For those that don’t already know, I am Canadian. I was thinking macroeconomics from the US’s perspective for nearly all of my waking hours. US markets are the most important and secondary in the global market.

The two worlds in which I reside provide an intriguing vignette to explain why the Fed seems to be reversing its approach on monetary policy and the economy.

Canadian unemployment rates have just reached a new cycle high, 6.8%. They appear to be rising even faster. The US unemployment rate appears to be stagnant. Both economies have been affected by the increase in immigration. But the Canadian labor market has suffered more than any other.

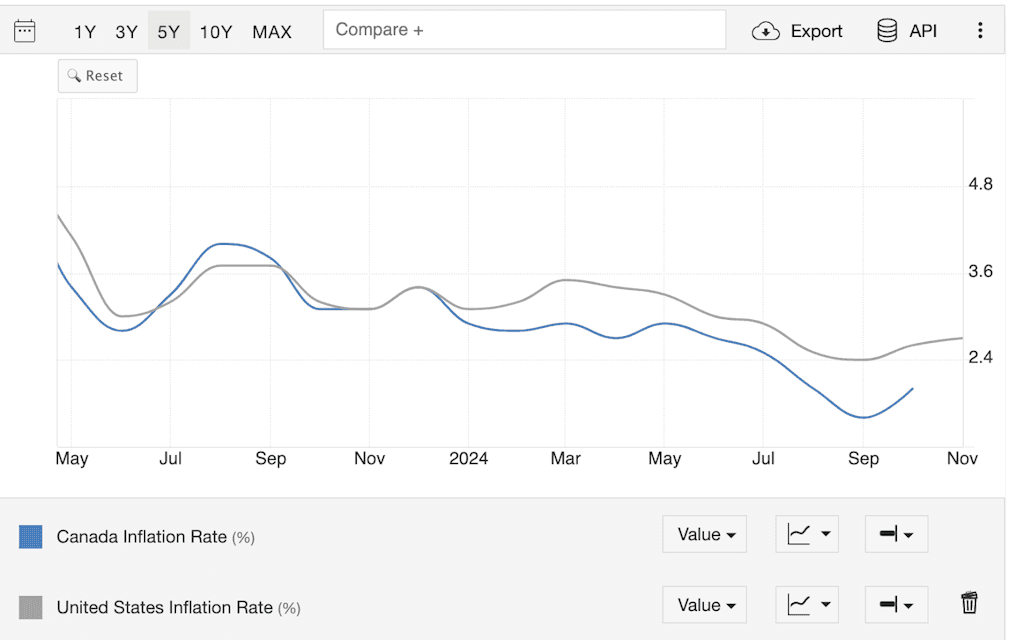

Canada managed to bring its annual inflation back down to 2% while the US continues to remain stubbornly over target.

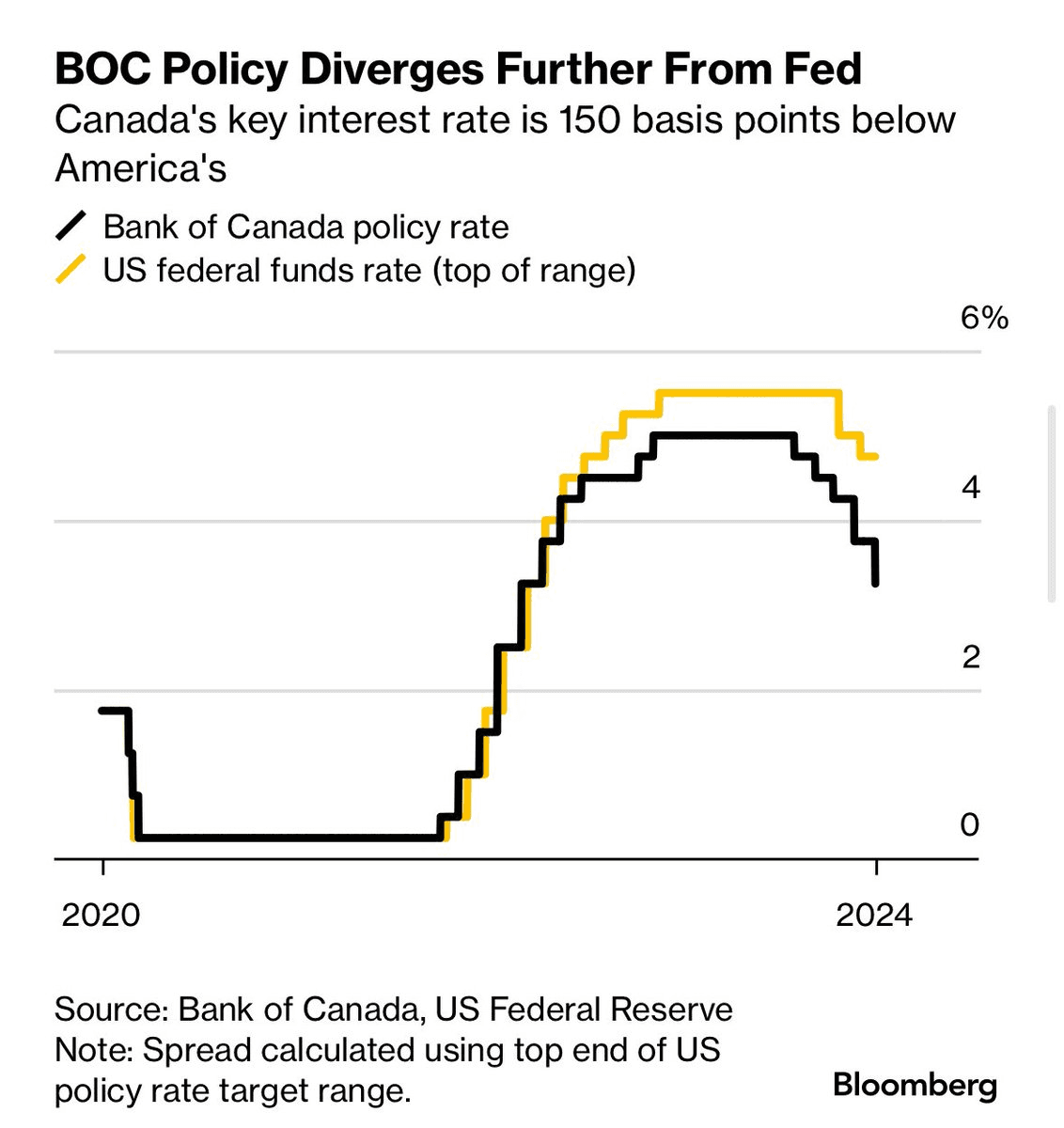

Bank of Canada has surprised the markets by cutting rates another 50 basis points, compared with their previous 25 basis point cuts. Next week, the US will likely squeeze out one last rate cut before taking a break as the US economy continues to grow.

What’s the deal? What is driving this discrepancy?

The US system of finance is less susceptible to short-term changes in interest rates than Canada. Two examples are:

Corporates

US companies can access the biggest debt markets and issue fixed rate bonds with tight spreads. Canadian companies, however, (as it is in other countries), are more likely to issue floating rate debt that changes immediately when the central bank’s policy rates change.

Families

As long as homeowners don’t change their mortgage, they won’t feel the effects of a Fed rate hike. This rate is for the whole mortgage. Since many homeowners refinanced at Covid’s low rates (under 3%), they are not affected by rising interest rates as long as the don’t change. In Canada, and in most countries, even with a fixed rate mortgage of 25 years, rates are reset every 5 years. Even if the homeowner stays put, they’ll eventually feel the effects of rising rates.

These two examples showcase why the Fed is having so much trouble getting into a consistent policy path — its main tool cannot impact large swaths of the economy like it can in other countries. We are now seeing a dispersion between US economies and those of other nations. Sweet US exceptionalism!

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.