The Bulls are Running

Bitcoin is now over 640 days into a bull market — if you believe we’re still in one.

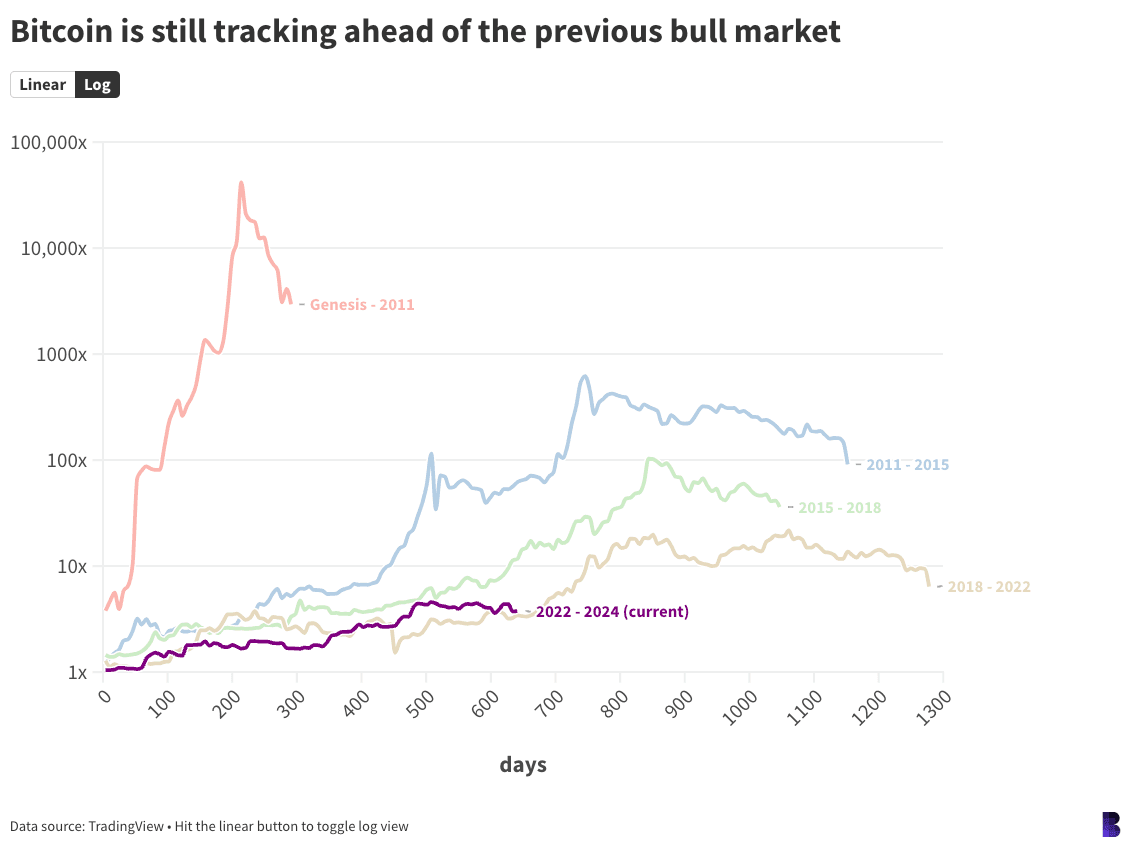

Lengths differ across various models. According to my calculations, I estimate that the three previous bitcoin bull markets lasted 1,047 (2015-2018) to 1,278 (2018-2022).

If bitcoin was indeed meant to correspond to these four-year cycles, then our current time period is already over halfway through.

The beginning of the year 2022 is November 9th, when bitcoin fell to below $15.670 following FTX’s withdrawal ban.

A couple hundred days ago — back in January — bitcoin’s bull market performance to date had more-or-less tracked between the previous two cycles: just under 4.5x returns.

Bitcoin, at this time in the 2015-2018 cycle, was heating up. Bitcoin exploded between January and July 2017 from $800 up to $2,800.

By the end of 2017, it had risen to nearly $20,000. This was a record high, which wouldn’t break for another three years.

As shown in the above chart, Bitcoin’s current cycle is closer to the last one, which was between 2018-2022. The market has returned 278% versus 244%.

If the bull market were already over, it would’ve been the shortest in bitcoin history — not counting the initial price discovery in the two years after the genesis block.

If the bull is still going on and the bitcoin price is still cyclical then it’s likely that we will have to move higher to match those patterns. This is in line with analyst forecasts.

Even if we look at the past three years, the bitcoin market would remain bullish up until mid-year next year. (NFA, past performance does not indicate future results, blah blah.)

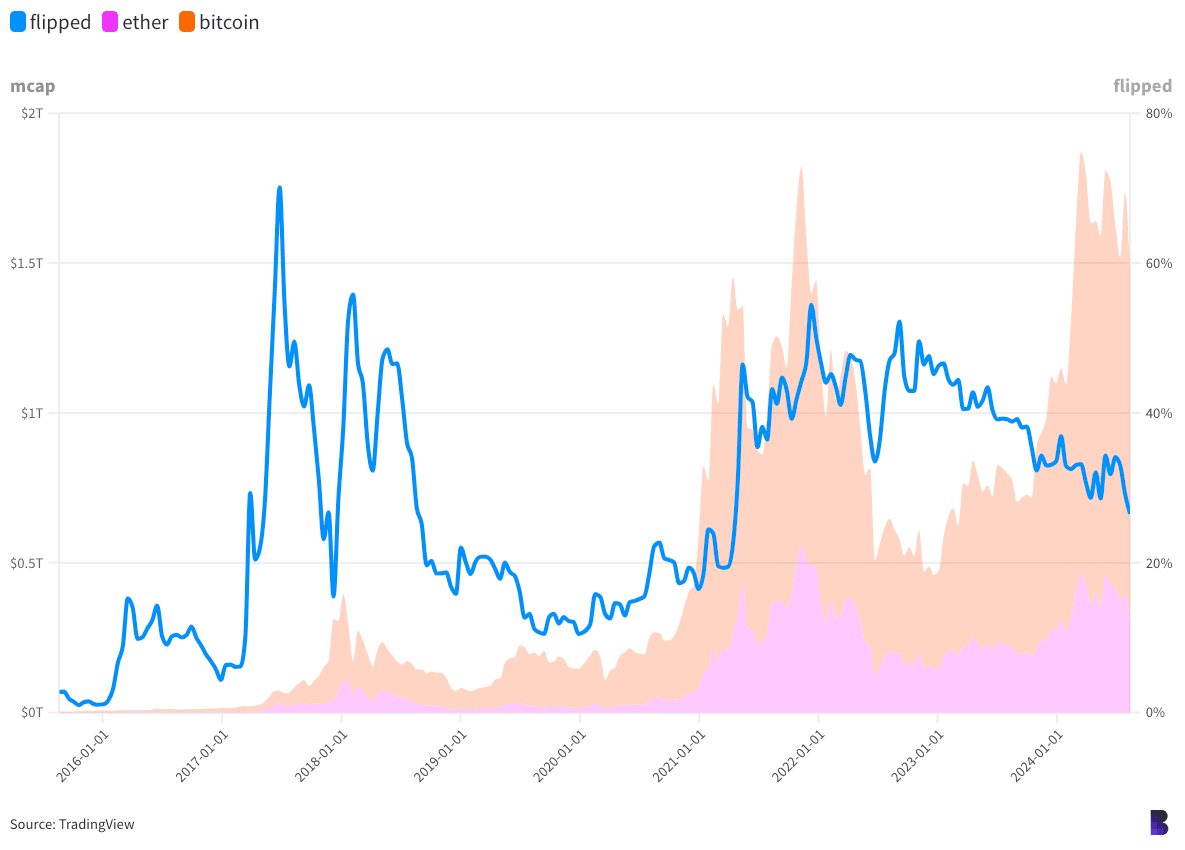

Not all cryptos have had the same level of bullishness as bitcoin. Ether is one cryptocurrency that has not been able to flip bitcoin for almost three-and a half year.

In the graph above, you can see the bitcoin market cap and the ether market cap shaded orange and rose in the backgrounds. A flippening is when the larger area takes up over half the space combined.

The blue line tracks the progress — and it’s been steadily retreating since peak 2021 bull market.

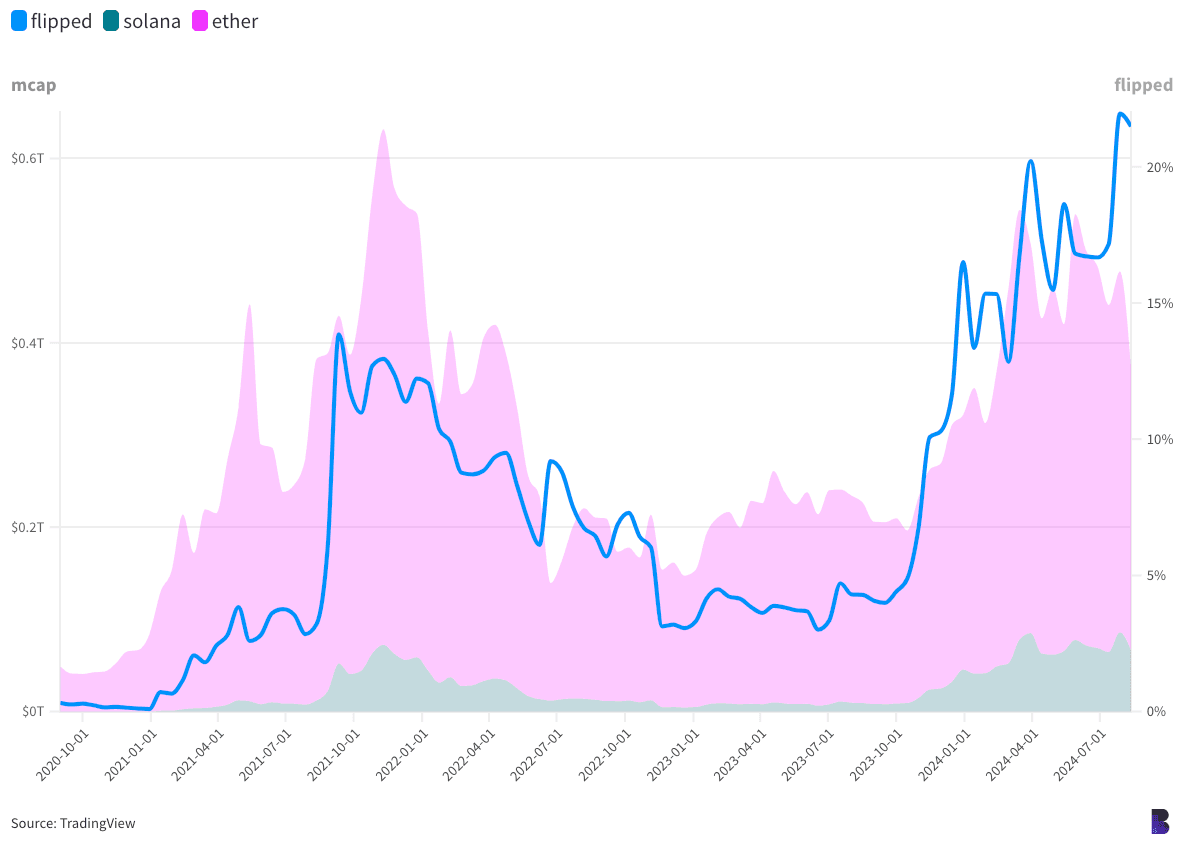

Solana is now closer than ever to flipping the ether.

This time last year, solana’s market cap was only 4% that of ether’s — or $9.3 billion to $217.2 billion. Now it is at 22%. The market cap has risen from $66 to $307.6 Billion.

Peter Brandt, a popular trader who is well-known for his predictions about SOL’s future performance against ETH in the next few months, has recently stated that SOL will gain 100 percent.

During the bear market of previous years, solana’s distance from ether increased dramatically.

Brandt would need to be right for at least another six months of bull.

Work for me.

Data Center

- BTC works hard at Take $60,000 After spending the weekend at range. ETH would otherwise aim for $2700.

- SUI is spreadingIt has more than doubled in the last week, and gained 18% within 24 hours. The price is still half of its record set in March, $2.17.

- MakerDAO generated more revenue than Bitcoin in the last thirty days. 21.1 Million to 19.7 Million. Aave Jito Solana Uniswap Lido Ethereum Tron Tron

- Global stablecoin supplies are above $166 billion — the most since Terra depegged The next May is 2022.

- The latest Polymarket odds Donald Trump: 46 %; Kamala Harris 52%. On the line are 575 million dollars.

Comeback queen

“Cryptocurrency looks to be making yet another comeback.”

It’s an exact quote taken from Barnes and Thornburg Investment Funds Outlook.

84% of respondents believe the private sector will see a surge in investment over the next 12 months.

“59% of respondents also expect the total number of crypto-dedicated funds will increase over the next 12 months. That is a shift from last year, when most respondents said the then-current state of the cryptocurrency market had significantly affected their organization in a negative way,” Noted in the report

Barnes and Thornburg surveyed nearly 140 venture capitalists, private equity, hedge funds, and investors — including US-based limited partners and sponsors. AI was also a hot topic for this group (though the recent stock market actions show that some investors may have burned out on AI).

This change is largely due to two factors: institutional adoption, which continues (duh), and a rebound in the crypto price.

“A year and a half away from the FTX collapse, we’ve seen significant recoveries in bitcoin and other cryptocurrencies, ” Scott Beal, partner at Barnes & Thornburg, said.

“The SEC’s approval of bitcoin ETFs is a big deal for the industry and may also increase the willingness of allocators to make investments in private crypto funds and other nonregulated products.”

The bitcoin ETFs have continued to experience some outflows.

“Considering the challenging environment for spot ETFs, as evidenced by recent BTC spot ETF flows, and factoring in the expected outflows from the Grayscale Ethereum Trust once it is converted into an ETF, the outlook for ETH spot ETFs appears positive,” Matteo Greco is a Fineqia Research Analyst.

Barnes and Thornburg’s report cites a 12-month period that could be bullish for cryptocurrency, depending upon the results of the US election.

Reports also suggest that Kamala’s campaign, the current vice president of the United States, is trying to reach out to leaders in crypto-industry. This could have an impact on matters.

But the Republican presidential campaign of former President Donald Trump is more vocal when it comes to its support for crypto. David Lawant, FalconX’s CEO, recently stated that the US elections could be a catalyst for crypto to break out of its current trends.

We’re stuck in a difficult moment of price movement despite the potential for a runway to a catalyst.

Fineqia Greco wrote “Since the end of July, total open interest in Bitcoin has dropped by about 12%, from $4.6 billion to $4.1 billion. This decline highlights the substantial liquidations that have impacted the digital assets market, causing a snowball effect that drove prices lower and reflected a strong correlation between market activity on centralized and decentralized exchanges and the recent price action.”

“A reduction in leverage, while leading to short-term price declines, is often viewed positively by markets as it reduces the risk of over-leveraging, which could result in a more severe market correction if growing more and reaching nonsustainable levels.”

The future is full of possibilities, but they aren’t always helpful right now.

We’re in vacation mode, but it is also August. We always say to keep swimming.

The Works

- Tether is said to Celsius The lawsuit, filed Friday night is not a “shakedown” The bankrupt lender is prepared to defend its claims.

- There are many more firms including Dragonfly The following are some examples of how to get started: Crypto.com. criticized CFTC proposed rule on prediction markets.

- L1 Canto Was offline on the weekend following a “consensus issue.” It was announced that the team would deploy an update on Monday.

- BitGo WBTC announced that it would be forming a joint-venture with BiTGlobal. “strategic partnership” Justin Sun

- Marathon, MicroStrategy, taking a leaf out of their book, has announced that it will be offering a private offer for $250M worth of convertible notes in order to purchase more bitcoin.

The Riff

It muffles it at times. It’s been so loud at times. It’s the only way to go when liquidity drops and people aren’t working.

The intense selling makes it a lot more frightening, but this summer’s rebound has been strong.

We’re always on crypto so it would be nice to have a quieter environment.

It’s important to not get used to this. The month of August has a reputation for being a bit slower, but I think September will be more active.

It is only natural that the enthusiasm for the market will be tempered in the second half of this bull run.

Positive snippets such as testnet launches and partnerships, or usage milestones, can have a significant impact on prices.

All of that barely makes a ripple in the current climate. It’s true that there is still a certain expectation that news of any kind will be good.

Right now, news is only that. Even negative news. The market is going through the motions — and that’s probably the most bullish thing about crypto right now.

How bad can it be for crypto with the uncertainties on macro-economic, political and regulatory fronts?

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.