Fri-yay!

This week has been relatively quiet for the crypto industry. So we will look at some different aspects. David, for instance, celebrated the weekend with memecoins.

Oh, also, Yano gave some insight into what he’s watching — and one thing that could be either bullish or slightly concerning.

You’ll be seeing us on Monday.

Every coin deserves three commas

Say what you will about memecoins — they’ve clearly found product-market fit.

The first memecoins were dogecoins, such as shiba, babydoge and floki, which is named after Elon Musk’s pet dog, a Shiba Inu.

At that time, there were very few memecoins at the top of the marketplace. There were, as always, silly projects with outrageous valuations that weren’t explicitly memecoins — such as SafeMoon and Hex.

Musk was ecstatic about Dogecoin, and so he surrounded it with a few dog-coins.

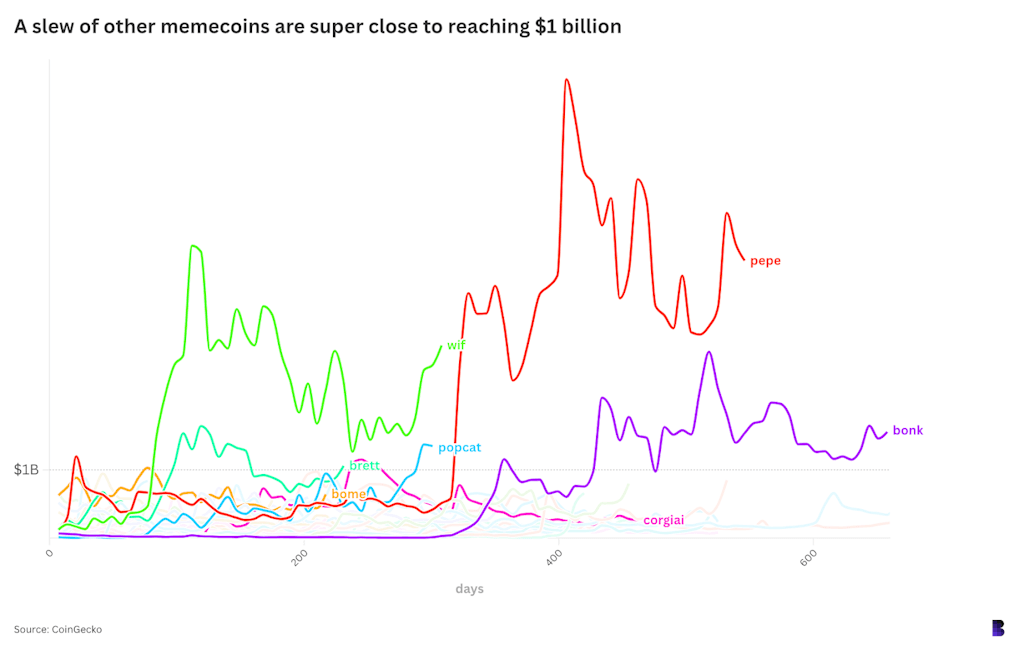

Over 10% of today’s top 250 are memecoins. They have a market cap in excess of $1 billion and continue to grow faster than any other time.

Seven memecoins have hit the $1 billion milestone at one point or another: BONK (Bome), WIF (Wif), POPCAT (POPCAT), CORGIAI, and PEPE.

In average, the seven memecoins took about five months on average to reach three commas. BOME achieved it in only four days. PEPE did so in 21 hours and WIF took 84.

Several smaller memecoins, such as MOG, TURBO and SPX6900 are also nearing new highs.

According to one theory, memecoins capture so much market interest because SEC sued the industry into submission.

Why not instead trade tokens that are the least useful?

Let’s assume that this is the case. Gensler has made crypto funnier than ever.

IYKYK

Empire Podcast host and Blockworks cofounder, Jason Yanowitz was our guest. Jason Yanowitz has been interviewed this week again to assess his feelings with just weeks until the elections.

Let me say this up front: there’s some good and then we’re headed for some uncomfortable situations. You can choose to take from this conversation what you want.

“I think, even [at the] end of Q4, I genuinely think there’s a chance that bitcoin breaks all-time highs in November or December. You have, on a macro level … The dollar’s kind of turning over … Interest rates are going down,” Yanowitz explains to me.

He also said he disagrees with the people who say that any one candidate for president is either good or evil for an industry.

“Either way, Kamala [Harris] or [Donald] Trump … would be good for crypto. We just need a new administration, Democratic or Republican.”

He is also concerned about the number of tokens that are coming.

“Everyone’s trying to launch a token after the election and before Q1 ends. If they’re low-float, high-FDV tokens, that’s a bad thing and a lot of people are going to lose a lot of money,” Yano said. On the other hand, they could launch a missile at “reasonable valuations,” Then that could be bullish. We don’t yet know the exact structure.

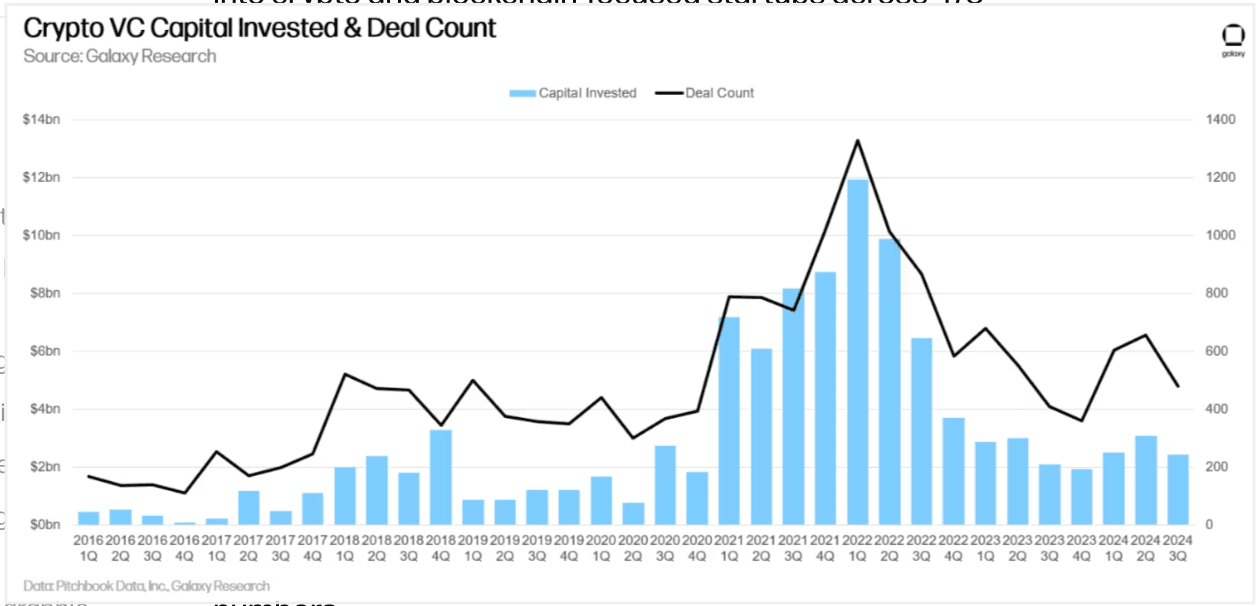

Galaxy published its quarterly report on crypto venture capital earlier this week.

Some of the key takeaways: VCs invested $2.4 billion last quarter, a 20% decrease quarter-over-quarter. The year 2024 will just slightly surpass 2023.

This last statistic might not surprise you if you are a regular Empire reader. We have had many conversations about funding with PitchBook’s Robert Le.

Le’s been pretty vocal about when we could see activity pick up (spoiler alert — it’s not this year).

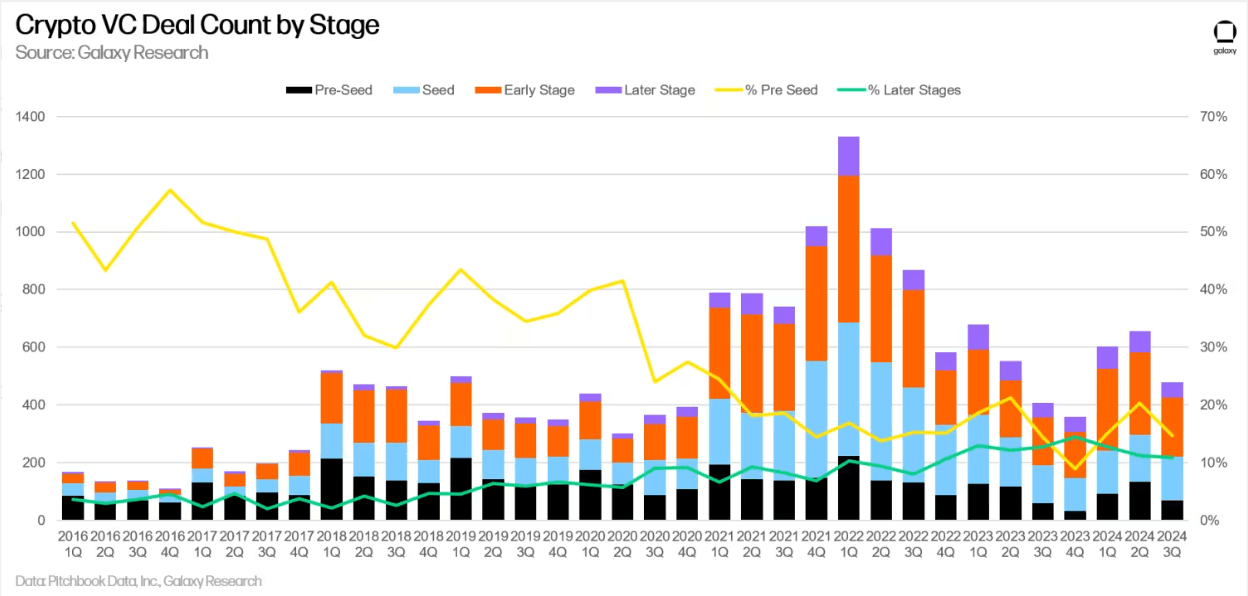

The stat that I was most interested in is the fact that a large portion of VC money went to crypto-projects at an early stage. To be exact, 85% of the VC pie was invested in early-stage crypto projects, with only 15% going to later-stage businesses.

Although VCs continue to pour in money, we’re still a long way off from seeing these types of projects reach the wider market.

It’s good to know that we can track the dealflow, and see how VCs are affecting crypto. It’s kind of fun, isn’t it?

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.