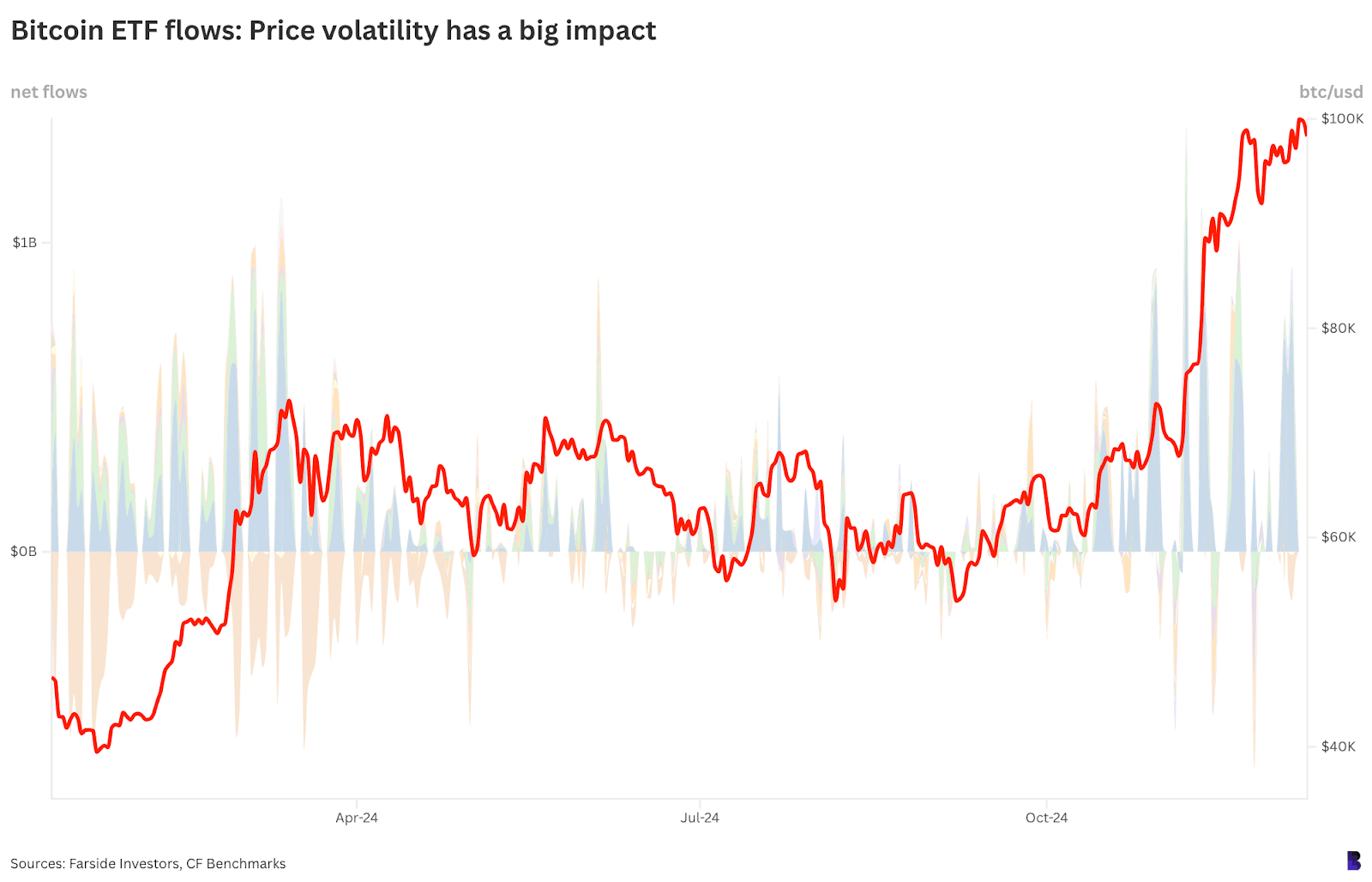

The same goes for Bitcoin ETFs.

No surprise then that almost $10 billion net has now flowed into US-listed spot funds since Trump’s win — about 83% going to BlackRock’s IBIT.

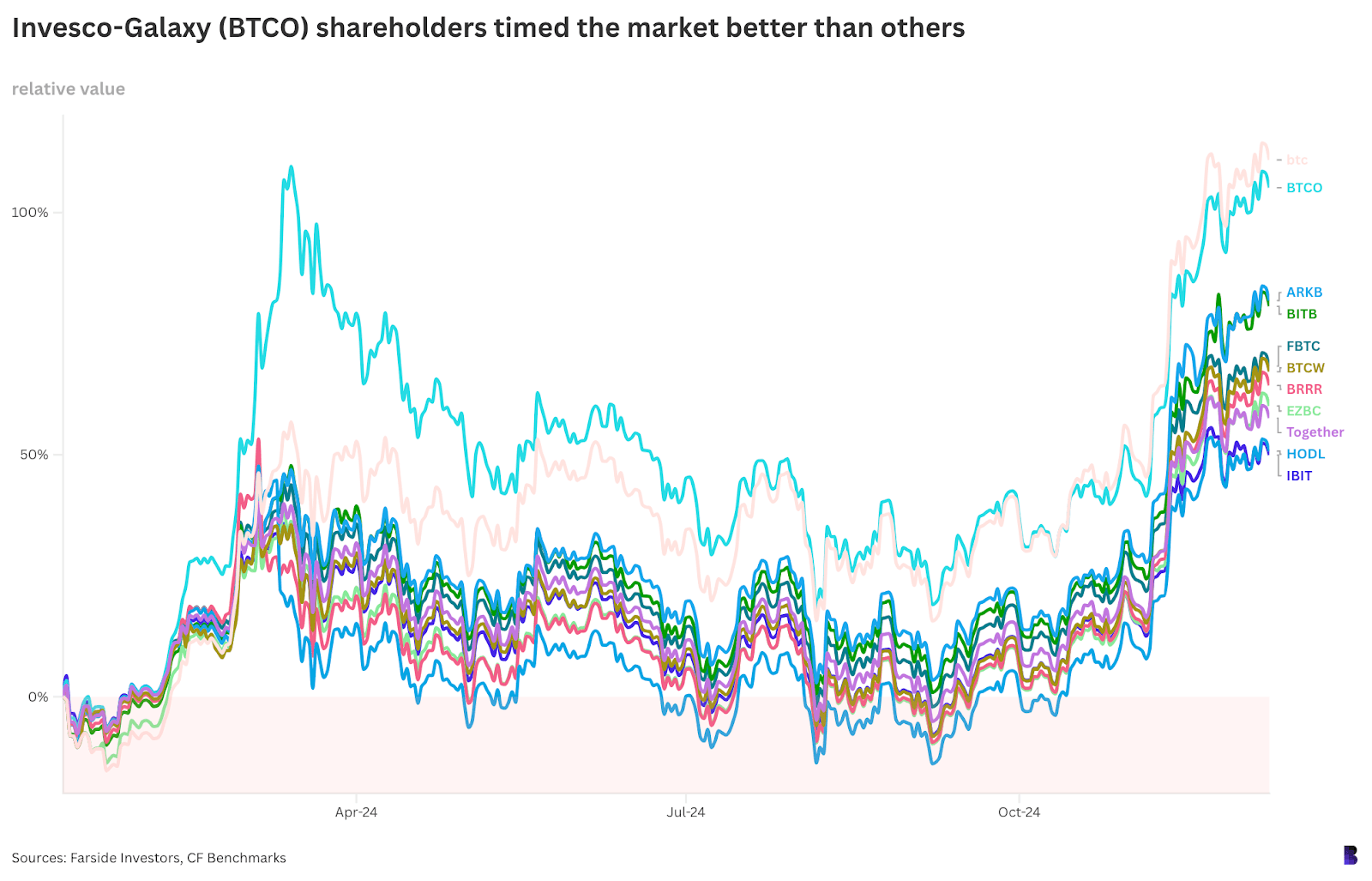

Some ETFs continue to perform better than other.

By design, the share prices of the ETFs closely track bitcoin’s price. Share prices do not reflect the performance of funds in terms of their Bitcoin purchases.

The funds are required to spend an equal amount of BTC on each stock exchange trading day. The funds must also sell their coins when the net flow is negative.

By dividing daily US Dollar flow figures (per CF benchmark reference rate which is used by all major funds) by bitcoin’s price, you can estimate how much BTC a fund purchases and sells each day.

If you add up all the BTC flow, it comes to over 1.1 million BTC worth of assets. This is about 5.6% the supply.

What we want to know is how much each fund paid for their BTC, or what I call relative value in the graph below.

It turns out that Invesco-Galaxy’s BTCO is far ahead of the rest of the pack — it has acquired around 8,740 BTC net for $418.9 million so far. BTCO bitcoin was worth $860.6m as of this morning. This puts its shareholders collective in the lead by over 100%.

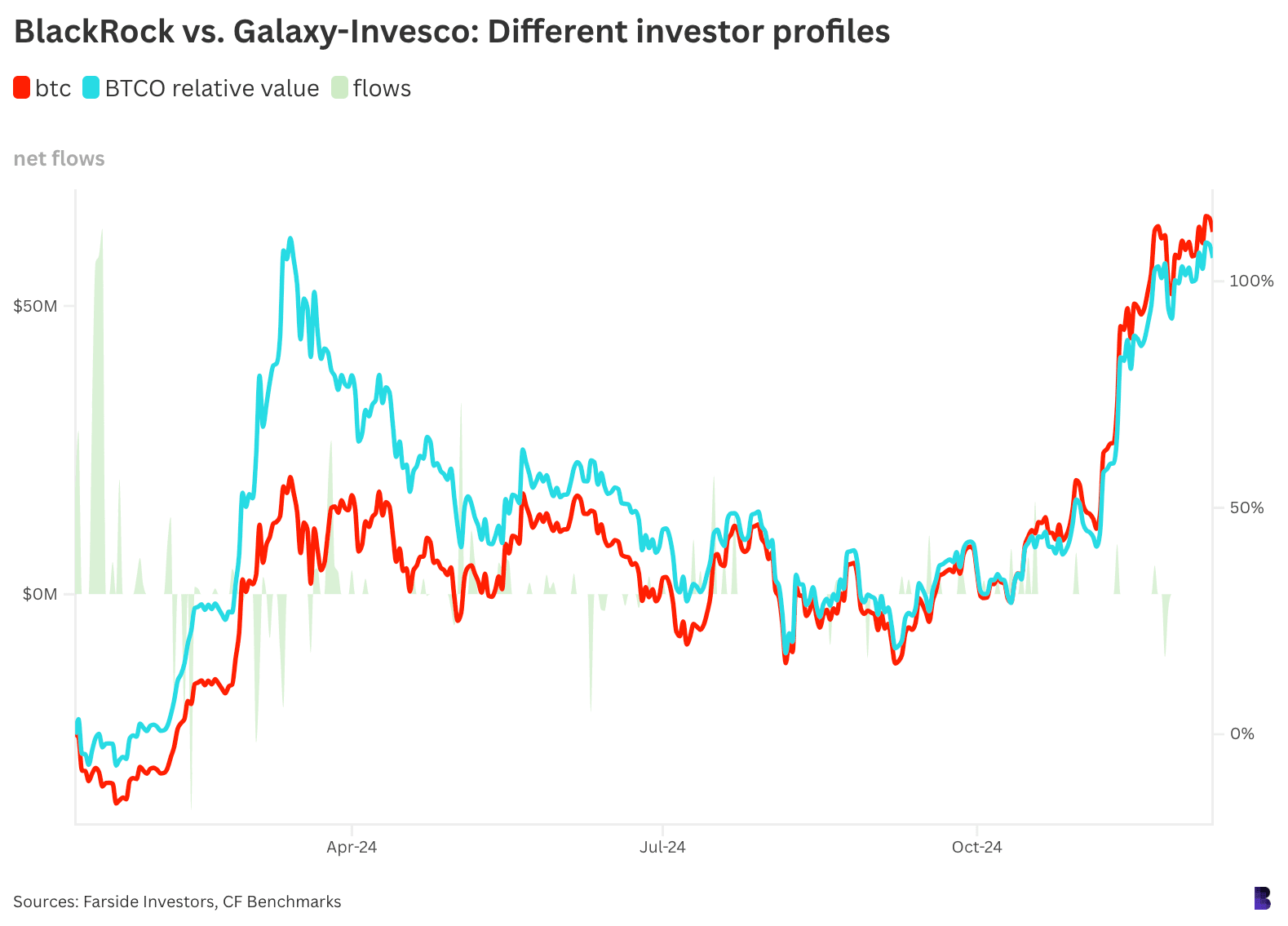

On the chart below, you’ll see that the majority of BTCO’s current net flows came during the first 2 weeks of trading when bitcoin was only changing hands at a price of under $43,000.

BTCO’s average estimated purchase price per coin: $47,930.

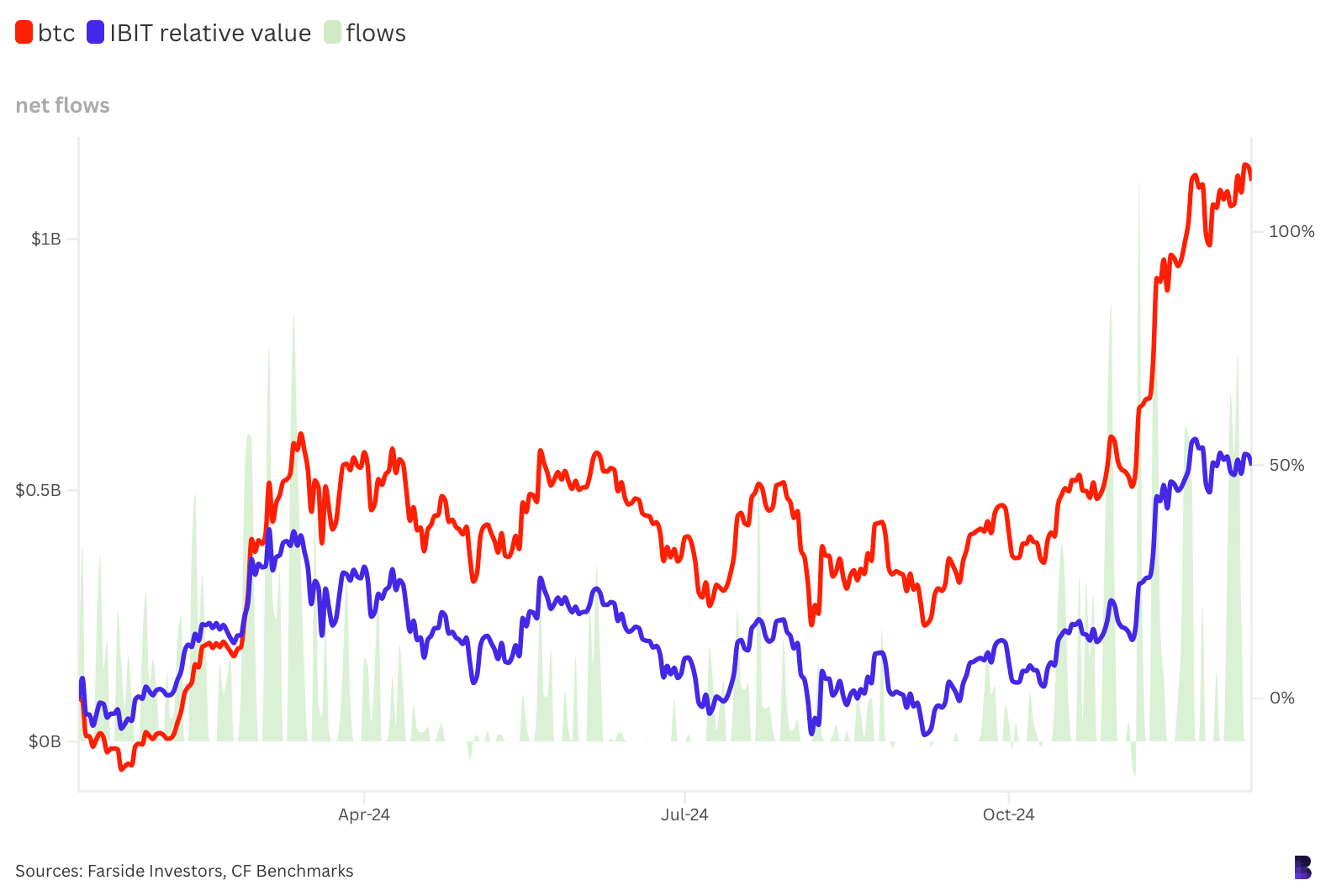

Comparing that with BlackRock’s IBIT. It has maintained more steady flows over the past 11 months — acquiring roughly 523,935 BTC from $34.4 billion net flows.

This means that the ETF is effectively averaging its Bitcoin stash at a dollar cost, which gives it a coin average of $65,600.

IBIT, which has been the worst performing fund of all the funds within the cohort in terms of timing the market and its BTC acquisitions to date, is approximately 50% ahead.

Due to the size of the funds, IBIT BTC’s has appreciated in dollars much more than BTCO BTC’s.

They deserve a round of applause. We’ll see now how long these guys can hang on.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.