Blockchain metrics used less incorrectly

A lot of information is generated by blockchains. Crypto Twitter is never satisfied with its quest to compare Blockchain A and Blockchain B. This means that investors, KOLs and researchers have no shortages of metrics when presenting their arguments.

However, a bad understanding of the numbers is often detrimental to our ability to comprehend this world.

Today’s 0xResearch looks at three metrics, and the problems they cause: blockchain, active addresses “profitability” Total value of the secured assets

Active Addresses

“Active addresses” This number tells us the total number of paying, active users for a particular protocol.

“Facebook has three billion monthly active users” It is an interesting statement about social networks. As spammers do not have a huge incentive to spam Facebook, the number of active addresses is a reasonable way to determine how useful it is for users.

But when it comes to blockchains, active addresses become less useful due to the ease of creating new wallets — and the overtly profitable opportunities to game airdrops or farm protocol incentives.

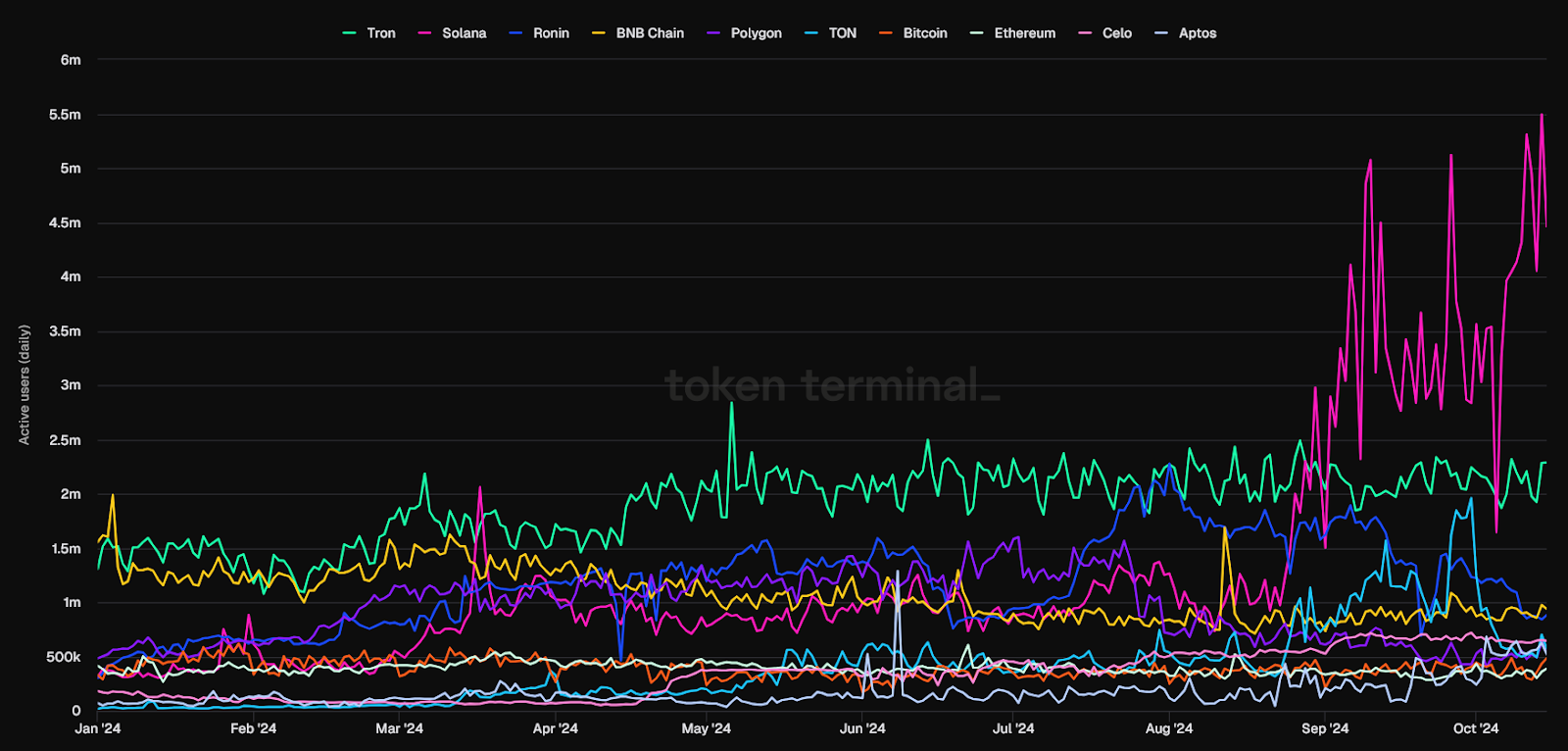

The chart below, for example, tells us that Solana had the highest number of active daily addresses over the past month. Solana is on fire!

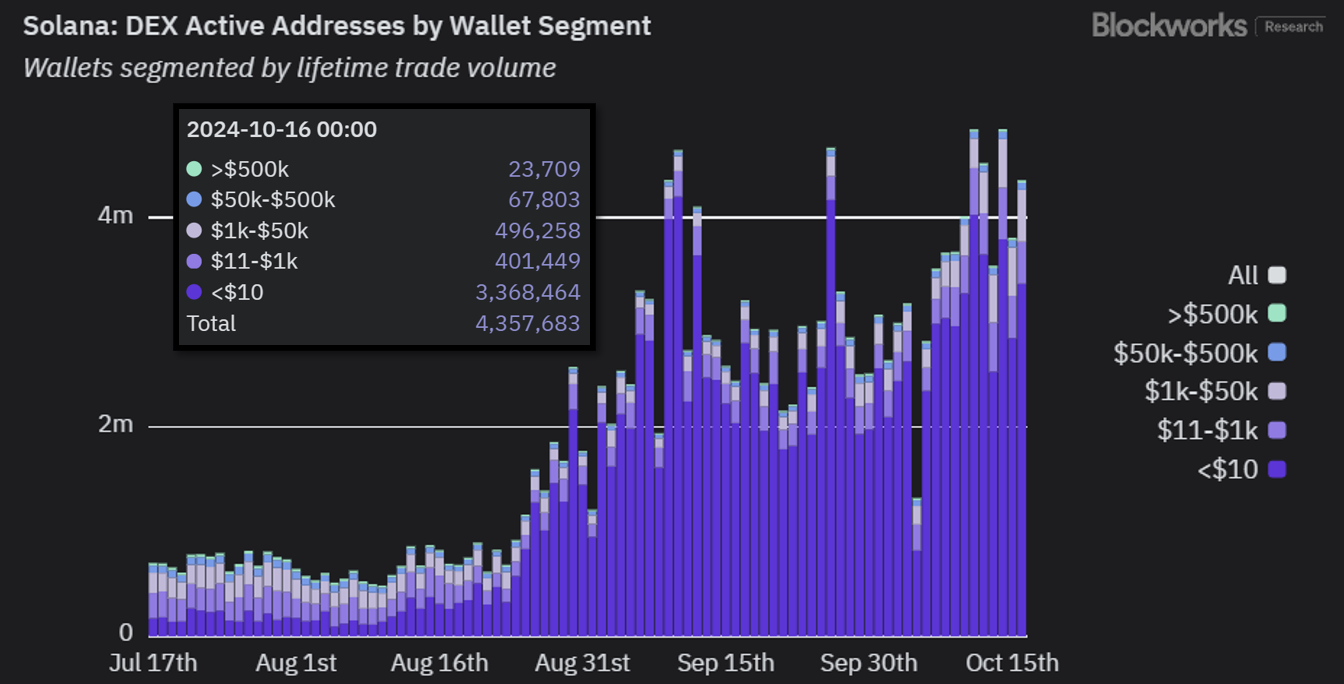

We should look closely at DEX trading activity, as most Solana users trade on DEXs. When we zoom into Solana’s active addresses on its DEXs, we see that the mass majority in the last day — about 3.4 million of a total 4.4 million — has traded less than $10 of lifetime volume.

It is more likely that the low Solana transaction fees are responsible for any spam or bot activity than actual numbers. “quality” users.

Another example that I’ve written about before: In September, the Celo L1 saw its number of daily active addresses sending out stablecoins jump to 646k. This led to a shout out from Vitalik Buterin, CoinDesk and CoinDesk.

Jack Hackworth of Variant Fund found, upon closer inspection, that 77% were Celo addresses which transferred negligible sums less than 2 cents. The reason for this is due in large part to the fact that tens or thousands of people claim a fraction of cent per month from an universal basic-income protocol called GoodDollar.

Both active addresses told a tale of heavy usage. On closer inspection, this story is shattered.

Dan Smith is a leading authority on the incorrect use of the daily active address.

Bitcoin profitability

Instead of focusing on addresses, it’s better to look at the network fees. You can use fees to calculate the amount of gas you’ve spent using a certain protocol. “quality” users.

Investors and analysts use the fees of blockchains to gauge which ones are producing the most revenue. “revenue.” We then deduct the cost of tokens issued to validators by the blockchain.

What is the result? Blockchain “profitability.”

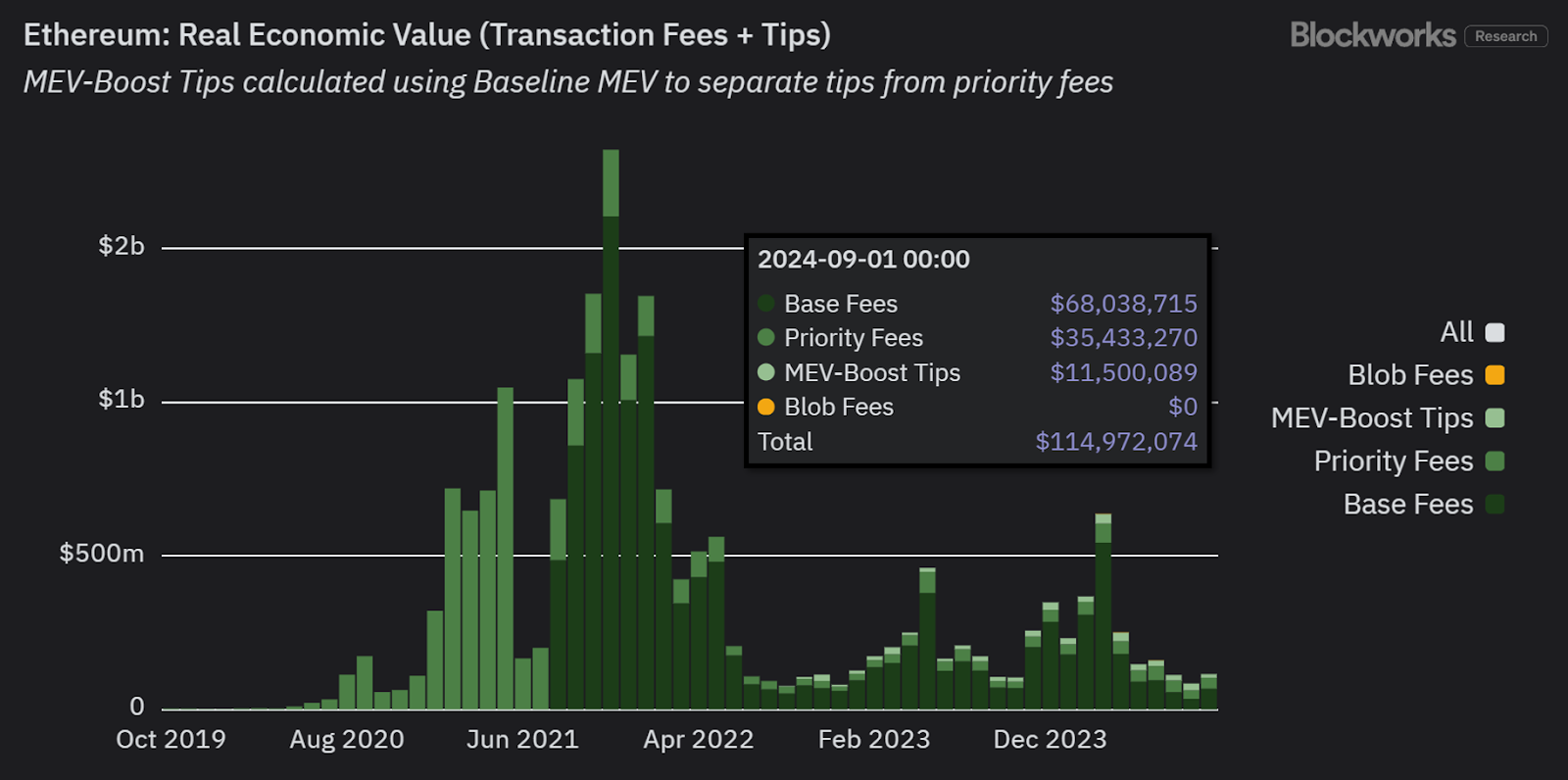

Token Terminal is a token generator that generates explicit tokens. “financial statements” For crypto protocols. For example, the image below shows you how the Ethereum L1 lost multi-millions of dollars in just two months.

This is not true for a crucial fact: unlike a PoW network like Bitcoin, users of a PoS blockchain can also easily benefit from token issuance rewards.

Why should I be concerned if the network was faulty? “unprofitable” What if my Lido/Jito liquid stake platform generates a yield of 5% on the ETH/SOL I have staked? The conclusion is questionable if token issuances are treated as cost items. “Ethereum is unprofitable.”

The real reason why inflation is bad, when central banks’ money printers go berserk “brrr,” The new money will reach different players in the economy and at different times. It is to the benefit of those who get it first. “real” Prices adjust. The Cantillon Effect is the name for this.

This is not what actually happens in an economy based on a PoS, as inflation (i.e. Everyone receives token issuance at the same moment. No one is made richer or poorer — everyone stays equally wealthy.

Consider the real economic value (REV) instead, which includes network fees as well as MEV tips to validators.

Ethereum’s profitability over the past 2 months can be seen from this data:

The REV metric is more accurate in assessing the true demand for a network and it’s also a revenue measure that can be compared apples to apples with TradFi.

Short and sweet: traditional accounting systems that use profit and loss don’t translate well to blockchain.

This Bell Curve Podcast with Jon Charbonneau will give you more information on this topic.

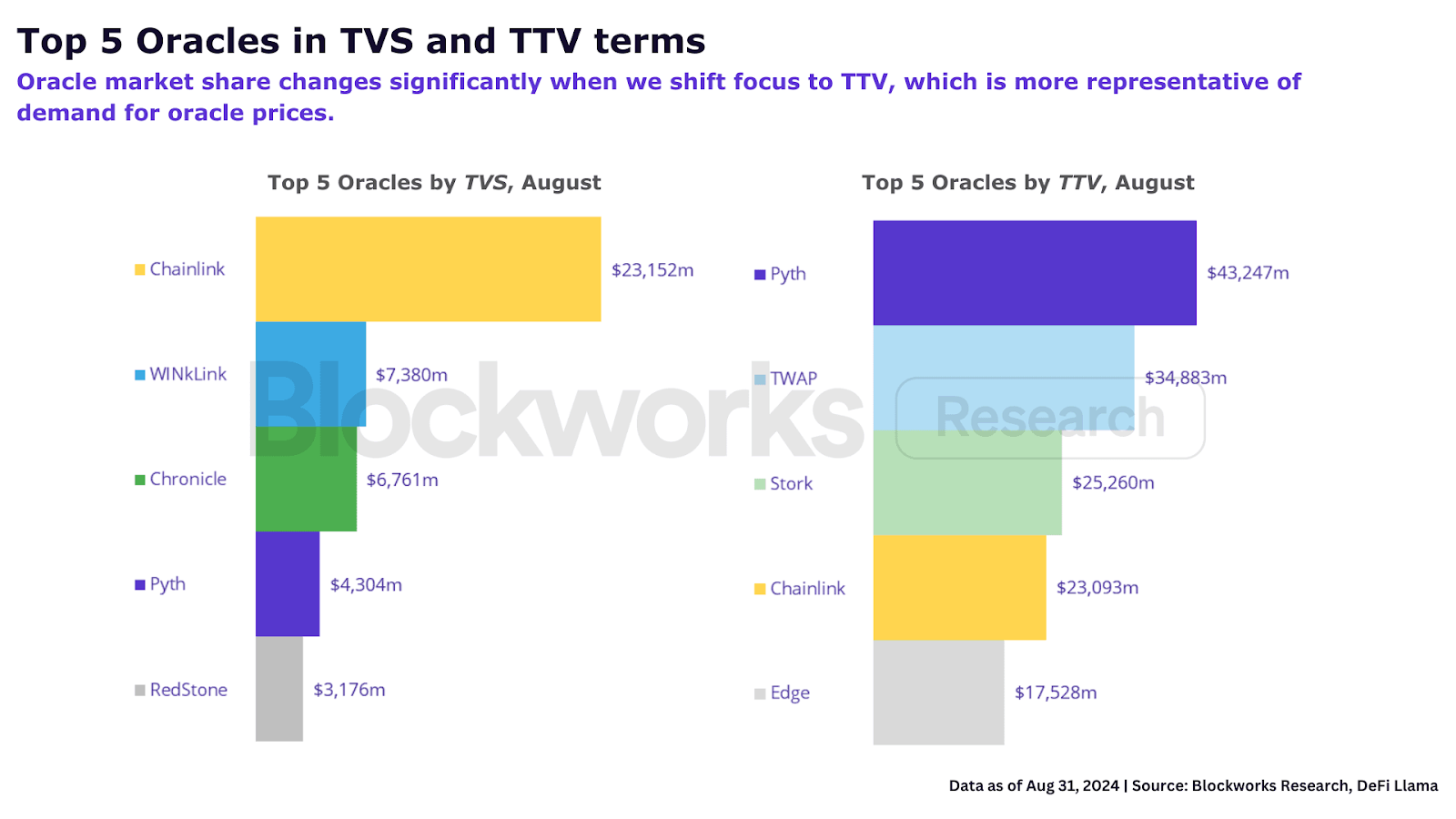

The total transaction value (TTV) is not the same as the total value protected (TVS).

Oracles form a critical part of a blockchain’s infrastructure, allowing data to be accessed from outside the chain. Chainlink and other oracles provide a reliable method for blockchain economies, such as the cryptocurrency market, to mirror real-world economic prices.

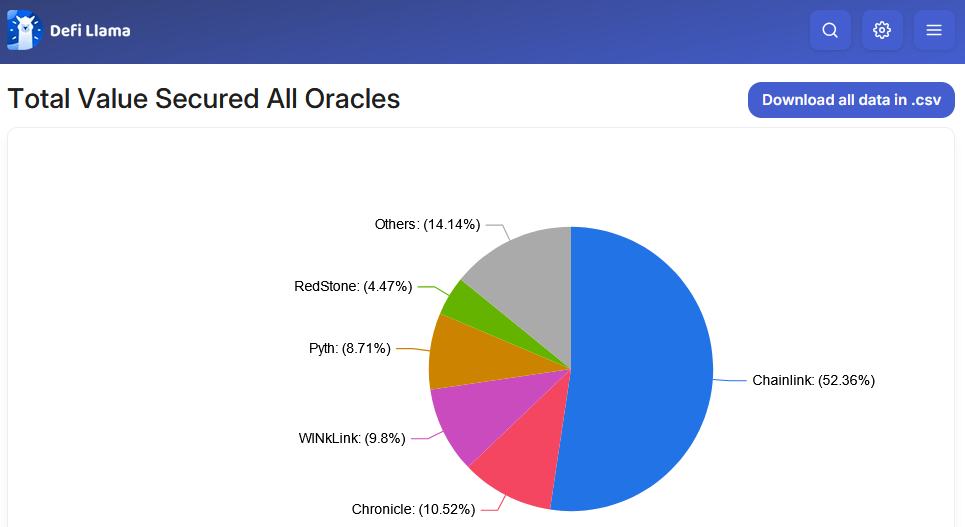

The traditional way to compare the market share of oracle vendors is to use “total value secured” The TVS metric is a way to sum up the TVL that an oracle has secured. This is exactly how DefiLlama works:

TVS has the disadvantage of obscuring what is being done by oracles.

Oracles, for example, that are used to power products with high frequency trading like perpetuals exchanges must be constantly updated. “pulling” A feed off the chain can provide price updates with sub-second latencies.

The contrast between this and a “push-based” Oracle for a protocol of lending that only updates the prices a few time daily on-chain because it is not necessary to update them as often.

TVS only looks at the value of an oracle, and ignores its performance intensity.

In other words, it’s like saying a $50 gourmet steak is the same as a $50 salad. It is worth considering that preparing a gourmet steak requires more effort than making a simple, inexpensive salad.

Another alternative measure, the Total Transaction Value (TTV), is the monthly transactional volume using oracle prices.

TTV excludes applications with low transaction frequencies like lending, CDP or restaking. However, as Ryan Connor explains “2-9% of oracle price updates come from low frequency protocols, which is a very small number in the context of crypto, where volubility of fundamental measures is very high.”

If oracles were assessed on the basis of TTV, market shares would change dramatically.

Blockworks Research published a study on the best way to reflect oracle’s fundamentals using TTV.

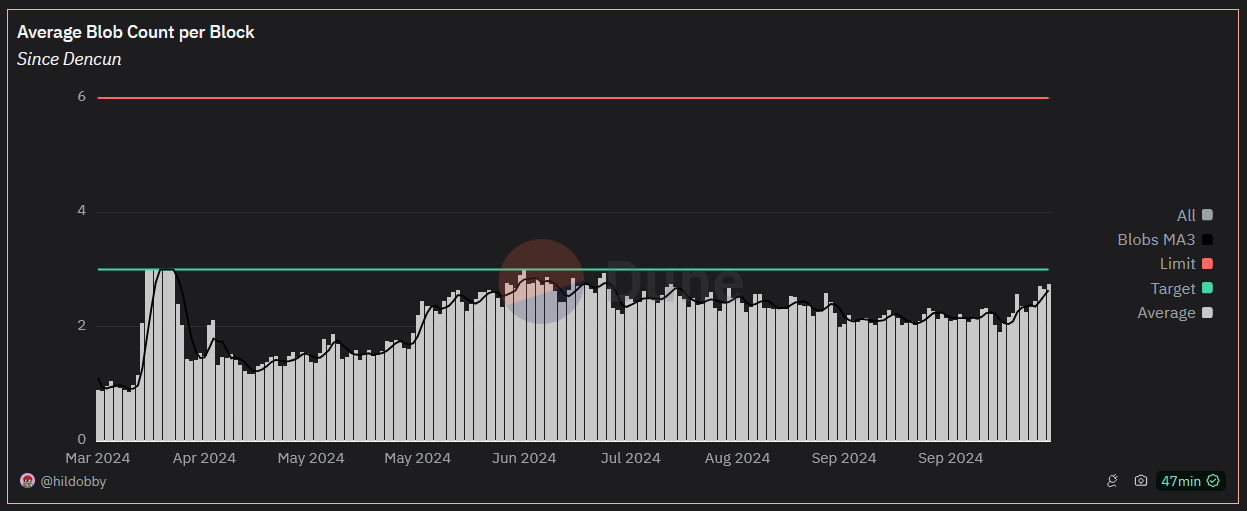

Chart of the Day

The limit of the Ethereum Blob Data is nearing.

In March, the Ethereum Dencun Hard fork (EIP-4844) was introduced. “blobspace,” A way to send L2 data to L1 at a lower cost. Blobs operate under a different fee structure than Ethereum blockspace. This makes them 10 times cheaper and a vital part of the rollups-focused roadmap. Blobs can only be six blobs in a L1 block. Vitalik called recently for an increase of 33%.

Ethereum L2s are once again approaching their three-block goal (see the green line). After that, blobspace use will depend on market forces like demand and availability. The base fee for the following block can increase by as much as 12.5% when four or more blocks are filled with blobs.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.