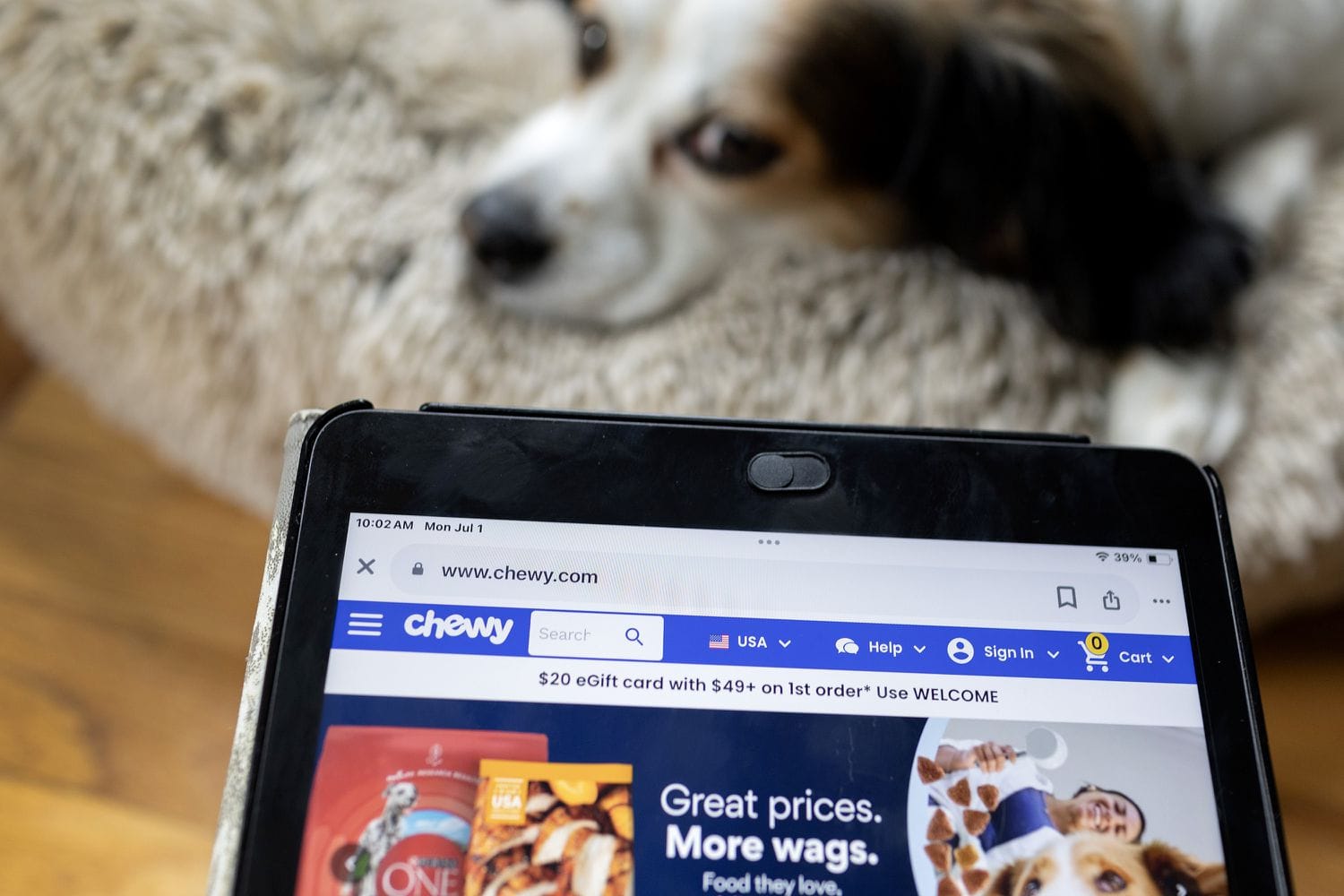

Joe Raedle/Getty Images

The Key Takeaways

- Chewy reported a lower-than-expected loss as its online pet supply retailer lost active clients and increased costs.

- Visible Alpha’s analysts had predicted a diluted EPS of $0.20. This is below the consensus expectation.

- The revenue rose by 4.8% to $2.88 Billion, slightly higher than expected.

Chewy’s (CHWY), an online pet supply retailer, missed forecasts for profit on Wednesday as its number of customers declined and cost rose.

Visible Alpha’s analysts estimated that earnings per share for the third quarter were $0.20. Revenue increased 4.8% from last year, to $2.88billion. This was slightly above expectations.

Chewy’s active customer count fell 0.5% from 20.16 to 801.82 millions, while operating costs rose by 3.3%. Sales per active customer rose 4.2% from $567 to $818.2 million, while autoship customers sales increased 8.7%.

Chewy Raises FY Sales Outlook

Chewy estimates current-quarter revenues between $3.18 Billion and $3.20 Billion. Chewy revised its forecast of full-year sales to $11,79 billion up to $11.81 million from previous estimates between $11.60 and $11.80 billion.

Chewy shares are up almost 40% this year, despite today’s drop. In 2024 they have enjoyed a very interesting ride after Keith Gill became a meme stock. “Roaring Kitty,” The company bought a lot of shares over the summer and then sold them a couple months later.

:max_bytes(150000):strip_icc()/CHWY_2024-12-04_12-15-08-397adbf97d284ecda3e922e20808744b.png)

TradingView

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.