MicroStrategy has taken the majority of air from the room. However, there are other forces that have a greater impact.

While the crypto market is still raging over Saylor’s status as a rare financial genius, or another overleveraged investor, stablecoins have brought even more liquidity.

That’s at least the amount of money being spent in this area right now.

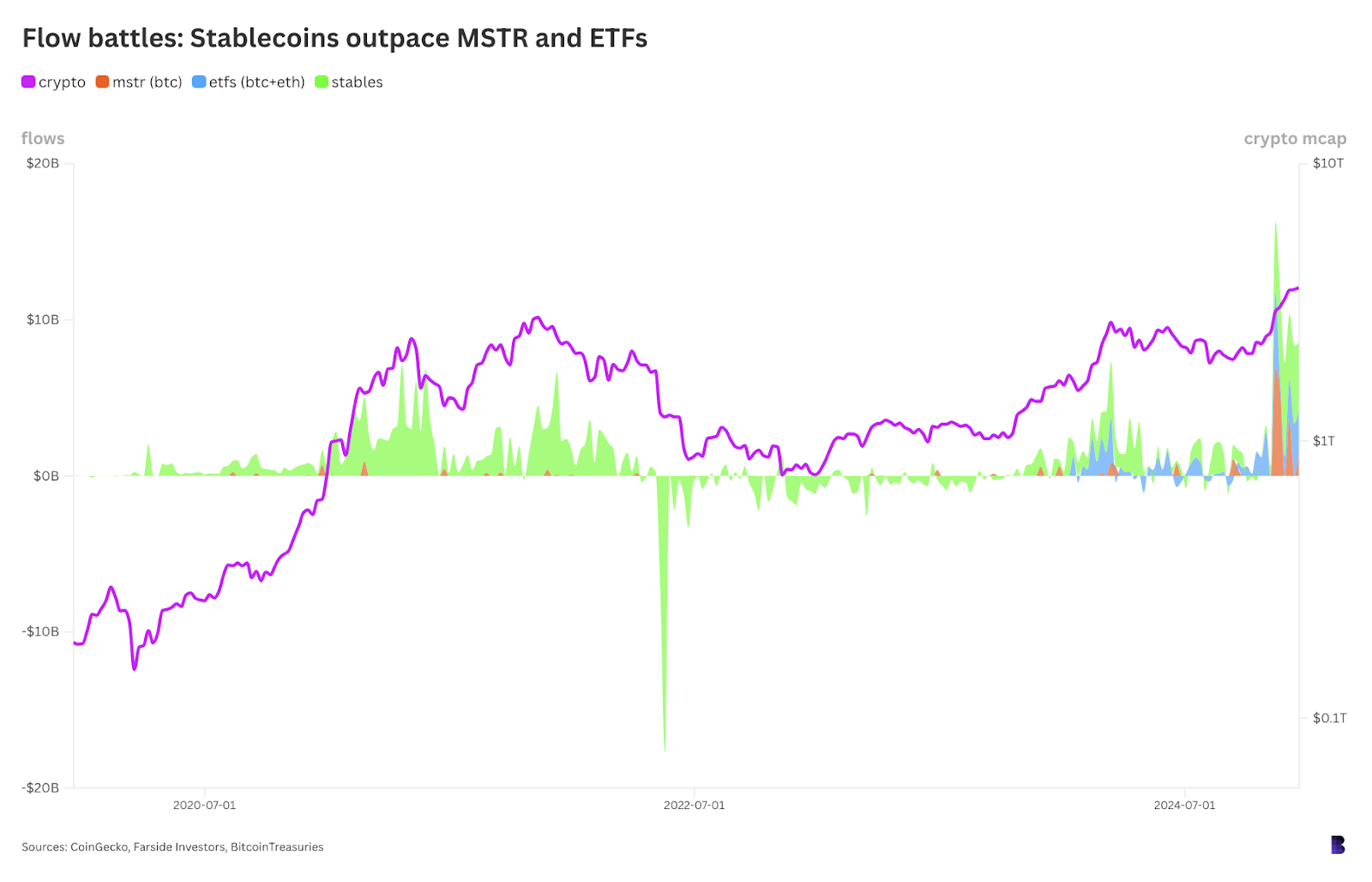

MSTR now has spent $17.5 Billion on Bitcoin in just the last two month, as can be seen by the orange zones on the below chart. This money was mostly raised from the infamous zero-percent convertible bonds.

MicroStrategy purchases are then viewed as simply accepting dollars and converting them to bitcoins with the other hand. In exchange for exposure, MicroStrategy offers cheap liquidity.

Net inflows of bitcoin ETFs to US funds increased by $16.5 billion during the same time period. ETH ETFs are also net-added $3 billion. Together, these flows can be seen in the blue area of the graph.

The ETF process is similar to MicroStrategy, but they do not include bonds. Investors use cash to purchase bitcoin or Ethereum, and then pass on the exposure to their shareholders.

Stablecoins are another option. Since mid-October stablecoin issuers have collectively issued an additional $30.8 Billion tokens. These inflows accounted for 92% USDT and USDC.

In addition to Sky’s USDS or the exotic alternative that has emerged such as Ethena USDe and Usual USD0 stablecoin manager’s generally purchase short-dated Treasurys (or other cash equivalents) and then release the same amount fresh token supply back to those who have wired cash.

Stablecoin flows are not the same as ETF cash inflows, or MSTR’s pipeline of funds.

However, they all share a common trait: an urge to invest in crypto-markets through a wide range of channels.

That’s now to the tune of almost $68 billion in the past nine weeks — easily the biggest liquidity wave on record, at least by my count.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.