Histoically, it was very costly to run an Ethereum L2. L2s paid millions of dollars in data access costs to L1s.

Dencun (EIP-4844) was introduced in March 2024. It introduced an expansion to blockspace called “blobs” It is possible for L2s and L1s to send batched data very cheaply. Blobs are a part of a different fee market than the L1. It is about an order-of-magnitude cheaper than the L1 blockspace. This makes it a crucial aspect of Ethereum’s roadmap centered on rollups.

To illustrate, TokenTerminal’s data shows Base spent $9.34 million on expenses in Q1 of 2024. These dropped sharply to $699k and $42k respectively in Q2 and Q3 of 2024.

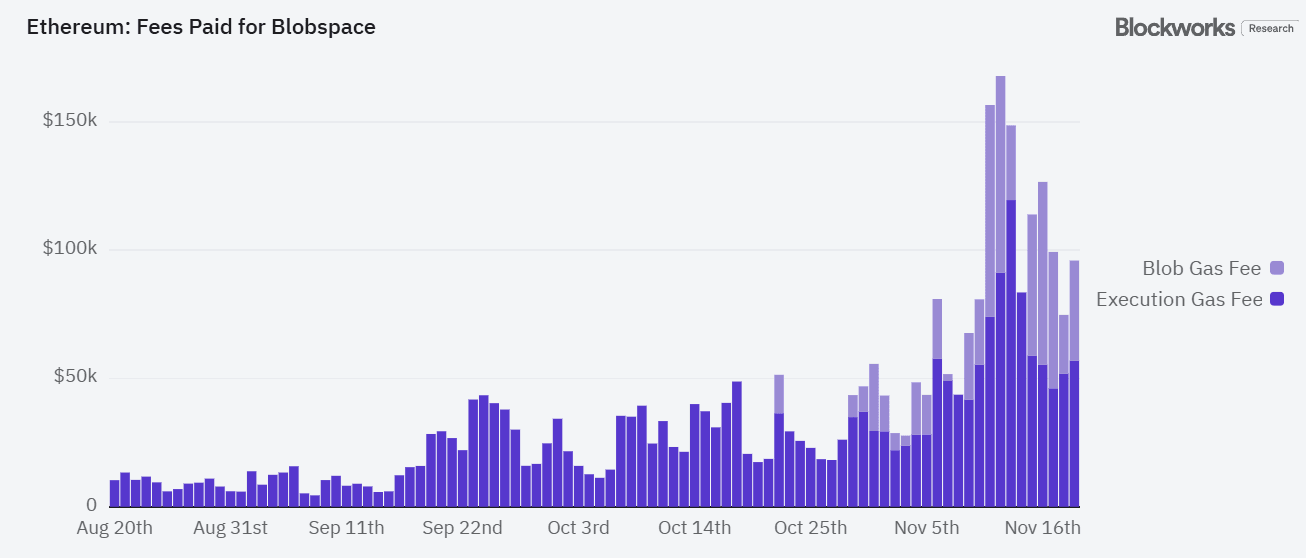

The good news (or bad?) The bad news (or good?) is that blobspace has become more expensive again, as the onchain market is picking up.

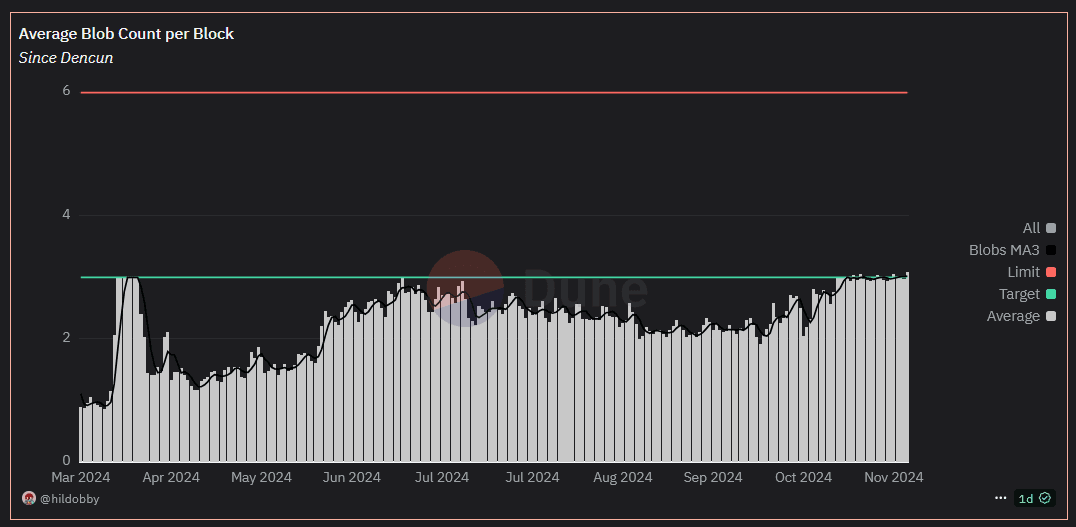

Blobs are currently limited to 6 per mainnet. After blob usage reaches a 50% target, or three blobs, a base charge is implemented to regulate demand usage among hundreds of L2s. Base fees increase by 12.5% when usage reaches four blobs.

This is what has been happening over the last few weeks (see below).

Blobs no longer come for free, and L2s have to pay. “rent.” According to ultrasound.money’s data, the blob fee has been burning about 212 ETH over the past 30 days. This has led to a substantial amount of blob fees being paid to Ethereum mainnet.

Blobs are great in general. L2s operate cheaper, which is great for L2 users.

People (read: holders of ETH) are not happy, because it appears that L2s get away with barely paying any expenses to the l1, which results in ETH’s value decreasing.

Two key reasons are at the heart of this complaint:

- L2s are fundamentally businesses. They’ll choose a less expensive data availability provider, like Celestia and EigenDA, or even worse, a centralized committee for data availability (DAC), with weaker safety properties.

- L2s simply delay sending data back to L1s when blob market prices get expensive. Scroll and Taiko have done this in the past.

Ansgar Dietrichs, Ethereum researcher at Devcon in a discussion about blobs admitted that L2s had misaligned incentive structures. However, he counter-argued Ethereum’s DA was more important over the long run as more L2s coalesced around it when trust bottlenecks emerged around bridging.

Then there was the “blobs is a loss leader” Blueyard’s Tim Robinson. He says that blobs may not be generating revenue now, but will do so quickly. The economics of blobs will pay huge dividends to Ethereum in the near future. Robinson’s blob simulation shows that a hypothetical Ethereum L1 processor 10,000 TPS at 16 MB blob (blob sizes today are 125 KB) would consume 6.5% ETH per year.

This is why blobs will be good for Ethereum over the long term. It would be bad to throttle blobs or raise blob fees in order to extract more value out of L2s. “rent-seeking” idea.

Ethereum researchers put their money on the line. In an Ethereum Research post published two days ago, Toni Wahrstätter called for either a conservative increase to 4/6 blobs or a higher 6/9 blob count.

Vitalik suggested in ACDE #197 that the next Pectra fork would have a 33% larger blob area. This, he said, was essential. If not, users will move to other chains.

It boils down to a question about whether Ethereum prioritizes the average L2 users and its “Ethereum-aligned” L2 ecosystems or prioritizing value accrual in ETH as the asset.

Researchers at Ethereum believe that a focus on the former may lead to a migration of developers and users away from Ethereum and towards cheaper chains. They are therefore doubling down in order to scale blob spaces for the long-term. This damages the perception that ETH is an economic asset. In turn, this angers ETH holders in the short term.

Ethereum faces a tough situation, regardless of the outcome. This is because it requires an enormous amount of foresight and a multitude of calculations. “what-ifs.” It is only a matter of time before we know which direction to take.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.