It would have been unthinkable a few short years ago that the (former president) of the United States could support a DeFi initiative. But it is happening.

World Liberty Financial, a project backed by Donald Trump and the Aave Governance Forums, submitted a Wednesday proposal for a deployment of Aave v3.

WLF, according to Stani Kulchov of Aave on the Chopping Block Podcast, is technically not a fork.

WLF is a separate application on its backend. “Aave” The main Aave Protocol. WLF users will then be serviced by its separate KYC front-end where they are presumably charged a fee.

This is very true. “DeFi” World Liberty Financial, in the sense that it is operating on the public smart contract blockchain with the highest compatibility and leverages DeFi core primitives.

It’s not exactly what you think. “DeFi,” Given its KYC strict measures for global users, as well as the fact that it is only available to accredited US investors at this time.

WLF will offer Aave 20% off its protocol fee and 7% on its WLFI token governance supply in exchange for Aave using Aave.

A portion of the allotted WLFI tokens is specifically for Aave’s liquidity mining rewards, contrary to previous statements from World Liberty plans leaked in the past that claimed the token was non-transferable.

WLF is launching a new platform for the lending and borrowing of USDC (USDT), ETH (ETH), and WBTC (WBTC).

Marc Zeller (founder of Aave-chan Initiative, ACI), has verbally approved the proposal. “welcomes the alignment between the WLF and the Aave ecosystem.” Some DAOs are however questioning Aave’s strategy to saddle her with Trump’s politics.

Although the Trumps’ names are associated with the project, there’s little reason to think that this is anything more than an association of brand names.

WLF is clearly a crypto company. WLF’s governance plan, its choice of Aave as a native token and strategy for incentivizing its liquidity providers is all signs of an experienced team.

Who knows how it will end — stay tuned, as they say.

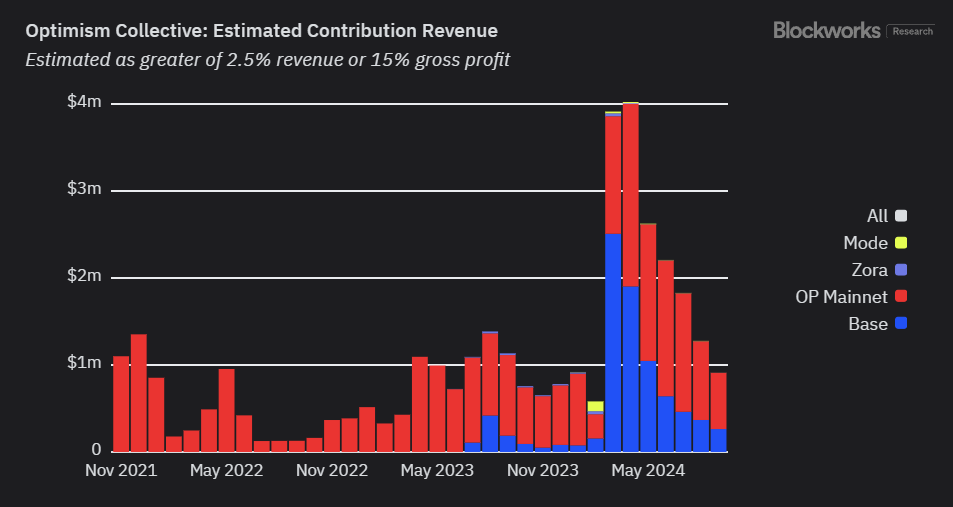

Chart of the Day

Optimism Collective generates monthly revenues of $911,000,000:

Uniswap announced its own Unichain L2 yesterday as part of the Optimism Collective/Superchain. One revenue-sharing criteria of being an L2 chain within the Optimism Collective is to share 2.5% of your total sequencing revenues, or 15% of your gas fee profits (after deducting data availability costs) — whichever is higher.

Optimism Collective raked $911 Million in Revenues in the Month of September. Base and Optimism are the largest contributors to revenue, each contributing $646 million.

The Blast L2 has been left off the chart. Although L2s can be constructed with Optimism’s OP Stack development kit, this does not mean they are committed to the Optimism Collective.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.