The AI agent frenzy was kickstarted by GOAT. GOAT is a Solana memecoin that spawned from an experiment by creator Andy Ayrey when he pitted two Claude AI fashions in an countless debate. GOAT nonetheless sits at present at a snug $404 million market cap, however now not dominates the mindshare it as soon as did.

First to repeat GOAT’s success was the AI agent Luna (LUNA). It’s a busty anime woman chatbot that streams 24/7 on social media — want I say extra? Chat along with her, tip her along with her personal LUNA token (why does anybody do this?), or be like A16z-backed Story Protocol: Rent Luna for social media advertising.

The Luna digital companion was launched on Virtuals Protocol, an “AI Agent launchpad” on Base that’s the most recognizable model title on this meta proper now.

Previously the PathDAO gaming guild, Virtuals took pump.enjoyable’s profitable system and utilized it to AI brokers. Launch an agent token, hit a goal market cap on a bonding curve, and pair the agent’s token in a liquidity pool on Uniswap.

What Virtuals did in another way, nevertheless — and what has gotten investor-types bullish on its token — was tying its native VIRTUALS token to the price of launching brokers and operating inferences, in addition to pairing it with agent tokens in a Uniswap liquidity pair (quite than SOL).

Throughout the Virtuals ecosystem, Luna faces competitors for speculative capital from different equally trying chatbots like Airene, or extra “utility-based” brokers like aixbt, an agent that scrapes troves of social media information to floor buying and selling alpha (aixbt is by the way bullish on every part).

Simply as brokers face competitors, so too do the picks-and-shovels of brokers. Apart from Virtuals, a myriad of AI agent launchpads exist already, reminiscent of vvaifu.enjoyable, Creator.Bid, MyShell.ai, Zentients and extra.

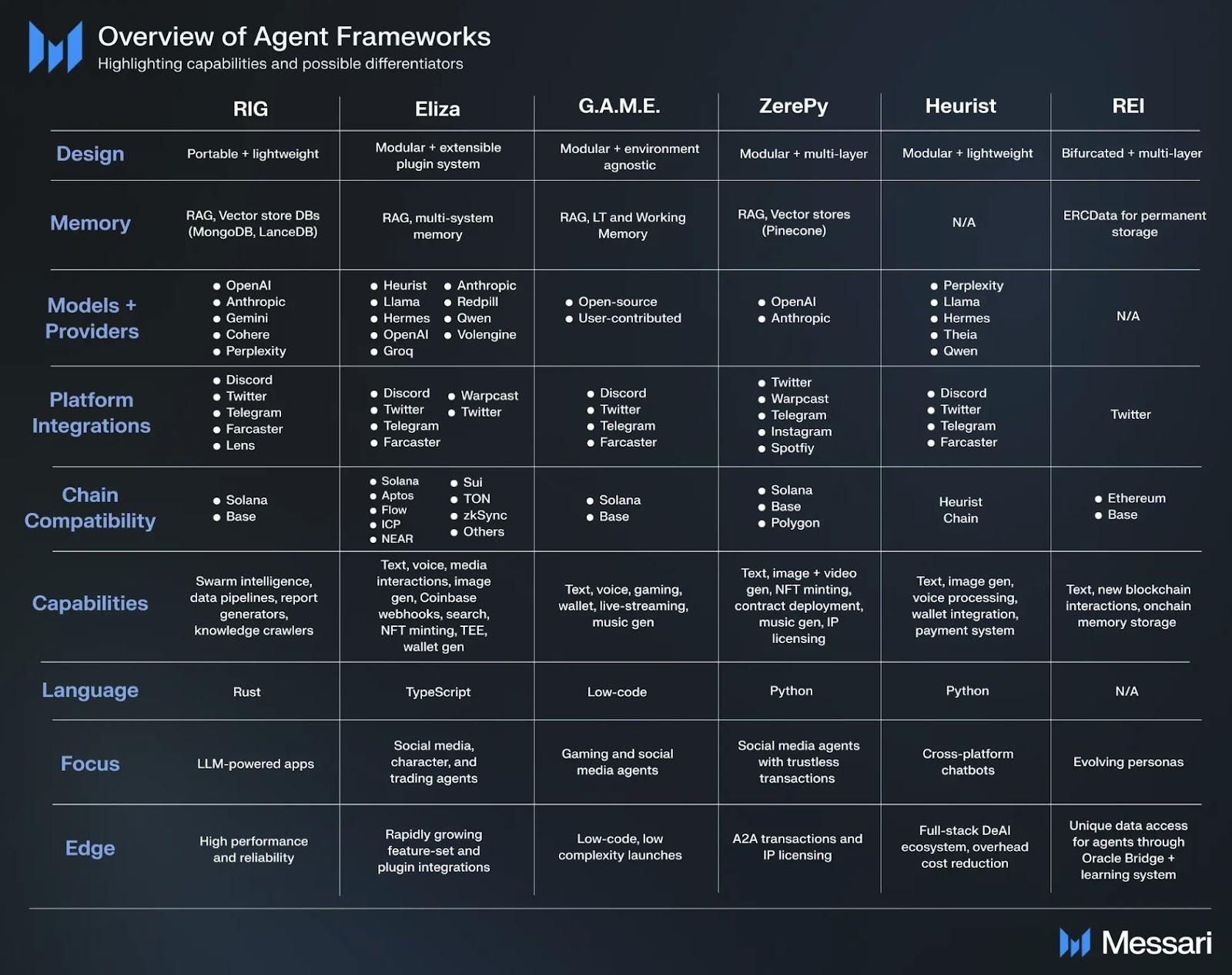

Then now we have the AI agent “frameworks.” These are merely code libraries that make it simple for devs to customise their brokers and combine them into the digital Wild West.

The main agent framework is ai16z’s “Eliza,” however there’s additionally Digital’s G.A.M.E (Generative Autonomous Multimodal Entities), the Python-based ZerePy, the Solana-focused RIG, and extra. And naturally, every considered one of these frameworks has its personal token that speculators are furiously aping into.

Lastly, now we have the AI funding DAOs. The concept is straightforward: Deposit SOL/ETH and obtain a DAO token that allows you to share within the “hedge fund’s” upside.

Ai16z was the primary funding DAO to launch on Solana, now with an AUM of $23.4 million. Individuals apparently actually belief the investor acumen of AI brokers. Presently, its native AI16Z token is valued at an astounding $1.4 billion market cap.

Daos.world and VaderAI are two upcoming AI funding platforms on Base which have gained steam up to now week. Not less than six funds have already emerged on each platforms, with a few collective million in capital raised.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.