Ulises Ruiz / AFP via Getty Images

The Key Takeaways

- The S&P 500 gained 0.2% on Tuesday, Feb. 18, 2025, posting a record close to kick off an abbreviated trading week that will see the release of the Fed's latest meeting minutes.

- Intel stock surged following reports that industry peers TSMC and Broadcom are evaluating separate deals that would separate the chipmaker's design and manufacturing assets.

- Medtronic stock fell as the company missed sales forecasts for the quarter. The results were impacted by a lack of demand in blood oxygen monitoring products and stapling.

After fluctuating through the majority of the market session, major U.S. stock indexes ended higher.

The Federal Reserve could reveal its policy preferences during the holiday-shortened trading period. Its minutes will be published and several bank officials have scheduled comments. The week will also bring earnings reports for big companies, including Walmart (WMT).

A Tuesday-afternoon rally helped the S&P 500 post a daily gain of 0.2% notch a record closing high. Dow Jones and Nasdaq closed with increases of under 0.1%.

Shares of Super Micro Computer (SMCI) rose more than 16%, adding the most of any S&P 500 stock and extending a string of gains posted since the sever manufacturer provided a business update last week. Supermicro also forecast robust growth for its fiscal year 2026. The company is confident that it can meet the February 25, deadline to submit its late annual report. Supermicro’s stock may be delisted if the company fails to meet the deadline for completing the regulatory requirements by the 25th of February.

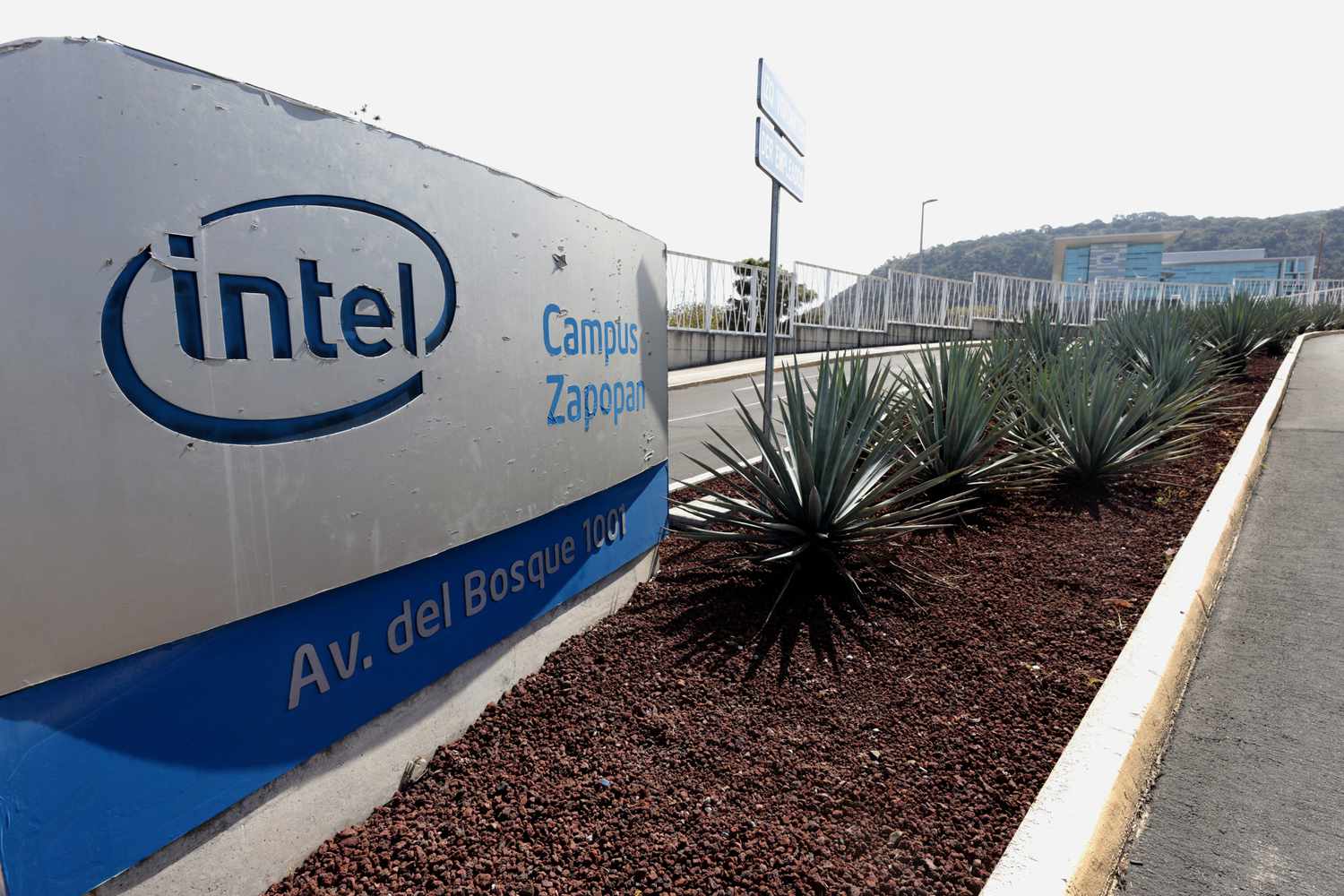

According to the Wall Street Journal, rival chipmakers Broadcom and Taiwan Semiconductor Manufacturing Co. could pursue deals which would cause Intel (INTC) to split. Broadcom was reportedly considering a purchase of Intel’s marketing and design business. TSMC, meanwhile, has explored the idea of taking some or all manufacturing facilities from Intel. Intel shares rose by around 16%.

Walgreens Boots Alliance shares (WBA), which are owned by Sycamore Partners, surged 14 percent after reports appeared on CNBC indicating that Sycamore may be interested in buying the pharmacy. Financial network reports that the possible transaction to take Walgreens Private appeared to be shelved several weeks ago. However, there may be new momentum for a deal.

The heaviest losses in the S&P 500 were in shares of Medtronic (MDT), which tumbled more than 7% after the medical device maker posted mixed results for its fiscal third quarter. The adjusted earnings per shares exceeded estimates but quarterly revenue fell short of expectations due to the slump in sales for Medtronic’s blood oxygen management and stapling products.

Conagra Brands lowered their full-year guidance citing concerns about supply. Shares of the packaged foods company fell 5.5%. Hunt’s Ketchup, Orville Redenbacher Popcorn and other staples from grocery stores were cited by the company as reasons for its lower forecast. They attributed it to problems at their main processing facility where they process chicken for frozen meals, along with an unexpected increase in demand for vegetables.

UnitedHealth Group shares (UNH), a giant in the health insurance industry, fell by 4.4% following the announcement that the Federal Trade Commission would continue to use the guidelines of the Biden administration for merger review. This could cause UnitedHealth Optum division’s acquisition of Amedisys by UnitedHealth to face obstacles.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.