MakerDAO has an excellent problem. The DAI stablecoin is in high demand.

SparkLend, an online borrowing and loaning platform that is organized under Maker’s DAO, has issued enough DAI over the past few weeks to require authorization for more lending.

Maker, in a vote on Thursday afternoon at 12 noon ET to approve the governance of D3M’s maximum debt ceiling limit to 2,5 billion DAI was unanimously approved.

“D3M” Decentralized Debt Markets module is a tool designed to maximize DAI liquidity on different DeFi platforms. The module automatically aligns DAI rates for external platforms, such as Aave, with Dai Stability fees within the MakerDAO.

The change was prompted by the rapid increase in demand for SparkLend loans over the last week. This resulted in a drop of DAI to only 250 million. The Maker’s Risk Experts lobbied for the increase, saying there was no reason to limit it.

“With recent bull market conditions, it is becoming increasingly difficult to keep up with borrowing demand,” Monet-Supply analyst of Block Analitica posted on the Maker forum that the protocol had blown through its debt ceiling, and was growing by an average rate around 20 millions DAI each day.

“This poses a risk of unintentionally hitting the D3M maximum debt ceiling and artificially limiting Spark’s growth,” He has written.

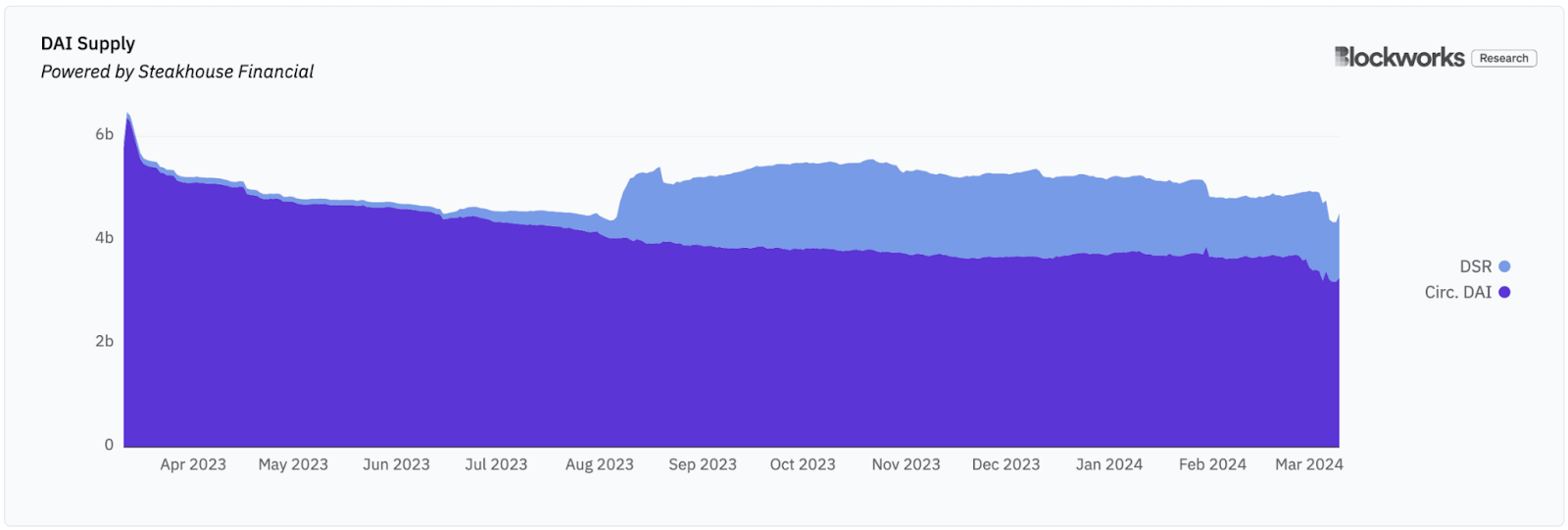

MakerDAO has recently doubled all stability fees following a vote by the executive on 10 March. Dai Savings rate (DSR), a measure of savings, increased from 5% up to 15%.

As stablecoin yields have increased, traders swap DAI lent at low rates in favor of USDC and other stablecoins that yield more.

In addition to high returns, the new stablecoin (Ethena’s USDe), is also incentivised by a point-like system known as “shards.”

This dynamic has a downward impact on DAI’s dollar peg, and the PSM module of Maker, which allows DAI to be swapped for USDC, is at record lows.

Read Blockworks ResearchMakerDAO – Organic Demand Doesn’t Grow on Trees

Ethena founder Leptokurtic argued in an X-space this week that Ethena’s protocol’s contribution to Maker’s rate hike was overstated. Ethena has captured less that 1% of total value (TVL), which is locked into DeFi, to date.

“I actually think the marginal impact that Ethena has had on these changes is probably less than people are giving credit for over the last few weeks,” Leptokurtic stated. “These rate changes were going to happen with or without Ethena being there — it’s just now people make that connection a bit easier between rates in [centralized finance] and DeFi.”

During the same conversation, Sam MacPherson CEO of Phoenix Labs said that current rates are not competitive. “almost certainly not sustainable” Long-term, it is better to invest in your future.

“Ethena is performing a great function here in bridging this disjointed rates behavior,” MacPherson said. “Maker is at the mercy of the market just as much as everybody else, it’s just that there’s no smart contract doing it, there’s more of a slower human process that people attribute agency to the rate setting within Maker — but that’s really not the case.”

Stablecoin investors have many choices to earn double digit returns in a relatively secure environment.

How long will it last?

“You can’t have 30,40, 50% rates on USD that is sustainable,” MacPherson told us: “Eventually [traditional finance] is going to come in on size,” The rates will drop.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.