This is a bitcoin game

Here we go again.

This is a big story in the crypto world right now.

This was something I mentioned yesterday when I dissected Republican vice presidential candidate JDVance’s crypto position. This is a topic that deserves a more in-depth look.

The past few days, I spoke to many people, asking them where they stood, and what the election meant.

GSR’s co-CEO Rich Rosenblum said to me that he had predicted the election would be pro-crypto. “give crypto the stage” The Democrats may be forced to reconsider their stance on the sector. The Republican Party was pro-crypto, but he didn’t know it.

He also pointed out that the ticket was “also far more polarizing, given that Vance holds some far right views.”

This ticket is seen as a whole. “extremely bullish” Rosenblum, Jacob Martin of 2 Punks Capital and other VCs.

“With this much support so early, and the current administration continuing to be on their back feet, it ups the probability that the Republicans will sweep the Senate, and gain a bigger majority of the House. This would put them in a much better position to push forward pro crypto legislation and initiatives,” Rosenblum noted. “Vance is a staunch crypto advocate. He not only owns $250,000 of BTC, but volunteered it to the public, and was the first to subscribe to Trump’s pro crypto approach.”

As a matter of fact, there are some “Trump Effect” Pedro Lapenta is Hashdex’s Head of Research. He told me that crypto prices are currently at a high.

The effect of this is “highlighting the growing intersection of politics and digital assets. As the 2024 elections loom, investors and industry stakeholders continue to monitor these developments closely, anticipating further impacts to prices and the evolving crypto landscape,” “He said”

Politics has taken center stage in the cryptosphere. Mark Cuban explained yesterday that the Silicon Valley’s switch to supporting former President Donald Trump wasn’t a coincidence. “bitcoin play.”

Just a few short hours later Vitalik Buterin wrote a blog explaining that he didn’t think people should support candidates because they are pro-crypto.

“There is a growing push within the crypto space to become more politically active, and favor political parties and candidates almost entirely on whether or not they are willing to be lenient and friendly to ‘crypto,'” Buterin wrote.

Whew.

Rosenblum noted that some of the biggest venture capitalists, such as Marc Andreessen or Ben Horowitz who had already announced their intention to contribute to a Trump Super PAC and many other “tech bros” might not have turned to Trump for Bitcoin alone.

“I don’t think the richest leaders in tech are voting solely on what helps their BTC positions. But, it’s a reasonable claim from Cuban, given that a Trump/Vance ticket is sure to increase the probability of a BTC strategic reserve and other crypto initiatives. If they were to be voting for economic reasons, I think it’s more due to Trump’s support for innovation rather than just support for crypto,” “He said”

Trump, while seemingly pro-crypto now, is also pro-innovation — and that includes AI.

“Generally players in tech have much bigger investments in AI than they do in crypto, so I think it would be more accurate to say that these leaders in tech are voting for Trump as a pro-business play, as he is volunteering views that are supportive of their industry,” Rosenblum, continued.

Rosenblum’s conclusion is that, in the end, this “virtuous cycle of crypto boosting politics and politics boosting crypto is going to activate a flywheel of historic proportions.” Even a. “crypto supercycle.”

“BTC and ETH are much easier to access now that they will both have ETFs, and this access will bring in new capital, and new awareness of the space. Long-time holders roll their positions into newer projects, which will fuel further innovation and adoption for the industry,” He also added.

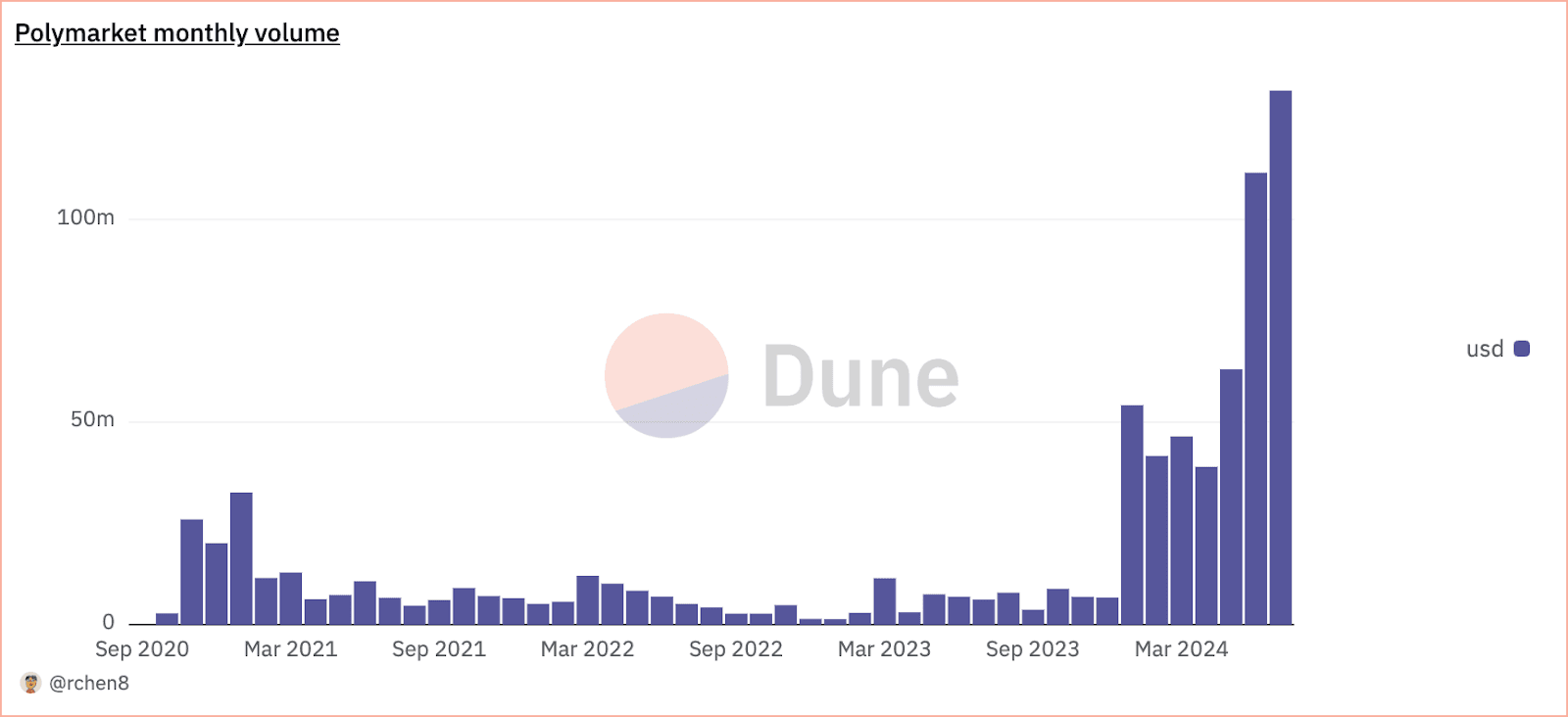

Look at the chart of Polymarket volume. The month of July is already ahead of June and it’s only half way through.

There are still a few more months until the next election. But be ready for the narrative to continue to dominate the conversation as industry leaders look to map a course forward.

There’s no doubt that this fall will be very exciting.

Data Center

- Polymarket has already reached a monthly volume of an all-time high There are still two weeks until the end of this quarter, which will bring in $131.85 Million.

- The total volume of the entire year is: $487.7 million.

- Polymarket improves the odds. Trump’s victory at 66%Kamala Biden is at 11% and Joe Harris is at 17%. Currently, $273.5 millions are on the table.

- WLD, WIF The following are some examples of how to get started: CORE The top 100 weekly gainers have between 50 and 32 percent.

- BTC The following are some examples of how to get started: ETH The daily average is hovering between $65,000 and $3.500.

Cryptocommander-in-Chief

The influencer Donald Trump has on the US presidential race is no longer a secret.

According to recent remarks, Trump may even be expanding his NFT collection, as he is already on his way towards his fourth.

What’s the point? Although floor prices are lagging, the first three have raised over a million dollars in primary sales.

Those funds are apparently separate from the $3 million in crypto raised for his campaign last quarter from around 100 donors — just shy of 1% of the total contributions for the period, per WSJ.

NFTs can be directly contacted by Trump. One collection includes a card with a real piece of Trump’s infamous hair. “Mug Shot Suit”). There are also unofficial Trump memecoins that may be more popular than official NFTs.

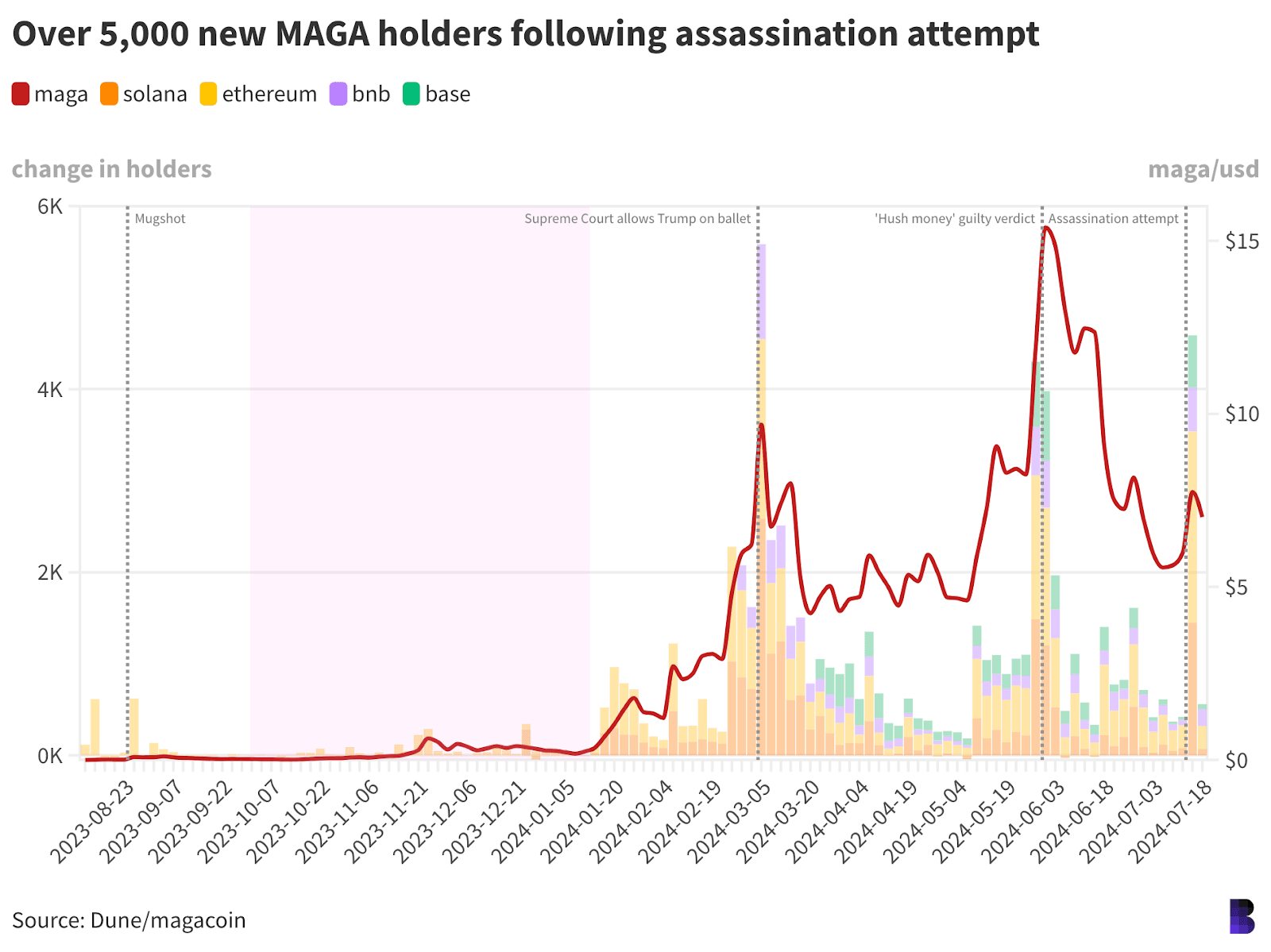

MAGA, the largest token launched in mid-2017 is now found in nearly 71,400 wallets. The token, which has a market cap of $319 million, is now found in nearly 71,400 wallets split between Solana, Ethereum, BSC and Base — almost double the amount recorded in April.

The purple shaded areas on the below chart cover Trump’s criminal fraud trial which concluded in January.

Positive or negative, major events on Trump’s timeline in the last year coincided with a wave of MAGA owners. Directly after Trump’s notorious August mugshot, wallets with MAGA increased by more than 620.

MAGA began to appear at more than 5,500 addresses when the Supreme Court, in March 2018, ruled that Trump’s name could be added on the California election ballot. It’s by far the most recent surge.

Similar spikes in new holders were seen when Trump was found guilty of paying $130,000 in ‘hush money’ to Stormy Daniels, and following the assassination attempt this past weekend.

The price of MAGA seems to have a correlation with the Trump narrative plots (as long as the news is positive, it is likely that the MAGA will be priced higher, if only in the short run).

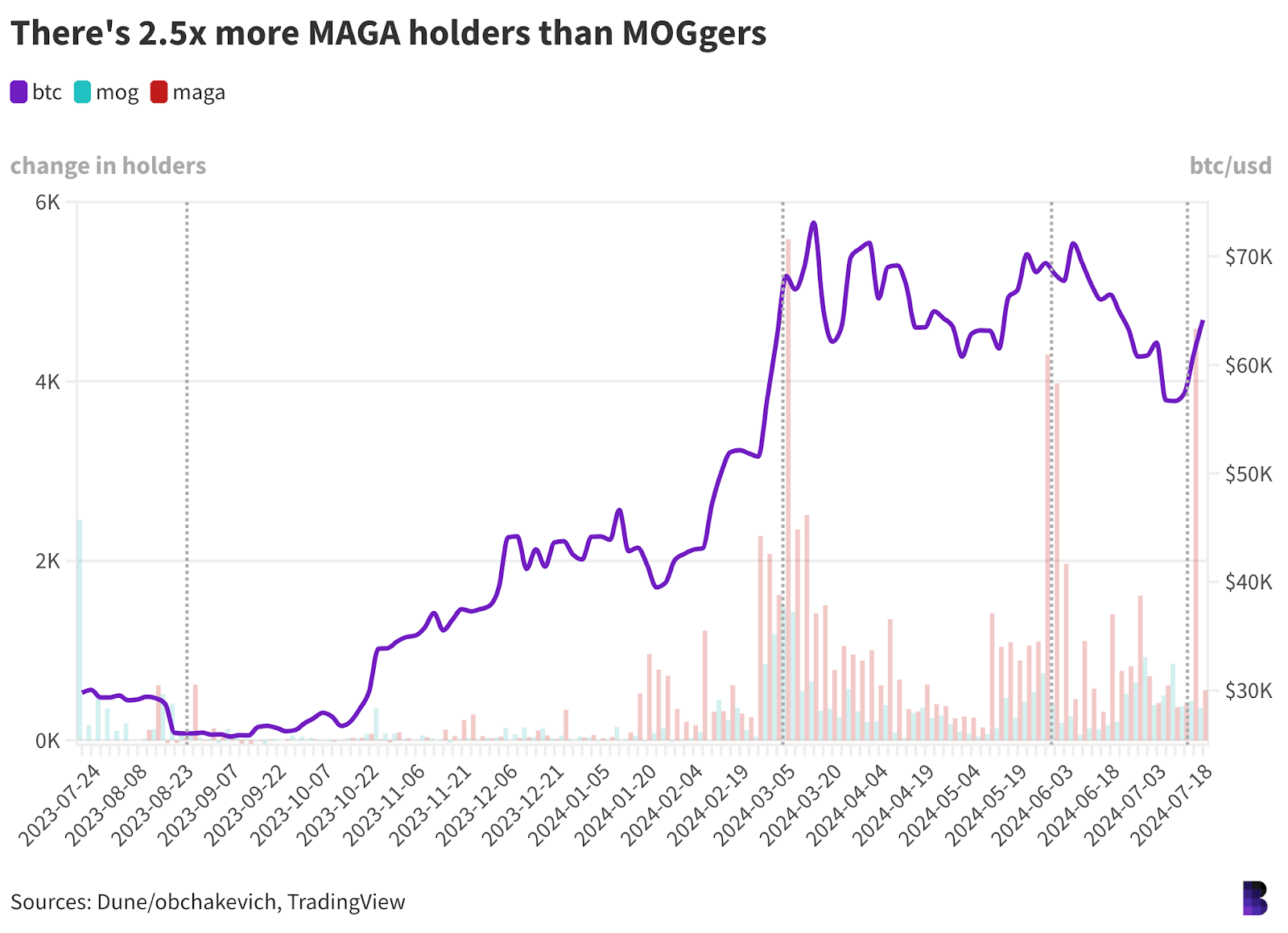

But the price of bitcoin also seems to align with Trump stuff — bitcoin’s price hit all-time high around the time that Trump was let on the California ballot, and rallied again around the end of his hush money trial, and also bounced following the botched assassination. The technical analysis suggests that this is mostly a coincidence. The same can be said for the increase in MAGA supporters, although the correlation is obvious.

As bitcoin reached its highest record in March, MOG also gained new owners.

While not to the same extent as MAGA’s, it was also a rise in the number of MOG owners when Bitcoin sought a test at the end of May.

What’s going on? Are the big traders trading technical indicators in control, or is Trump carrying over for former crypto-influencers such as John McAfee or Elon Musk from past cycles?

Both. Whichever answer you choose, I’m sure we will have a lot more fun in the run-up to November’s elections. We’ll go with it.

The Works

- BlockFi Coinbase has begun its first crypto distributions.

- Ethereum Developer Virgil Griffith His sentence was reduced to seven months in 2021 after he pleaded guilty for North Korean sanctions violation.

- State Street Bloomberg said that the company is working on creating a new stablecoin.

- The fees charged by the Ether ETF Issuers were announced on Wednesday. BlackRock The upcoming approval could be as high as 0.25%.

- Former President Donald Trump Bloomberg Businessweek quoted him as saying that the US should concentrate on cryptocurrency so other countries like China don’t dominate this space.

The Riff

Full version of Gandhi’s quote:

“First they ignore you. Then they ridicule you. And then they attack you and want to burn you. And then they build monuments to you.”

Jamie Dimon’s transition between third and fourth phases is currently taking place.

Bitcoin was ignored by the President in 2014. “It’s a terrible store of value. It could be replicated over and over,” “He said”

He ridiculed the idea in 2017, calling it an “fraud” The following are some examples of how to get started: “worse than Tulip bulbs.”

Dimon stated that the next year he wanted Bitcoin to be burned. “I really don’t give a shit.”

Dimon will build the next monument to Bitcoin, perhaps in the form a JPMorgan ETF for bitcoin?

Retrospectively, this will be seen as inevitable.

You’re all allowed to make mistakes.

Dimon may not be wrong, but his anti-crypto attitude is a misunderstanding of the crypto world.

JPMorgan’s CEO has every right, after surviving the 2008 economic crisis to maintain his CEO role, to criticize the financial industry. When I worked on Wall Street I too was skeptical at times.

Here, education is the key. Dimon may not support certain parts of the crypto world (we’re unlikely to see him endorse celebrity memecoins for instance), but it is reasonable to think he might change his mind.

Larry Fink of BlackRock is an example. He called Bitcoin in 2017. “an index of money laundering” He called it earlier in the week “a legitimate financial instrument.”

Fink’s change of heart isn’t just about the money. He has shown that he is now a crypto enthusiast.

Dimon, whose firm is heavily invested in blockchain technology may be just a few months away from donning laser eyewear. However, as I said previously, I don’t bet.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.