Plenty of people feel strongly about the tokenization/RWA space that appears poised to one day transform financial services — even if that change takes years to play out.

Tuesday’s first day at the RWA Summit was filled with a variety of opinions, both positive and negative. The promises and expectations for the RWA segment were both lauded and questioned.

RWA stands for Real-World Assets. In this context, it refers to the efforts to bring tokenized versions of such assets — from bonds to real estate — onto blockchains.

Standard Chartered expects that the market for tokenized RWA will reach $30 trillion by 2034.

A number of executives have stated the obvious but critical fact: Tokenization will be driven by specific benefits and utility (and their economics).

“Rather than asking the question of what can I do with the technology, I think adoption is going to come from what are the issues that investors are facing?” Cynthia Lo Bessette of Fidelity. “What are the pain points or expensive operations, and what can we do to solve those pain points?”

In a survey conducted by EY-Parthenon in March, 52% of asset management firms cited the ability to access new capital and investors as their main motivation for tokenizing. Second, with 46% of the vote, were cost savings and reduced administration fees.

Roger Bayston from Franklin Templeton brought up a second point: the cost difference between transfer agents and the legacy system. It would cost around $50,000 to complete 50,000 transactions with the legacy system. That’s about $1 per transaction. The total costs for blockchain are $1.52.

Jenny Johnson was the CEO at Franklin Templeton, and she took note of his comments.

Franklin OnChain US Government Money Fund of asset manager BlackRock had $435m in assets as of September 30. BlackRock has built an alternative product with assets exceeding $500 million. This was in July.

This money market fund category is distinct from stablecoin market capitalization, which amounts to $170 billion.

Eric Ervin, from Securitize, said that during the panel discussion I moderated earlier this month at Permissionless he believed the BlackRock Fund alone could have assets of $50 billion within the next couple years.

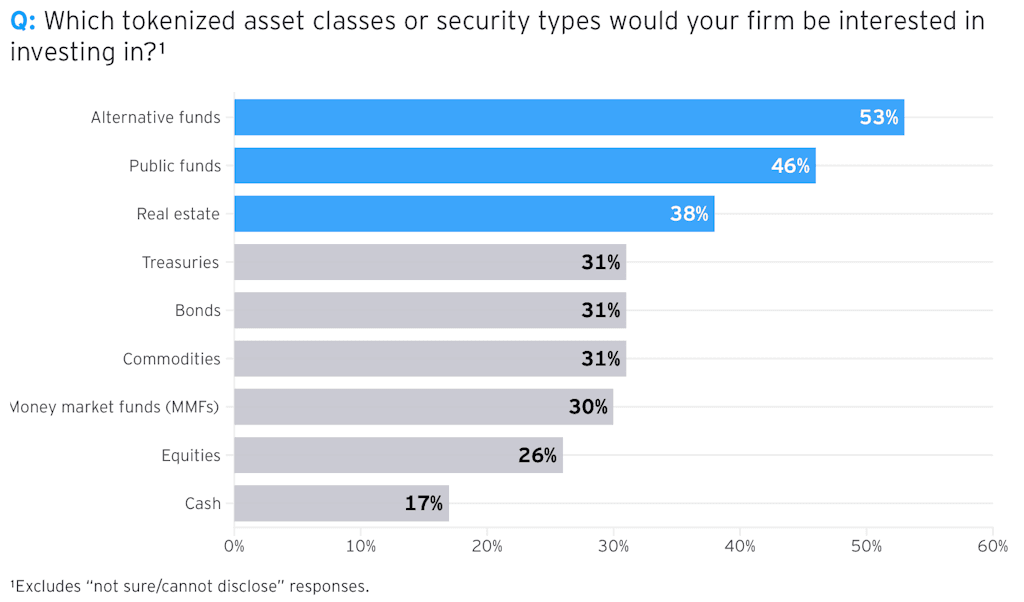

Here is another EY Parthenon find:

CoinFund president Chris Perkins said the $7-plus-trillion-per-day foreign exchange market offers “an opportunity set” For stablecoins, that is “just staring everyone in the face…because of the instant settlement.”

Perkins noted that CFTC clarification on the use of blockchain to transfer and hold non-cash assets could open up opportunities for firms using tokenization.

While Dragonfly’s Rob Hadick noted stablecoins’ utility, he voiced some skepticism about tokenization/RWA more broadly — at least for now.

“My guess is that equities, bonds — things that are regulated products that exist in the current financial system — it’ll be really hard to extract those and put them on a public chain in a place where unregulated entities are,” Hadick said.

Then there’s Crucible founder Meltem Demirors who was a little more open in his discussion with Superstate CEO Robert Leshner. “Debate: RWAs Are the Real Point of Crypto.”

“Tokenization” is like adding lipstick to an ugly pig. To make an asset crypto-compatible, you dress it up to be more liquid. It’s “a worthwhile endeavor” It’s a good use of the blockchain technology, but it doesn’t mean that crypto is.

Also, she clarified: “Taking a pile of dogshit, putting a wrapper around it and putting it onchain does not make it a better asset, does not create demand for it. Case and point: real estate.

“I want to attract dollars outside the crypto world onchain into crypto.” Demirors added. “RWAs today are taking dollars from within crypto and giving them to traditional financial institutions, custodians, banks and — as we saw with the Stripe acquisition of Bridge — [payments service providers]Not the crypto-ecosystem, but those who will benefit.”

Even if you are bullish on the space, execs agree it will take a while before some of the multi-trillion-dollar projections are met.

Leshner noted that ultimately $500 trillion or so of assets will migrate “From bad to good ledgers” — aka move onchain, so those assets “You can be more than you are.”

But, he added: “All of the wealth of the world is changing its location in the early stages.”

Will Nuelle, a general partner at Galaxy Ventures, said that while stablecoins are a “Beachhead Market” a broader tokenization boom will take longer than two years, or even five years.

He added: “This is something that has been going on for two decades.”

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.