Howdy!

Memorial Day is just around the corner and I am personally looking forward to eating a hot dog somewhere on a Brooklyn rooftop.

But for now it’s a rainy Thursday, and we’re thinking about a future where everything — even perhaps my aforementioned hot dog — is tokenized on public blockchains. We’ll see.

Jupiter’s Grand Plan to Unify Markets

This week is a holiday. Jupiter Announcement “Grand Unified Markets” The initiative aims at bringing together “all assets” Solana indexes them in Jupiter.

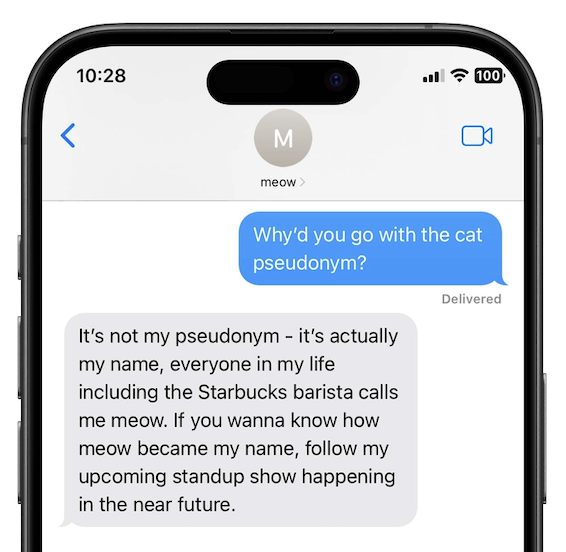

GUM allows for the consolidation of forex, stock, and other assets, including crypto, into a single platform. “state machine” Jupiter’s pseudonymous founding father will trade for fractions. Meow I wrote about X a while ago.

Jupiter announces partners for its “GUM Alliance” This includes market makers and projects involving real assets. Jupiter is working closely with its partners in the coming months to integrate more liquid assets onto Solana.

“Anyone who’s spent significant time in DeFi knows that something like GUM is possible, and something we should aspire for,” Another pseudonymous Jupiter Employee wrote on X. “We want to 10x the scope in crypto.”

Jupiter, a DeFi application that allows you to perform swaps or limit orders is available. Jupiter is a DEX that aggregates liquidity from different sources, allowing it to search for the lowest possible swaps prices. GUM is a DEX aggregator that searches across different liquidity sources to find the best possible prices on swaps.

In crypto, and even among TradFi users, the idea of tokenizing your assets is very popular. BlackRock Larry Fink I am a big fan of tokenization.

Jupiter believes that the tokenization of assets will be implemented at a large scale. Jupiter charges fees for some products. This is a good reason to create a huge market.

GUM has been designed to enhance the quality of life for all. “first unified market with [a] sufficient critical mass of assets, [liquidity] and users,” In a text, meow said to me.

Email is a good way to communicate. 21.co’s Tom Wan GUM is also known as a “brilliant” Market makers, tokenized asset issues and other stakeholders are brought together by a campaign.

“Onboarding tokenized assets will always have a chicken/egg problem. Issuers are reluctant to tokenize the assets without liquidity, and liquidity wouldn’t pick up until more tokenized assets are launched,” Wan writes

— Jack Kubinec

Exclusive

Zeta Markets introduces litepaper as a replacement for their layer-2

It was first heard here, people. Zeta Markets released a new litepaper. “Zeta X” Layer-2 is the next layer that it hopes to have on mainnet by early 2025.

Zeta runs a DEX that focuses on trading crypto perpetuals. It leverages the Solana Blockchain’s low fees and high scaling to improve trading. Building an L2 using Solana may seem out of the ordinary. After all, the network already boasts high scalability and low fees — features most often cited by developers when proposing new side chains for legacy networks like Ethereum.

Zeta representatives say that their network is pushing the limits further, offering an experience of trading which, according Zeta representative Tristan Frizza. “competes with centralized exchanges.”

Zeta will be able to customize block space, transaction processing and costs. This allows for low latency and lower cost transactions. Frizza explained how Zeta L2’s solution would be integrated closely with Solana, rather than build an isolated rollup. This will allow Zeta to take advantage of Solana’s growing Total Value Locked (TVL) as well as liquidity. Its design is similar to that of an appchain, where transaction latency can be low enough to rival CEX speed. It would be nearly impossible to create similar offerings on Ethereum chains, as transactions can often be too costly and need to bundle to base layers for efficiency.

Zeta is constantly looking to the future and it’s becoming more evident that in order to stay ahead of the curve, the DeFi market will need to be continually innovated to satisfy the modern trader.

— Jeffrey Albus

Zero In

$44 Million

Solscan data shows that the USDY token and the OUSG on Solana’s blockchain represent the total market value of Ondo Finance. Both tokens provide exposure to US Treasurys through real-world, asset-linked products. Real-world Asset-Linked Tokens bridge the gap between TradFi & DeFi, allowing investors to get exposure to traditional assets like Government Bonds via digital tokens. To put things in perspective, OUSG (on Ethereum) and UDSY (on Ethereum) have a market cap of over $250,000,000, according to Etherscan.

According to Ondo, a significant portion of the portfolio supporting OUSG has been invested in BUIDL. This tokenized fund was launched by BlackRock, the largest asset manager worldwide.

— Jack Kubinec

One Good DM

Text from MeowFounder of Jupiter:

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.