Two Republican Congressional Members are asking the Securities and Exchange Commission to provide clarity on how they view airdrops.

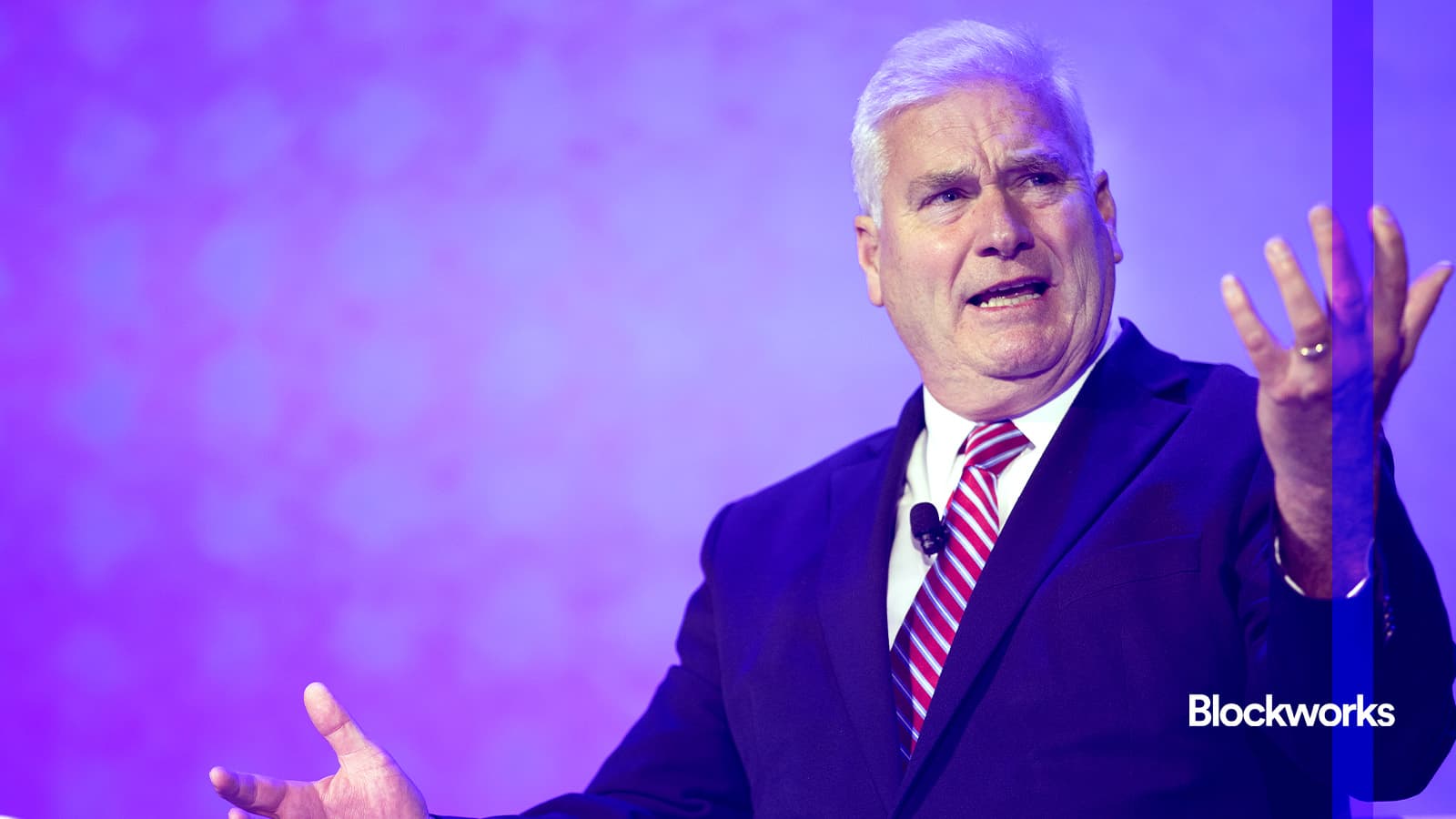

Tom Emmer (R-Mich.) and Patrick McHenry, R-Pa., wrote to Gary Gensler on Tuesday. They expressed concern over the fact that regulators are not doing enough. “misapplied” They say that airdrops are a new technology which plays an important role in securities laws. “crucial role in the development of a decentralized blockchain system.”

In recent years, airdrops, defined by Emmer and McHenry as the distribution of digital assets to early adopters of certain protocols, has been a gray area for regulation, just like other parts of crypto.

The SEC alleged that even tokens given away for free in an initial coin offering by Tomahawk Exploration were subject to enforcement. “free,” Like airdrops they are securities as well because they allow for a market to be created. The SEC said that airdrops were usually given out to community members who performed menial tasks, such as downloading apps or promoting projects. However, the transfer of funds is not required to qualify. “sale.”

The argument is similar to what securities regulators in 1990s said during the dotcom bubble. “free stock” In a recent blog, Hunton Andrews Kurth attorneys wrote about enforcement actions.

“In what have become known as the ‘free stock’ cases, investors were typically required to sign up with issuers’ websites and disclose personal information in order to obtain the ‘free’ shares,” The post states: The post reads:

DeFi Education Fund, an advocacy group for cryptos, and Beba Collective (a clothing company based in Texas) sued the SEC at the beginning of this year. They were seeking a court decision confirming that Beba’s token distribution was not securities. The SEC has filed a motion to dismiss the amended complaint that was filed by plaintiffs in July. They are currently awaiting a ruling.

Emmer and McHenry asked securities regulators in their letter of Tuesday to clarify if airdrops are securities according to the Howey Test. The letter asks why airdrops are treated differently than other reward programs that companies engage in regularly, such as airline miles and credit card points.

Gensler must respond to the Reps’ questions by September 30.

This letter is being sent a week ahead of the House Financial Services Committee’s scheduled hearing on September 24, where SEC commissioners will be questioned. McHenry who will not be running for reelection next November chairs the panel, and Emmer is also a member.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.