MicroStrategy has defied gravity. The company is reaping huge rewards for its top executives.

Stocks haven’t dropped yet, despite the fact that they were pumped up three times more than Bitcoin at the beginning of this year.

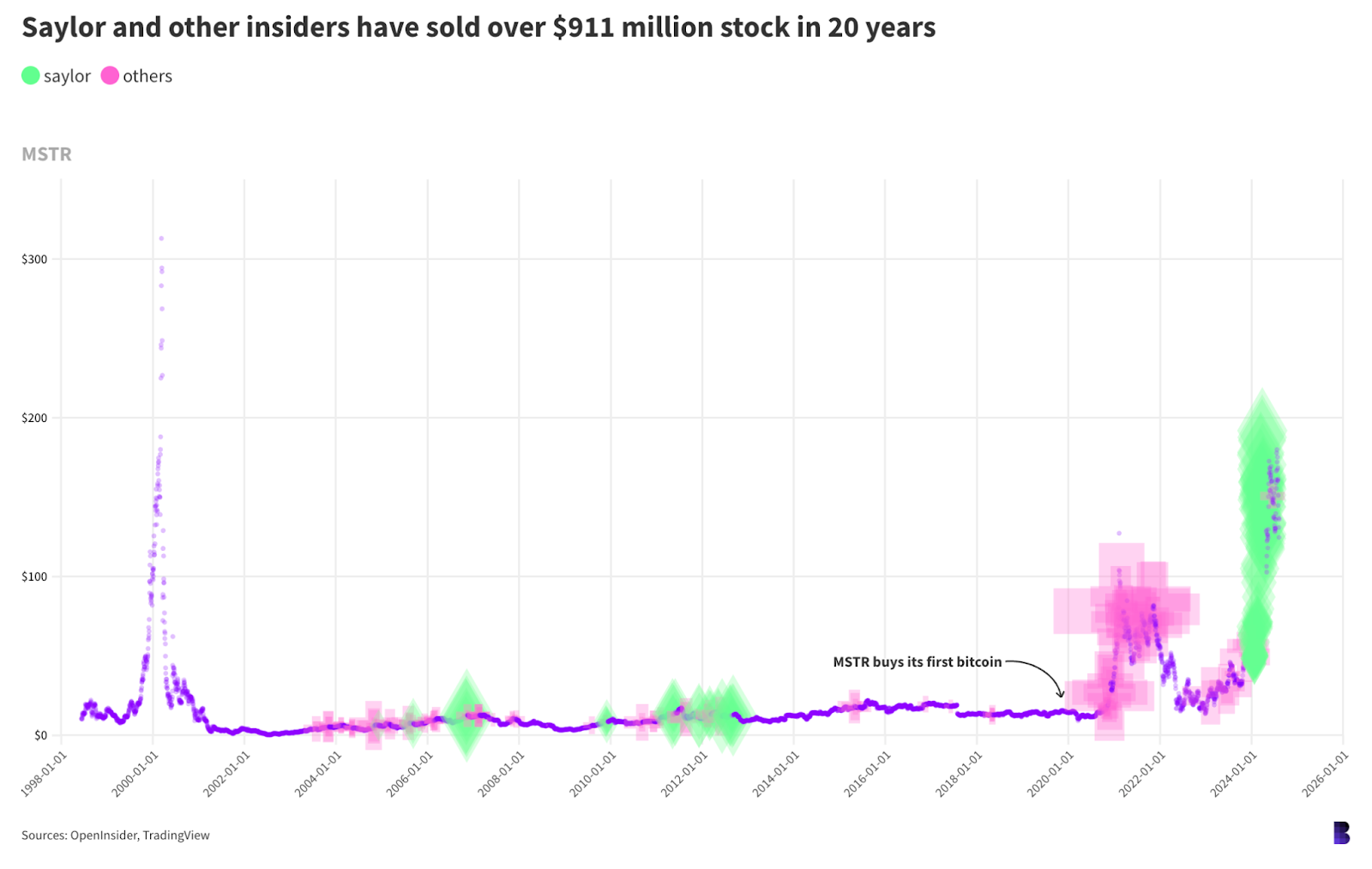

Michael Saylor, former CEO and executive chair of the company, has been leading insiders to sell hundreds of millions in stocks. Most of the money went to Saylor who, according to recent reports, owns 1 billion dollars in bitcoin.

Saylor, in total, sold 400,000 stocks through daily transactions between January and end-April, just a couple of days after the halfing.

He generated $410.8 million as MSTR tripled bitcoin’s performance — nearly half of all cash brought in by MicroStrategy insider stock sales since before the dot-com bubble.

MSTR collected its first billion bitcoins at the same time as other insiders.

Bitcoin rose between October 2020 and Nov 2021 from 11,000 dollars to almost $69,000. MSTR grew from $165 per share to $900, and company executives other Than Saylor sold nearly $215 millions in shares.

These same sales, if sold today would have netted $588,000,000. Saylor, meanwhile, benefitted from waiting until this bull market to cash in his own chips — during his own spree earlier this year, MicroStrategy’s share price was at times double what it was when the other company insiders were selling.

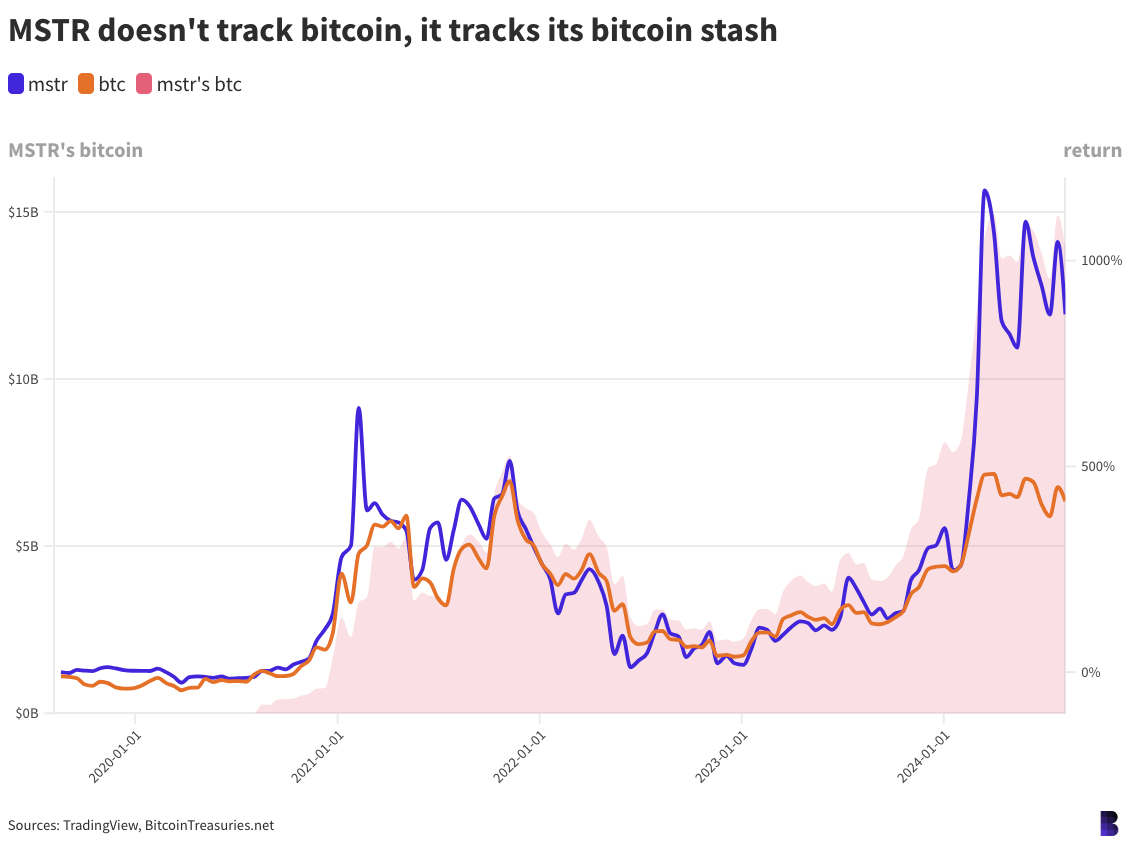

MSTR has recently rallied to around 180%, between the months of January and March. This is close to bitcoin’s highest point. Bitcoin, meanwhile, had managed to reach 60%.

It appears that the earnings report for Q4 2020, released in February, has made a difference. At least that was when MSTR’s and BTC’s performances began to separate.

In February the bitcoin-hoarding data-intelligence firm posted a 136 percent increase in income. However, the company missed its quarterly revenue targets.

MicroStrategy’s earnings this year aren’t that impressive. It has, however, been buying a lot of bitcoin — spending about $2.42 billion on 37,350 BTC ($2.26 billion) — which the market seems to appreciate.

MSTR has a negative number for its total bitcoin purchase to date (2024), but when zoomed out it is way up. It has paid a total of $8.35billion to buy 226,500 BTC in the past 4 years.

That same collection is now valued at $13.74 Billion, giving the company a 65% advantage, or $5.4 Billion.

In the past, markets may have overlooked low earnings for this year because of these figures. Two-thirds returns on its bitcoin purchases in four years is indeed impressive, but it’s also what the S&P 500 has done across the same period.

MicroStrategy’s balance sheet showed a debt of $3.905bn at the close of June. That put a damper to those gains. Its share price is still a strong indicator.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.