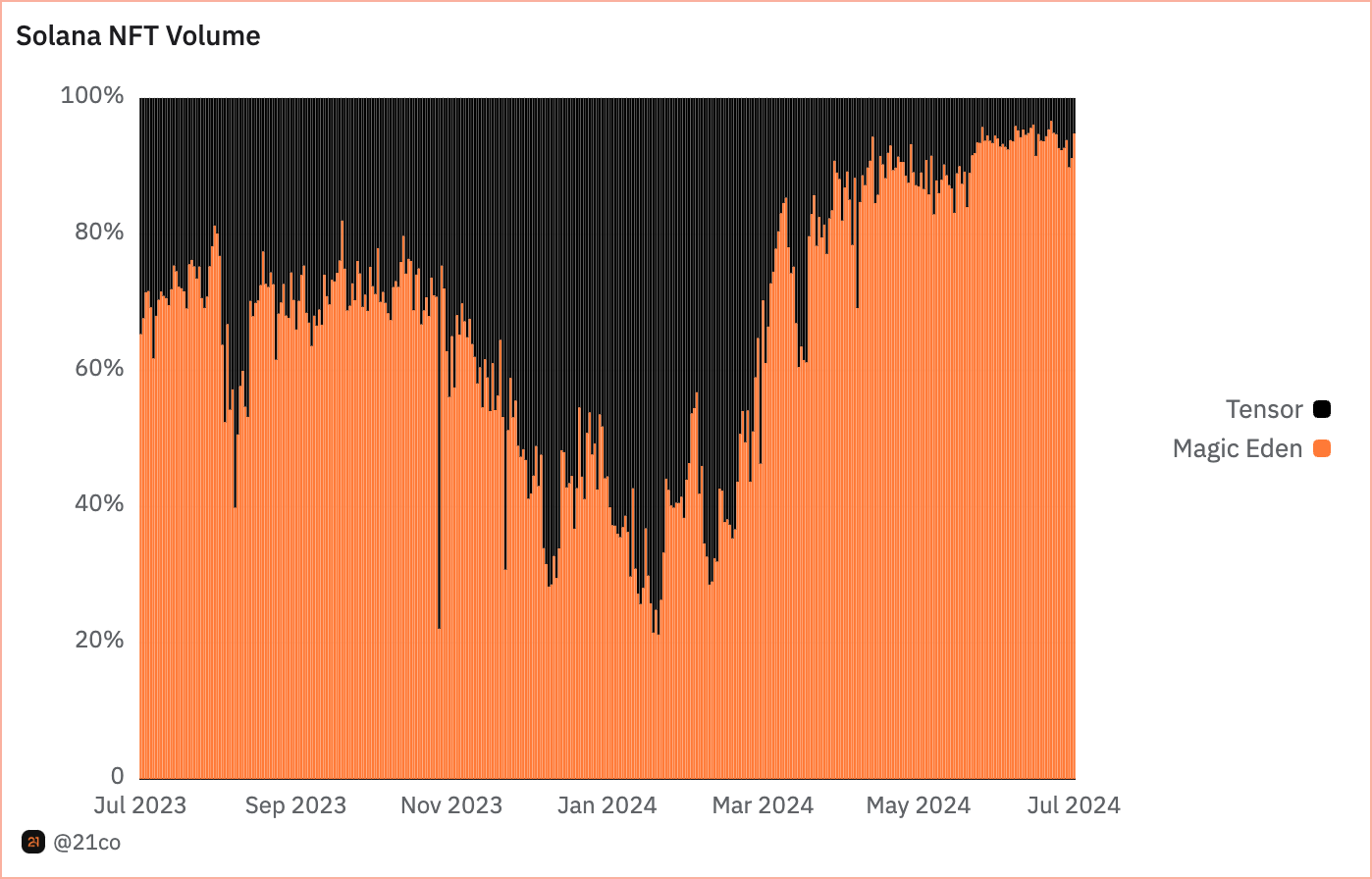

Magic Eden Solana NFT’s market share continues to grow:

Dune Dashboard from 21co reports that Magic Eden had between 90-95% the trading volume combined between rival Tensor and itself for most of the last month. Tensor had more than 75 percent of the total volume for a short time in January. But Magic Eden is now the leader and has solidified the position.

— Jack Kubinec

The Pulse

Helium has recently announced that it plans to expand its mission beyond decentralized wireless and build a bigger decentralized physical infrastructure (DePIN). High-cost, centralized infrastructure networks have traditionally dominated. Helium claims that these players, who are largely centralized, have hindered innovation and scalability for many years. This is especially true in areas like disaster detection and monitoring, asset tracking and cellular solutions.

Helium announced its intent to build a more efficient, scalable and flexible infrastructure with its Network of Networks Initiative. It plans to use its global community and footprint to help support decentralized networks in compute, storage, mobile, etc.

Community member @hansaFL speculated on X about Helium introducing a Proof of Location Network (PoL). He outlines how Helium hotspots would verify devices’ locations and enhance trust in the DePIN area. Hans says that “Before Helium, there was no way to prove location – GPS was too easy to game.”

Members of the community responded by making various predictions. @Sunbasher mentioned possibilities such as bandwidth or computation, while @BloodReaver speculated it could be WiFi. @ke6jjj stated that community vote would be required for any new network, highlighting the collaborative nature Helium’s expansion.

— Jeffrey Albus

The One Good DM

A message to Edith YeungEarly investor in Solana:

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.