Blockworks.co is now offering the On the Margin email newsletter. Get the latest news tomorrow delivered to your mailbox. Subscribe to the On the Margin email newsletter.

On the margin newsletter is brought to you today by Felix Jauvin. Ben Strack, and Casey Wagner. You’ll find the following in today’s issue:

- What NVDA’s remarkable run means for market size

- How and when BTC could price break out of current range.

- According to reports, the SEC appears to have ended its Ethereum investigation. Consensys may not be in the clear.

NVIDIA grinds up in the world of dispersion

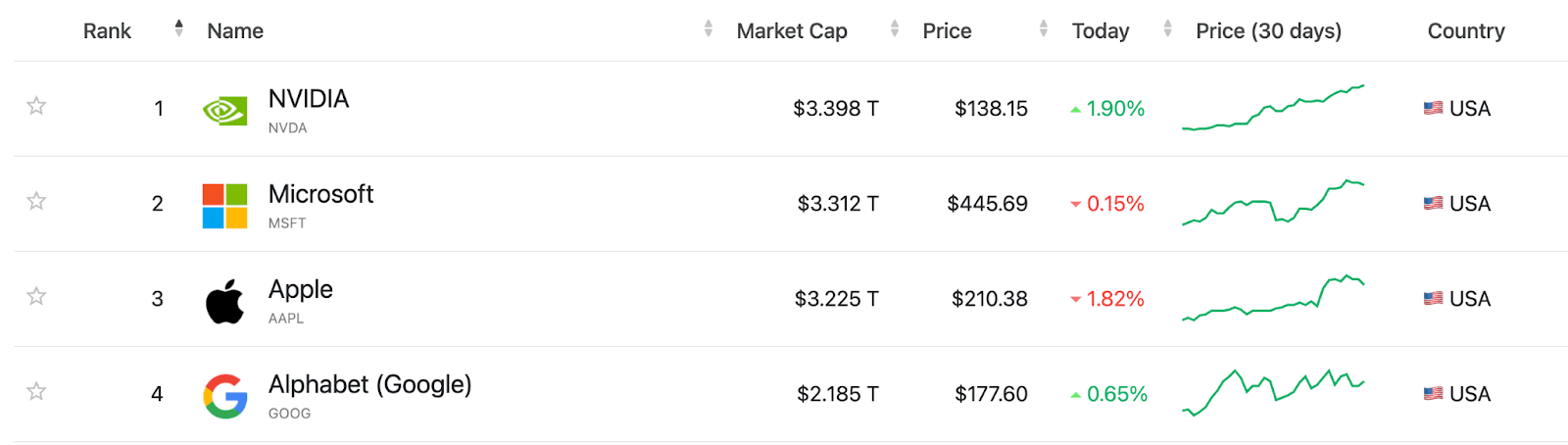

This week NVIDIA overtook both Microsoft and Apple as the world’s largest company.

And let me tell you — some days I feel like I’m the only one who’s never bought or sold NVDA. I don’t feel bad about saying that I missed out on the entire run. I salute those who are able to make generational gains but have the confidence and conviction to secure them.

This NVDA run can be a good indicator of a dynamic that is taking place in the markets today. The vast majority of returns come from a small number of stocks and the market breadth has been very narrow.

As seen in the breadth index below, we are currently at 19 — whereas the 30-year average is at 35:

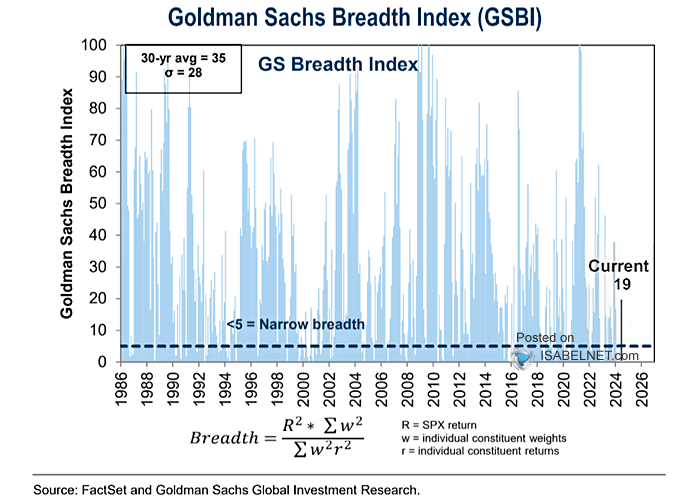

Another simple way of looking at this dispersion in breadth is comparing the S&P 500 Equal Weight index to the SPX Market Cap weighted index. Although historically they have been somewhat similar, the market-cap-focused index is soaring while the one with equal weight has flatlined.

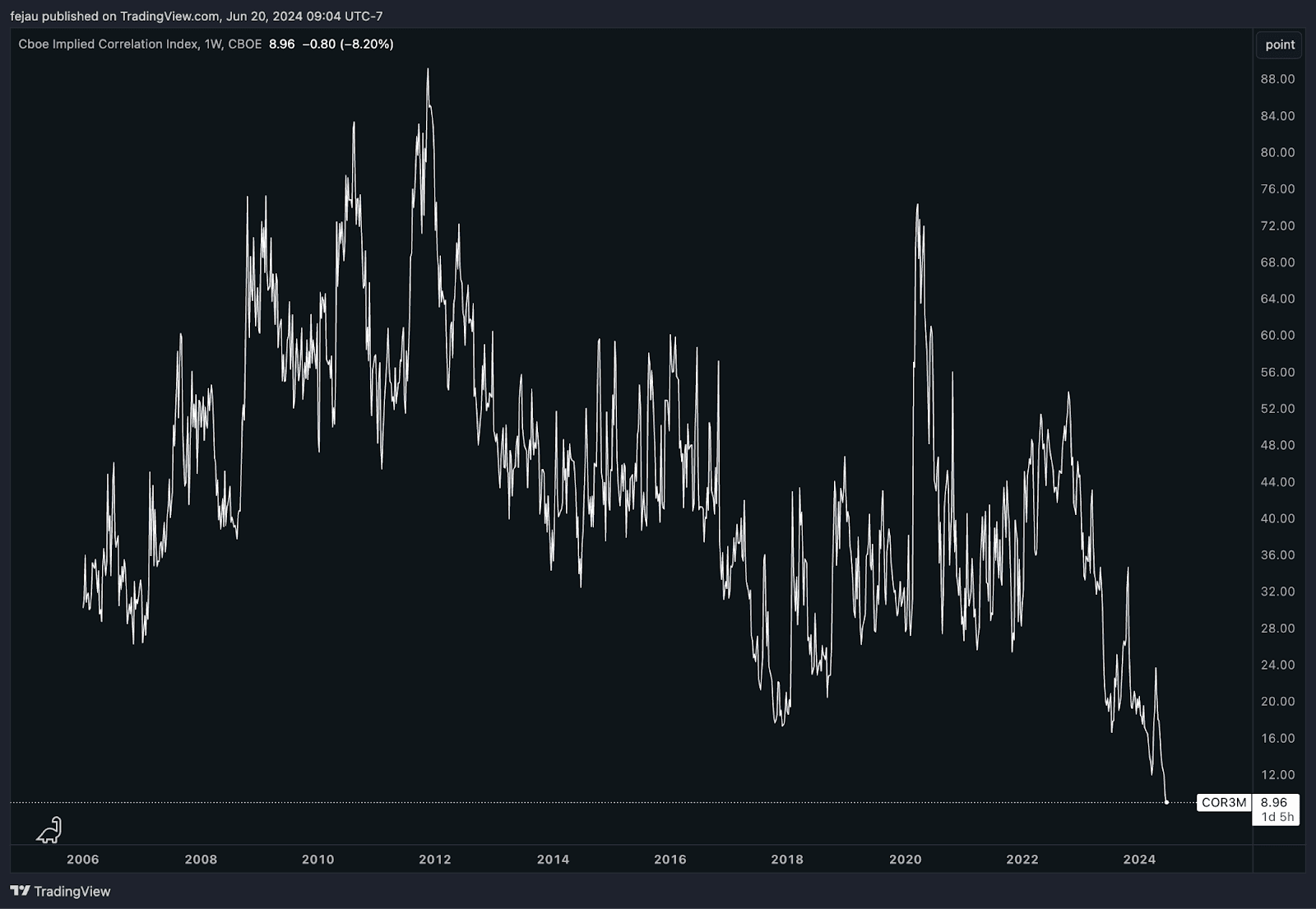

This dynamic makes for one of the most fascinating charts I’ve ever seen. The implied correlations between the indexes that comprise those indexes, and the stocks which make them up are at an all-time high:

What’s the bottom line? We are currently in a stock picker’s market. You will miss out on the most recent rally if your portfolio doesn’t include the few stocks (mostly AI/tech narrative based) that are hitting new highs. Everyone wants to be a part of the AI revolution, not owning consumer staples.

Two things are at the root of my theory about why there is a lack in breadth on the market:

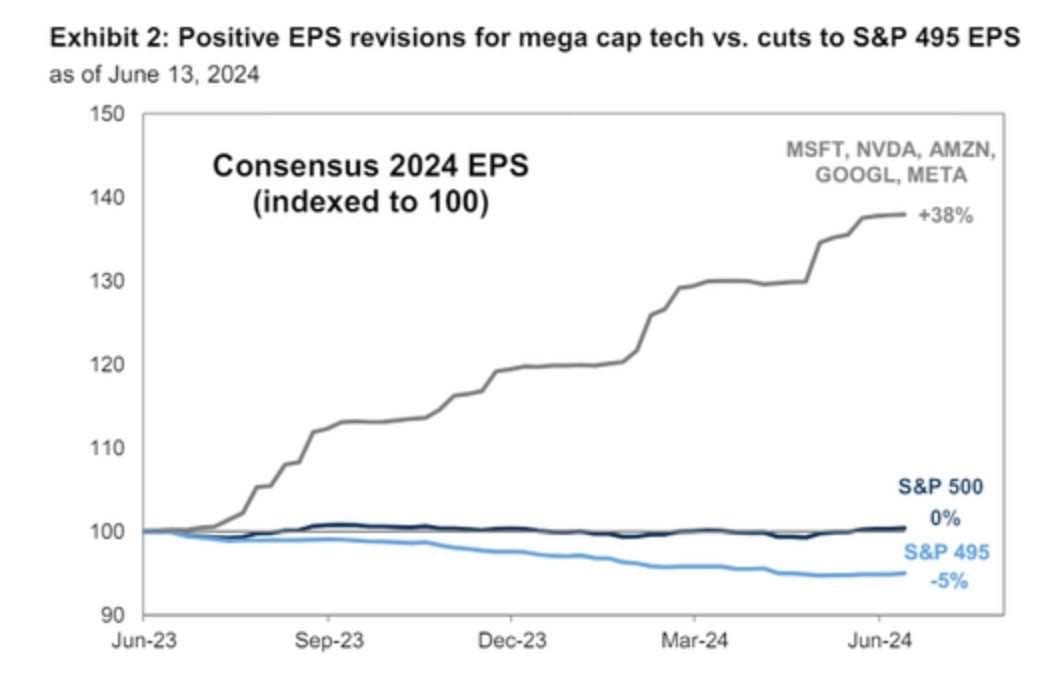

Earnings revisions to the upward

It’s not a coincidence that the largest tech companies are experiencing significant earnings revisions. As the world moves more and more online, digitally and away from traditional offline media, it is important to understand that our economy will continue to grow. “real,” This makes sense. These few companies have seen the biggest gains.

Liquidity constraints

One slightly more negative view is that the Fed Funds rates are at their highest levels in decades, and with wages rising faster than costs of living there is simply less money to buy all stocks. The majority of the liquidity in the market is being brought by passive bids to index ETFs like SPY and QQQ, which are weighted according to market capitalization. These are the only stocks that have any real movement.

I am wondering if this narrowing of the spread is an indication of a possible top in the equities market, or if it will widen and continue to rise as more companies join the Mag7.

In a world of secularly higher inflation and higher fiscal deficits — and knowing that equities are a nominal asset (revenues go up when inflation goes up, due to price increases) — I tend to lean towards the rally continuing and broadening.

— Felix Jauvin

72

The percentage of “wealthy” Americans (with at least $3 million in investable assets) — aged 21 to 43 — who say “it is no longer possible to achieve above average investment returns by investing solely in traditional stocks and bonds.”

They didn’t start NVDA until too late.

Bank of America’s most recent survey also showed that 28% of those aged between 44 and 65 prefer crypto investments to traditional ones when it comes down to growth. Only 4% wealthy investors aged 44 and older agreed.

BTC’s game-theory fueled boost is coming?

Some have predicted that BTC will reach $100,000 by the end the year. However, patience is the key.

You don’t need to look further than the past month to see that crypto prices don’t always rise.

Bitcoin dropped below $65,000 on Thursday. It was trading at roughly $64,980 at 2:15 pm ET — down 9% from a month ago.

Galaxy Digital CEO Mike Novogratz predicted a $100,000 BTC price earlier this month. However, he noted that the type of price increase expected in 2024 would depend on BTC’s ability to surpass the $73,000 resistance threshold in the near-term.

It’s not true, and the Fed’s choice to hold interest rates at their current level last week hasn’t helped.

Novogratz, who has previously stated that he expects to earn $100k in the future (in May), also indicated earlier that a “consolidation phase” was possible — at least until rates come down, or the US election in November.

LMAX Market Strategist Joel Kruger stated Thursday that BTC may remain in the current range for several weeks. “can often translate to apathetic conditions.”

Globe 3 Capital CIO Matt Lason is confident that BTC will rally in the coming months or two due to forced liquidity increases caused by currency fluctuations and economic effects of high interest rate.

He also mentioned another reason: Game theory.

“There has been an increasing stream of corporations and pension funds adding bitcoin to their treasury,” Lason said Blockworks. “We feel this will not only continue but ramp up as other companies and pension funds look to keep pace with their competition.”

He said that game theory is also being played out by investment advisers now having easier access to BTC, via US spot-based ETFs. This summer, it is expected that spot ether ETFs will be launched.

“Some of the large firms still have yet to embrace bitcoin, but that is changing quickly,” Lason added. “As the old saying goes: ‘Slowly at first, then suddenly.'”

— Ben Strack

SEC (sort-of) spares Consensys

Consensys said on Tuesday that it appears the SEC decided against filing charges against Consensys as a result of its investigation into Ethereum Foundation.

An SEC letter (which the agency failed to authenticate) indicates Consensys is in the clear after the end of the so-called Ethereum 2.0 probe that first came to light in April.

Blockworks spoke to a SEC spokesperson who confirmed the agency. “does not comment on the existence or nonexistence of a possible investigation.”

The industry saw the situation as a victory. ETH gained up to 3,6% on Wednesday, after Consensys announced: “Ethereum survives the SEC.”

It is important to note that the SEC still has the Wells notice it sent Consensys last April. The agency stated that it planned to file charges against the company for securities violations in relation to its MetaMask wallet. An enforcement action has not yet been taken — at least not publicly — but is very much still on the table.

Remember that Coinbase stated it received a Wells notification in the spring 2023. About 10 weeks later, the SEC brought charges against Coinbase. Consensys may be sued within days if the timeline is followed.

Consensys and Coinbase are both ready to fight. The company sued the regulator preemptively in April, claiming that the SEC overreached their authority. “unlawfully” Attempts to regulate the crypto-industry.

Consensys has clearly made a positive impact on the industry. However, we are all aware that no one is envious of its high legal fees.

— Casey Wagner

Bulletin Board

- MicroStrategy has revealed that it has purchased nearly 12,000 bitcoins in the second quarter. The BTC assets of the business intelligence firm (totaling 22,331) now amount to roughly $15 billion.

- Marathon, a bitcoin mining company, has expanded to a second continent. Its pilot project is a Finnish initiative that uses heat from the datacenter to heat a town with 11,000 inhabitants.

- S-1s (amended registration statements) for the US spot-ether ETFs should be arriving by tomorrow. Bitwise Fund Group, which filed one on Tuesday, shared a mocking ad. “Big Finance.”

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.