Ethereum is a fan of rollups. Recent times have seen a rise in the popularity of Ethereum rollups. “based” The rollup is in style.

What makes base rollups so special? The sequencer.

Based rollups, however, defer these execution duties to Ethereum’s layer-1 validators. The term for this is “based sequencing.”

Interoperability, and resistance to censorship are the two most important reasons why this approach is better.

The layer-1 can be used as a sequencing tool to ensure the same level of liveness as Ethereum’s layer-1 blocks. This avoids any potential for censorship that could arise from centralized trusted sequencers.

Second, based rollups offer better interoperability. Justin Drake and other proponents of based rollups have touted the benefits in recent months. “synchronous composability,” Where transactions are simultaneously sequenced or bridged across multiple layers-2 in Ethereum.

Simply put, smart contracts on based rollups will be able to call any other contract on the layer-1 in near-instant finality within the same block — as if they were all on the same chain.

The composability of this material is a good example. “money legos” This isn’t a brand-new concept. In fact, it has always been one of Ethereum’s core values.

Due to the fragmented nature of rollups, an Arbitrum is not synchronized with an Optimism. This creates uncertainty in fees. Gas fees can cause fee uncertainty because they are calculated at different times. This is in contrast to the 12-second time slot of an Ethereum block.

Ahmad Mazen Bitar explains that in addition to making Ethereum interoperable once again, the Ethereum ACD developers at Nethermind, and Ahmad Mazen Bitar as technical product leader, can also save significant amounts of money.

“A user may want to swap his token on the [layer-1] but wants to take advantage of a deep liquidity pool on a [layer-2]. With synchronous composability, they would be able to push a singular transaction from the [layer-1] to the [layer-2], execute it, then bring it back to the [layer-1].”

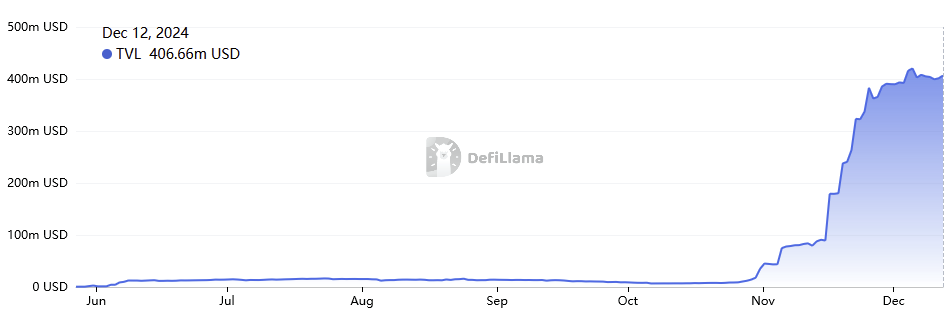

Taiko is the largest and oldest existing base rollup for live production. It has recently seen a surge in TVLs and daily transactions in this month.

Also, other early rollups, like Surge and UniFi from the Puffer Finance Team are in the early stages of production. Both forks are Taiko.

However, based rollups are not without their own disadvantages. Because execution (i.e. Sequencing duties are now being returned to layer-1 validators. This means that based rollsups have been constrained to the 12-second layer-1 block time.

The benefits that based rolls are supposed to provide, such as synchronous composition, might be harder to achieve than they seem. For a based rollup to be effective, it would have to prove in real time within one 12-second window.

Brecht Devos is the co-founder of Taiko and its chief technology officer. He remains optimistic that the tech will catch up.

Taiko enabled two zk-proofs for its rollup, by Risc Zero & Succinct Labs. This was done on Intel’s SGX TEE (trusted execution environment). It was the first rollup to use multi-proofs without having a single trusted party.

“Provers are improving quickly with more TEEs, faster and cheaper zkVMs and AVSs that can be used. We think the zk development is going very well and the sub-slot latency for proving is not far off,” Devos told Blockworks.

Another perceived disadvantage is the loss of MEV, as a main key. “revenue” Due to the absence of a central sequencer, stream is not possible. Devos explained that there are some clever workarounds.

On Taiko, “MEV can also be captured by auctioning “Orders of execution” to layer-1 block proposers,” Devos told Blockworks.

It is not necessary that based rollups give away layer-1 validity rights by default.

Matthew Edelen shares the same view. He is a co-founder at Spire Labs. Spire Labs provides rollup infrastructure. In a Bell Curve podcast, he explained: “Auctions don’t have to be the only way to distribute sequencing rights. You could distribute 99% of sequencing rights through an auction and give the last 1% to friends or solo stakers to look good on L2Beat.”

MEVs may end up not being a major issue in the future. The idea is based on a cost-benefit analysis. Today, blockchain revenue comes from congestion charges, which dwarfs the much smaller MEV revenue that has been declining over time because of better MEV solutions.

The smarter revenue model to use for rolling up is one which relies on the network effect of the congestion charges that come from the synchronized composability rather than MEVs.

Justin Drake explains in The Rollup podcast.

“Congestion fees against contention fees is roughly at an 80:20 ratio today. 80% of the income on the [layer-1] comes from congestion fees — about 3200 eth per day since EIP-1559. MEV is about 800 ETH daily since the Merge. My thesis is that this ratio is becoming more extreme, going from 80:20 to something like 99:1.”

As a conclusion, based rollsups have brought the Ethereum user experience back to its roots.

It’s ironic that blockchains have already enjoyed these advantages since the beginning. Since the Bitcoin network was founded, synchronized composability has been a standard for all blockchains.

In the last couple of years, this deviation in execution layer duty was only possible because of the rollup centric roadmap (or Multichain Paths for Polkadot Cosmos Avalanche). The based rollups will run the system back.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.