Howdy!

The newsletter will be shorter today as our office is closed in observance of Juneteenth.

If I can survive the ungodly heatwave, we’ll return to our full schedule tomorrow.

Marinade reveals another piece of its ‘V2′

Marinade The platform has announced that it is creating a marketplace for stake auctions to increase yields. The marketplace is still not live but will see validators bidding for delegations from staked solana.

Marinade’s v2 project, which focuses on reducing the risks and increasing yields.

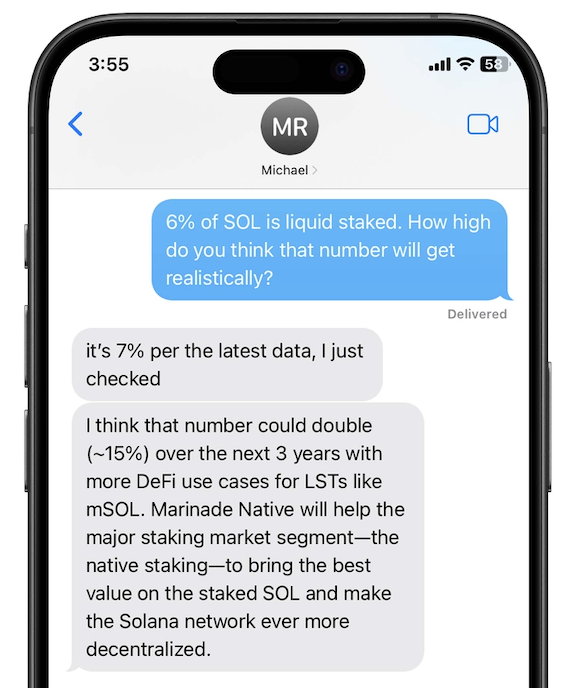

Marinade core contributor Michael Repetny The stake market will require validators to bid 1,000 solana for every epoch. That’s about 2 days. By doing so, Repetny thinks Marinade can raise staking yield above 9% — possibly even to 10%. Solana Compass says that the majority of validators are currently offering a 7% APY.

Repetny compares the platform “Booking.com for staking.”

Validators are already bidding for stakes in that they must offer users a yield that is competitive based on an open market. The market for validators is not very efficient. Coinbase’s validator doesn’t offer the most attractive yields or rarest slot skips, yet it has the most stake delegated of any validator — likely because of the Coinbase brand, as Blockworks Research Analyst Hayden Tsutsui A recent report made this point.

Repetny said that Marinade’s auction stake marketplace was different than the current stake marketplace because it allows validators to share block rewards and stakers. Currently, it is not feasible. Validators may also set their yield higher than usual for Marinade staked SOL, effectively bidding more to Marinade.

Marinade v2 includes a stake auction market. Marinade introduced native stake. It reduces the risks associated with staking solana in smart contracts and offers protected staking reward, similar to cutting down on validators who are underperforming.

Repetny stated that v2 was partly a play for institutions, as they want to protect yields and reduce smart contract risks.

The following are some of the ways to get in touch with each other “dry-run” Repetny stated that the first phase of the platform for stake auctions is scheduled to launch at the end this month. The second phase will be rolled out in phases during Q3 and Q4.

Marinade’s version 2 has very little to do directly with liquid stake tokens. Marinade’s second-largest LST is behind the LST that was introduced by Betfair. Jito’s JitoSOL.

Repetny stated that MSOL will remain competitive in terms of yield, however, Marinade’s is more attractive because the majority staked SOL doesn’t come from LSTs. “mainly…interested in this 95% untapped market.”

One Good DM

You have received a message Michael RepetnyCore contributors at Marinade:

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.