Uniswap Labs is launching its personal L2 chain, Unichain.

Unichain will probably be constructed on Optimism’s interconnected community of rollups, dubbed the Superchain.

Why Unichain? Uniswap Labs claims block instances will see an preliminary velocity of 1 second, after which they may fall to 200-250 millisecond block instances — an enormous enchancment over the 12-second block time on Ethereum mainnet.

As a part of the Optimism Superchain, customers on the brand new Unichain may even get pleasure from native cross-chain interoperability of property throughout the Superchain’s community of blockchains.

For L2s exterior of Optimism’s Superchain, Uniswap Labs plans to leverage ERC-7683, a cross-chain intent normal co-developed with Throughout Protocol, that can successfully allow customers’ buying and selling orders to be fulfilled by middleman relayers/solvers no matter what chain they’re on.

This probably obviates the necessity for Uniswap to “port” its huge pool of liquidity it enjoys on the Ethereum L1 to Unichain, and thereby summary away the hurdles of shifting its current consumer base to a unique chain.

Hayden Adams, CEO of Uniswap Labs, stated of the launch: “Unichain will deliver the speed and cost savings already enabled by L2s, but with better access to liquidity across chains and more decentralization.”

Unichain may even leverage new technical improvements, like a trusted execution setting (TEE) for block constructing, and a “community validation network.” Each options are developed with Flashbots.

Unichain’s validation community will probably be open to any node operators staking UNI, however solely a “limited number of validators with the highest UNI stake-weight will be considered the active set,” in keeping with the Unichain white paper. It means that the biggest UNI token holders, such because the Uniswap Basis and early buyers, will possible be the one preliminary validators on the community.

Ethereum’s largest DEX shifting to an L2 could be taken as an important or horrible piece of reports, relying on whether or not you approve of Ethereum’s roadmap.

For Ethereum-aligned customers who’re onboard with its rollup-centric roadmap, Unichain makes good sense. From Uniswap’s perspective, this can be a win-win for each the protocol and its customers: Uniswap retains its MEV, and customers get pleasure from cheaper fuel charges.

From Ethereum’s perspective, that was clearly at all times a part of the plan.

On the flip facet, this seems to speed up the continued complaints about Ethereum L2s being “parasitic” to the L1, and the dearth of worth accrual to ETH (the asset).

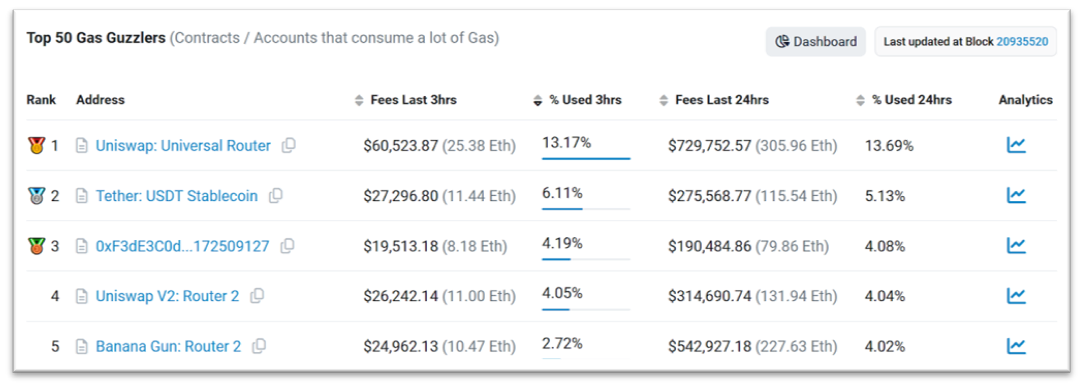

Uniswap is the biggest fuel guzzler on the Ethereum L1 immediately (see under), which implies that ETH spent as fuel charges on the L1 is contributing to a non-trivial portion of ETH burn and worth accrual to ETH, due to EIP-1559.

Moreover, MEV that’s accruing to the Ethereum L1 will now be “leaked” to the Unichain L2 within the type of sequencer revenues — additional lowering ETH’s worth accrual.

A reversal of fortune for Ethereum largely is dependent upon the “induced demand” its core builders consider would finally emerge from having a mess of cheaper L2 execution environments. The thought is that quicker blockchain speeds would considerably drive extra transactions on L2s, which in flip would improve settlement charges paid to the L1. To this point, that hasn’t occurred but.

The UNI token has rallied 11.9% within the final 24 hours, in keeping with CoinGecko.

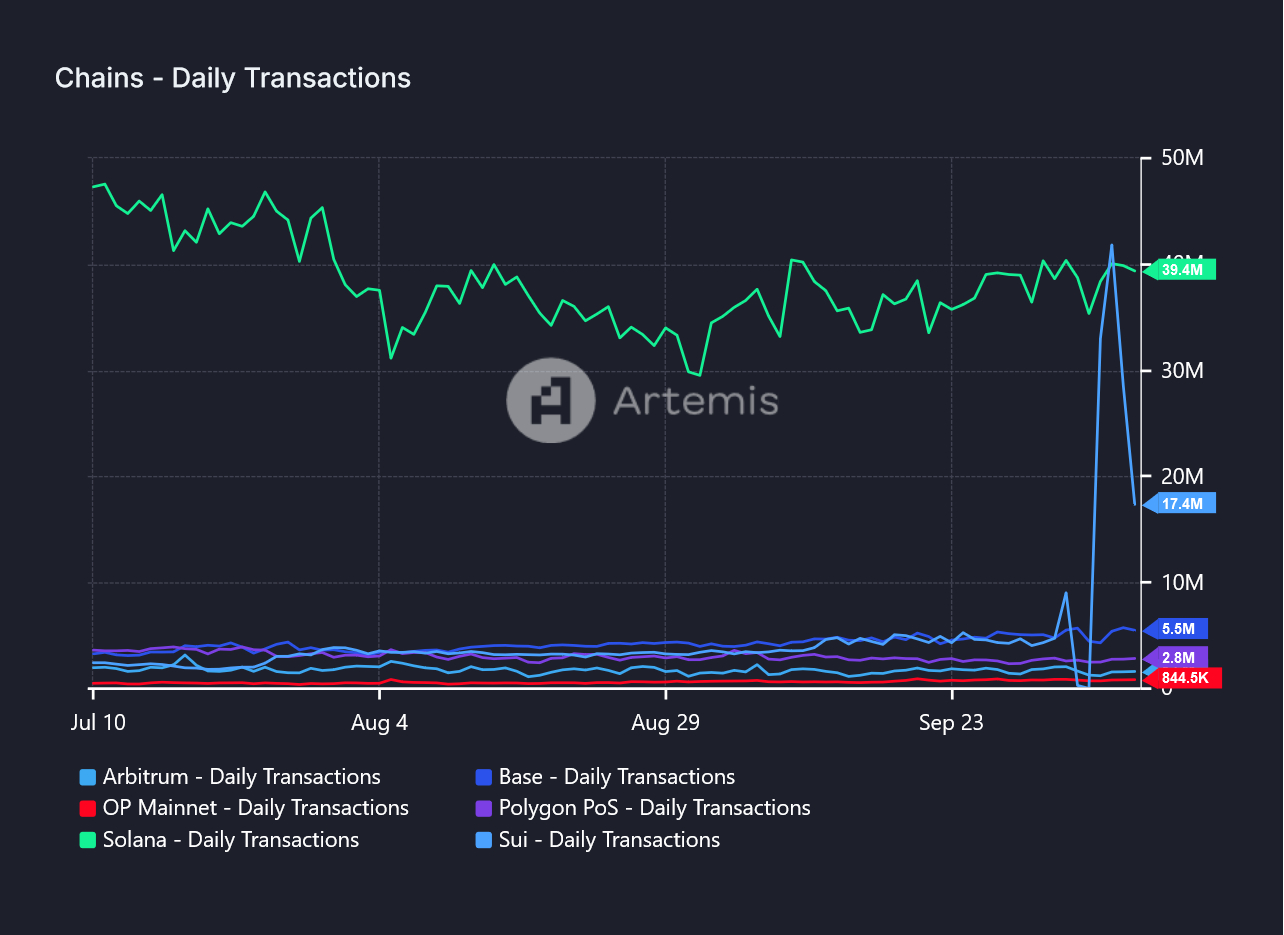

Chart of the Day

There’s a tsuinami coming:

The MoveVM-based L1 blockchain Sui briefly flipped Solana in day by day transactions earlier this week. Sui noticed 41.8 million transactions towards Solana’s 40.1 million on Monday, although it has since fallen again down. Simply as Solana as soon as posed itself as an “ETH killer,” Sui seems to do the identical to Solana.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.