It is difficult to reach $100,000 right now.

It’s not surprising that we saw some resistance Friday when bitcoin reached $99.8k, before reversing. This is because of how much bitcoin can be sold on Coinbase alone once we reach the record.

Michael Novogratz of Galaxy said that this is what amounts to in a post on X. “normal profit taking” Alex Thorn’s data indicates that many sellers are trying to sell their properties this year, as they have a price above $56,000.

This week is a holiday for Americans (which on Wall Street means volumes are generally lower), but there could be a good reason to expect $100k.

It’s no surprise that all roads lead to MicroStrategy. The firm, in an SEC filing this morning, announced that it purchased 55,500 bitcoin — worth $5.4 billion — at the end of last week into the weekend at an average price of nearly $98,000 per bitcoin.

It was almost expected that the filing would be made, since we knew that a large purchase was coming after the company announced that its bond offering was closed at the end last week. It was also upsized from $1.75 to $3 billion.

The latest purchase follows a $4.6 Billion purchase earlier in the month. That means — if you’re looking at the math — we’ve seen Saylor’s company buy up $10 billion worth of bitcoin this month alone. Wild, right?

Although Saylor’s purchase is a catalyst for price movement, it doesn’t look like it will be enough to send us above $100k yet. However, perhaps it will help people break through the current wall.

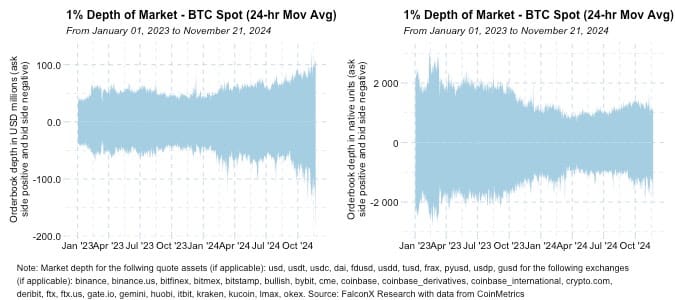

There’s another trend that suggests we may break the $100,000 barrier sooner than later. David Lawant of FalconX says that there have been some notable changes in market liquidity.

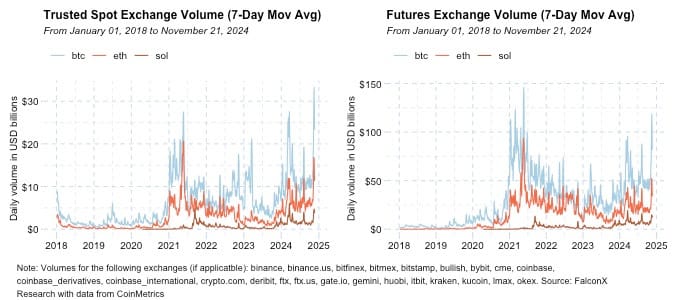

“BTC reached its highest spot volume print ever on a seven-day moving average basis and for the first time since 2021 is in shooting range of doing the same on the futures side. While spot volumes on the week after the election brought the daily traded value to above $40 billion, over the past week it was slightly lower at $25-35 billion but still two to three times the levels we have been seeing between March 2024 and the election,” Lawant wrote.

The jump in volume has not been accompanied by an increase in order depth. This would have led to a “stronger” Impact on Price Action

This data shows that breaking through $100,000 is still a difficult feat. “the overall picture remains encouraging,” Lawant.

If MicroStrategy’s acquisition isn’t sufficient to send us over, we may only be a few CZ posts away.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.