Bitcoin has now enjoyed a 686-day bull market, since its low in November 2022 of under $15,500, during the FTX crisis.

Between 1,047 days and 1,278 were the length of each bull market. This is the time from when bitcoin’s price reaches its local bottom, past its peak cycle and ends with its final correction.

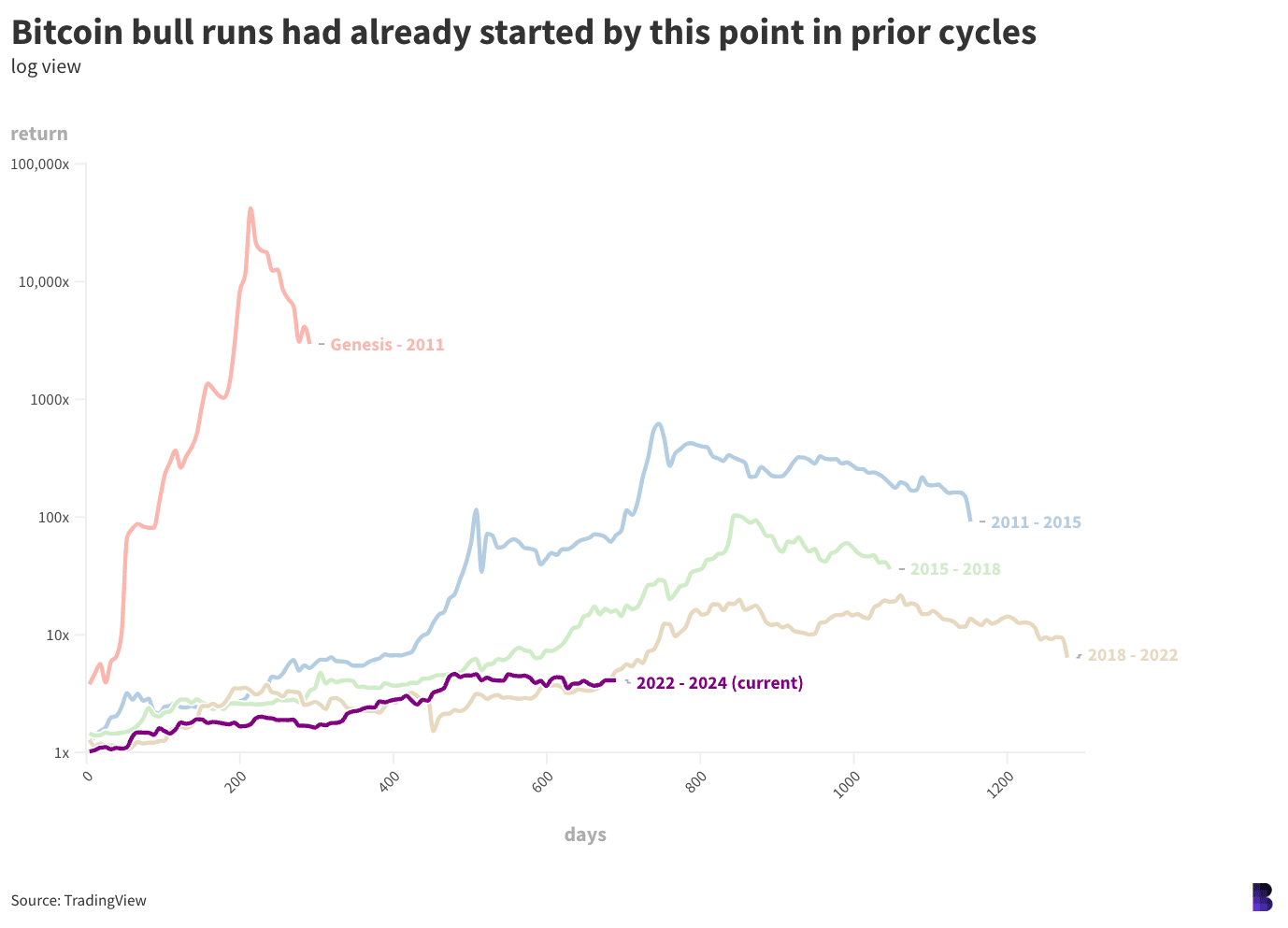

So, bitcoin is now firmly in the second half of its current bull market — if the cycles since 2011 are anything to go by.

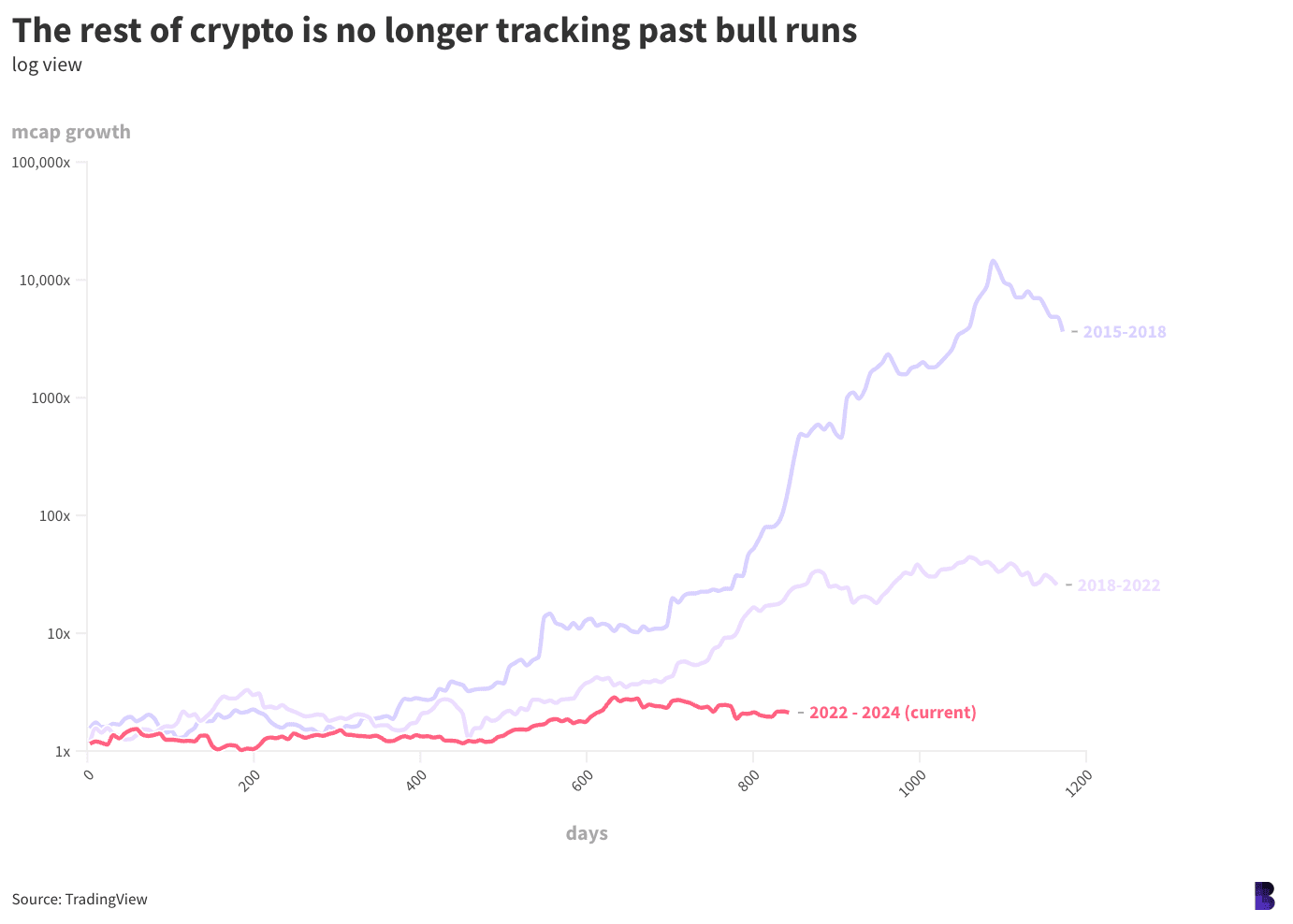

It is well known that the returns on bitcoin have decreased with every cycle. Bitcoin’s first bull market cycle began in 2011 and saw its value rise from less than a million dollars to $12 billion, or 620x.

After a couple of billions were invested in 2015, the value grew to $300 billion by 2018 (103x) and $1.2 trillion at the peak in 2021 (21x), which represents the current valuation.

If bitcoin this time around were to undergo the same degree of growth as it did between 2018 and 2022, then it would need to rally from a $300 billion market cap to a $6.3 trillion one — which would make it almost twice as valuable as Apple stock.

BTC is currently priced at $63,000. If Bitcoin were to be bigger today than Apple, its price would be about $1.32million. Tom Lee, Fundstrat’s manager and bull-poster, previously stated that BTC would reach $500,000 by next year.

In this context, Bitcoin has performed remarkably this cycle.

Notice that the purple line above — the current bull market — started off more or less in line with the three previous cycles, thanks to a monster opening in 2023.

Around day 100 bitcoin started to fall behind, but after a short reversal below $20,000 it caught up rapidly. The hype surrounding a BlackRock Bitcoin ETF started circulating around that time.

Bitcoin was then outpacing market cycles from 2018 to 2022. The price spike between 2015 and 2018 was briefly surpassed, culminating with a high in March that atypically happened before Bitcoin’s halving.

The bitcoin price has been moving sideways since long enough that it does not outpace any bull markets.

Bitcoin’s cycle peak is usually reached between days 750 to 1,060 of each bull run. Prices typically spend hundreds of day ramping up before reaching these peaks.

Bitcoin could have made the most gains during the first 500 trading days of this bull run. This would be in line with the diminishing return trend.

Or, bitcoin is simply late to the real bull run, due to crescendo over the next eight months or so — a period that would interestingly end about five months into the next US president’s first term, in June 2025.

This could be the case if there were ever a reason to argue that the outcome of the elections was pivotal in the current state of the crypto markets.

It is possible that the immediate effect of the elections will be the start of the end.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.