THORChain, a DeFi L1 OG chain founded in 2018, rose to prominence with its unique cross-chain Swaps (THORSwap). The chain now offers lending accounts and interest-bearing savings.

THORChain officially halted its withdrawals of Lending and Savers earlier today. Both THORSwap, and the chain that underlies it, are in good shape.

The halted withdrawals come off the back of the painful decision by THORChain co-founder JP Thor two weeks ago to pause deposits into the Savers and Lending program for a six-to-twelve month period — a decision which was overturned by Thorchain validators.

It has about 200 million BTC or ETH liabilities it can’t pay, at least without further devaluing its RUNE token.

Why is RUNE in the picture?

The THORChain money market is different from other DeFi markets such as Aave. On THORChain collateral is sold immediately for RUNE, the token native to lent collateral. The token then is burned and swapped into a debt asset of a borrower’s choice.

The RUNE will be re-minted when borrowers pay back their loans. This is to buy the collateral pledged by the borrower from the market, and return it to the borrower.

It is a way to make RUNE token holders the counterparties for every loan.

It’s a nice mechanism if RUNE is your favorite. The design of the mechanism puts RUNE as the centre of the value-accrual flywheel, increasing its demand.

This is a risky situation because it depends on the RUNE performing better than assets such as BTC or ETH against which you are borrowing. THORChain is, in essence, long RUNE compared to BTC and Ethereum.

If RUNE is depreciated in relation to BTC or ETH at the end of the loan, then more RUNE will need to be created than what was originally burned.

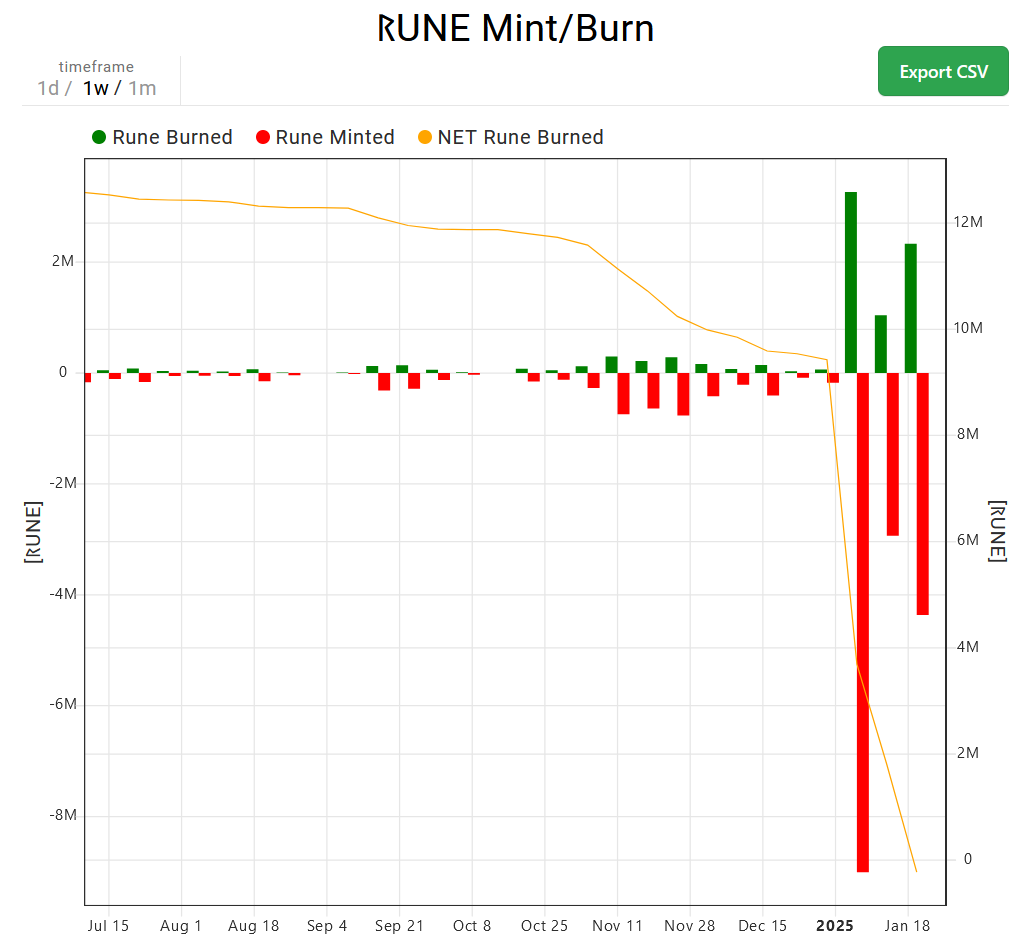

We are now experiencing the opposite of what we intended: deflationary, and not inflationary, pressure on the RUNE.

RUNE’s tokenomics are also closely linked to its Savers yield-producing product.

THORChain’s Savers utilizes a synthetic wrapper (called Synths) that exposes only one side of the asset. It works roughly like this:

- The user will deposit one BTC.

- THORChain exchanges BTC half for RUNE and adds BTC/RUNE to a pool of liquidity.

- Synthetic BTC is received by the user, and can then be staked (for yield) to receive swap fee rewards or liquidity rewards without any risk.

- When the user decides to withdraw the purchased RUNE, THORChain converts it into BTC to be returned to him.

The similar “long RUNE, short BTC and ETH” Here’s a dynamic in play. This is a design that protects LPs against temporary losses but at the same time, it means LPs take a leveraged position in RUNE.

RUNE’s performance is a similar downward spiral for Savers that it was for the lending product.

Below is a chart that shows RUNE mints burning at a rate far higher than RUNEs.

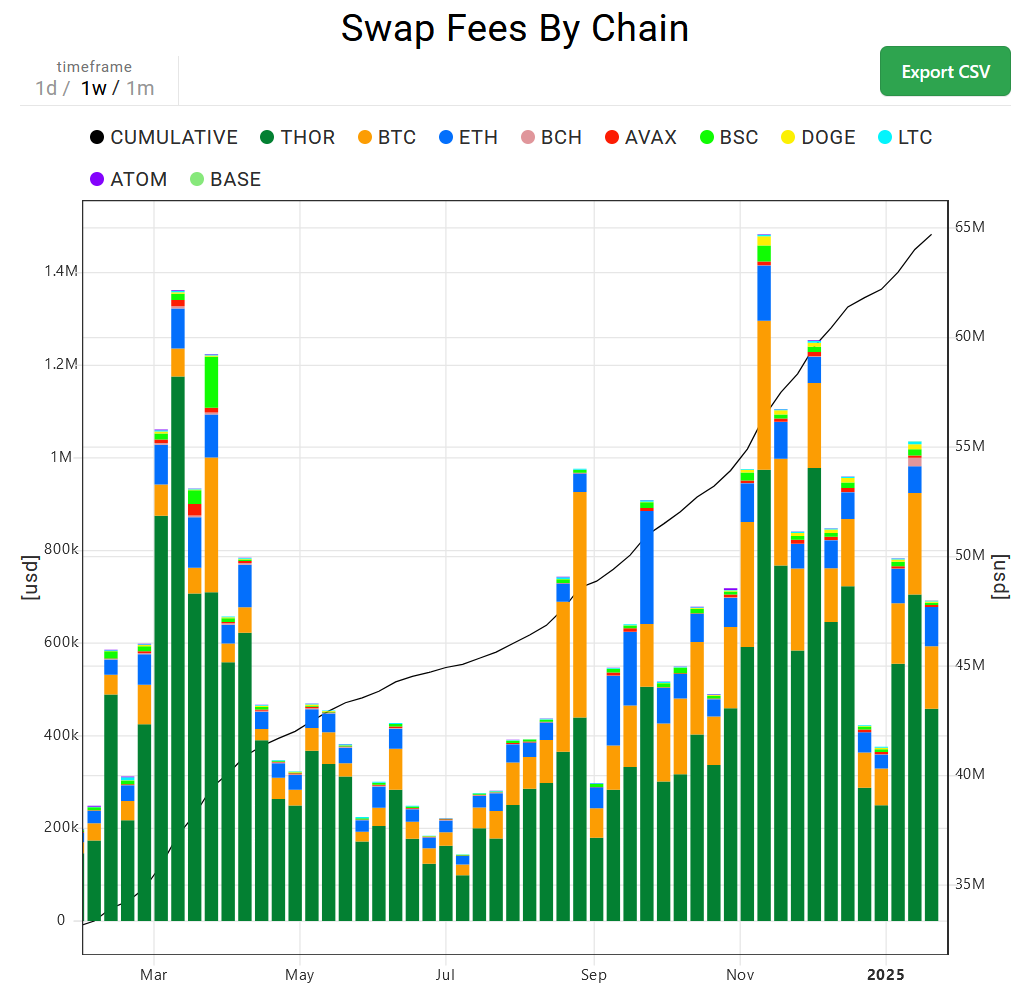

THORSwap is a good use of THORChain. It is still trading about $50-60 billion per week and has generated $700k of fees in the last 7 days.

It is not good that the token RUNE is down 44 percent on the past week. The asset is what needs to be sold in order to pay back borrowers who want to close loans or for savers to withdraw money. However, doing this would cause the price of RUNE to crash, leading to further insolvency.

Sunny Aggarwal, Osmosis’ co-founder, spoke out about the THORChain saga: “The situation unfolding with THORChain is eerily similar to what happened with Terra/Luna implosion in 2022, where the protocol’s solvency was too heavily dependent on the price performance of the native token.”

The next step? THORChain’s co-founder suggests using protocol revenue and incentives from its sister company Rujira (previously Kujira) to make lenders whole over a 2-3 month timeframe while everything is on pause mode.

“It’s uncertain whether lenders can be fully compensated. Some have suggested that the shortfall could be covered by protocol fees collected over time. But this overlooks an important point: the bulk of THORChain’s liquidity comes from its lending and savers platform, ThorFi. So it doesn’t make sense to consider THORChain and ThorFi as separate entities,” Aggarwal has told Blockworks.

Luke Leasure’s Blockworks Research report from the past week provides a more detailed look at what led to THORChain insolvency.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.