JHVEPhoto/Shutterstock modified by Blockworks

It is a section from the Empire e-newsletter. To learn full editions, subscribe.

If the US authorities actually intends to create a strategic bitcoin reserve, it might want to compete with MicroStrategy.

Because it stands, the rate of MicroStrategy’s bitcoin shopping for has exploded, to the purpose that it now holds 331,200 BTC ($30.9 billion), or 1.7% of the circulating provide.

For scale, Sen. Lummis has pitched a 1 million BTC goal for the federal government reserve, price $93.2 billion at present costs. In July, the newest figures confirmed the US holding over $608 billion in gold certificates in its strategic reserve.

To be clear, there’s no official indication that the US will truly make bitcoin its fifth reserve asset (Polymarket places the present likelihood at 36%). And as Blockworks’ Byron Gilliam identified in his e-newsletter yesterday, it may even be a very dangerous concept.

Let’s say it does occur. That may imply MicroStrategy is frontrunning the US authorities at measurement, doubtlessly driving up costs earlier than the reserve buys its first, very hypothetical, cash.

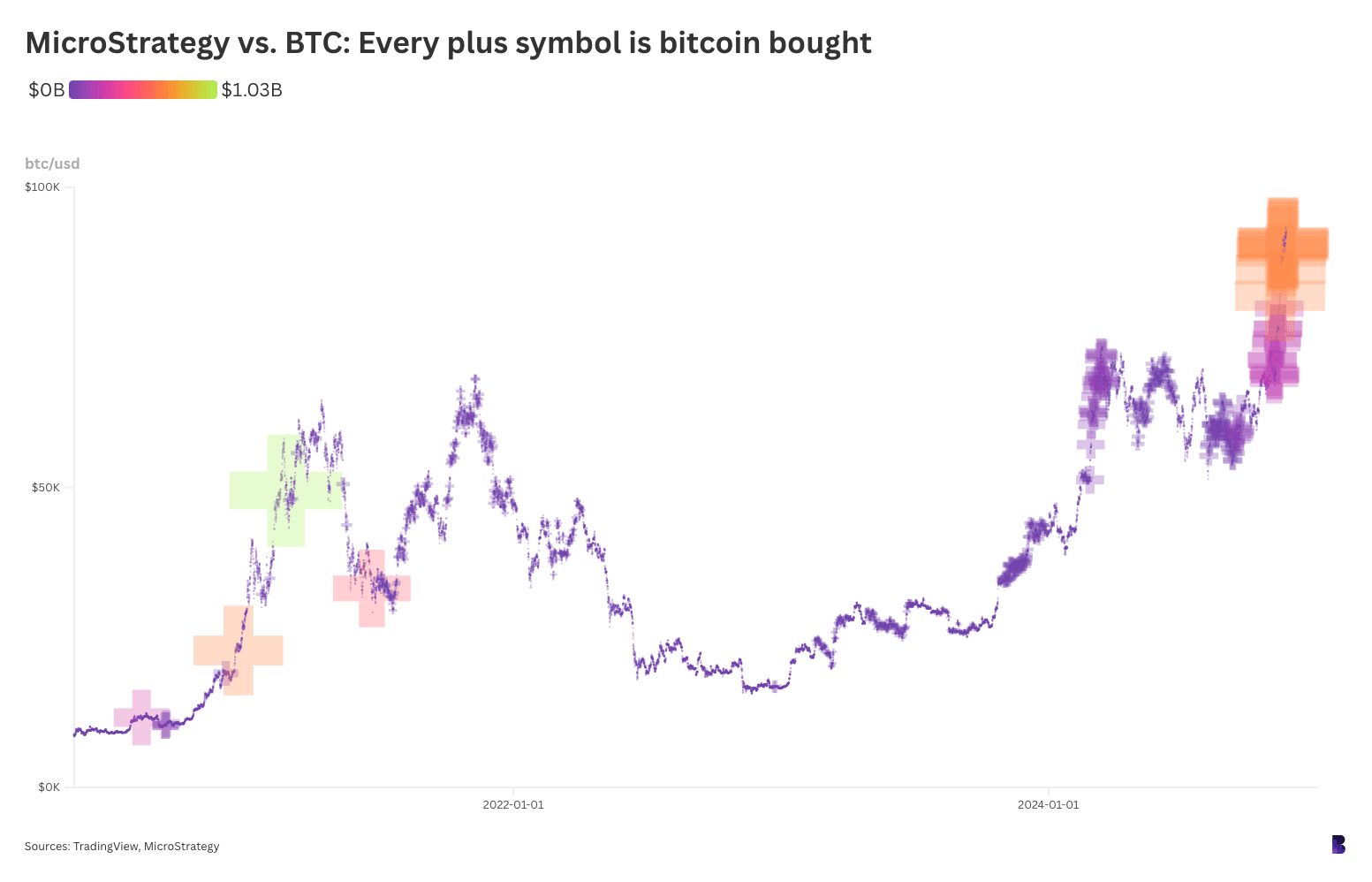

Mapping precisely when MSTR buys its bitcoin — to maybe discover constructive correlation between the worth of BTC and the agency’s trades — is sadly unimaginable with the publicly-available information.

MicroStrategy does disclose the variety of bitcoins it buys alongside its complete greenback spend. Nevertheless it typically solely provides a spread of dates on which these trades had been made.

Nonetheless, averaging these figures out exhibits that over many of the previous three years, MicroStrategy would’ve spent as much as a number of thousands and thousands of {dollars} on BTC per day throughout its shopping for sprees. These sprees typically final for over a month, in response to its filings.

By March of this yr, when bitcoin was setting all-time highs round $74,000, that quantity had jumped to $80 million per shopping for day.

Come early November, it was $190 million, earlier than ramping as much as over $657 million final week — $4.6 billion on 51,780 BTC between Nov. 11 and Nov. 17, at a median value of $88,627.

The worth of bitcoin climbed as much as 14% throughout that interval, from $80,000 to greater than $91,000.

Saylor has beforehand stated that MSTR has purchased bitcoin on spot markets, however that was early on.

It may very well be that the agency lately acquires bitcoin over-the-counter, which might dampen direct affect. The sheer measurement of the buys, nonetheless, would most likely nonetheless affect costs someplace down the road.

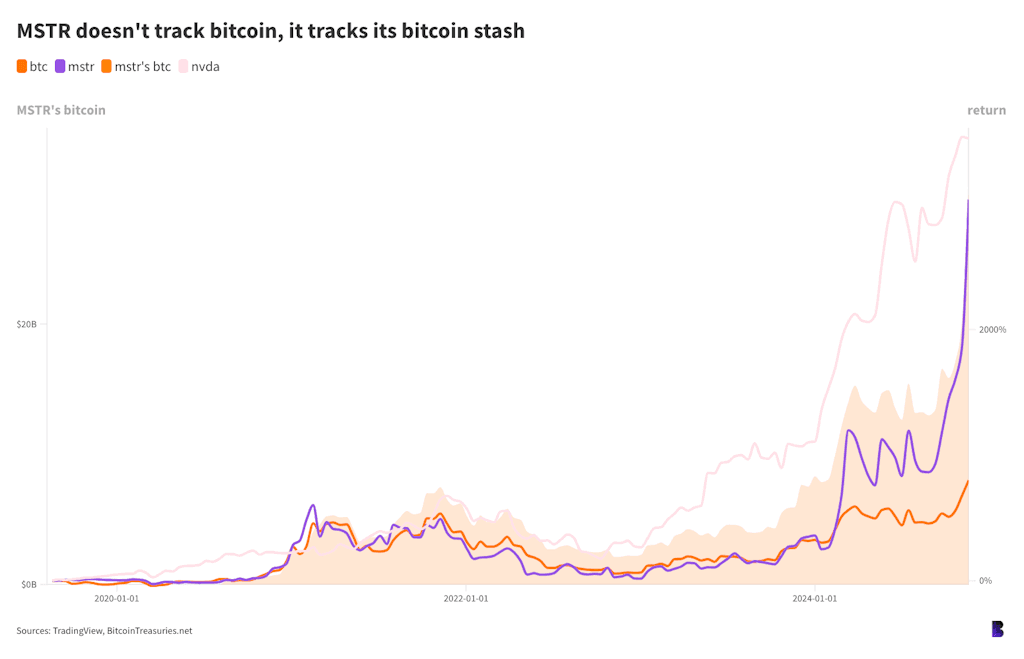

Linking MicroStrategy’s bitcoin buys and its share value is much extra straight-forward.

There was a time when MicroStrategy inventory (in blue) was weighed down by its bitcoin (the orange space within the background) — main the 2 property to carefully monitor one another within the bear market.

All that modified in late February, when Saylor introduced his firm had added 3,000 BTC ($155 million then, $280 million now). MSTR inventory then jumped 27% in two days, and bitcoin went on to set an all-time excessive three weeks later.

MSTR has been tightly correlated with the greenback worth of its bitcoin treasury ever since — not the worth of bitcoin — swelling its market cap from $10 billion to just about $100 billion.

If that persists, MSTR’s share value could be proof against bitcoin downturns so long as it buys the dip, which it most likely will, contemplating the debt raises hold coming. Within the meantime, shareholders are little question having fun with the present.

As would MicroStrategy execs and insiders, who’ve now offloaded nearly $559 million in firm shares thus far this yr, per OpenInsider information, which compiles SEC filings (nearly three-quarters going to Saylor, who’s stated that he intends to purchase bitcoin himself).

They usually say the important thing to constructing generational wealth is diversification.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.