Howdy!

As I have been writing about sandwiches all morning, it has made me crave a tasty sandwich. So, here’s my recent favorite recipe: green apples, brie cheese, and walnuts in a baguette.

It’s so delicious to have a combination of savory, tart and crunch. Here, I am getting hungry. Okay, I will now move onto sandwich attack, which I dislike.

Solana ecosystem is prepared for sandwich attacks

It is important to note that the word “you” means a person. Solana Foundationa nonprofit organization dedicated to the growth of Solana, has prevented a group of people who are believed to be waging so-called “sandwich attacks” on its network from joining their Solana Foundation Delegation Program.

When traders manipulate prices to make money at the expense of users, they commit sandwich attacks. Solana doesn’t have a platform for unprocessed trades where attackers could find their targets. In order to get around the problem, some validators operate private mempools which allow users to be attacked with sandwich attacks.

(Of note, Ethereum The network is plagued by sandwich attacks, which are caused by a native memory pool. Today, jaredfromsubway.eth was responsible for spending more than 10% on ETH gas.

It’s safe to say that everyone agrees with the statement. It wasn’t a major move by the Solana Foundation: they matched stakes with validators, to incentivize good practices. The foundation won’t give grants to validators who are blacklisted, even though they can still operate nodes.

The message sent by the action to Solana’s actors who have influence on staking is perhaps the biggest consequence.

On the same day, Solana Foundation kicked out sandwich attackers of the SFDP Jito DAO put up a governance proposal that would create a blacklist of malicious validators and exclude them from Jito’s stake pool — which is by far the largest in Solana.

The measure was discussed in a space on Tuesday X. Jito Foundation contributor Andrew Thurman You can also read about the importance of this in our article Jito is “working in concert” The Solana Foundation and its two anti-sandwich attacks, which were taken rapidly in succession, was not an a “mistake.”

Solana also offers a stake analytics platform Stakewiz It added disclaimers of 51 validators that it discovered were participating in private IMSpools, which allows sandwich attack. Stakewiz awarded a disclaimer to its third most-ranked validator.

You can also read about how to get in touch with us. Brian LongCo-founder and Solana RPC provider Triton OneI was told by that the company will offer infrastructure to allow transaction senders opt out from sending transactions to certain leaders.

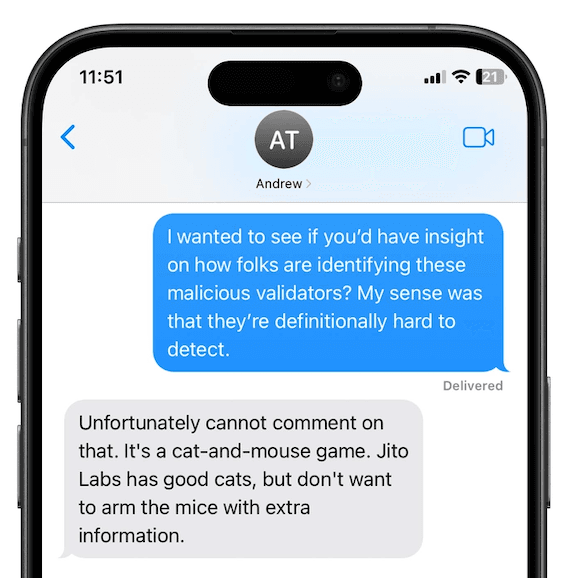

There’s one other interesting piece of fallout here: it’s not publicly known how many validators the Solana Foundation blacklisted or how they went about identifying validators who participate in private mempools — which are by definition not publicly identifiable.

Long said Triton sends small transactions with high slippage to see who sandwich attacks the transaction — essentially going undercover to get sandwich attackers to identify themselves. Jito Labs, the Solana Foundation as well as other organizations declined to give any comments on their methods of identifying malicious validaters.

Solana could be trying to destroy a monster by focusing on sandwich attacks. According to a Solana Discord user, their data showed that bad MEV revenue was constant following the blacklistings. The remaining users of private mempools were grabbing market shares from those lost delegations.

Zero In

Should we refer to it as the Mother Effect?

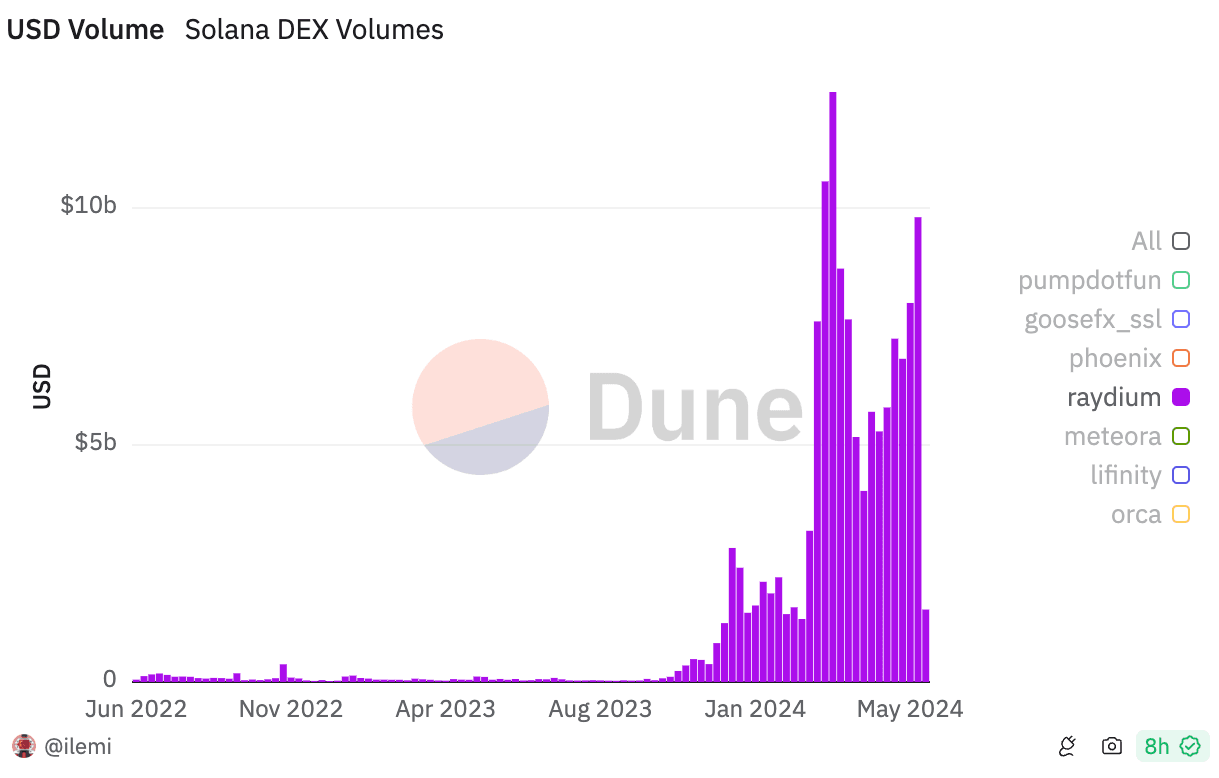

DEX protocol Raydium’s volumes popped last week to nearly $10 billion — potentially buoyed by the launch of Iggy Izalea’s MOTHER memecoin, among others.

Raydium’s volumes are trending upward, as per @Ilemi. Last week’s breakout in volume didn’t surpass the DEX weekly record of $12.4 billion.

It’s not worth speculating about the future of memecoins, even for those who are most interested in cryptocurrency. These coins do generate a lot of volume for DEXs.

The Pulse

Last week, the dYdX Community voted on its v5 Upgrade. Blockworks reported that the upgrade has been completed on the backend but will not allow users to interact with v5 before later this week.

Previously, dYdX used cross-margin markets where collateral would be pooled, resulting to increased risk, and the potential for cascading transactions in volatile market conditions. This update separates collateral pools by introducing isolated margins for markets. The new update allows traders to better manage collateral by separating markets and margins.

This upgrade includes features like the Slinky Price Oracle, which is a high-speed and accurate way to update prices. The protocol is integrated into Raydium and can now provide price data for all Solana assets. In turn, traders have a greater range of assets to trade derivatives, like those that are based upon Solana.

Before the upgrade, DYDX’s price rose to $2.17. The price of DYDX has fallen to $1.68 after the weekend. The price drop has still generated excitement among the community. Users like @Elodie_de highlighted the surge in DYDX’s prices on social media. Others like @Kaylee183843 were optimistic about future gains.

The dYdX ecosystem development program also announced several initiatives that support new features and integrates. Helius Labs is managing two more dedicated Solana RPC Nodes, allowing dYdX testers to use Slinky’s Solana Price Feeds.

One Good DM

A message to Jito Foundation contributor Andrew Thurman:

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.