The crypto markets are hinting at altcoin season. But we’re far from there.

Since the beginning of this month, the total crypto market capital has increased by almost 20%. It is now worth $2.35 trillion. This represents an increase of over $360 billion. Altcoins account for 40% of these gains. Bitcoin is responsible for the remainder.

But first, let’s define altcoin season.

According to a commonly cited index, an altcoin era begins when three quarters of the top fifty coins perform better than bitcoin in the last 90 days.

Only 34% of top 50 coins have beaten Bitcoin over this period. It was only for a brief time at the beginning of the year that these conditions were met, but they didn’t translate into a full-blown season for altcoins.

Empire subscribers (subscribe here to the daily email) will know that a new way of tracking altcoins seasons takes into account much more than just the 50 top coins. Even so, we are still a long way off.

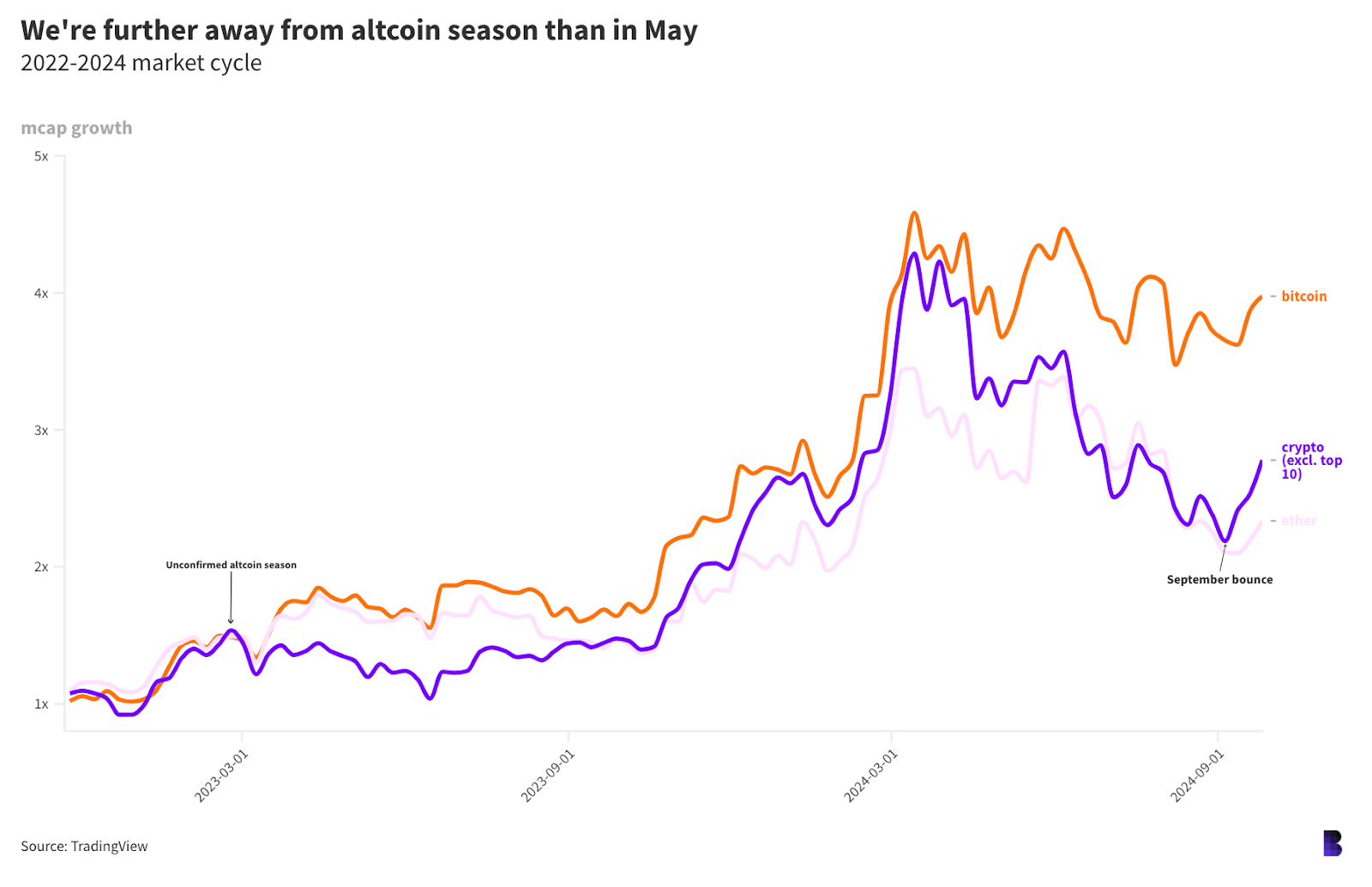

It goes like this: Altcoin season potentially starts when the market cap growth of the entire crypto market — minus the top 10 — eclipses that of bitcoin, starting from the cycle bottom.

A full-blown crypto season can only be confirmed if for at least 90 consecutive days, the larger crypto market has grown faster than bitcoin.

The model is not perfect, but it works well in backtesting. Also, it’s generous towards altcoins. In many cases, market cap growth merely reflects the rate at which tokens are unlocked and added to circulating supplies — not price appreciation.

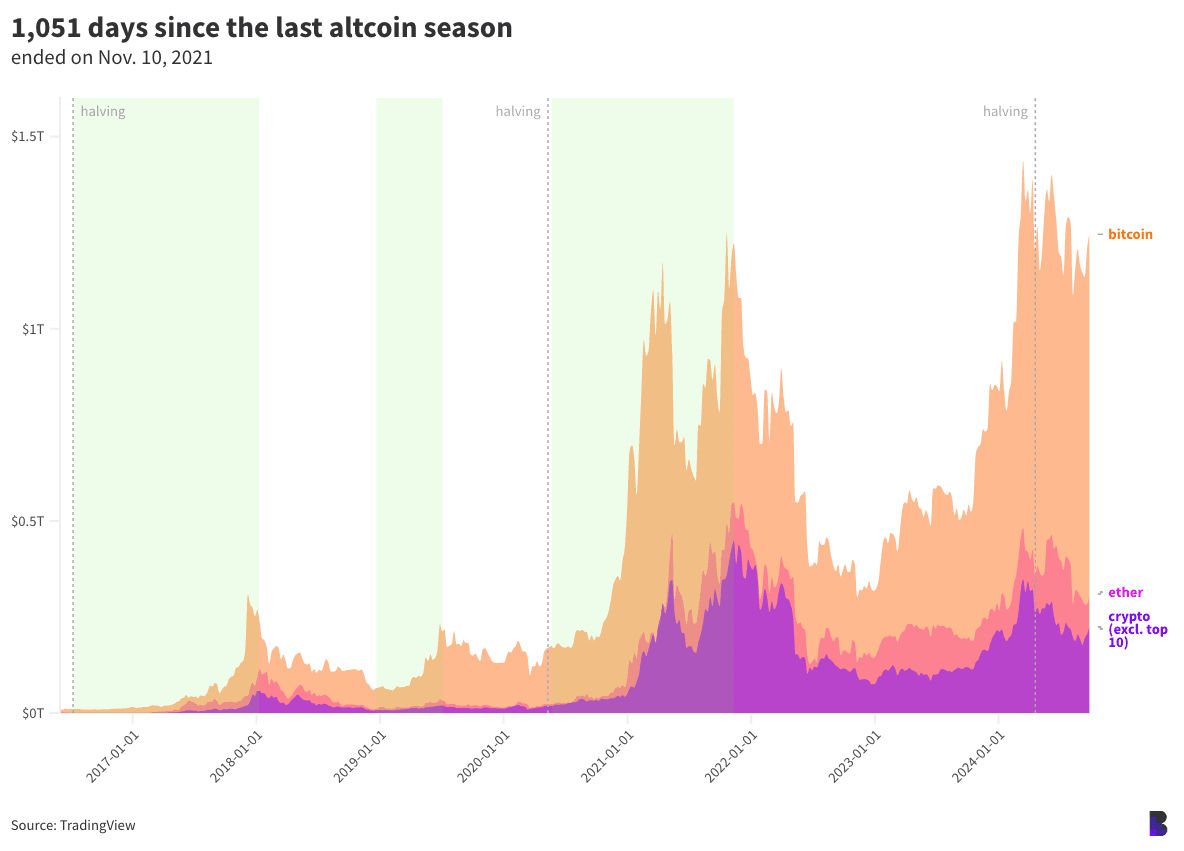

The chart below shows that based on these rules, the crypto market has experienced three distinct altcoin periods in the past eight-year period, as indicated by the green shading on the chart.

- 18 months between July 2016 and January 2018 — litecoin, monero, ethereum classic, dash and proto-prediction market token augur were in the top 10.

- Six-and-a-half months between December 2018 and July 2019 — bitcoin cash, EOS, stellar and bitcoin sv were close to blue-chip status.

- Nearly 18 months between May 2020 and November 2021 — polkadot and chainlink sat at the top end.

The current cycle started in November 2022 when the total crypto market cap dropped to $727.58billion after the FTX disaster, its lowest since December 2020.

Bitcoin’s market cap has grown by almost four times from that cycle bottom — from $313.4 billion to $1.27 trillion ($15,500 to $64,400).

Altcoins meanwhile have grown by less that 2.8x during the same period. That means we’re still over an order of magnitude from altcoins season.

The gap between April and this month was the largest it has ever been. Altcoin season is the furthest from the current cycle. The closest it came was when bitcoin peaked in march.

All of this implies that recent altcoin rallys are just solid bounces. Altcoins corrected sharply after Bitcoin’s recent high, and are only now roughly back to where they were in July.

The bears say the altcoin market won’t begin until after the bull market has run its course.

Bulls, however, might reason that we’re in for what could be the most powerful altcoin season on record — considering how far they still have to run.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.