The Fed cut interest rates yesterday by 25 bps and the markets went crazy. We even published a story about the Santa rally. Whoops. There are always mistakes.

What’s the story? What happened? What actually happened?

A number of factors combine to produce the tension which leads to the outcome of an FOMC. These expectations are a combination based upon the FOMC’s guidance for the future (the title of this email!) This combination of expectations is based on the FOMC’s forward guidance (the name of this newsletter!) and the position taken by market participants prior to the event. Break down the two.

Expectations

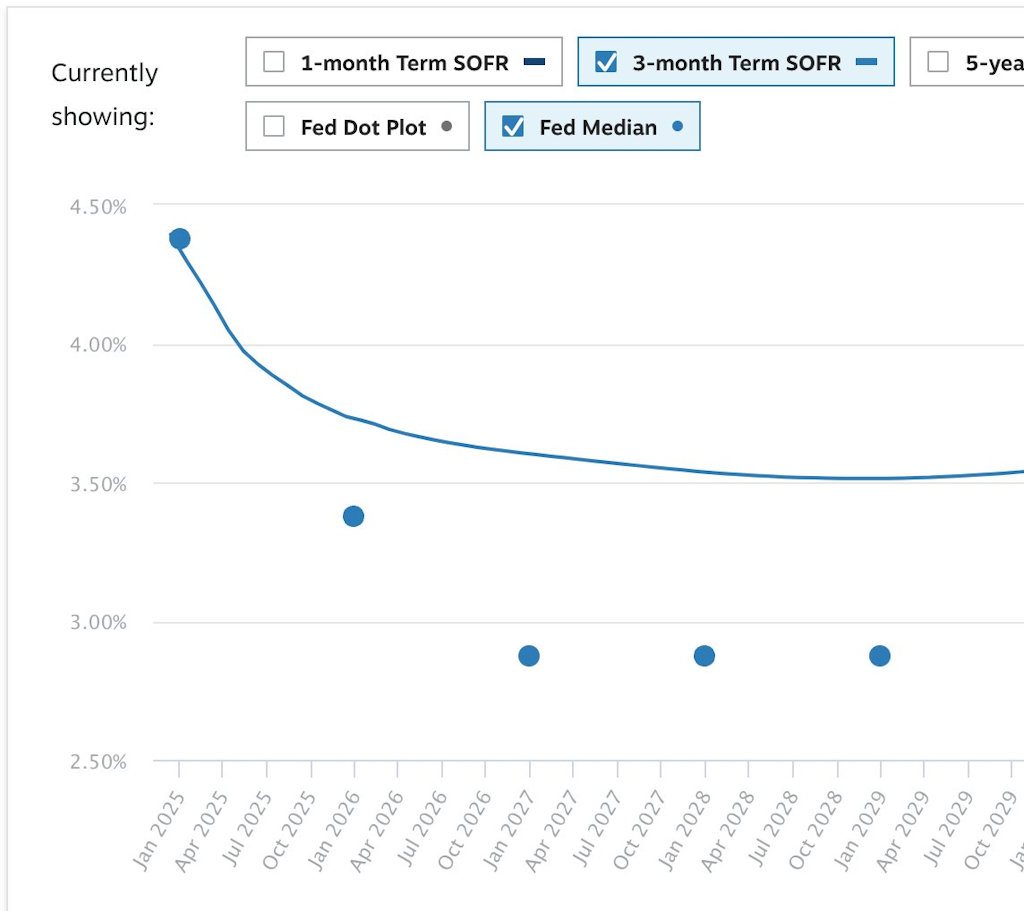

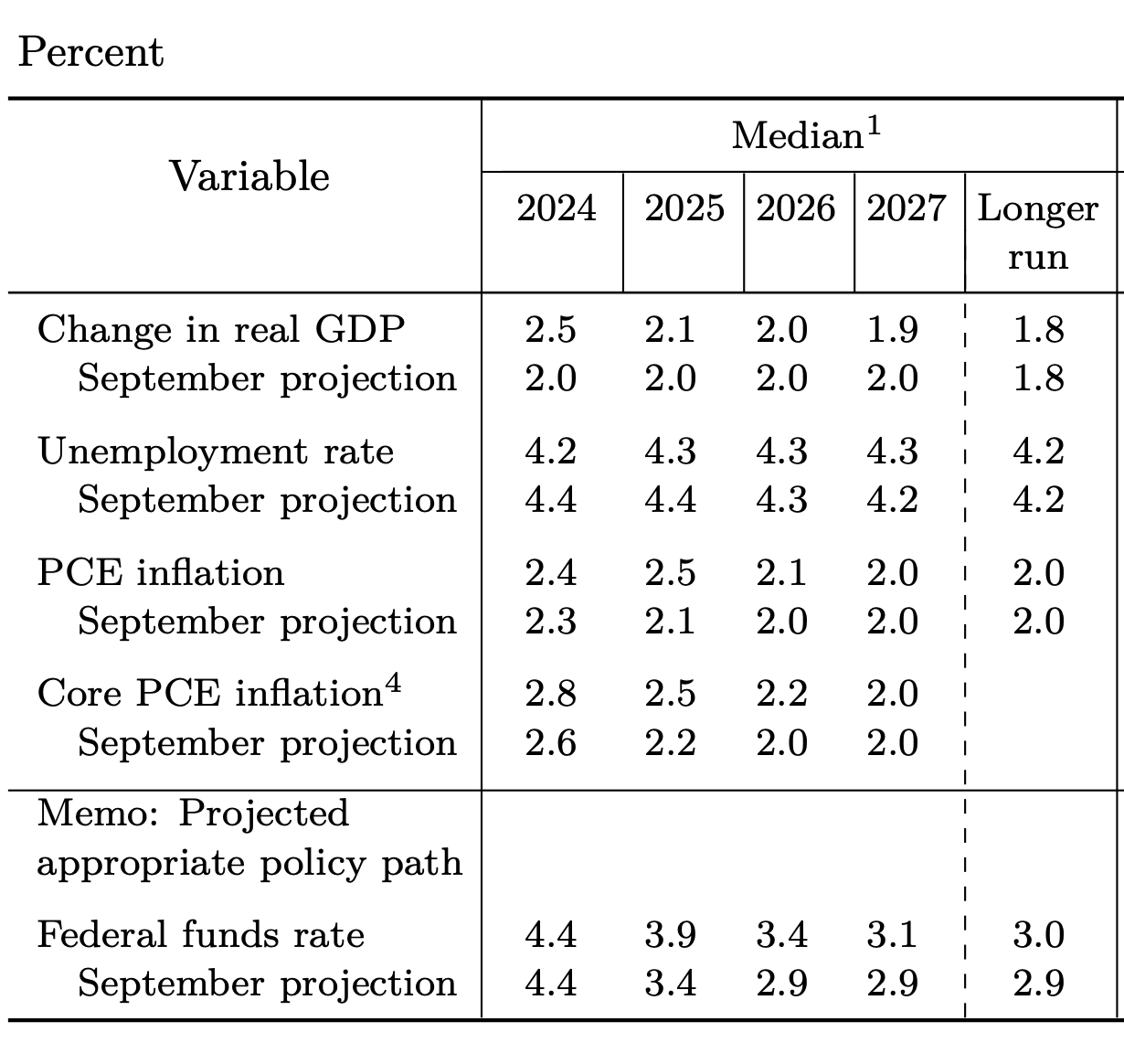

The SOFR curve went into the meeting having diverged significantly from the Fed’s September summary of its economic forecasts.

It was largely due to a significant shift in the strength of the economy and in the resilience of labor markets, which required less rate reductions than everyone had expected back in September.

Markets only anticipated three or so rate cuts in 2025. The hurdle to overcome to shock the market into a hawkish position was high.

Yesterday, I was surprised to see that the FOMC also cut rates. Was it a hawkish rate cut? This is a wonderful time to be alive.

FOMC has forecast only two rate cuts for 2025, compared to the hawkish market which expected three.

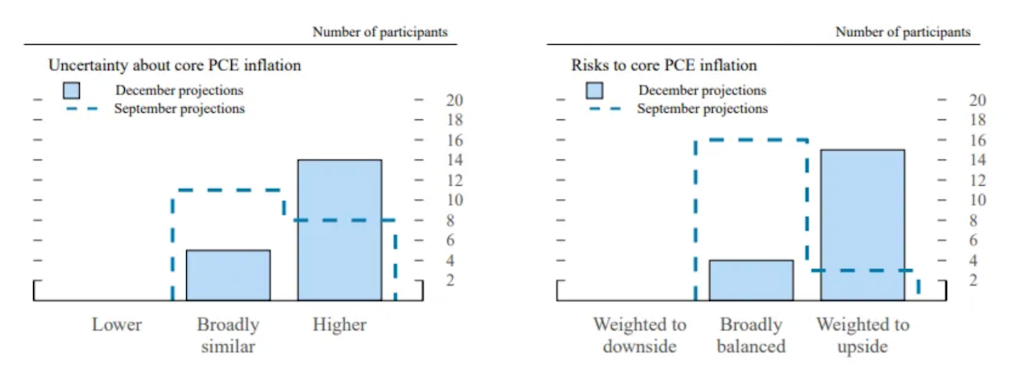

As can be seen in this chart, the decrease in cuts is largely due to increased uncertainty about the direction of inflation over the next year.

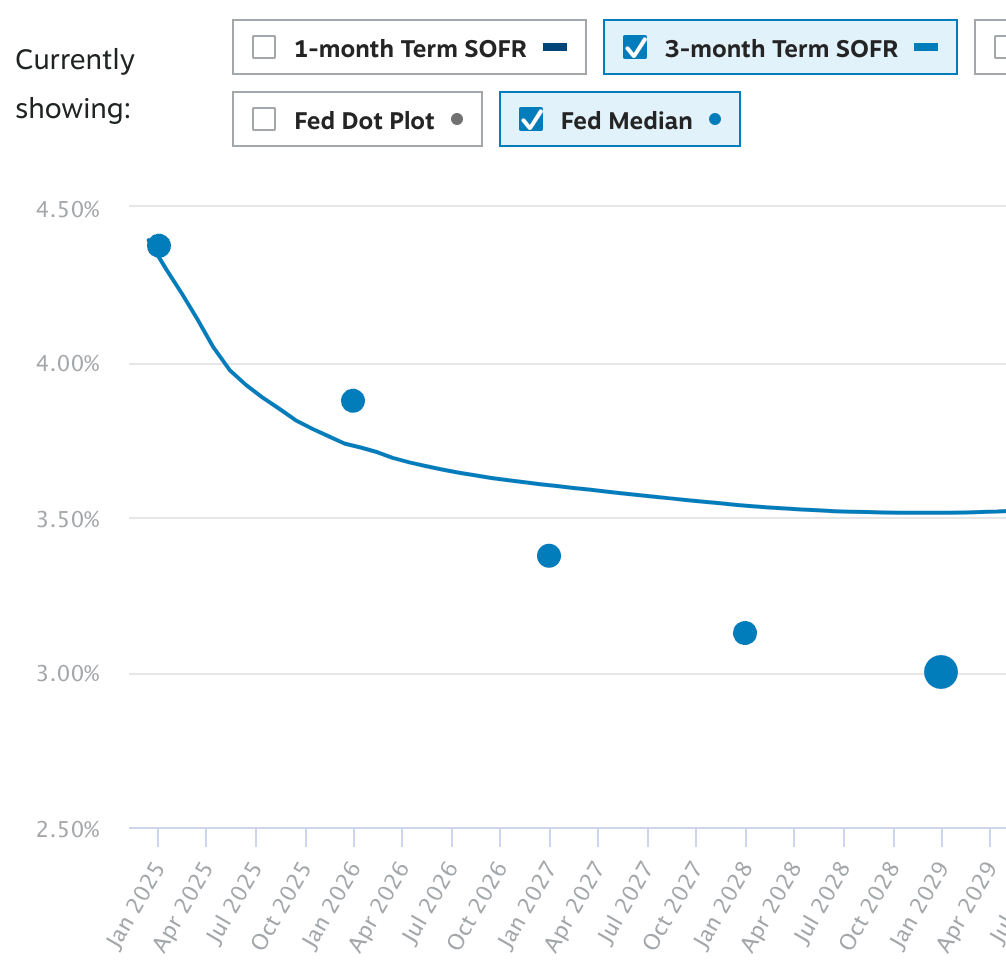

All of that information got distilled into this simple move — the second dot here moving above the market’s expectation in 2025:

What made the move yesterday so violent? Positioning is the second component.

Positioning

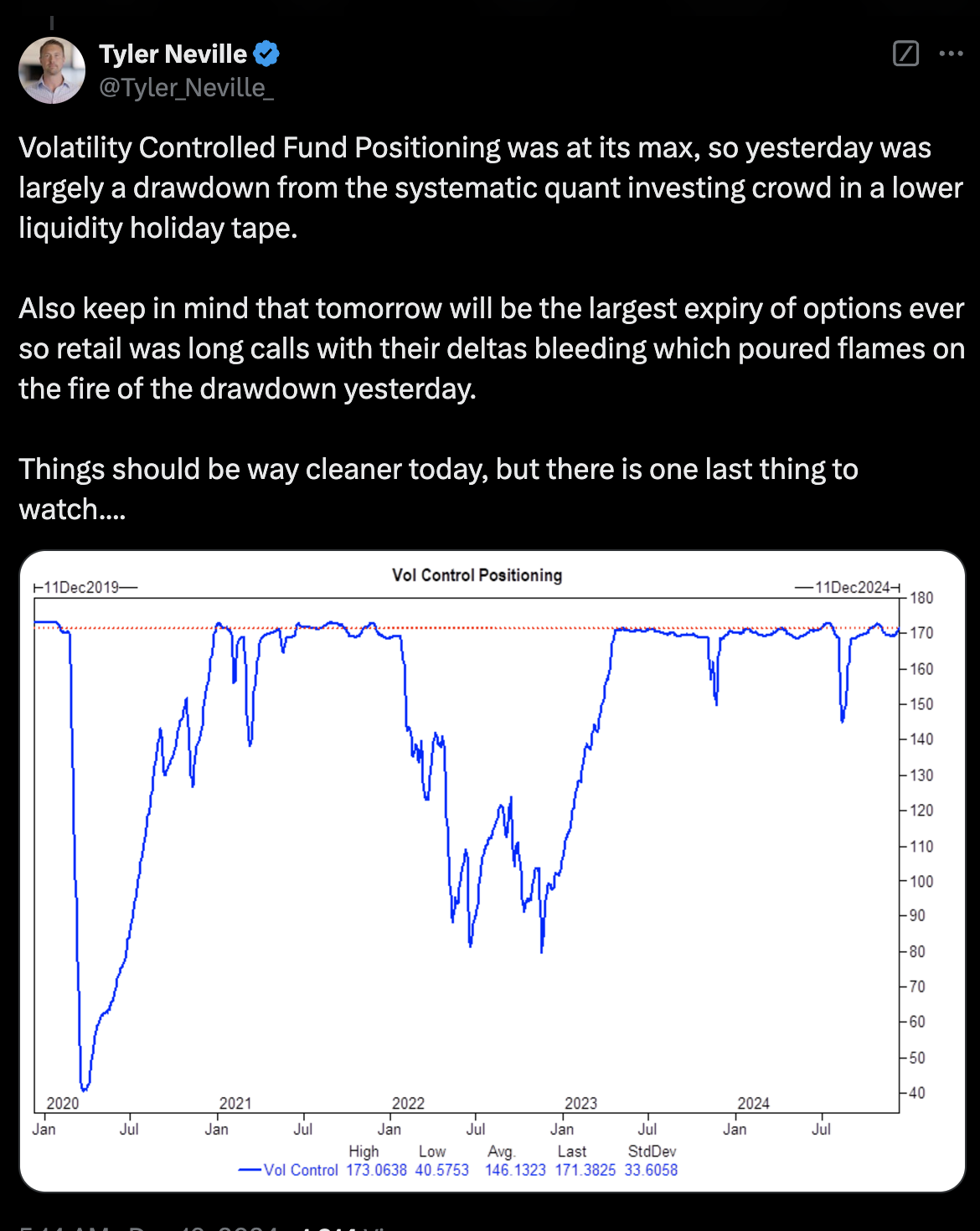

The perfect combination of dynamics in positioning led to the explosion that happened yesterday. Tyler Neville, co-host of this roundup, discusses how, because the VIX was so low in the event, there were a lot more people than usual.

There were also widespread expectations that seasonality dynamics would be prevalent in the markets. The Santa rally, which we mentioned yesterday, was supposed to lead us to our promised land. Everyone piled in to the same longs of high beta-risk assets, assuming that Powell would continue his dovishness.

This week, the biggest options expiry ever will take place. Due to the large amount of open interest in options, traders who need to protect their delta exposure are forced into chasing gamma as a reaction. This amplifies movements in the markets. It was this that led to the acceleration of yesterday.

There is no one single reason for the market’s movements on any given day. In fact, the result is more likely to be determined by a constellation of various factors. Some days, these moves are quite aggressive. Yesterday was one of those.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.