Are you looking for a fresh narrative? Marc Boiron of Polygon Labs has an idea for you. Yield-bearing, stablecoins.

Boiron believes that once stablecoins become more widely understood, their use will take off. Boiron said he would not be surprised to see stablecoins driving the economy. “a decent amount of activity in 2025.”

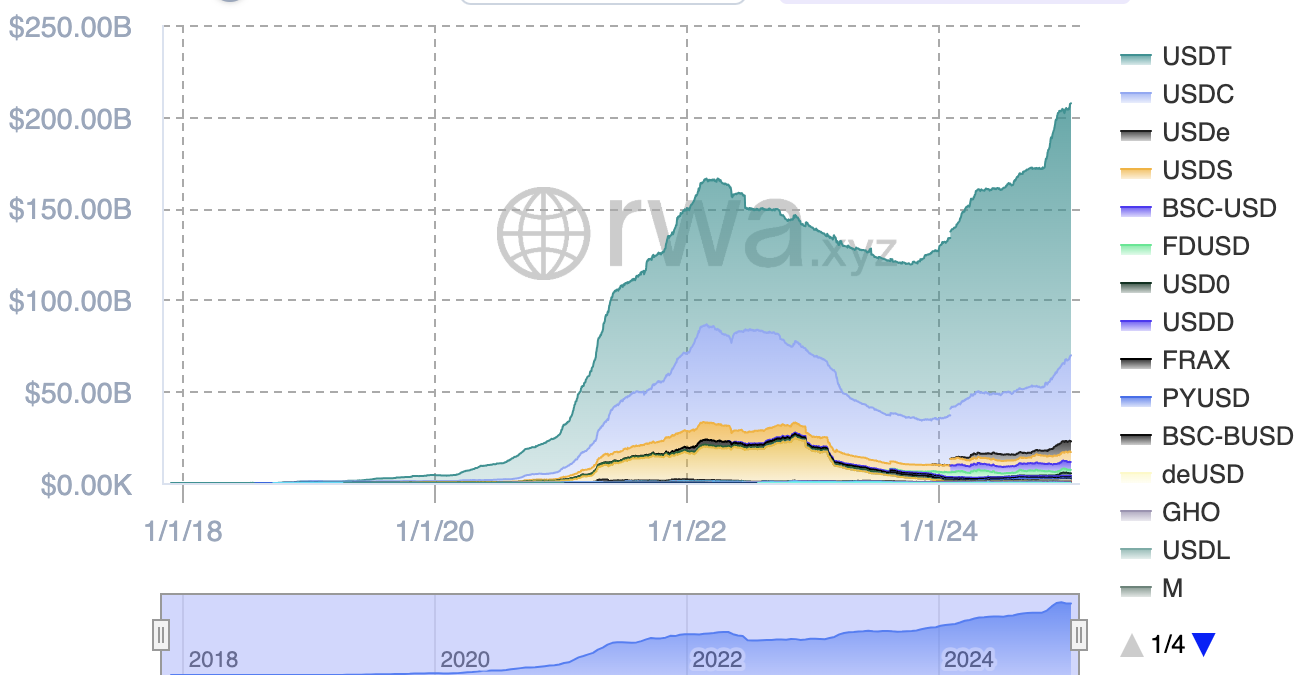

According to data from rwa.xyz, the market capitalization of stablecoins, including yield-bearing coins, is up to $207 billion.

MiCA’s regulatory clarity in Europe is not only a factor that will attract stablecoins, but also the activity. Even the US seems to be on the same regulatory track.

For companies — like fintechs — watching the stablecoin market from the sidelines, it’s hard to not feel the FOMO when looking at Tether’s attestations. Boiron has had conversations with people who aren’t crypto natives.

Boiron tells us that a group of new players is telling him what to call them. “hey, we want our own stablecoin, because we can see how much money we can make off of it, and we’ve got a boatload of users, it’s really easy to push them into that stablecoin and get a lot of volume, and obviously revenue from that as well.”

“The second part of it is just having better rails for their users, knowing that there’s a set of users who are [going to want to] send payments, especially remittances, as of right now, and they actually want to make that available rather than incurring” He continued.

Let’s look at Tether’s third quarter attestation last year. Even if the firm bundles unrealized bitcoin gains with other revenues in its disclosures, it reported an astounding $2.5 billion in net profits in just that one quarter.

“Everybody sees how profitable Tether is, and they’re like, ‘Okay, I can do that with less risk now,’ especially fintechs, right?” He added. Boiron said that he believes there will be new players in the market, as stablecoins with yields could improve user experience.

It doesn’t necessarily mean that companies will launch stablecoins of their own. Boiron also added that the companies will adopt other stablecoins.

“They understand that there’s a significant distribution of USDC, and a lot of people hold it. They’ll, for example, want to make that still available through their application, while also launching their own stablecoin,” He made a note.

Boiron also believes Polygon Labs will be able to push the envelope in terms of its ability and scale. “massive” Stablecoins are now gaining in popularity as a result of the volume they have onchain.

Boiron told me that 2024 is the year the stablecoin will be released, but now I am beginning to believe this could just be the first step.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.