Howdy!

Yesterday, as I was walking past the ambulance, it belonged to a startup ambulance company named, I’m not kidding, “Ambulnz.”

There are many companies. All of them can’t have the best names. If you are naming your startup, please use words that can be easily pronounced. Anyways:

The SEC did not say that SOL was not a security

The SEC has announced that it will drop the allegation in its SEC v. Binance lawsuit that SOL and other tokens listed on Binance are securities. Therefore, the court does not need to make a decision about whether SOL constitutes a financial instrument.

Binance initially faced 13 SEC charges last summer. They alleged that Binance had violated US Securities laws by listing SOL, among other assets. SOL tokens being securities is a legal classification that could determine how easily US-based investors can access the asset — but SOL’s standing is currently up in the air as the SEC mostly continues its “regulation by enforcement” The cryptographic approach

Social media spread quickly the falsehood that SOL was no longer considered a security after the amendment to the case dropped. Experts say that’s not likely to be true. The SEC’s litigation against Binance is more likely a tactical move.

“I wouldn’t get too excited,” Jordan Teague is a partner in the Campbell Teague law firm. She replied to my direct message about an update on the Binance lawsuit.

Teague explained that it is likely the SEC’s view on SOL has not changed, as they make this same claim against Coinbase in their ongoing lawsuit. The SEC could have chosen to not argue about SOL’s legal status in order to benefit its litigation strategy.

Teague gave a couple of reasons as to why dropping the non-registered securities allegation might be advantageous for the SEC in the Binance case. “because it does not want to deal with the third party discovery that would be required to prove the allegation; because it thinks it stands a better chance of winning on the issue in the Coinbase suit; or because it does not want to risk a circuit split (given that the Binance suit is in the Second Circuit and the Coinbase suit is in the DC Circuit).”

Teague appears to be a common view among other crypto-industry lawyers.

“There is no reason to think SEC has decided SOL is a non-security,” Variant Fund chief legal officer Jake Chervinsky wrote on X, adding that the SEC made a tactical choice not to go through discovery, which is the information-gathering phase before a trial begins, on ten tokens.

Justin Slaughter is the Paradigm Policy Director. He said the SEC might be in a state of shock over the outcome that Binance received from its motion to dismiss this case. “rather than take another bad loss on the beware of their approach, [the SEC is] backing down … [b]ut so far they’re only backing down here. There’s no sign yet that they’re making a similar filing in the Coinbase case.”

SOL’s legal status is in flux as long as the Coinbase lawsuit continues to assert that SOL constitutes a security. Investors may want to open some Champagne if the Coinbase lawsuit is similarly modified.

SOL could become a securities if the SEC ever decides to do so. This could put the sustainability of the SOL ecosystem at risk, because the US venues selling tokens may be selling securities that are not registered.

Teague explained that even a negative ruling in the Coinbase lawsuit might not be the end of SOL. Any potential decision is not binding for Solana, since the network hasn’t been named in the suit. The case is also being heard in circuit court. This means that any ruling would not be binding on courts from other circuits.

The US crypto industry would not let altcoins like SOL be delisted without any fight.

“We have seen major exchanges—both centralized and decentralized—willing to go to the mat with the SEC because they understand that these are existential issues for crypto and a permissionless future,” Teague writes.

— Jack Kubinec

Zero In

SOL’s price campaign lost momentum as the calendar turned to August.

According to CoinGecko the token has fallen 9.7% in 24 hours and is now trading around $162, after reaching as high as $293 on Monday.

Cryptoassets fell across the boards today, despite Fed chair Jerome Powell allowing for an interest rate cut in September that would theoretically boost cryptos.

SOL has risen by about 10% in the last 30 days.

— Jack Kubinec

The Pulse

Scottie, what’s going on? Basketball legend Scottie Pippen recently promoted his latest venture on social media: tokenizing the iconic NBA basketball of Game 5 in 1991. The blockchain-based project will combine sports history with the technology of blockchain, and offer fans fractional ownership in a real-world asset.

Pippen made a bizarre announcement, which included AI-generated images showing him in bed cuddling the ball. He also posted pictures in cars with the ball firmly seated into the front passenger seat. And he even showed himself showering the ball while still in his jersey. The posts were rounded off with an account of his (truly bizarre) dream in which Satoshi, the creator of Bitcoin, was said to have endorsed the project.

It has always been a risky venture for celebrities to get involved in cryptocurrency. Recent celebrity memecoins —like Caitlyn Jenner’s JENNER and Iggy Azalea’s MOTHER— saw dramatic rises followed by crashes, leaving investors with nearly universal losses.

Pippen’s initiative has received a negative social reaction, especially among Solana users. They have criticized its cringe-worthy approach. Helius CEO, @0xMert_, captured the feelings of many in a single tweet. “What the fuck.” @Evan_ss6 said, “So glad it’s not on Solana,” When @validator_com made a sarcastic comment, “Ah yes, because if there’s one thing Satoshi Nakamoto loves, it’s basketball crossovers, RWAs and life advice from dreams.” @LitecoinRicky remarked, “I thought football players got CTE not NBA players,” When @HouseofYogiX made a joke, “At least it’s not a pump fun.” Coltyn Seifert blatantly speculated. “Dude has lost his mind,” The question was posed by @solostakers. “Is this a joke!? 😲 These celeb projects are getting crazier.”

@mshodl asked, “Omg, what in the name of cringe did I just read,” When @rot13maxi pleaded, “please stop posting top signals. It’s too early for this.” Posting by @AlexFinnX was questioned as to its authenticity. “is this real or were you hacked? There’s no way one of the greatest NBA players of all time is doing this.” Other users, such as @boldleonidas have criticized Pippen’s lack of knowledge in the crypto space. “This is the epitome of what an outsider thinks would be successful in crypto.” @btc_overflow added, “Someone please tell the real Scottie Pippen that this payday is not worth the reputational damage…”

— Jeffrey Albus

One Good DM

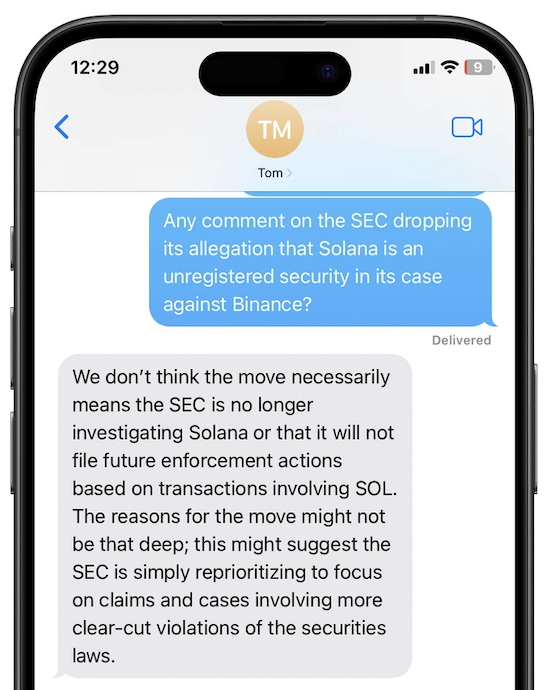

Messages from Tom MombergAttorney at DLx Law:

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.