The Financial Conduct Authority of the UK (FCA), has conducted a study that shows 93% adults in Britain have heard of cryptocurrency assets. About 12% of those surveyed own them — representing about 7 million people.

The findings of this study point out that “the need for clear regulation that supports a safe, competitive and sustainable crypto sector,” Matthew Long, FCA director of digital assets and payments.

This is a great time to give an update about the FCA’s strategy.

On Tuesday, Long shared some key takeaways he had from his conversations with UK regulators, crypto companies, lawyers, officials, and regulators across the UK. The US SEC also weighed in.

Long’s reports contains some interesting details.

- Participants liked the concept of a regime for industry-led disclosures that is proportionate to and tailored towards different business models. Retail and institutional).

- Those who want to apply the same disclosure rules as TradFi to crypto have raised concern.

- The discussion was around “best execution” Customers should consider the following criteria when placing orders:

- The participants believe that exchanges operating their brokerage services and providing market making or releasing tokens of their own pose a conflict of interest risk.

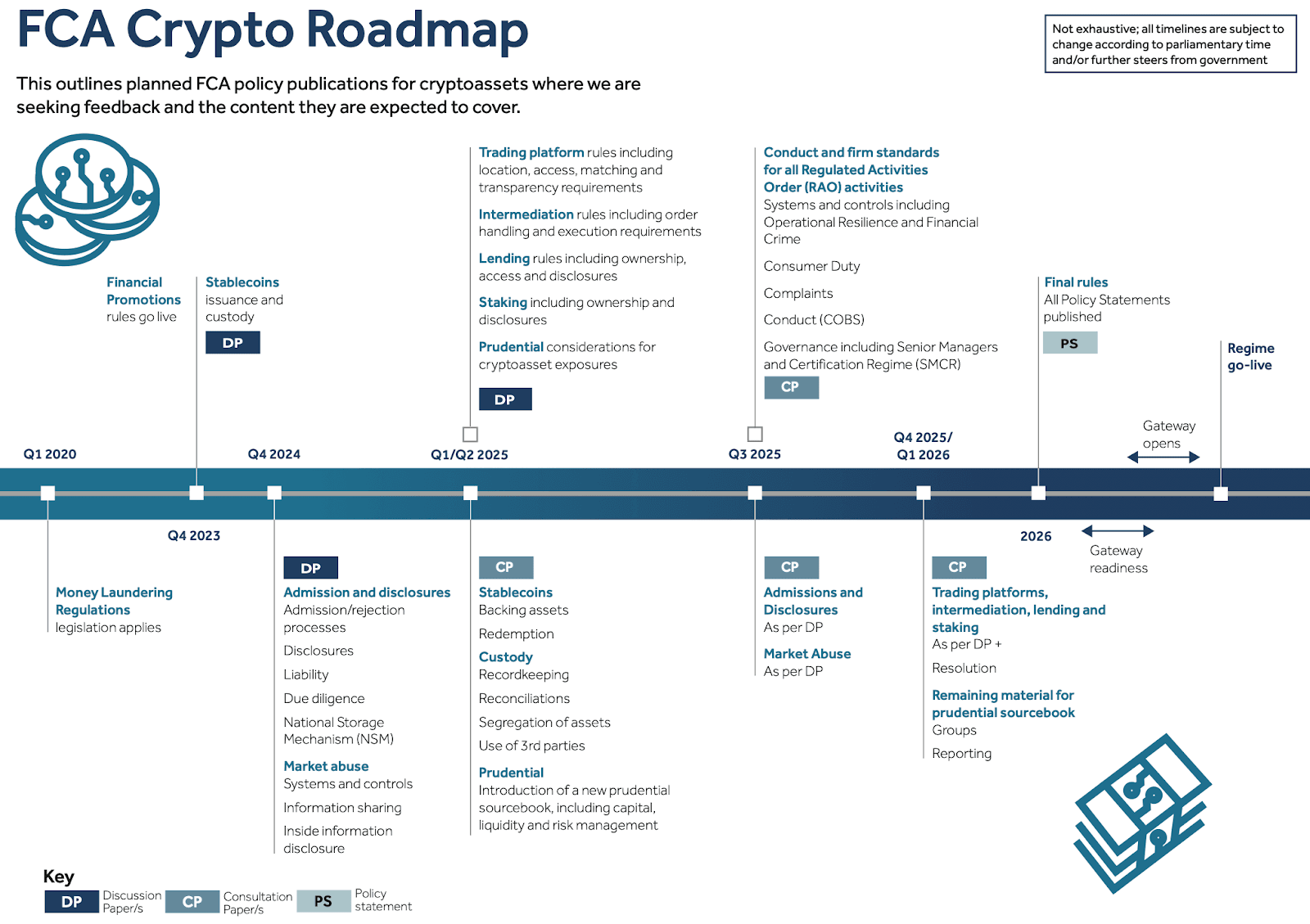

A roadmap for FCA shows that the system will be operational in some time around 2026. There are also other milestones along the way.

Meanwhile, the FCA announced that it was working on an information-sharing platform to combat market abuses (to tackle the stated challenges of data privacy laws between jurisdictions, as one example).

The UK Treasury Economic Secretary Tulip Siddiq had said the previous week that legislation regarding stablecoins, staking and other services would be coming soon.

As the UK tries to catch-up to the EU, there is a lot more to be monitored. Next year the US will also be expected to regulate under a president and Congress that are more crypto-friendly.

Keep in touch

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.