Microsoft’s board was asked to evaluate whether bitcoin holdings on its balance sheet were beneficial for shareholders over the long term.

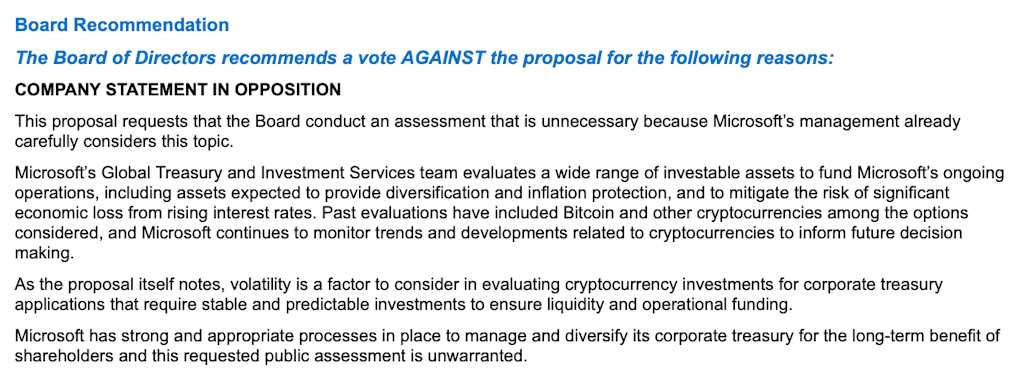

It was revealed by the company on Tuesday that there were no votes in favor. It wasn’t a big surprise as the company had insisted on this outcome, citing the following reason:

Michael Saylor (the bitcoin bull) got some face-time with directors and shareholders today, via a recorded presentation.

Saylor has creatively described bitcoin in many ways over the years — from an “apex property of the human race” The following are some of the ways to get in touch with us: “a city in cyberspace that is 276 blocks wide, 276 blocks high [and] 276 blocks deep” This is a reference to its 21-million supply limit.

The MicroStrategy co-founder referred to Bitcoin as during the Microsoft presentation:

- “The greatest digital transformation of the 21st century”

- “A revolutionary advance in capital preservation”

- “Highest performing uncorrelated asset”

- “Outperforming Microsoft by 10x annually”

- “An asset without counterparty risk”

“It makes a lot more sense to buy bitcoin than to buy your own stock back, or to hold bitcoin rather than holding bonds,” Saylor argued.

This was not what many people in the crypto community wanted. Microsoft’s management, however, claims that it has considered bitcoin as an investment. With more and more businesses adopting BTC, perhaps the tech giant would follow suit next time.

Saylor was able to speak to an entirely different audience.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.