Investopedia / Alice Morgan / Getty Images

What you need to know

- On Wednesday, the Federal Reserve revised its projections of future rate reductions. This indicated that borrowing costs in 2025 could be higher.

- The Fed “dot plot” In September, the forecasts were lower by a half percent point.

- Officials don’t expect the rise in interest rates to have the same impact on the job market. They believe that the rate of unemployment will remain stable over the next couple years.

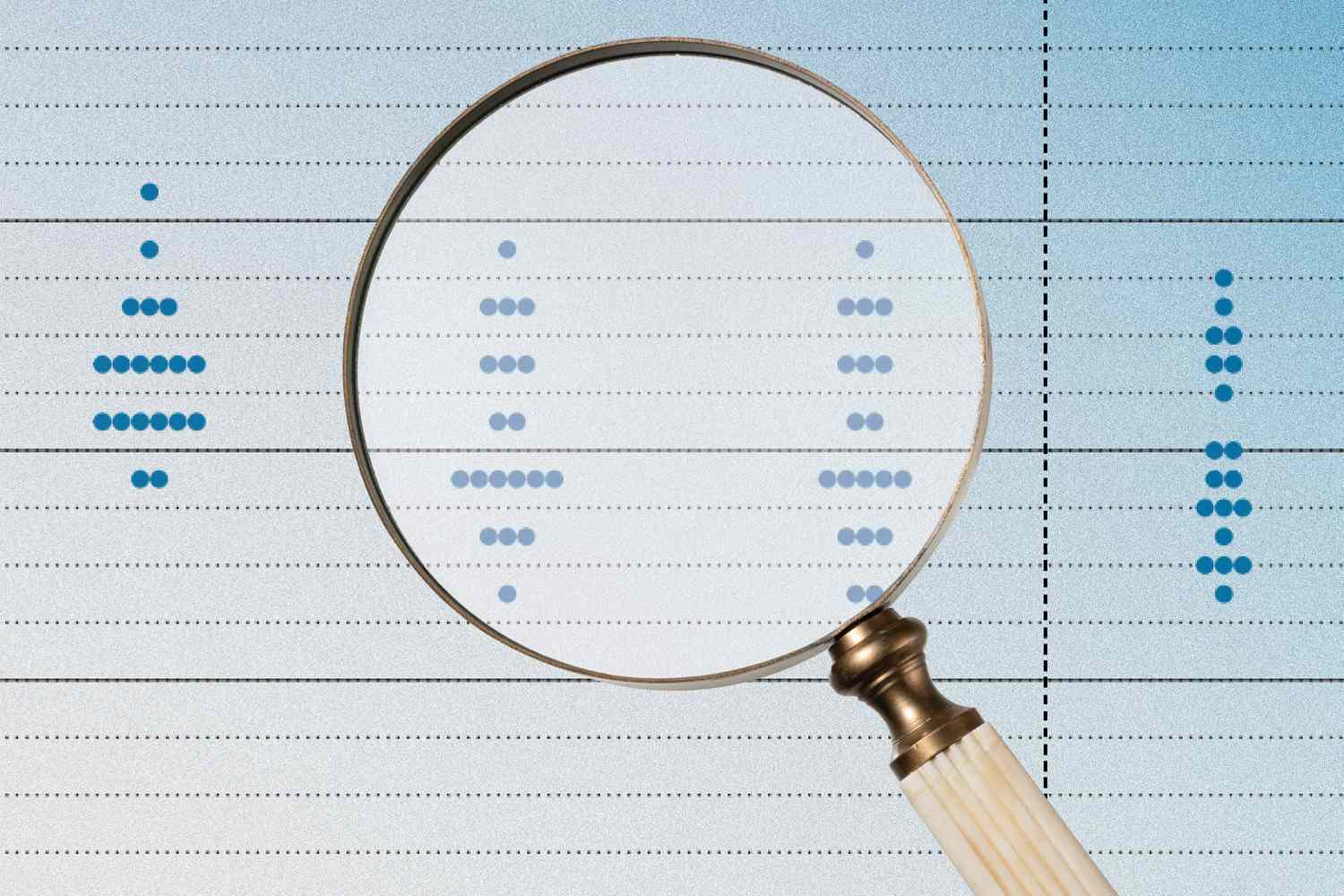

Although the Federal Reserve’s announcement this week that it would cut its main interest rate had been widely anticipated, Wednesday’s series of dots published by the Fed surprised both economists as well as investors.

Closely followed “dot plot” Fed officials had predicted that they would only cut the federal funds rate, which is a key indicator of inflation in America, by a half-point percentage point. This is half what the central banks projected in their last forecasts released in September, and it’s a quarter point less than many traders and economists expected.

:max_bytes(150000):strip_icc()/Fulldotplotdec24-3e21732ebc104aae907260c1142bc044.jpg)

Federal Reserve

Markets fell significantly on the uncertainty laid out for the policy path ahead, with the S&P 500 falling more than 3% into negative territory after the predictions were released.

Dot Plots: What they tell investors

Dot plots are part of every FOMC meeting, which is held four times annually.

The dots show an anonymous picture of what the 19 members think the federal funds rate will look like in the future. Investors can get a general idea of where the fed fund rate is headed by looking at a median of all these dots, although some question its effectiveness.

Fed projections for the economy are based on conditions at present and can change with changes in the economy. For example, after Fed officials in June projected just one quarter-point rate cut, the FOMC in September raised their forecast to a full-percentage-point cut for the year as inflation fell further and the labor market showed signs of weakening. The Fed followed up on its projections.

Fed Funds Rate for 2025

:max_bytes(150000):strip_icc()/2025dotplotdec24-95bafbb8bc9141d3933db507470c7e43.jpg)

Federal Reserve

It says: Dot plots for 2025 show that the majority of FOMC members believe the Fed will reduce the Federal Funds Rate by 50 basis point, which is a half percent. Ten members shared this view; the remaining nine held views that were more diverse.

What does it mean: Investors’ expectations for rate cuts had been reduced, but projections from the Fed showed the bank would be willing to keep interest rates high as long as it continues to work to reduce inflation to its target level of 2%. Market watchers may find it hard to judge the direction of monetary policies due to the diverse opinions among members, economists say. This is especially true in light of uncertainty surrounding economic change under Donald Trump.

Fed Funds rate for 2026

:max_bytes(150000):strip_icc()/2026dotplotdec24-0ff98966121643e99bb58f564b3635f8.jpg)

Federal Reserve

It says: The interest rate situation becomes murkier after 2025. Most members see further reduction going into 2026, but beyond that, central bankers seem to think they'll need to hold interest rates steady.

What does it mean: According to government officials, not a whole lot. As Fed Chair Jerome Powell said in a press conference to reporters after the projections were dropped, it's difficult to make any kind of accurate reading beyond the near future.

"When you're projecting the economy, three years out, two years out, you're talking about high uncertainty," Powell said. "It's not possible to confidently predict where the economy is going to be in three years."

Unemployment Rate

:max_bytes(150000):strip_icc()/UEdotplotdec24-713e2e802ac748afa2bd542f9a5bdc00.jpg)

It says: In 2025, most Fed officials expect the unemployment to remain steady around the 4.2%-4% range. That’s close to its current 4.2% rate. A few others predict that it could rise as high as 4.4%-4.5% by next year.

After this, there are divergent opinions, as projections of unemployment for 2026 range between 3.8% and 4.7%. But the vast majority of government officials see little change in unemployment.

What does it mean: The majority of officials do not see an increase in unemployment that is bad for the economy. A strong job market may prevent the Federal Reserve to further reduce interest rates.

“The Fed projects continued low unemployment, steady economic growth, and persistent inflation in the year ahead – all of which may make future cuts unnecessary or even counter-productive," said Cory Stahle, an economist at Indeed Hiring Lab.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.