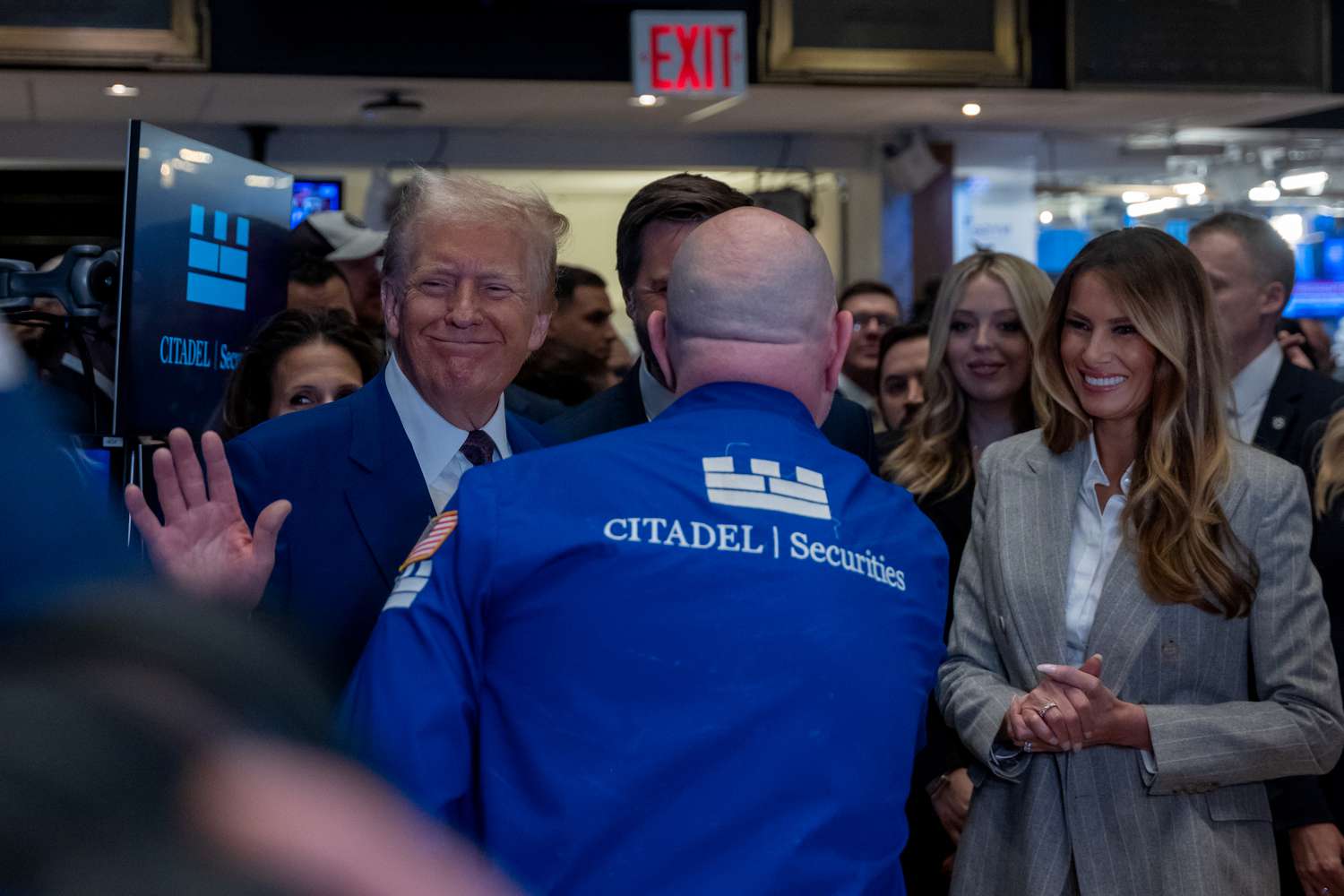

Spencer Platt / Getty Images

What you need to know

- Stocks on Friday were on track to have their best week since early November as investors bid up equities after this week's reassuring inflation data and ahead of Donald Trump's inauguration next week.

- Cryptocurrencies, Trump Media & Technology Group, and Tesla have all charged higher this week in anticipation of Trump's first week back in the White House.

- Wall Street, as well as individual investors may be showing caution. This could mean that volatility will increase next week after Trump signs a number of executive order.

Wall Street was jittery on Friday. It was the last day of trading before Donald Trump is inaugurated on Monday.

The stock market was on course to enjoy its best week since the early part of November, when election results sent stocks soaring. Bitcoin also reached its highest levels in over a month.

The Republican trifecta in Washington—control of both chambers of Congress and the White House—that will be realized Monday is expected to usher in a raft of deregulation, tax breaks, and other business-friendly policies.

Trump’s vows to support blockchain technology—and his personal and business ties to the cryptocurrency industry—have lifted cryptocurrency prices since his reelection. Bitcoin (BTCUSD), as well as other lesser-known currencies, rose above $105,000 in price on Friday.

Another way to get in touch with us “Trump trades” Also, on Friday, the stock market was advancing. Shares of Trump Media & Technology Group (DJT), which can be seen as a proxy for the president-elect’s popularity, were up about 2%, and have gained more than 20% since the start of the year. Tesla’s (TSLA) shares, whose CEO Elon has been one of Trump’s closest advisers, gained 6% last Friday. Their post-election gains now total 75%.

Some investors cautious heading into Trump 2.0

Investor enthusiasm is not unwavering. Wall Street has been grappling with the uncertainty of how Trump’s immigration and trade policies will impact inflation for several months. The majority of economists believe that Trump’s deportation and tariff plans, if implemented in the manner he promised, would cause inflation to rise and require the Federal Reserve rate to remain high.

Trump’s advisers are calming some market fears, suggesting that he will take a measured approach as opposed to what his rhetoric during the campaign implied.

The markets may still remain volatile, however, as Trump releases a string of executive orders. Cboe Volatility Index (VIX) was at 16 on Friday, after steadily falling this week, as Wall Street cheered encouraging inflation data. But according to data from brokerage Charles Schwab, VIX options volume was above-average on Thursday and the most traded contract—the VIX at 18, expiring on January 22—could imply traders expect volatility to rebound next week.

Retail investors also showed caution in the week leading up to Trump 2.0. Vanda Research’s data shows that individual investors bought DJT and crypto-stocks in the days following Trump’s election, but have been less aggressive in recent weeks. Retail traders might have waited until this week to buy stocks after the inflation data.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.