As traders and market members start to digest the impression of Donald Trump’s win and the purple Congressional sweep that got here with it, the main focus is now on making an attempt to unpack how Trump’s distinctive perspective on economics, international commerce coverage and the worldwide American safety complicated will play out.

Many issues had been mentioned throughout the marketing campaign. The tough a part of making an attempt to gauge which guarantees are each practical and possible now begins.

This week I sat down with Dr. Stephen Miran, fellow on the Manhattan Institute and senior strategist at Hudson Bay Capital. Miran was additionally on the US Treasury throughout the first Trump Administration.

His newest financial paper gives a toolkit of methods to unpack and perceive a world of elevated international tariffs and different protectionist financial insurance policies.

Titled “A User’s Guide to Restructuring the Global Trading System”, the paper is an interesting roadmap into understanding the final word query surrounding a heavyhanded tariff coverage: Will it’s inflationary or not?

Stephen started our interview discussing the “Triffin world” we dwell in. Merely put, a Triffin world is the consequence that comes with being the worldwide reserve forex.

The greenback’s standing has for many years resulted in an overvalued forex (when in comparison with rate of interest parity concept) and protracted and rising twin deficits (each a fiscal and a commerce deficit).

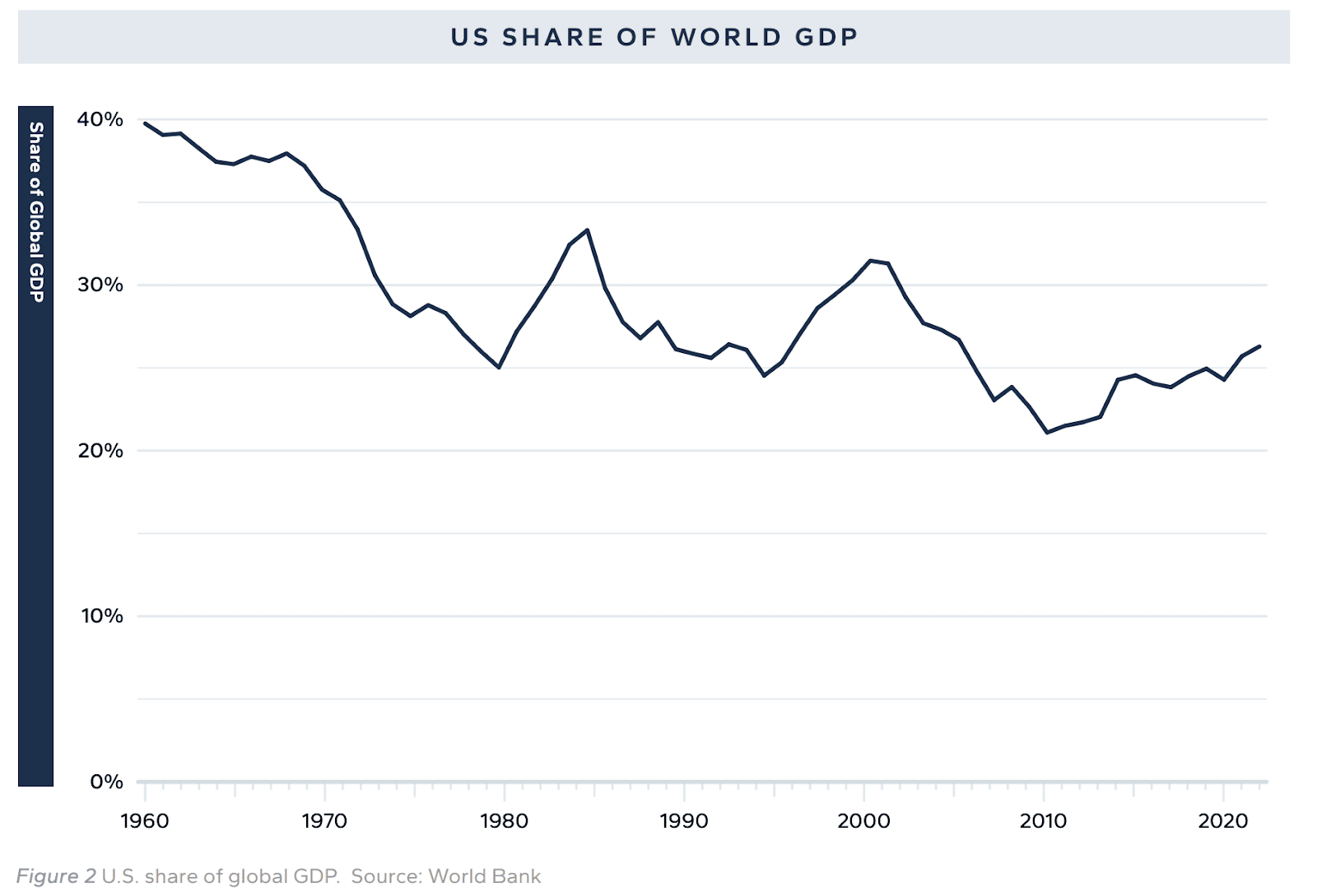

A Triffin world can rapidly grow to be a disaster for the reserve forex issuer – i.e a Triffin’s dilemma, when the overall share of world GDP secularly declines — prefer it has for the US lately:

Due to this, deficits widen and additional pressure the priorities of the reserve forex, creating an imbalance between home and worldwide priorities.

As proposed by Trump and analyzed by Dr. Miran, one strategy to “recalibrate” this pressure is thru both tariffs that rebalance these commerce imbalances or an outright forex devaluation that brings the US greenback again in step with rate of interest differentials.

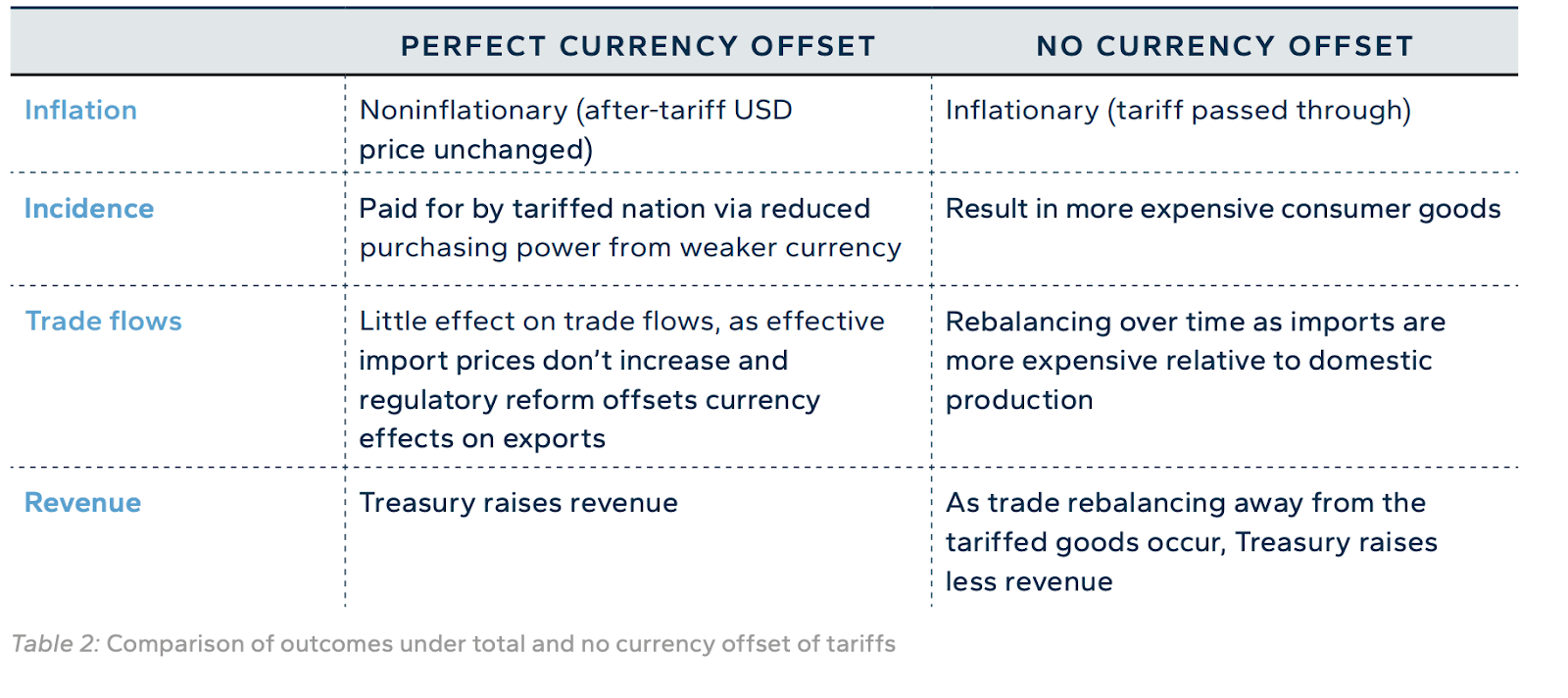

The massive query from here’s what might the impression of a tariff-heavy coverage on home inflation be? How a lot of the worth will increase will get handed onto customers?

As Dr. Miran analyzes within the paper, the important thing to this query lies in how a lot the forex offsets the rise in worth:

Additional, one of many key issues for these tariffs being carried out is the context of the enterprise cycle that we’re in, as this can, partially, decide the tariffs’ success.

The opposite aspect of the coin that the paper and interview talk about is outright multilateral and unilateral forex agreements and the way they may additionally assist recalibrate the USA from spiraling right into a Triffin dilemma.

As for understanding the specifics of what model of forex settlement would work finest, nicely you’re simply going to should hearken to the interview to seek out out.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.