FOMC met yesterday and there wasn’t much to report.

Since many months, the SOFR has been predicting that Fed will stop cutting rates at this meeting.

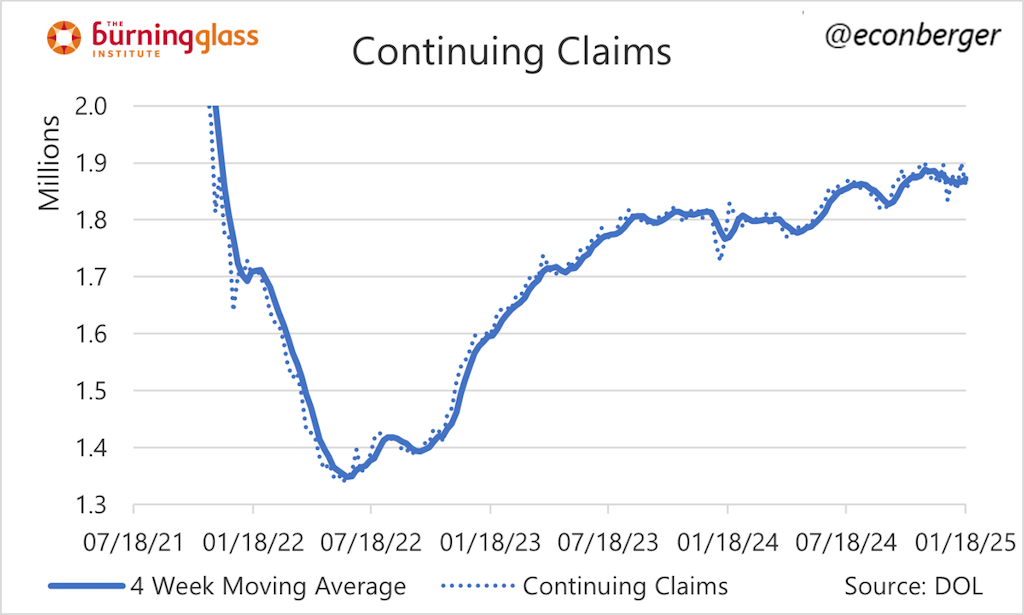

The statement is released first, before Fed observers comb it through to see what changes were made.

It’s interesting to note that they have changed their language in regards to inflation.

At first, risk assets fell on interpretations of a Fed more hawkish. Powell said in a press conference shortly after that it was merely a cleaning-up of language, and not indicating if the Fed had changed its policy. This then sent risk assets in the opposite direction — higher. This is a real whipsaw.

It is important to understand which of the two sides the Fed prioritizes at any particular time. Let’s look at how the economy is doing with no meeting in March.

Work market

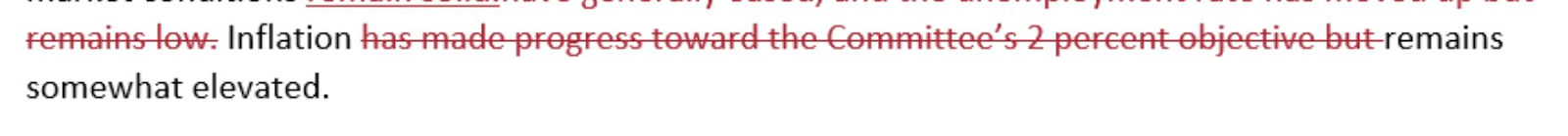

We received today the latest weekly data on initial claims for unemployment benefits. These are some of the most recent and frequent labor market statistics that we have. Noteworthy, claims fell by a significant amount:

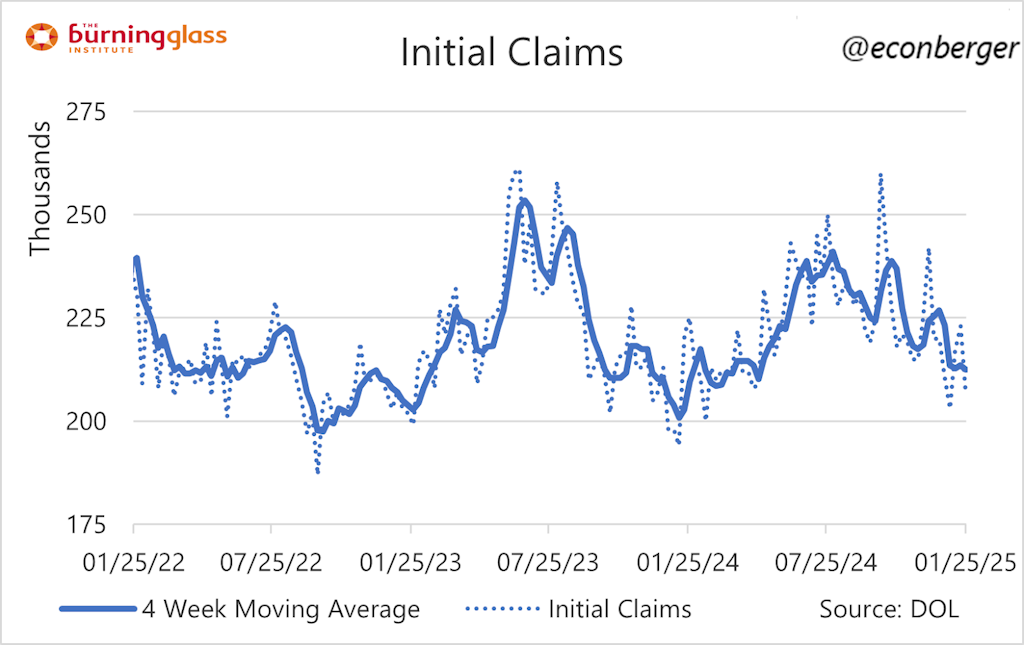

We also saw that the number of claims for continuing benefits continued to decline:

The Fed is not concerned by these statistics, which show that there’s no reason to worry.

There are many ways to grow.

Central banking’s golden goose is to achieve solid economic growth, without inflation as its main driver. It’s like magic when it happens.

We received today preliminary data on GDP growth that sheds light on a solid economy.

Even though the actual print was 2.3% below the expected 2.6%, there are still solid drivers.

The primary growth driver, 4.2% was consumption. As long as the consumer remains strong, the outlook for growth is not too worrying.

Notably, however, fixed investment saw its first contraction since 2023 — of -0.6%. The Fed will have to consider how this growth dispersion between investment and consumption is interpreted. However, overall, nothing is alarming.

Comparing all of this with the dual mandates of the Fed, it is clear that there are no significant concerns about deterioration in our labor market. The consumer is strong. And spending doesn’t indicate any major concerns about a slowdown.

All of this sets up the Fed to be justified in its decision to stop cutting rates for the time being, as they assess the impact their 100 basis point rate cuts have had on the economy so far.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.