When crypto initiatives make massive bulletins utilizing phrases like “buyback,” “burn,” or “revenue sharing,” that’s often taken to imply there are bullish investing tailwinds at play.

However I’ve questions. How a lot does an annualized 10% buyback yield truly matter when these tokens can plummet 20% in a day?

Does worth accrual matter as a result of it’s beneficial for causes of elementary evaluation (i.e. money flows), or merely for narrative optics?

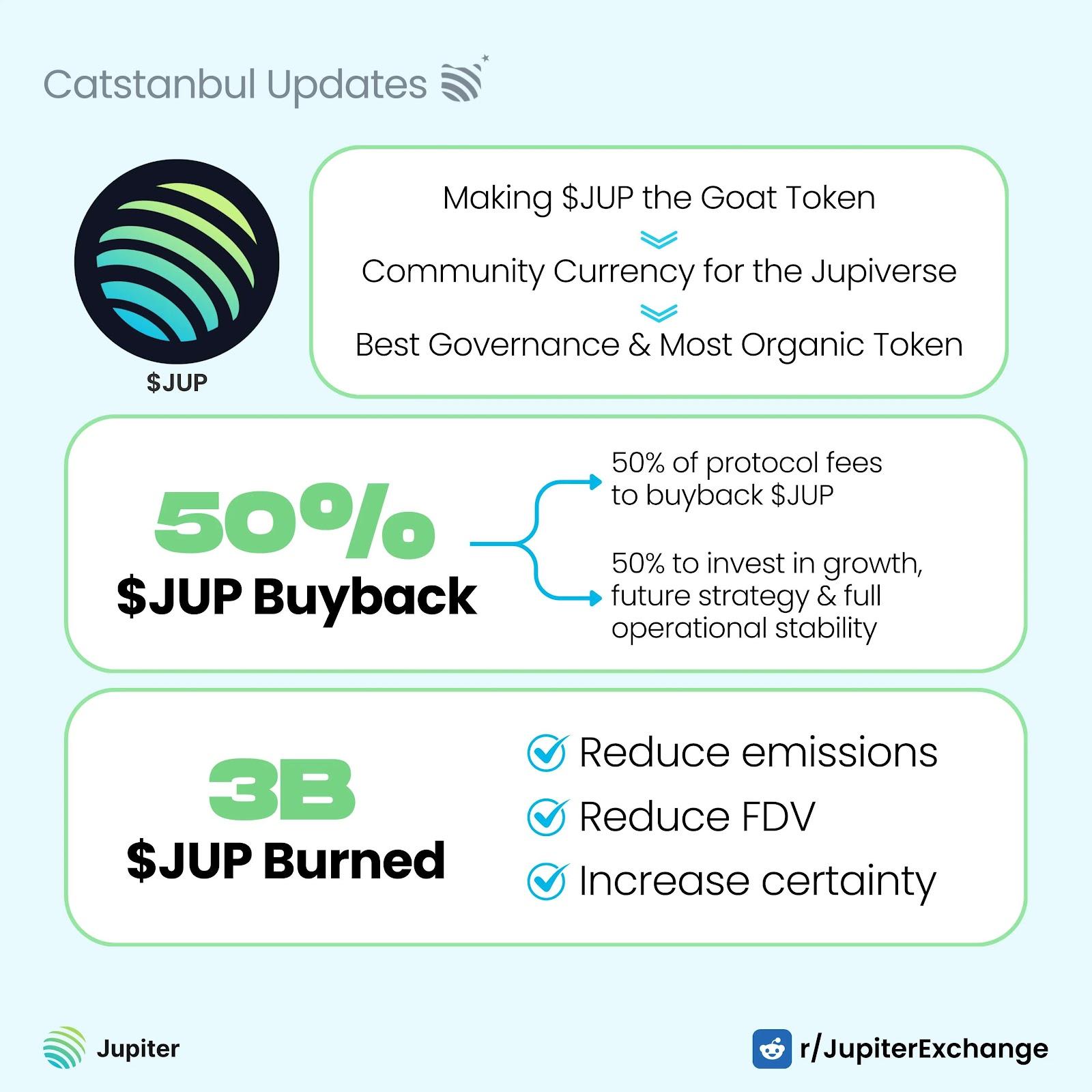

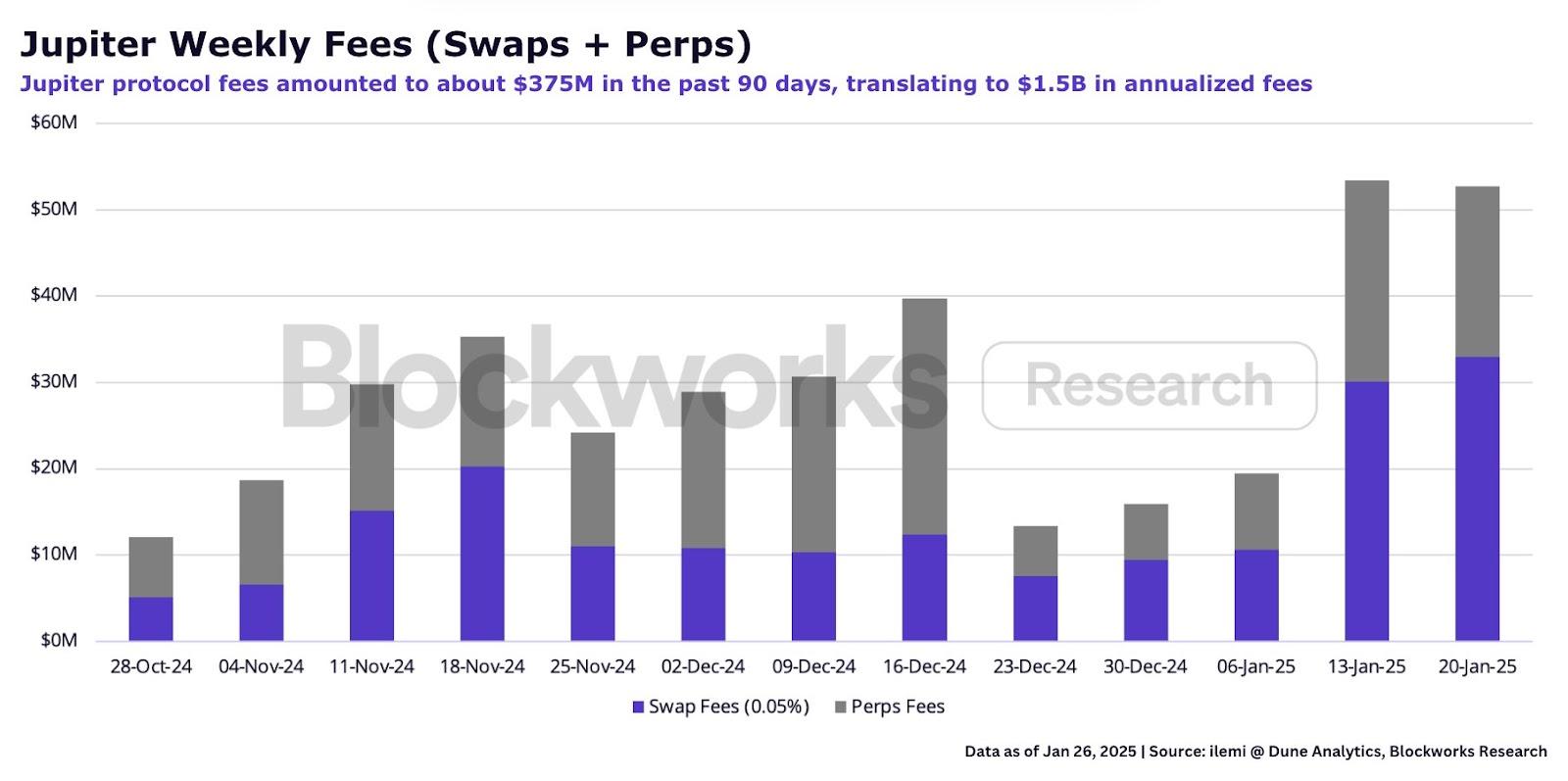

Over the weekend, Solana DEX aggregator Jupiter introduced a major JUP buyback program with 50% of charge revenues.

Primarily based on estimates by Blockworks Analysis analyst Carlos Gonzalez, that interprets to about $750 million in annualized JUP buybacks, or a couple of important 40% of JUP’s circulating provide in a 12 months.

That’s a reasonably spectacular annualized buyback yield of about 42%.

However what does 42% matter when token costs can tank 90% in per week?

Properly, it’s not a flash within the pan answer, nevertheless it helps to maintain in opposition to promoting strain. Carlos pointed to Raydium’s profitable experiment with buybacks:

“Raydium has accumulated 20% of RAY’s supply since the start of their buyback program. In terms of market structure, it adds buying pressure to the token and RAY has outperformed most of Solana DeFi. Fundamentals matter but of course you could also find examples to argue that buybacks aren’t that bullish. For instance, Maker.”

Virtuals, the main AI agent launchpad on Base (now increasing to Solana), additionally dedicated two weeks in the past to an estimated $40 million in buybacks and burns for 10k+ agent tokens over a 30-day TWAP.

For the reason that buybacks have been introduced on Jan. 15, the 5 largest agent token buybacks by far are GAME, CONVO, AIXBT, SEKOIA and MISATO, all of which have given up all their beneficial properties as of yesterday’s market crash.

During the last 12 months, many blue-chip DeFi protocols with precise product-market match have additionally sought to return revenues to token holders.

Compound, for example, proposed in August a charge swap to allocate 30% of its reserves to COMP stakers.

Marc Zeller of Aave proposed final July a “Buy & Distribute” proposal to purchase again AAVE on the open market with “net excess revenue of the protocol.”

Then there’s Uniswap, which deliberate to implement a UNI charge swap for stakers, however rapidly deserted the proposal after receiving an SEC Wells discover two months later (Uniswap is once more trying some type of worth accrual on its upcoming Unichain).

Main L2s like Arbitrum, Starknet and Gnosis have floated proposals final 12 months to return worth to token holders who stake their tokens.

Starknet voted final September to allow Starknet staking (12.94% APY) and Gnosis handed a proposal in June to spend $30 million of the DAO’s treasury to purchase again liquid GNO over a six-month interval.

So far as I can inform, out of all of the above-mentioned worth accrual proposals, solely Starknet and Gnosis have truly applied their worth accretive mechanisms.

But from the time these worth accrual mechanisms have been put in place, GNO has seen a 46% decline, whereas STRK has stayed flat.

So what are the best psychological fashions to consider worth accrual mechanisms? They’re not a magic bullet. However they’re a key ingredient within the recipe of getting a profitable token launch proper.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.