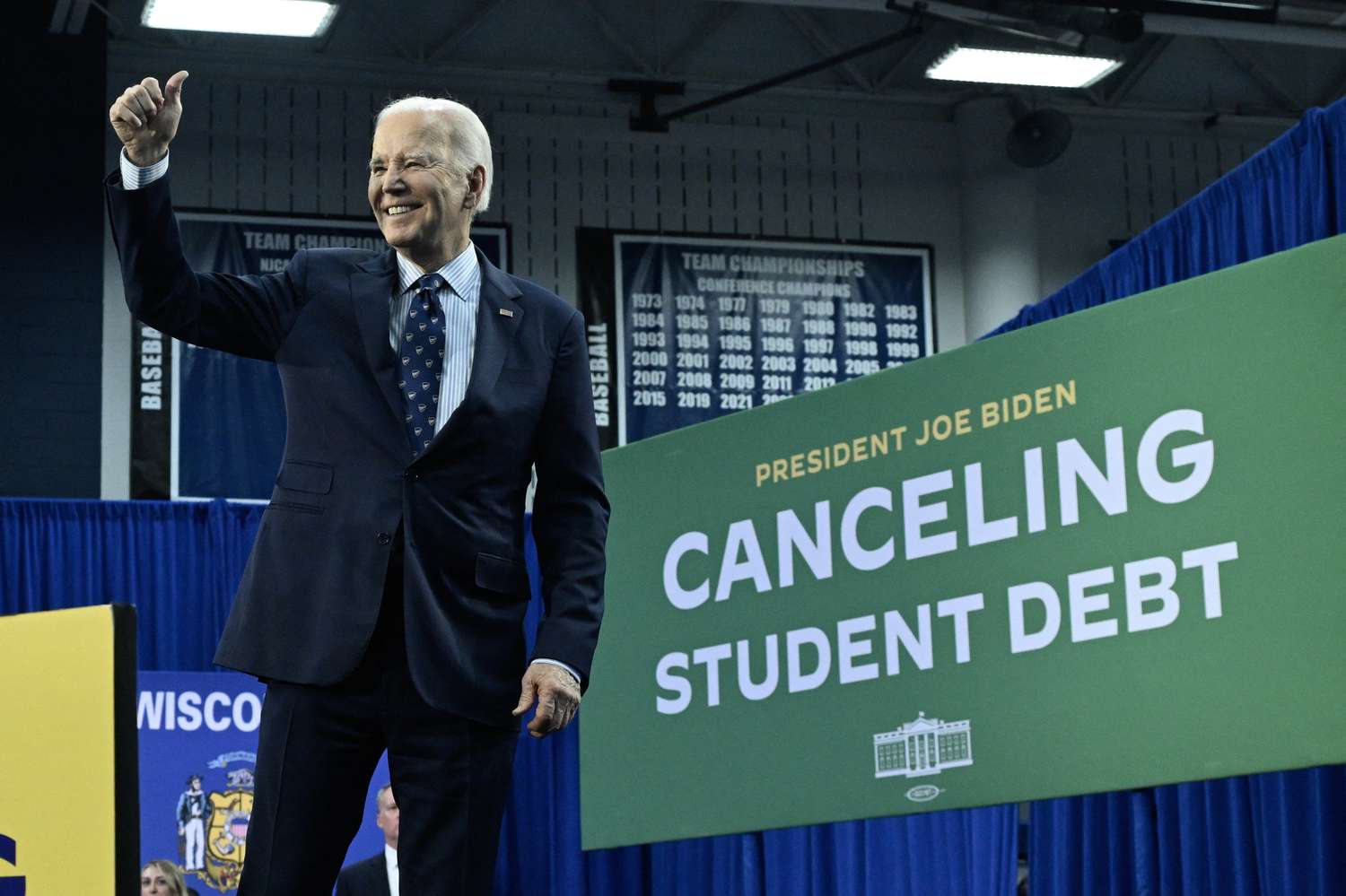

Andrew Caballero Reynolds / AFP – Getty Images

TAKEAWAYS KEY

- Joe Biden, the current president of the United States, promised to forgive student loans and offer more generous payment plans before he was elected. But he has only implemented some of these proposals.

- The Supreme Court blocked Biden's initial student loan forgiveness plan, and legal challenges are still preventing his more generous income-driven repayment plan from being implemented.

- Biden has forgiven $188.8billion in loans to over 5.3million borrowers under his administration.

- The incoming administration has been critical of Biden's forgiveness and repayment plans, and after it enters the White House, some Biden-era rules may come to an end.

President Joe Biden is leaving the White House without fulfilling many of his promises to federal student loan borrowers—but it wasn't for lack of trying.

Biden had promised to borrowers that they would be able to pay off their student loans more easily and at a lower rate. He directed his Department of Education, during his four-year tenure, to follow closely his campaign promises. However, many of these plans were blocked by the courts.

Biden was able to forgive or discharge the debts of student loans for 5.3 millions borrowers totaling $188.8 Billion.

What did Biden promise?

Biden’s plan to help student loan holders was outlined during the 2020 election campaign.

He said those making $25,000 or less would not owe payments on their federal student loans, which wouldn't accrue interest. He stated that all other borrowers only had to contribute 5% of discretionary income towards their student loan payments, while all borrowers’ loans would be forgiven in 20 years.

He also pledged to amend the tax code to ensure that all borrowers receiving forgiveness through the Income-Based Repayment Plan will no longer be required to pay any taxes.

Additionally, Biden said he would simplify the Public Service Loan Forgiveness (PSLF) program. The new program will offer forgiveness of up to $10,000 per year for borrowers who have worked in the public sector for a maximum period of five years.

Biden Came Through On Some Of His Promises—Others Were Blocked In Court

Biden's initial student debt relief plan proposal would have forgiven up to $10,000 to $20,000 in student loan debt for lower to middle-income borrowers. It would have also created a new income-driven repayment plan to cut payments to 5% of a borrower's discretionary income.

In June 2023 the Supreme Court rejected this proposal, but Biden’s administration has been working to achieve some of these ends by using other rulesmaking processes.

Biden introduced in October 2023 the Saving for a Valuable Education Plan (SAVE), a plan that reduced payments monthly to 10% of income discretionary and allowed forgiveness at 20 years.

A provision of the SAVE Plan, which was to be implemented in July last year to limit payments to just 5% discretionary income for borrowers, has been blocked by a court. After much haggling, the provisions in question were eventually blocked by a court. The end of this month saw all SAVE Plan borrowers placed on forbearance, until the legal cases could be resolved. Biden had been able to obtain almost $5.5 Billion in forgiveness before the plan was shut down.

Biden’s promise was fulfilled when he adjusted the tax code to allow for forgiveness. According to the American Rescue Plan Act borrowers that have loans forgiven by Dec. 31 2020 and Jan. 1 2026 are not required to pay federal income taxes.

Biden also loosened the eligibility requirements for the PSLF Program, making it easier for more service workers who are eligible to receive forgiveness of their loans. Only 7,000 borrowers were eligible for forgiveness before Biden took over the White House. The Department of Education stated that by the time Biden leaves the White House, nearly 1.1 million PSLF-borrowers will receive $78.46billion in forgiveness.

More than 1.9 millions borrowers attended schools where there was misconduct. Nearly 633,000 of these borrowers had total and permanent disabilities. The government also forgiven more than 34 billion dollars to them.

What's Next For Borrowers?

Biden is leaving office and the new administration will have many officials who are critical of SAVE or other plans for student loan repayment forgiveness. This has caused borrowers to be concerned about what happens with income-based repayment and forgiveness.

SAVE Plan is limited to the extent that it can be sued and must now wait for the 8th Circuit Court of Appeals. SAVE Plan may be terminated if an appeals court declares the program illegal, or a new administration decides not to defend it.

A top Republican legislator told Forbes magazine in December, that a reform of the student loan repayment and forgiveness plan could be implemented in 2025. This would affect more than just SAVE.

After the recent court cases, legal experts and the Department of Education have indicated that the forgiveness of loans by previous administrations or courts cannot be reversed.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.