Binance Bitget Bybit and other platforms are ready to be onboarded by Sanctum

Binance Bitget and ByBit, all crypto exchanges, are partnering up with Sanctum for the launch of Solana liquid stake tokens (LSTs), according to a Blockworks source who has direct knowledge about this matter.

The three centralized exchanges (CEXs) all teased Solana LSTs on X yesterday within hours of each other — naming the tokens BNSOL, bbSOL, and BGSOL. Sanctum sparked rumors of a partnership by cryptically responding to posts made from its X-account. Sanctum’s co-founder FP Lee confirmed the partnership with a similar post.

Sanctum’s involvement with Binance is a major coup, since it launches and aggregates Solana LSTs. LSTs are tokens that represent some staked Solana. Users can therefore hold a liquid Token while also earning staking reward.

Binance has a total of 33 Million SOL in its possession, valued at over $4 Billion dollars, today, according to Binance’s statement on reserves. The exact amount staked is not known. Bybit’s Proof of Reserves shows around 2.6 Million Solana. Bitget’s does not list SOL.

Last week, Sanctum added Bybit’s bbSOL to its LST list. Binance’s and Bitget’s tokens have not been added to the list.

Sanctum Tokens have access to its reserve and router. This means that they can access the liquidity generated by hosting multiple LSTs in one place. Sanctum Verified Partners can also join INF, which is arguably Sanctum’s flagship product — a token offering the average staking yield of a basket of LSTs.

Sources close to the issue also confirmed that LST partnership agreements with two more centralized exchanges were in development, though they refused to reveal which of them. Coinbase has not responded to a question about whether the exchange plans to launch Solana LST.

If you read the tea leaves, it seems that Sanctum is taking a broad approach in pitching central exchanges to secure these Solana LST partnership. But despite the centralization fears, crypto exchanges remain amongst crypto’s top consumer applications. Their distribution, by crypto standards, is also massive.

Lee predicted that CEX LSTs could bring in “millions” New users. “I’m especially happy that instead of building their own gated solutions, CEXes are adopting open-source, decentralized, community-owned programs instead,” Lee added.

Sanctum is able to make money by charging swaps and deposits, according to an anonymous cofounder named j. J said that Sanctum’s current focus is on expanding the LST industry, rather than generating revenue. Its infrastructure has already been set up to collect fees once the market grows.

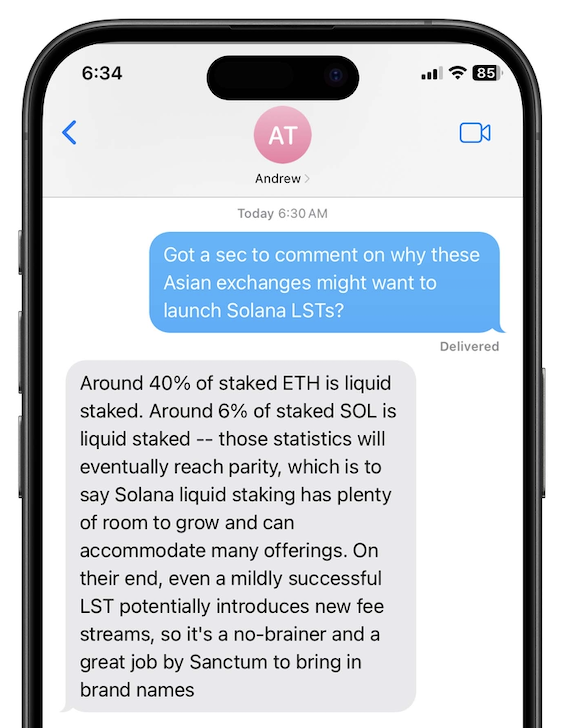

According to Dune’s dashboard, despite the efforts of Sanctum, Jito, Marinade and Jupiter as well as Blaze and Jito in providing LSTs, the amount of Solana staked that is held by LSTs remains between 6%-7%. This has been the case since the beginning of May. If Binance gave every staker the opportunity to switch to LSTs, that percentage might start to change.

Zero In

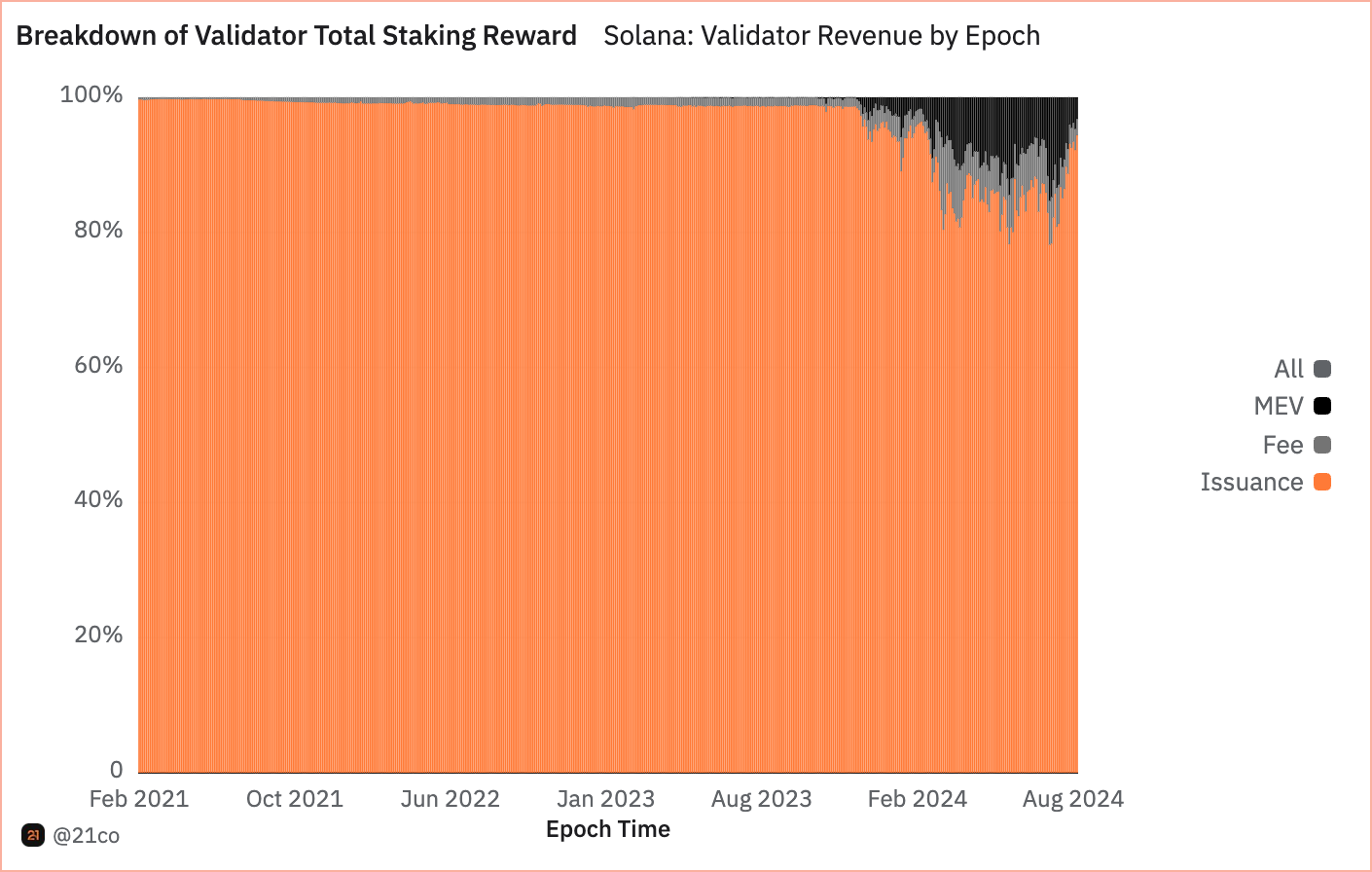

Solana’s validators’ revenue sources are changing during this Solana-cycle:

The revenue generated by validators was almost entirely from issuance. It is an incentive paid at the end each Solana Epoch to validaters.

This chart was sent to me by Tom Wan, 21 Co’s X representative. It shows that the graph has changed in recent months due to the explosion of memecoins and DeFi on X. Today, only 92% is validator revenue. However, this number dropped to under 80% some days during summer.

It is consistent with the increase in both transaction fees and maximum extractible value, which are presumably fees on Jito packages.

The Pulse

This week, ICYMI:

- Robinhood: Robinhood Wallet is live with the Solana network, allowing you to receive and send Solana tokens via Solana’s blockchain.

- Coinbase: Helius now powers Solana Support on Coinbase Wallet.

- PYUSD: Solana, which holds 64% of the market for PYUSD compared to Ethereum’s 36%, has been chosen as its primary residence. The DeFi platform Kamino has been a major driver of growth.

- Jupiter Exchange Jupiter Exchange has integrated pump.fun by dexscreener and moonshot, which allows users to instantly buy and sell tokens.

- Helium Mobile: Puerto Rico has launched decentralized wireless networks, marking the expansion of infrastructure built on Solana.

- Mango DAO: After the hack of 2022, DAO faces complex challenges in governance.

- Blockworks Research Recent releases of the Solana Dashboard track key metrics, such as validator cashflow, TEV and transaction activity.

The One Good DM

You have received a message Andrew Thurman. Contributor Jito Foundation:

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.